To be honest, over the past two years, I have seen too many #Web3 projects telling "stories," but the only one in Asia that can write its story into the regulatory framework, into the prospectus, and into the mainstream capital system is basically a lone example—#HashKey (@HashKeyGroup).

Now it has officially passed the Hong Kong Stock Exchange hearing and is set to be listed on December 17. It has also invited three top cornerstone investors from the financial sector: UBS, Fidelity, and DCM. This lineup is quite impressive; it’s not just simple "support," but a real vote of confidence with actual capital. Foreign investors see its compliance path, and DCM understands its territorial value. As an old investor, this is the first time I feel that Hong Kong has shifted from "experimenting" to "taking real action," and #HashKey's listing is the starting gun.

1️⃣ HashKey's Core Value—Systematic Compliance Capability

Most exchanges start with "listing new coins and boosting trading volume," but HashKey takes the opposite approach, beginning with "regulatory compliance framework, a top-down complete system," setting high standards from the outset.

The outcomes of these two development paths are completely different: trading volume can be manipulated, coins can be listed, and retail can be advertised. However, compliance capability + institutional-level risk control framework + asset management capability + on-chain infrastructure cannot be replicated; they require sufficient time for sedimentation and accumulation.

Although this path started slowly, it has become increasingly stable:

▸ 2018–2021: While others rushed for trading volume, they focused on building infrastructure.

Conducting KYC, risk control, custody, and compliance internal control may sound quiet, but this is the "underlying operating system" needed to obtain licenses.

▸ 2022 Obtaining Licenses: A Watershed Moment and a Barrier

Becoming one of the first virtual asset exchanges to obtain Class 1/7 licenses is not just a "permit"; it essentially means they can serve clients using traditional financial institution standards. This is not a simple certificate; it is HashKey securing the ticket to collaborate with banks, family offices, and funds.

▸ 2023~Present: HashKey's Ecosystem is Basically Formed

• Exchange: Expanding from professional investors to retail.

• Custody, OTC, and staking services: A complete chain.

• HashKey Capital: One of Asia's largest blockchain VCs and secondary fund managers.

• HashKey Chain: Building the underlying network for RWA and institutional on-chain assets.

Many people think HashKey is just an "exchange." But if you look closely at its structure, you will find that it is building the compliance foundation for the Hong Kong digital asset market, comparable to Coinbase in the US stock market.

2️⃣ Not Surviving by "Collecting Fees," but "Helping Institutions Make Money"

Many people think HashKey is just an exchange. Wrong! Its core is actually a triad of "asset management + infrastructure + investment."

Managing HKD 7.8 billion (as of September 2025), it is one of Asia's largest licensed digital asset management institutions; its fund returns exceed 10 times, double the industry average (data from Frost & Sullivan); it has invested in over 400 projects, covering the entire chain from early-stage VC to the secondary market.

It has also developed its own chain—HashKey Chain—not to issue tokens for speculation, but specifically to compliantly put "real assets" like bonds, real estate, and fund shares on-chain. This is precisely the current booming "RWA tokenization," the next frontier that global financial giants are rushing to enter.

Therefore, HashKey is not just an "exchange," but a cutting-edge player that "invests in projects, invests in sectors, and invests in the future." This "ecosystem + asset management" growth model is something that no one in Hong Kong's virtual asset industry has been able to replicate so far.

3️⃣ Finance: Behind High-Speed Growth is Reasonable "Transition Period Volatility"

Seeing three consecutive years of losses in the financial report (with a loss of nearly HKD 1.2 billion in 2024), most people might frown. But if you examine closely, you will find that these losses are not operational losses but strategic investments.

HashKey's gross margin has consistently been over 70% (73.9% in 2024), indicating that the business model itself is very profitable; the losses mainly come from: technology research and development (like HashKey Chain), license compliance, global team building, and early investments. Currently, it has HKD 1.657 billion in cash + HKD 592 million in digital assets, with extremely healthy cash flow.

This is similar to Tesla, which was also losing money in 2019, but no one questioned its technological barriers and ecological ambitions. HashKey is doing something similar now—exchanging high investment for a long-term moat.

