The data from the prediction market is rapidly cooling, with the probability of Bitcoin breaking $100,000 by the end of the year dropping from a recent 45% to a collective wait-and-see approach among traders as the year-end approaches. Polymarket prediction contracts show that the probability of Bitcoin surpassing $100,000 by the end of 2025 has fallen to 45%, while the probability of it dropping below $80,000 has risen to 34%.

At the beginning of December, Bitcoin's price plummeted by 7%, retreating about 31% from the historical high on October 6, with the entire cryptocurrency market's market cap evaporating by over a trillion dollars.

1. The Thermometer of the Prediction Market

● The prediction market serves as a barometer of sentiment in the crypto space, clearly recording the entire process of declining investor confidence. On the Polymarket platform, the prediction data regarding whether Bitcoin can return to $100,000 by the end of the year remains at 45%, a state of hesitation close to a "fifty-fifty" split.

● Behind this data lies a collective psychological shift among market participants. Meanwhile, the probability of a more aggressive target of $110,000 is only 17%, while the proportion of participants believing there will be a deep correction, dropping below the $80,000 line, has reached 34%.

● Market observers have pointed out: “A 45% probability is essentially a gambler's mentality; no one really dares to go all in.” This state of divergence reflects a complex emotion of neither fully bearish nor entirely confident in new highs.

2. Dual Pressure from Price and Structure

● The Bitcoin market is undergoing a comprehensive stress test from both technical and fundamental perspectives. On December 1, Bitcoin experienced a sharp decline, dropping from around $90,000 to approximately $83,600. This crash was accompanied by over $500 million in long positions being forcibly liquidated, pushing the market fear index back toward the "extreme fear" zone.

● From a technical indicator perspective, Bitcoin's technical structure has undergone substantial changes. Analysts point out that the 50-day moving average has crossed below the 200-day moving average, forming a typical "death cross," which is a clear signal of a mid-term trend reversal.

● At the same time, the ADX indicator, which measures trend strength, has risen to 40, indicating that the market is entering a clearly defined and rapidly moving trend.

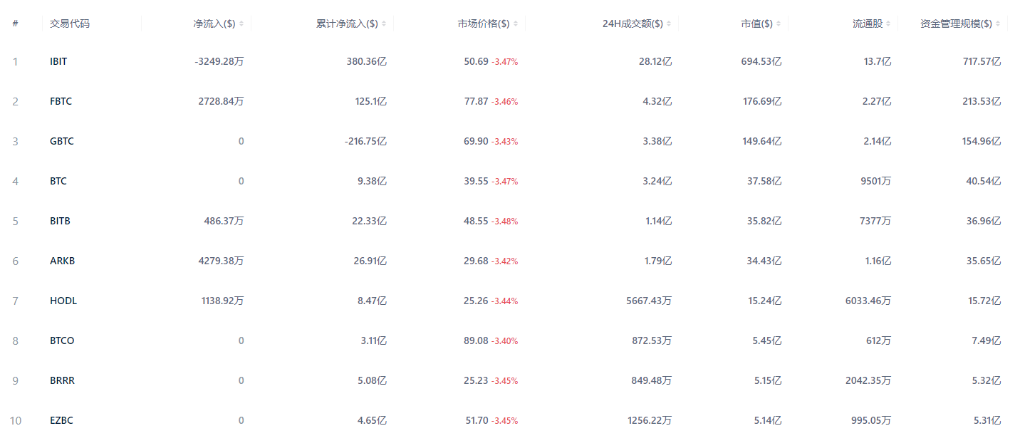

3. The Withdrawal Tide of Institutional Funds

● The attitude of institutional investors towards Bitcoin has subtly changed in December, directly reflected in the fund flow data. AiCoin data shows that December saw a net outflow of up to $3.5 billion from Bitcoin spot ETFs, marking the worst month since February. More detailed data indicates that just in the first few days of December, institutions withdrew over $250 million from Bitcoin ETFs.

● As a primary tool for traditional fund allocation in cryptocurrencies, ETF inflows and outflows often represent the attitude of "long money." Continuous fund outflows indicate that the pace of external incremental funds has clearly slowed, and institutional investors may be reassessing the positioning of cryptocurrencies in their portfolios.

