Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Market Performance

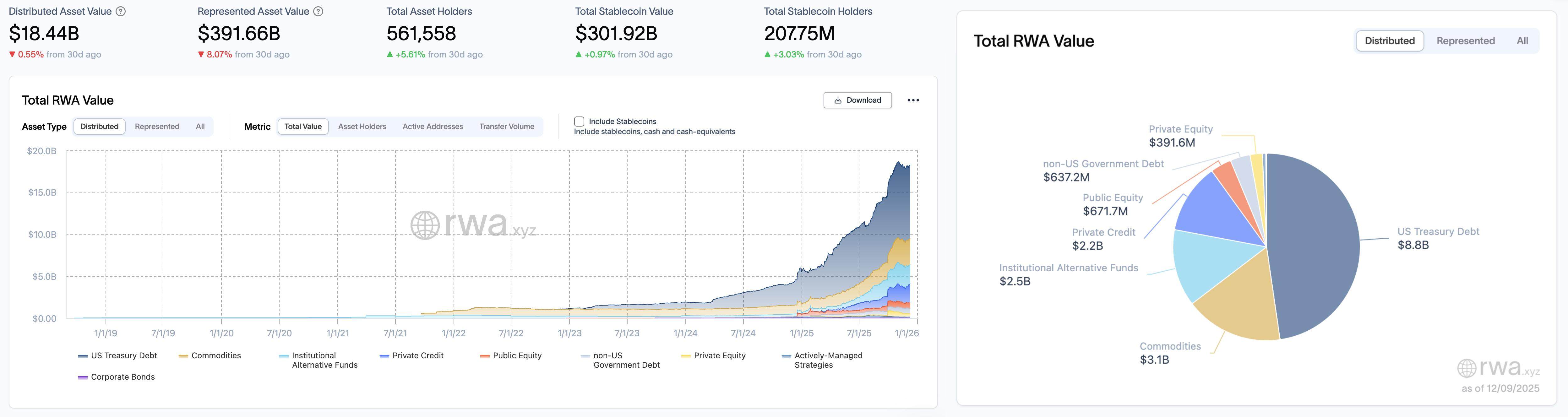

According to the data dashboard from rwa.xyz, as of December 9, 2025, the total on-chain value of RWA (Distributed Asset Value) has stabilized significantly this week after experiencing drastic fluctuations last week due to adjustments in statistical standards. The data shows that the total value slightly increased from $18.41 billion on December 2 to $18.44 billion, a growth of about $0.03 billion, with a weak increase. Meanwhile, the value of representative assets (Represented Asset Value) rose from $391.55 billion to $391.66 billion, indirectly confirming the resilience of the broader RWA market. The growth momentum on the user side remains strong, with the total number of asset holders jumping from 555,428 to 561,558, an increase of 6,130 people in a single week, or about 1.1%. In the stablecoin market, the total market capitalization rose from $300.99 billion to $301.92 billion, an increase of $9.3 billion; the number of stablecoin holders surged by 2.06 million, from 205.69 million to 207.75 million, providing extremely ample potential purchasing power for on-chain assets.

In terms of asset structure, the U.S. Treasury bond sector, which has been a core support recently, slightly adjusted from $8.9 billion last week to $8.8 billion, a decrease of $1 billion. In contrast, the private credit sector, which saw a significant contraction last week, showed signs of rebound, with its scale recovering from $2 billion to $2.2 billion, an increase of $200 million in a single week. Institutional alternative funds continued to be under pressure, further shrinking from $2.6 billion to $2.5 billion. Commodity assets maintained a high level of stability, remaining at $3.1 billion for two consecutive weeks. Among other sectors, public equity performed well, increasing from $655.8 million to $671.7 million, while non-U.S. government debt slightly rose to $637.2 million, and private equity dipped slightly to $391.6 million.

Trend Analysis (Comparison with Last Week)

This week, the RWA market showed stable overall growth, disregarding the impact of last week's "data adjustments." Although there was no retaliatory rebound in total market capitalization, the halt and recovery of the private credit sector may bring a positive signal to the market. The flow of funds has begun to diversify from leading U.S. Treasury bonds to slightly riskier credit and equity assets. The massive growth in the user base of stablecoins remains the biggest macro highlight of the week, indicating that off-market funds are accelerating their entry, although it has not yet fully translated into an increase in RWA assets, the reservoir effect is already quite evident.

Market keywords: stabilization and recovery, credit return, liquidity reservoir.

Key Event Review

Caroline D. Pham, acting chair of the U.S. Commodity Futures Trading Commission (CFTC), announced the launch of a digital asset collateral pilot program, allowing digital assets such as BTC, ETH, and USDC to be used as compliant margin in the U.S. regulated derivatives market, and released regulatory guidelines on tokenized collateral while abolishing old rules that became ineffective due to the introduction of the GENIUS Act.

The CFTC stated that this initiative is an important milestone in promoting the application of tokenized assets in regulated markets, providing a clear regulatory framework for the futures and swaps markets, including: the scope of tokenized assets, legal enforceability, custody and segregation requirements, valuation and risk management, operational risks, etc. In the initial three months, the acceptable digital asset collateral for FCMs (Futures Commission Merchants) is limited to BTC, ETH, and USDC, and they must report their positions to the CFTC weekly on a segregated account basis.

