Original Author: Bitpush Editorial Team

In the past month, Bitcoin has experienced significant fluctuations around $80,000 to $90,000, while altcoins have generally retraced by 15%-40%. This has created a comfortable "private accumulation" window for the whales. According to real-time monitoring data from on-chain analytics platforms like Santiment, whales are quietly accumulating in the following sectors, with some cryptocurrencies reaching new highs in accumulation intensity since 2025.

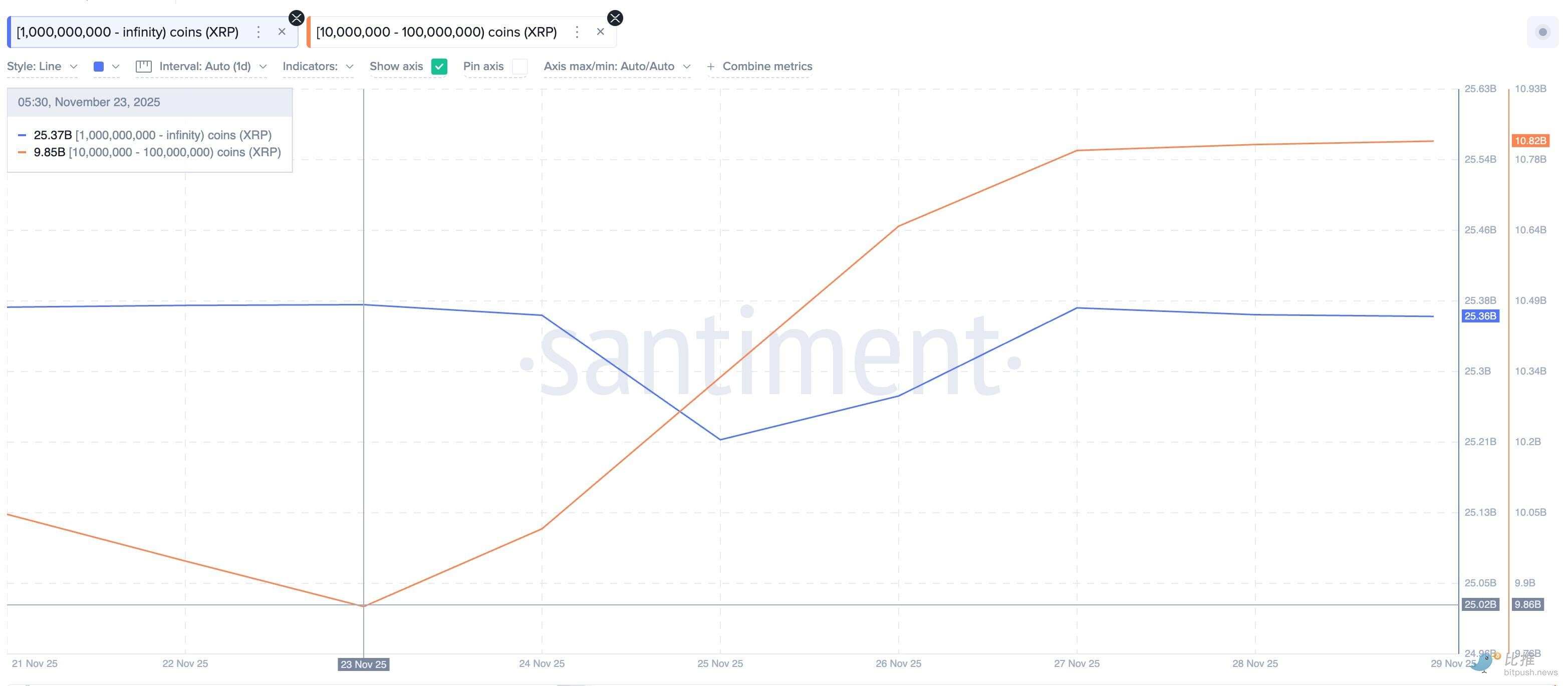

1. Payment/Cross-Border Settlement Sector: XRP Becomes the Favorite of Whales

With the settlement between the SEC and Ripple, the XRP ETF has transitioned from expectation to reality, further stimulating the accumulation behavior of whales. In the past 30 days, XRP has seen the most exaggerated net inflow among all altcoins:

- Addresses holding 100 million to 1 billion XRP net increased by 970 million XRP

- Addresses holding over 1 billion XRP net increased by 150 million XRP

- The total inflow from these two types of addresses exceeded $2.4 billion;

- The balance of XRP on exchanges continues to decline, reaching a new low since 2023.