4. Dangerous Signals from the Derivatives Market

● Abnormal phenomena in the derivatives market cast more shadows over Bitcoin's price outlook. Bitcoin has exhibited a "futures discount," where futures prices are lower than spot prices. This situation typically indicates market pressure, extreme fear, or strong hedging activity. The last occurrence of this was in August 2023, when news of the Grayscale ETF triggered massive sell-offs.

● The three-month rolling annualized basis has dropped to around 4%, the lowest level since November 2022. This basis measures the annualized return obtainable through basis trading, i.e., traders buying Bitcoin spot and selling futures contracts expiring in three months.

● In a bull market phase, traders are willing to pay higher fees for forward risk exposure, which pushes up the basis. However, during periods of extreme market enthusiasm, the curve may turn into steep futures contango.

5. Constraints from the Macroeconomic Environment

● December's macroeconomic agenda is dense, adding more uncertainty to Bitcoin's price. This month's market direction will depend on several key macro events: U.S. CPI, unemployment data, FOMC meeting, Bank of Japan interest rate decision, and Powell's speech.

● Recently, a Bank of Japan official made a rare statement suggesting a possible consideration of interest rate hikes, which quickly sparked global concerns about a potential reversal of "yen carry trades." If investors have to cover their yen positions instead of continuing to borrow yen to buy U.S. stocks or crypto assets, global risk markets may enter a phase of "passive deleveraging."

6. Is a Market Bottom Forming?

● Amidst the pessimistic sentiment, some analysts are trying to find signals that the market may be bottoming out. Derek Lim, head of research at Caladan, believes that Bitcoin is likely to fluctuate within a certain range, with prices consolidating between $83,000 and $95,000.

● Tim Sun, a senior researcher at HashKey Group, points out that Bitcoin is unlikely to initiate a sustained upward trend before the end of 2025; a more realistic scenario may be "struggling to find a bottom formation."

● Notably, Vanguard, an asset management giant that has always viewed cryptocurrencies as "speculative assets" and kept them at arm's length, suddenly announced it would open up crypto ETF trading to its clients. This shift occurs against the backdrop of the crypto market's market cap evaporating by over a trillion since October, carrying complex signaling implications.

7. Challenges of Liquidity and Market Depth

● The liquidity situation in the Bitcoin market is deteriorating, further exacerbating price volatility. The "market depth" of Bitcoin's order book hovered around $568.7 million last weekend, down from the peak of $766.4 million in early October.

● This means that market depth has plummeted by nearly 30% over the past month. Market depth is an indicator of the resistance to price fluctuations caused by large trades; a decrease in depth means that any large trade will lead to greater price volatility.

● Worryingly, the scale of leveraged trading is currently at a relatively high level, creating a hidden market trigger point. In a situation of insufficient market depth, the liquidation of high-leverage positions could trigger a chain reaction, further amplifying price volatility.

8. Year-End Outlook and Investment Strategies

In the face of a complex market environment, analysts hold a cautious attitude towards Bitcoin's year-end performance. Multiple analysts predict that Bitcoin is unlikely to initiate a sustained upward trend before the end of 2025.

● Lim from Caladan compared the current situation to that of 2019, when risk assets saw significant increases only about 6 to 12 months after the Fed ended its last quantitative tightening cycle.

● However, some analysts still believe that Bitcoin is in a bull market correction rather than a bear market. Sun explains that a true bear market is usually accompanied by a large-scale withdrawal of long-term funds from the market, a collapse of market narratives, and massive withdrawals by institutions.

● Lim warns that if Bitcoin's price falls below $75,000, it could trigger a more severe sell-off.

The speed of market sentiment change is lightning-fast. Just days before Bitcoin's decline, most traders in the Myriad prediction market still believed Bitcoin "would first reach a new high of $100,000." After the decline began, this expectation flipped instantly, with nearly half betting on a "drop back to $69,000" first.

Institutional funds are quietly withdrawing, with December's Bitcoin ETF net outflow reaching $3.5 billion, the worst performance since February. On the technical charts, the 50-day moving average has crossed below the 200-day moving average, forming a mid-term bearish signal known as a "death cross" among traders.

As the year-end approaches, the balance of the market is tipping towards the cautious side.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。