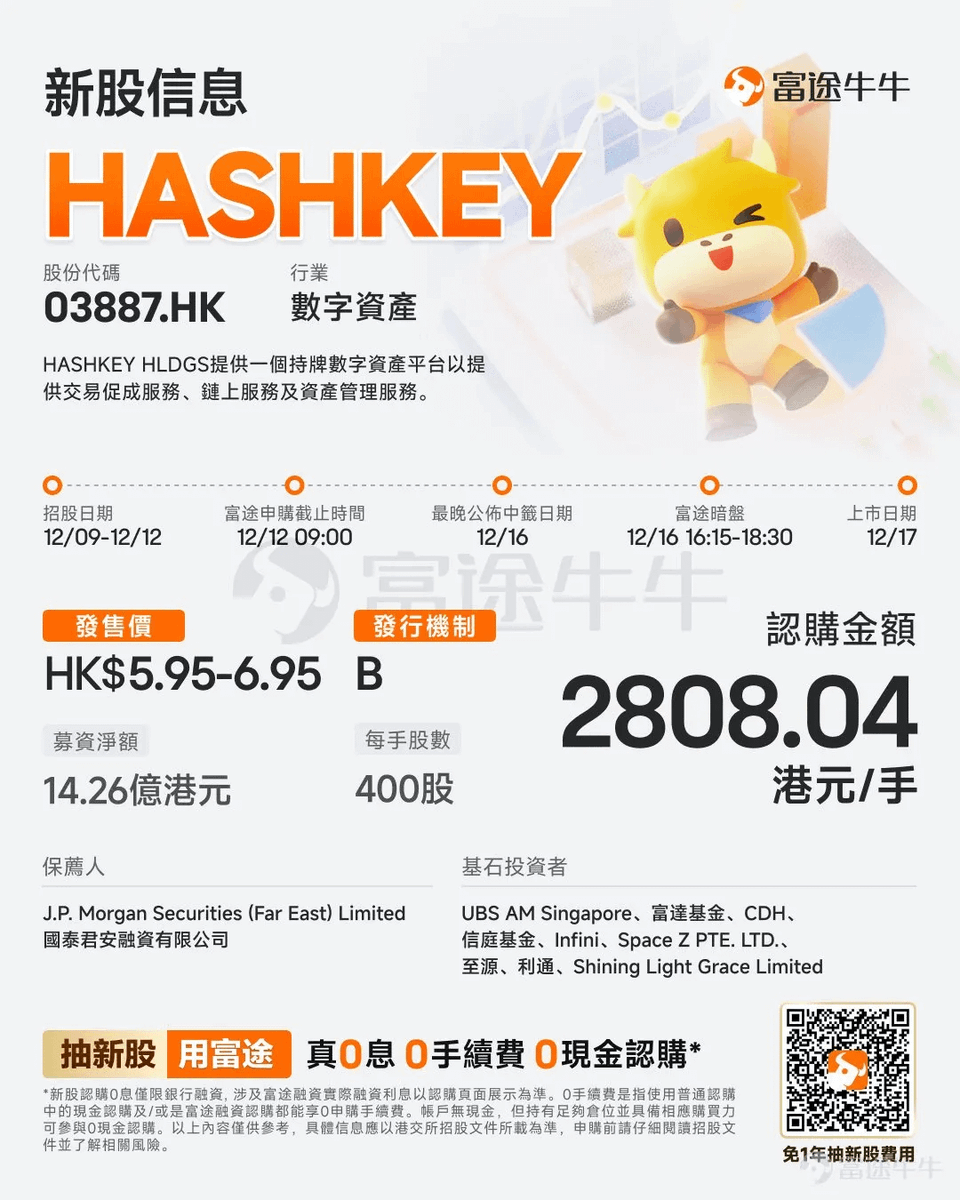

In conclusion, on December 17, #HashKey will be listed on the Hong Kong Stock Exchange. Today I saw that Futu is also supporting the IPO, and we must support "Hong Kong's first crypto stock." If Coinbase represents the "American model," first growing the user base and then seeking compliance; then HashKey represents the "Hong Kong model," first securing compliance, then serving institutions, and finally driving the ecosystem. In the context of Chinese capital, HashKey's path will be more stable and sustainable. I believe that in the future, international institutions wanting to enter the Asian market will regard HashKey as a "compliance gateway"; if it succeeds, a batch of similar companies will follow suit and go public, forming a "digital finance Hong Kong stock sector," creating a clustering effect. Asia's Coinbase is setting sail, and we are watching closely! 🧐 @siyahashkey

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。