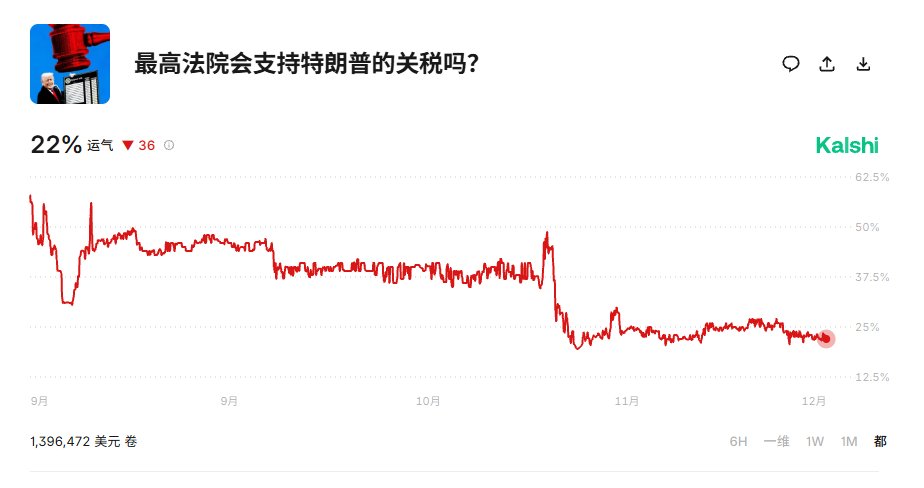

The market sentiment on Monday is still quite good, although there are concerns that Trump's tariffs may be deemed illegal by the Supreme Court, leading to some pessimism. After all, Trump's biggest achievement since taking office has been the tariffs, and if they are declared illegal, it could shake his voter base and increase social instability. However, from a risk market perspective, the removal of tariffs could actually be a good thing, as it would reduce the likelihood of stubborn inflation, lower the prices of imported goods, and could even boost the GDP of the United States.

So, in my personal view, while tariffs may undermine Trump's position, they are beneficial for the U.S. economy. Of course, if Trump loses the case, he may initiate other measures to maintain the tariffs, which would have a greater impact on the economy. I wrote about this in my weekly report last week; interested friends can take a look.

Aside from that, there are almost all good news. Hassett changed his previous statement about interest rate cuts being gradual, now believing that the Federal Reserve should act quickly to lower rates. Although he mentioned that future rate cuts would depend on data, it still indicates that rapid rate cuts could alleviate economic issues in the U.S. Additionally, the U.S. and China have entered a "honeymoon period," with the U.S. opening up the Nvidia H200 chips to China, while China has agreed to purchase more U.S. soybeans.

Overall, the macro market sentiment is still manageable, at least not overly pessimistic. The remaining factor will be the interest rate meeting early Thursday morning.

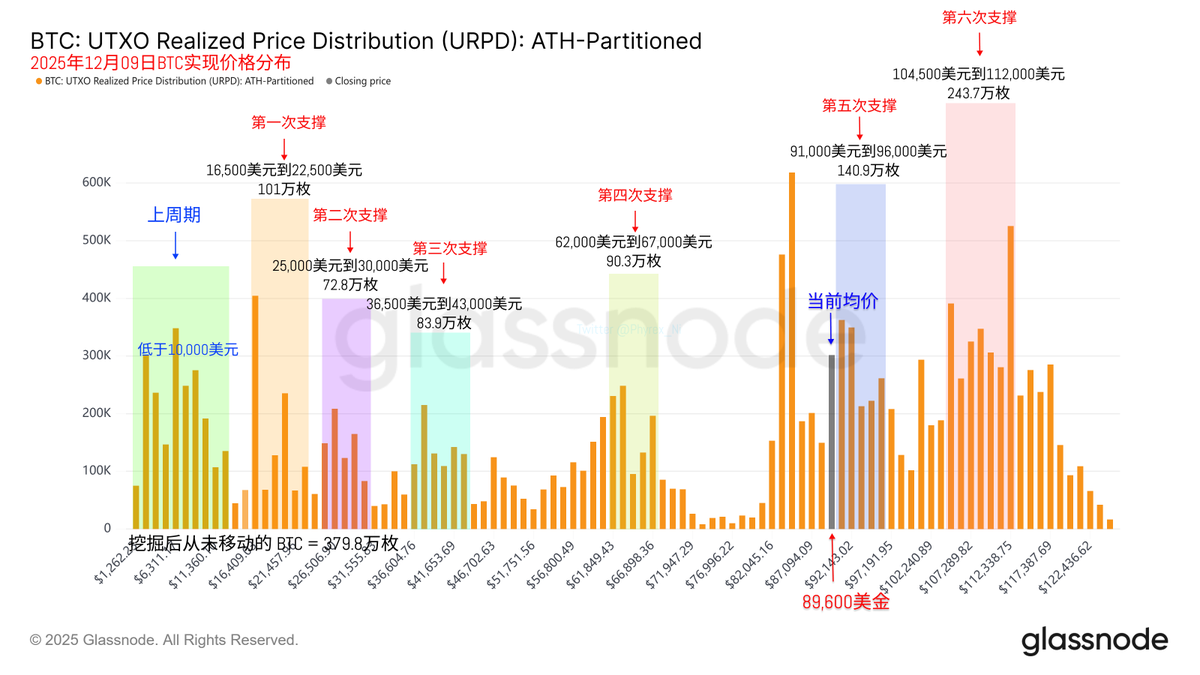

Looking at Bitcoin data, the turnover rate surged significantly just as we entered Monday. Recently, the sentiment among short-term investors has been unstable, leading to very high turnover, which has also limited the price increase of $BTC. The frequent turnover among short-term investors is mainly due to pessimistic expectations for the future, while the sentiment among earlier investors remains quite stable.

The chip structure is currently still considered safe, with no signs of a significant collapse among loss-making investors. This week's focus remains on the Federal Reserve's interest rate meeting. Although Powell's influence may be weakened by Hassett, the dot plot still represents the views of Federal Reserve officials and will have a significant impact on sentiment.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。