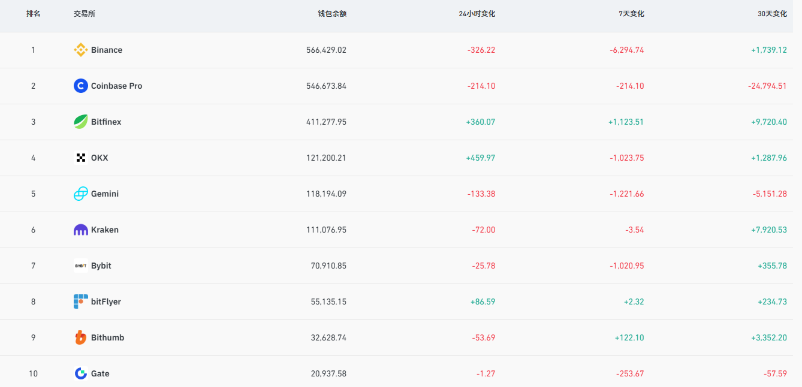

In the past seven days, approximately $800 million worth of 8,915 Bitcoins has net flowed out from major centralized exchanges (CEX). Among them, Binance, Gemini, and Bybit have become the "main forces" in withdrawals. This phenomenon occurs against the backdrop of Bitcoin's price correction from a high point and complex market sentiment, raising widespread attention: Are investors fleeing in panic, or are they quietly hoarding for the next rise?

1. Capital Flow Landscape: Continuous Outflow and Short-term Volatility

The recent trend of Bitcoin flowing out of exchanges is not coincidental.

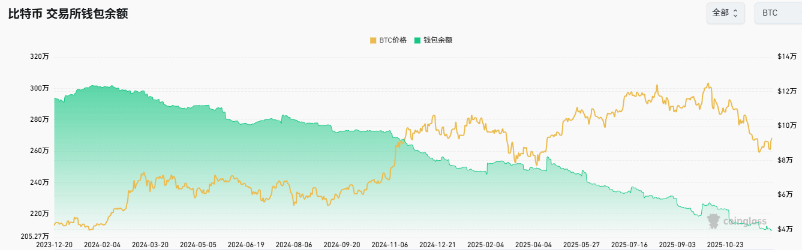

● AiCoin data shows that this "negative net flow" pattern has been present since March 2025, indicating that the amount of Bitcoin withdrawn from exchanges consistently exceeds the amount deposited. In an earlier 30-day period, the net outflow even reached approximately 170,000 Bitcoins.

● Data from the past 24 hours shows a slight differentiation in market sentiment: overall, there is a small net inflow of 145.36 BTC, but Binance still recorded a net outflow of 326.22 BTC, while OKX, Bitfinex, and others experienced net inflows.

● This indicates that the long-term trend of "withdrawing from exchanges" is clear, but short-term capital flows may fluctuate between different platforms, possibly reflecting the immediate actions of different categories of investors (such as institutions and retail).

2. Where Did the Withdrawn Bitcoins Go?

A large number of Bitcoins leaving exchanges does not directly equate to being sold on the market. Their destinations usually point to several possibilities, each conveying different market signals:

● Transferred to private wallets for long-term hoarding: This is the most mainstream bullish interpretation. Investors transferring assets to their controlled cold wallets means they have no intention of selling in the short term, aiming for safer long-term holding. This self-custody behavior directly reduces the "circulating supply" available for trading on exchanges, creating fundamental conditions for price increases.

● Custodial adjustments and allocations by institutional investors: Large institutions, funds, or enterprises may be significant forces behind the outflows. They might transfer Bitcoins from exchanges to professional custodians that meet regulatory requirements or prepare underlying assets for new financial products (such as spot ETFs). Some analyses point out that structural buyers like corporations and ETFs are currently absorbing Bitcoin at a rate far exceeding the new output from miners, necessitating their continuous acquisition of existing Bitcoins from exchanges or the secondary market.

● Responding to market volatility and avoiding risks: In times of severe market fluctuations and increased uncertainty, storing assets in personal wallets is a defensive measure to control risk. This is not necessarily based on strong bullish expectations but more on avoiding potential risks associated with exchanges (such as liquidity and credit risks).

3. Core Impact: Tightening Supply, Restructuring Market Structure

Regardless of the specific purpose, the direct result of continuous net outflows is the total amount of Bitcoin reserves on exchanges is constantly decreasing. This will have two key impacts on market structure:

● Supply-side tightening raises price floors: The "floating chips" available for immediate sale are reduced. When demand rebounds, buyers will need to offer higher prices to persuade holders to sell, naturally creating a more solid price support. Some viewpoints suggest that this supply-demand imbalance is the core driving force behind Bitcoin's long-term rise.

● Market leverage and sentiment "cleansing": Capital outflows are often accompanied by deep market corrections. The recent market has experienced large-scale liquidations of leveraged positions, which some analysts view as a "surrender signal," clearing out unstable speculative positions and laying the foundation for healthy market rises. At the same time, some on-chain indicators show that short-term holders are suffering significant losses, which is often one of the characteristics of market bottoms.

4. Market Outlook: A Mid-game Break in a Bull Market or a Turning Point?

Regarding the future market, opinions are divided, but most analyses view this outflow as a positive signal.

● Bullish views see this as a power accumulation phase: Historical data shows that large-scale outflow events from exchanges often mark the start of a bull market or the end of a bear market. Currently, many long-term bullish narratives for Bitcoin remain solid, such as the permanent reduction in new coin supply after the fourth halving and the global trend of institutional and national adoption. The current fluctuations are seen as a "mid-game break" and range consolidation within the bull market cycle, accumulating energy for the next rise.

● Cautious views focus on short-term risks: The realization of bullish logic requires cooperation from the macro environment. If global liquidity tightens or the inflow trend of key buyers (such as ETFs) reverses, upward momentum will be hindered. Additionally, prices may still need to test and consolidate key support levels in the short term.

5. Insights for Investors: Focusing on Essentials Amid Complex Signals

In the face of complex market signals, ordinary investors can grasp several key points:

● Focus on long-term trends rather than short-term noise: Net outflows from exchanges are a medium to long-term on-chain indicator, revealing accumulation trends. Short-term price fluctuations and capital flow reversals are normal and should not be the sole basis for decision-making.

● Understand the multiple meanings behind indicators: "Outflow" does not equal "bullish"; it may also be for risk aversion. It is necessary to combine data from the derivatives market, macroeconomic factors, and regulatory news for a comprehensive judgment.

● Recognize the fundamental changes in market structure: The Bitcoin market has shifted from being retail-dominated to deep participation by institutions, enterprises, and long-term holders. This means that price volatility may change, and long-term holding strategies are more attractive than ever.

The withdrawal of nearly ten thousand Bitcoins within a week is the latest stroke in a grand picture.

It is both a collective choice of investors voting with their feet to place their assets under their own custody and a reflection of Bitcoin's accelerated transition from a highly volatile trading asset to a long-term hoarded scarce value storage medium amid the evolution of the global financial landscape.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。