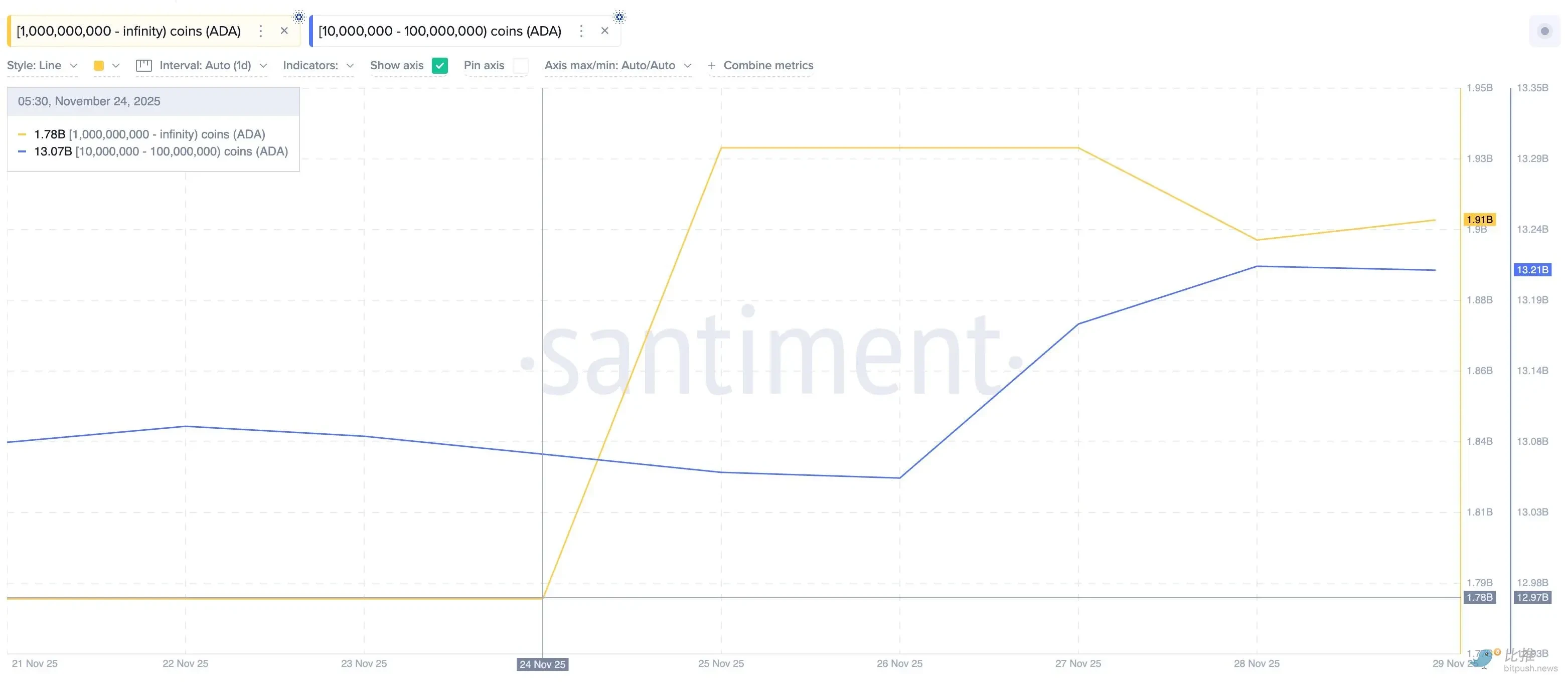

2. Established Layer 1: Accumulating ADA Against the Trend

Cardano (ADA) experienced a rare "whale rotation buying" from November 24 to December 4 over 12 days:

- The largest wallet (holding over 1 billion) began accumulating on November 24, having added a total of 130 million ADA to date;

- Wallets holding between 10 million and 100 million began accumulating on November 26, with an increase of 150 million ADA;

- Both groups achieved net increases within a few days, indicating strong confidence among large holders even as ADA's trading price approached recent lows;

- Whales have a lower cost basis, and if the price can break through $0.43, it is expected to rise to $0.52. If it drops to $0.38, the bullish pattern may weaken, and reversal signals could fail.

