Global credit markets hold $300 trillion in debt but are still running on infrastructure built decades ago.

@pactfinance is rebuilding structured credit from the ground up, fully onchain.

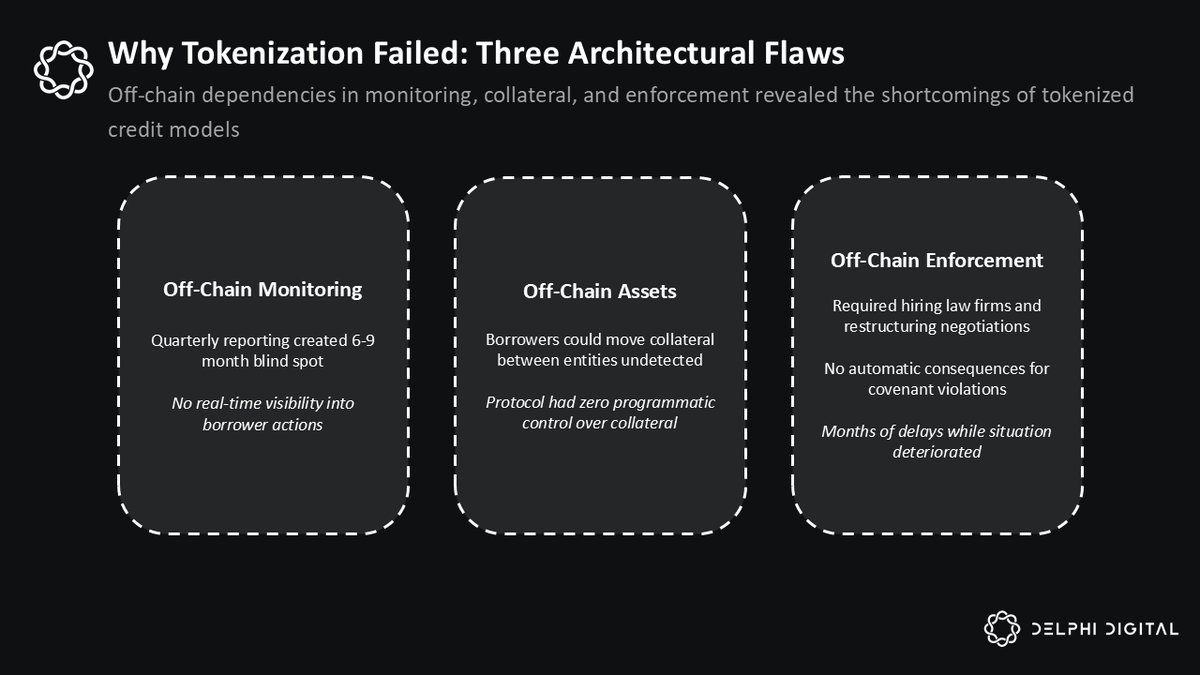

Traditional structured credit depends on layers of intermediaries, each adding fees and friction. Upfront diligence alone is expensive. Covenant enforcement happens quarterly. Borrowing base shortfalls can go weeks undetected.

Most onchain credit platforms function as refinancing layers rather than native lending systems. They tokenize existing offchain loans, but the underlying origination, servicing, and enforcement remain dependent on traditional intermediaries.

PACT Protocol rebuilds the system from first principles bringing all components fully onchain. Rather than using blockchain as a passive record keeping layer, it embeds compute, data, and execution directly into the credit lifecycle.

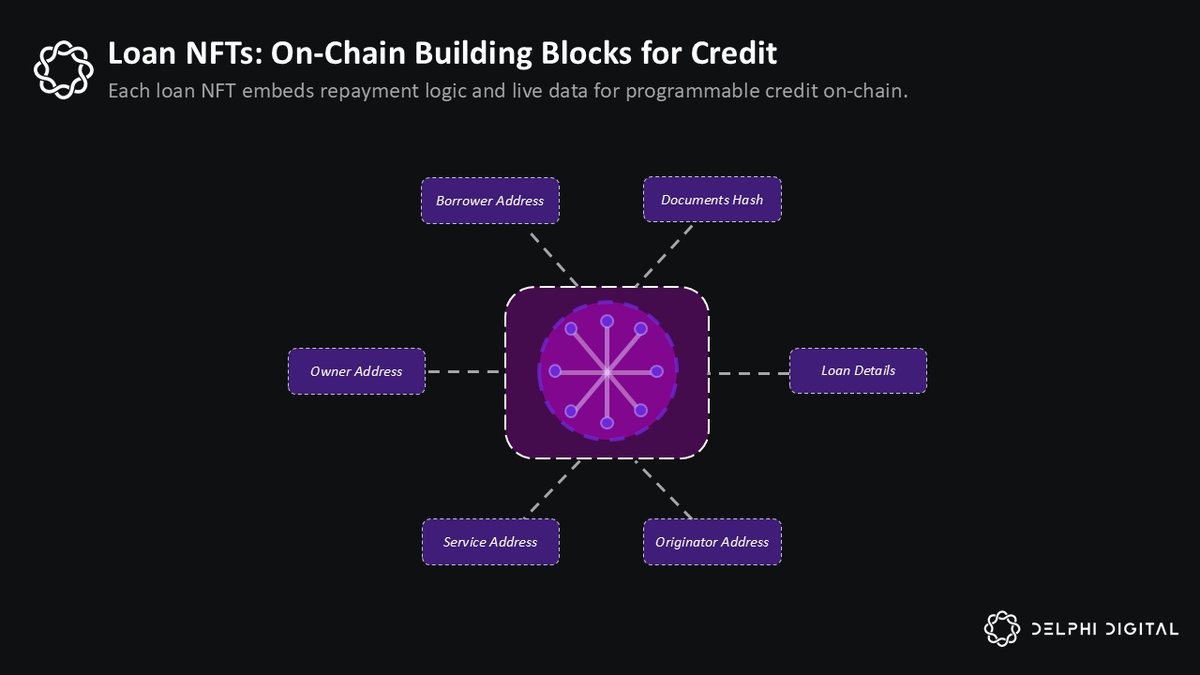

Loans originate directly as NFTs onchain with embedded repayment schedules, covenant logic, and payment routing.

Each loan NFT carries a unique identifier (similar to a CUSIP), borrower data, collateral details, and performance metrics.

The NFT is the loan itself. PACT calls this "farm to table RWAs": assets native to blockchain infrastructure.

This eliminates the reconciliation gap that plagues tokenized credit. When a borrower pays, the entire system updates in real time, adjusting principal balance, payment history, waterfall distributions, and facility metrics automatically.

Double pledging becomes impossible since a loan NFT can only have one owner. Covenant checks execute on every draw request. Violations are caught immediately.

The composability unlocks the full structured credit stack. Loan NFTs aggregate into loan books, which get pledged as collateral to facilities. Borrowing base logic and concentration limits are all enforced through code.

And to date, PACT has been able to scale quickly. The project has originated over $1.9B in loans across more than 900k borrowers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。