At the same time, the CFTC provides "no-action" protection for FCMs accepting digital assets as margin, offering regulatory clarity to institutions and requiring them to maintain robust risk control. The CFTC also rescinded staff notices 20-34, as the content became inapplicable due to the GENIUS Act and rapid developments in recent years.

Several industry companies welcomed this move. The Chief Legal Officer of Coinbase stated that the CFTC's decision proves that stablecoins and digital assets can enhance payment efficiency. The president of Circle stated that this move will reduce settlement friction and strengthen the dominance of the U.S. dollar. The CEO of Crypto.com called it "a significant moment in U.S. crypto history." A Ripple executive pointed out that clearly including stablecoins as eligible margin will bring higher capital efficiency.

The CFTC stated that the relevant actions incorporated feedback from market participants, public comments, feedback from the Crypto CEO roundtable, and recommendations from its Global Markets Advisory Committee.

U.S. CFTC: Spot Cryptocurrency Can Now Be Traded on CFTC Registered Exchanges

Caroline D. Pham, acting chair of the U.S. Commodity Futures Trading Commission (CFTC), announced that spot cryptocurrency products will be allowed for the first time to be traded on CFTC-registered regulated futures exchanges.

Pham stated that this move is part of the Trump administration's plan to make the U.S. the "world's cryptocurrency capital," aiming to address the lack of protections associated with offshore exchanges by providing a regulated domestic market.

Additionally, as part of the "Crypto Sprint" initiative, the CFTC will also promote the use of tokenized collateral (including stablecoins) in the derivatives market and revise rules to support the application of blockchain technology in infrastructure such as clearing and settlement.

U.S. Lawmakers Urge Regulators to Implement Stablecoin Regulations Before July 2026 Deadline

The GENIUS Stablecoin Act, passed by the U.S. this summer, has entered the implementation phase, with federal regulators advancing the formulation of supporting rules, aiming to complete them by July 18, 2026. Congressman Bryan Steil urged regulators to "complete on time" during a hearing to avoid long delays in the introduction of regulations. The FDIC stated that it will propose a draft of the GENIUS-related rules this month, while the NCUA indicated that the first rule may be the application process for stablecoin issuers. The GENIUS Act requires stablecoins to be fully backed by U.S. dollars or highly liquid assets and mandates annual audits for issuers with a market capitalization exceeding $50 billion. During the hearing, Democratic Congresswoman Maxine Waters also questioned potential conflicts of interest regarding President Donald Trump's involvement in crypto projects.

Wang Yongli, former vice president of the Bank of China, published an article on the public account titled "Why Does China Firmly Halt Stablecoins?" In it, he pointed out that China is accelerating the development of the digital RMB and has a clear policy orientation to firmly curb virtual currencies, including stablecoins. This is based on a comprehensive consideration of China's leading advantages in mobile payments and digital RMB, the sovereignty security of the RMB, and the stability of the monetary and financial system. The space and opportunities for developing non-U.S. dollar stablecoins are limited, as U.S. dollar stablecoins account for over 99% of the global fiat stablecoin market capitalization and trading volume. He emphasized that with U.S. dollar stablecoins already dominating the crypto asset trading market, developing RMB stablecoins along the path of U.S. dollar stablecoins would not only struggle to challenge the international status of U.S. dollar stablecoins but could even turn RMB stablecoins into a subordinate of U.S. dollar stablecoins, posing a serious threat to the sovereignty security of the RMB and the stability of the monetary and financial system.

Several European Banks Promote Euro Stablecoin, Aiming for Launch in the Second Half of 2026

Ten European banks, including BNP Paribas, ING, and UniCredit, have formed a new company called Qivalis, planning to launch a euro-pegged stablecoin in the second half of 2026 to counter the U.S. dollar's dominance in digital payments. Qivalis is headquartered in Amsterdam, with former Coinbase Germany CEO Jan-Oliver Sell as CEO and former NatWest chairman Howard Davies as chairman.

The ruling Democratic Party of Korea has requested the government to submit a new bill by December 10 to regulate won-pegged stablecoins.

Kang Jun-hyun, head of the Democratic Party's Policy Committee, stated that the draft bill will only allow commercial banks to hold at least 51% of the alliance issuing fiat-pegged tokens. Kang Jun-hyun said this move aims to coordinate the positions of the Bank of Korea, the Financial Services Commission, and the banking sector.

If the government fails to take action, Kang Jun-hyun stated that the National Assembly will lead and advance the legislation. The proposal will limit stablecoin issuance to alliances where commercial banks hold no less than 51% to resolve long-standing disputes over the qualifications of issuing entities. However, the Financial Services Commission later issued a statement saying, "No final decisions have been made regarding the alliance proposal."

International Monetary Fund Warns: The Popularity of Stablecoins May Undermine Central Bank Control

The International Monetary Fund (IMF) stated that stablecoins are expected to broaden individuals' access to financial services, but this may come at the expense of central banks in various countries.