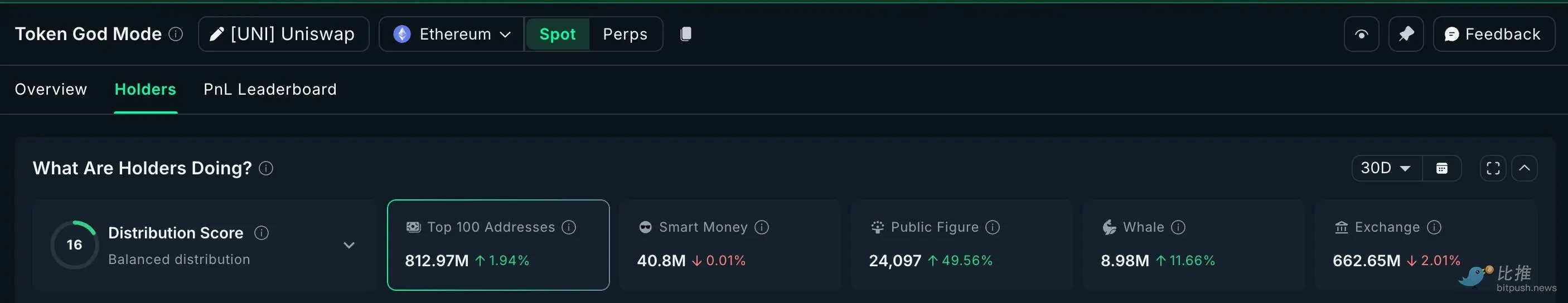

3. DeFi Blue Chips: UNI and AAVE Being Accumulated Simultaneously

UNI: In the past week, whales added approximately 800,000 UNI (worth nearly $5 million). After the fee switch vote passed, the top 100 addresses collectively hold 8.98 million UNI, showing strong accumulation momentum, while the supply on exchanges continues to decrease.

AAVE: In the past 30 days, whales have added over 50,000 AAVE, bringing total holdings to an all-time high of 3.98 million.

Commonalities between the two: TVL continues to rise + real income (fees) begins to increase, with whales positioning themselves in advance.

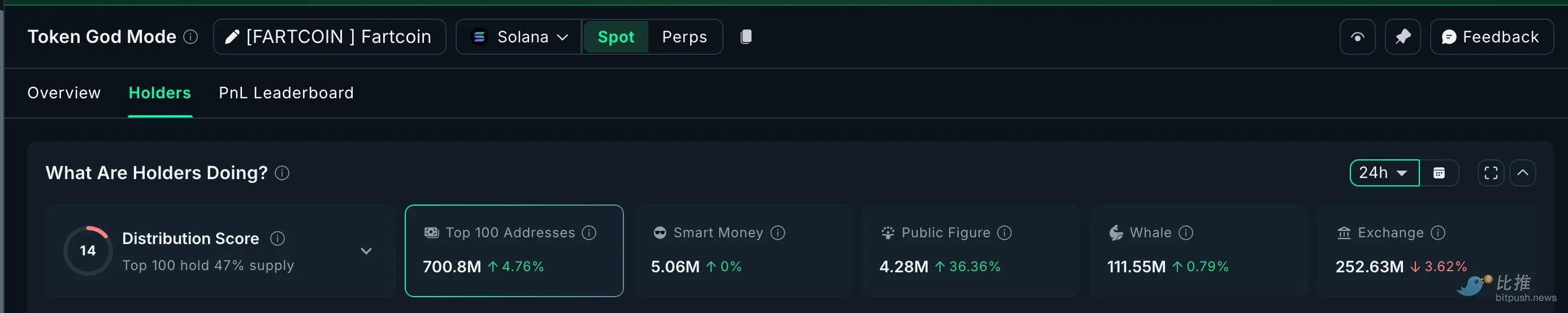

4. Meme Coins: Overall Retracement, Some Being "Low-Priced Tickets" by Whales

Main Battlefield:

FARTCOIN: A single address accumulated 32.43 million coins in 24 hours (worth $10.7 million)

