🧐 When AI no longer writes code, but writes profits: What story is Almanak @almanak telling?

I've been thinking about a question lately: Where will automation in the WEB3 track first explode?

After some thought, I believe the most likely answer is:

Putting money in places that can automatically make money.

1) First principles: Crypto is very close to money; most people come to make money, and the ability to earn money is even more attractive.

2) Finance is the ultimate feedback loop of all intelligence; the act of making money is itself an optimization problem.

1️⃣ The future of trading is the era of AI!

Recently, in an interview with Duan Yongping, he mentioned that the future trading market will likely be an era of machines battling machines, and AI is already taking shape.

For example, there are so many models, machines, and black-box strategies in the market that claim to be "smart money."

But they have never belonged to us.

Funds exceeding hundreds of millions enjoy automated execution, real-time arbitrage, and cross-market scheduling.

What about us? Scrolling through Twitter, watching K-lines, and betting based on intuition.

Is it reliable?

Clearly not, which is why most trading activities result in losses.

Why?

Because execution capability is hundreds of times more important than prediction.

Humans may know opportunities, but only AI can truly seize them.

Understanding this path is key to grasping the essence of future trading.

And Almanak has done something bold: it has taken back the execution rights of institutional-level strategies from institutions.

2️⃣ Cursor for DeFi: Not AI "writing code," but AI "writing strategies"

What Almanak aims to do is actually quite simple:

To democratize the execution capabilities of strategies that only institutions could use, where AI Swarm is not a "robot that randomly operates your funds," but rather:

Users describe their strategic intentions, and Agents generate executable on-chain code for the strategy, which undergoes multiple layers of risk control review, automatically rebalancing and executing strictly according to the strategy logic, with funds fully under the user's control and all execution actions verifiable on-chain.

In one sentence: Users maintain complete control from start to finish. The strategy is automated, and rebalancing and trading are executed according to the strategy logic, not decided by the Agent.

Key data:

TVL in 4 months → $130M+,

Realized profits exceeding $1M,

Pendle daily trading volume $3M.

3️⃣ Their TGE mechanism is also quite interesting:

Almanak has released a TGE mechanism:

Turning TGE into an on-chain consensus experiment: completely transparent, community co-creation, and high participation incentives:

Almanak Games + The Pledge Movement

On-chain real trading behavior competition (trading, LP, strategy deployment all count as contributions)

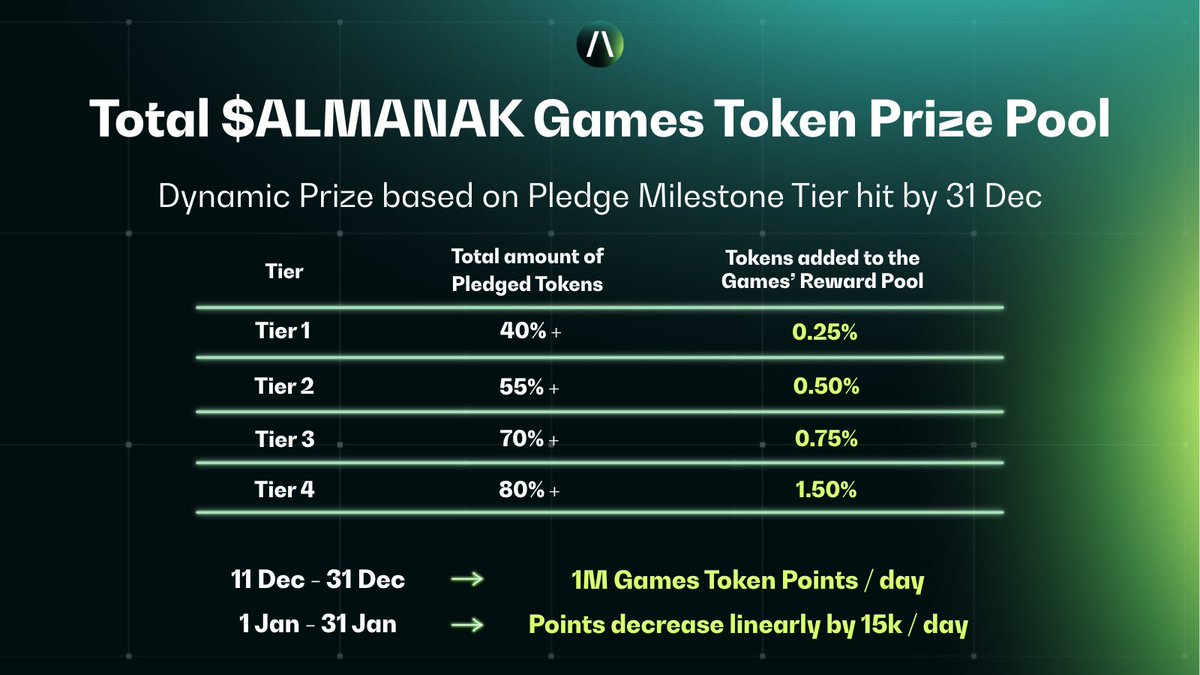

Rewards = up to 3% of total token supply + up to $1 million USDC incentives.

Commitment to long-term holding (until the end of 2025) → additional Boost

You can check their latest announcement for specifics!

4️⃣ Conclusion—

Perhaps we can really turn making money into a programmable, verifiable infrastructure, no longer relying on human greed, emotions, and luck.

If you're interested, take a glance: @almanak

I don't recommend blindly rushing in, but I do suggest understanding what might happen in the future; sometimes, cognition is more important than position.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。