In a 56-page report released on Thursday, the international organization pointed out that "currency substitution" is a potential risk brought by stablecoins, and this trend may gradually erode the financial sovereignty of nations.

Historically, if individuals wanted to hold U.S. dollars, they typically needed to possess physical cash or open specific types of bank accounts. However, the IMF emphasized that "stablecoins can rapidly penetrate a country's economic system through the internet and smartphones."

The organization added, "Especially in cross-border scenarios, the use of foreign currency-denominated stablecoins may lead to currency substitution, potentially undermining monetary sovereignty, particularly in the absence of custodial wallets."

The IMF indicated that if a significant amount of economic activity no longer relies on the domestic currency, central banks will find it challenging to effectively control domestic liquidity and interest rates.

The report noted that if foreign currency-denominated stablecoins gain a foothold through payment services, domestic alternatives such as central bank digital currencies (CBDCs) may face competitive pressure. Unlike privately issued stablecoins, CBDCs are sovereign digital forms of currency issued, regulated, and managed by central banks.

WLFI Co-Founder: A Series of RWA Products to Launch in January 2026

According to Reuters, Zach Witkoff, co-founder of the crypto company World Liberty Financial, supported by the Trump family, announced at an event in Dubai on Wednesday that the company will launch a series of real-world asset (RWA) products at the beginning of January 2026. World Liberty Financial's stablecoin USD1 was used this year by an Abu Dhabi-backed company, MGX, to pay for its investment in Binance.

Hot Project Updates

Ondo Finance (ONDO)

One-Sentence Introduction:

Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, high-liquidity assets while maintaining decentralized transparency and security. Its token ONDO is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application scope in the DeFi ecosystem.

Latest Updates:

On December 8, it was reported that the U.S. Securities and Exchange Commission (SEC) has concluded its investigation into the tokenized asset company Ondo Finance without recommending any charges.

This investigation began in October 2023, initiated by former SEC Chair Gary Gensler, primarily examining whether Ondo complied with U.S. securities laws when tokenizing U.S. Treasury bond products and whether the ONDO token should be classified as a security. An Ondo spokesperson stated that the company received formal notification in late November that the two-year SEC investigation had concluded. Since the appointment of pro-crypto SEC Chair Paul Atkins, the agency has ended most investigations related to cryptocurrencies. Ondo stated that the resolution of the investigation clears obstacles for its expansion in the U.S., as the company has registered as an investment advisor and acquired SEC-registered broker-dealer, ATS operator, and transfer agent Oasis Pro Markets. Ondo is scheduled to hold its annual Ondo Summit in New York on February 3, where it is expected to announce new tools and products for tokenized real-world assets.

Previously, according to Ondo Finance official news, over 100 tokenized stocks and ETFs launched by Ondo have officially gone live on Binance Wallet based on the BNB Chain, providing investment opportunities to 280 million users.

MSX (STONKS)

One-Sentence Introduction:

MSX is a community-driven DeFi platform focused on tokenizing U.S. stocks and other RWAs for on-chain trading. The platform achieves 1:1 physical custody and token issuance through a partnership with Fidelity. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins such as USDC, USDT, and USD1, and trade them around the clock on the Base blockchain. All transactions, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradFi and DeFi, providing users with a high liquidity, low-threshold entry point for on-chain investments in U.S. stocks, building a "Nasdaq of the crypto world."

Latest Updates:

On December 3, data from the MSX official website (msx.com) showed that the platform's trading volume reached $2 billion in the past 24 hours, setting a new single-day historical high. As of the time of publication, the platform's total trading volume has surpassed $20.6 billion, with an increase of over $7.5 billion in the past five days, a cumulative increase of over 57%. Additionally, MSX concluded its points season S1 on December 2, and the M Credits earned by users will be directly used for future MSX token distribution.

On December 5, MSX founder Bruce posted on X stating that Nasdaq has submitted an application for stock tokens, and MSX is ready to transition to "official" tokens. He stated, "Nasdaq submitted its application for stock tokens to the SEC in September this year, and if progress goes well, it will officially launch in Q1 next year. The launch of Nasdaq's stock tokens will impact all 'unofficial stock tokens,' and MSX is ready to transition to 'official' tokens at any time."

Related Links

Sorting out the latest insights and market data in the RWA sector.

Seven financial industry associations in China jointly issued a risk warning, explicitly classifying the tokenization of real-world assets (RWA) as illegal activities related to virtual currencies, alongside stablecoins and air coins. Lawyer Liu Honglin authored the analysis, detailing the legal risks of RWA, the joint liability of service institutions, and the regulatory penetration of the "overseas entity + domestic personnel" model, providing authoritative reference for understanding the current direction of financial regulatory policies.

《Analyzing the First RWA "Blowup" Case: What Risks Are Worth Noting?》

Lawyer Xiao Sa's team provides an in-depth analysis of the first "blowup" event in the RWA industry, not only detailing the event's progression but also systematically dismantling the risk transmission mechanism, revealing the core vulnerabilities of RWA projects from the perspectives of underlying assets, technical architecture, and legal compliance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。