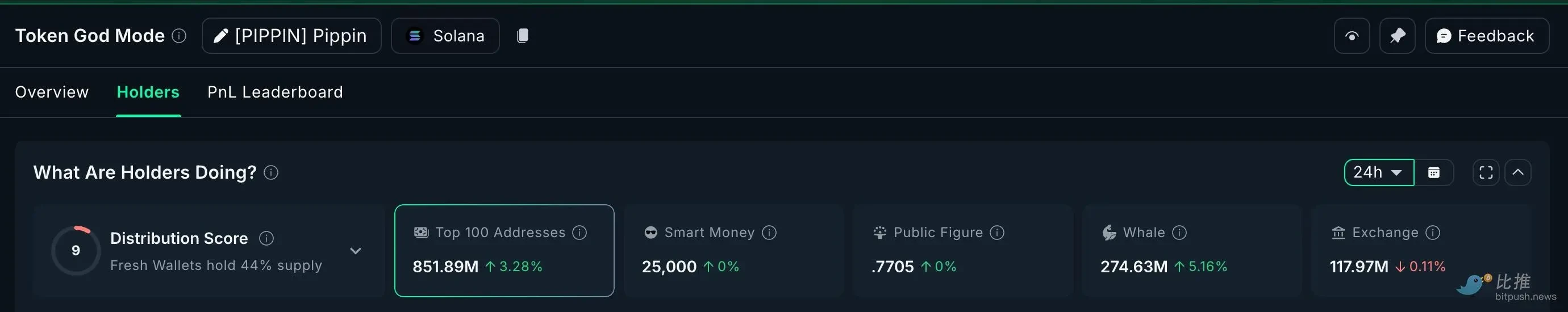

PIPPIN: 40.45 million coins were moved by whales in 24 hours (worth $7.28 million)

PEPE: In the past 30 days, whale holdings increased by 1.36%, totaling over 10 million coins. In summary, speculative funds and old money are entering together, and a violent surge could happen at any time after liquidity is exhausted.

5. AI + Data Sector: ENA and TIA Most Favored

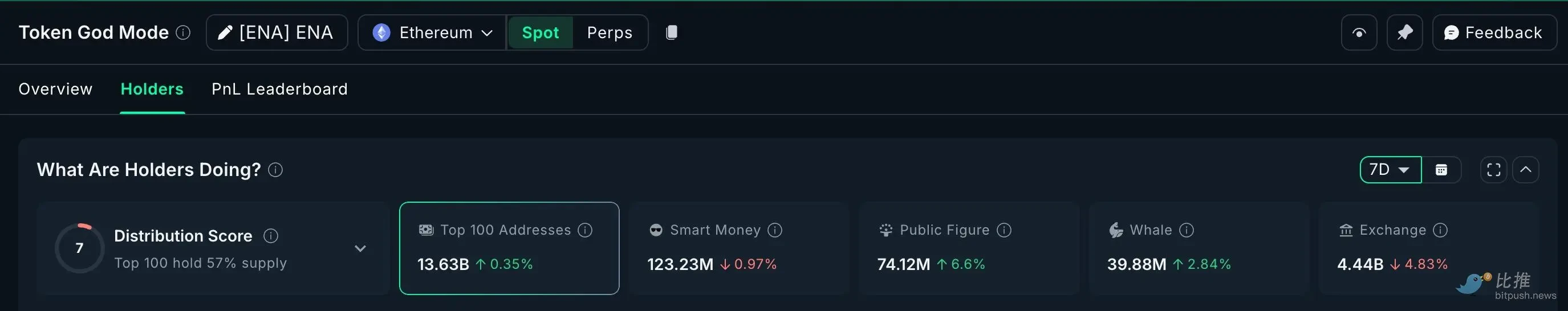

ENA (Ethena): In the past 7 days, whale holdings increased by 2.84%, with the top 100 addresses adding over 50 million coins.

TIA (Celestia): Exchange supply decreased by 5%, with both staking ratio and TVL reaching all-time highs.

The combination of AI narrative and modular narrative has become one of the long-term sectors with high certainty in this round.

6. Storage Sector: FIL and ICP

Since late November, large whale addresses for FIL and ICP have simultaneously shown significant outflows from exchanges, with active address numbers and TVL rising in sync, indicating that the demand for decentralized storage from AI large models is being realized.

FIL: In the past 30 days, whale holdings increased by over 100,000 coins, totaling approximately $50 million; exchange supply decreased by 15%.

ICP: On-chain active addresses increased by 30%, with whales transferring out over 50,000 coins from exchanges; TVL rose to $120 million.

Summary

It can be seen that the current operational logic of whales is:

A retracement is a buying window; the more it falls, the more they buy, with little regard for short-term prices;

They prioritize sectors with "real income" or "policy dividend certainty";

Meme coins remain a high-risk, high-reward "lottery zone";

Long-term sectors (AI, modularization, storage, privacy) have been preemptively positioned by whales 2-3 quarters in advance.

Risk Warning: Whale accumulation does not guarantee an increase; it may also lead to subsequent selling pressure. Please be sure to DYOR, trade cautiously, and strictly control your positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。