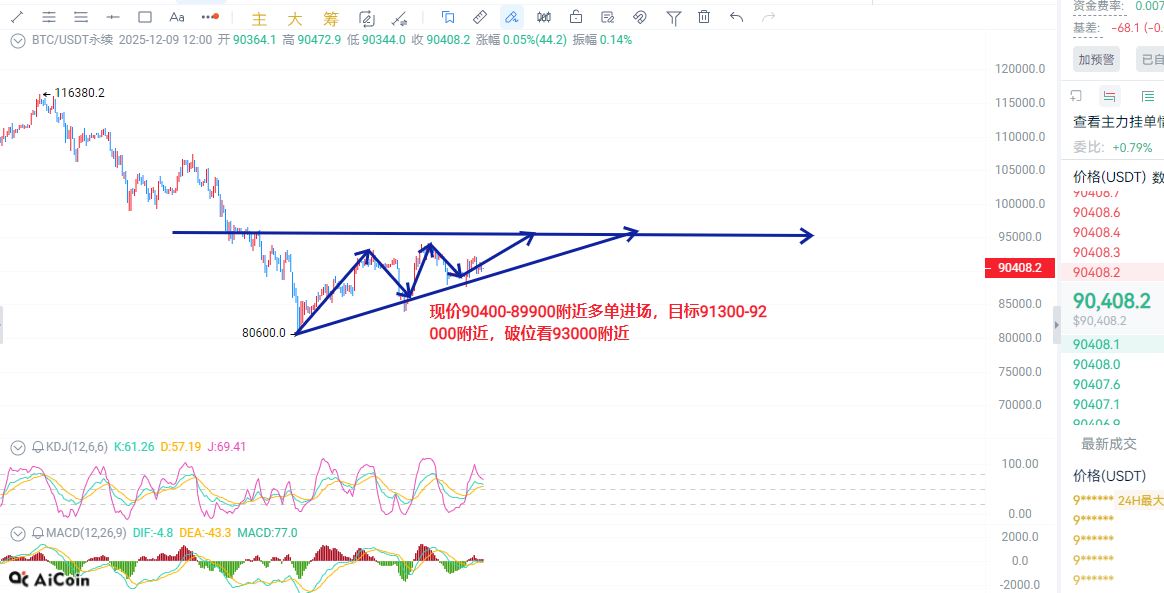

On December 9, Bitcoin was experiencing a very frustrating volatile market ahead of the Federal Reserve's interest rate decision. In the morning, the price briefly broke through $92,000 but then sharply retraced and fell below $90,000. The MACD on the hourly chart has entered the negative zone, indicating a weak short-term trend. However, on the daily chart, the MACD fast and slow lines maintain a golden cross above the zero axis, suggesting that after a short-term pullback, there is still upward potential.

Ethereum was also influenced by the market sentiment ahead of the Federal Reserve's interest rate decision, showing an overall bullish pattern. Although it dropped in the morning along with Bitcoin, it demonstrated stronger resilience against declines. The daily chart shows that the highs are gradually rising, the Bollinger Bands are in a contracting state, and the candlestick is repeatedly testing upwards around $3,170, indicating that the bullish strength is greater than the bearish.

It is recommended to enter long positions for Bitcoin around the current price of $90,400-$89,900, targeting around $91,300-$92,000, with a breakout target near $93,000.

It is recommended to enter long positions for Ethereum around the current price of $3,120-$3,100, targeting around $3,160-$3,200.

The market is ever-changing, and these strategies are for reference only!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。