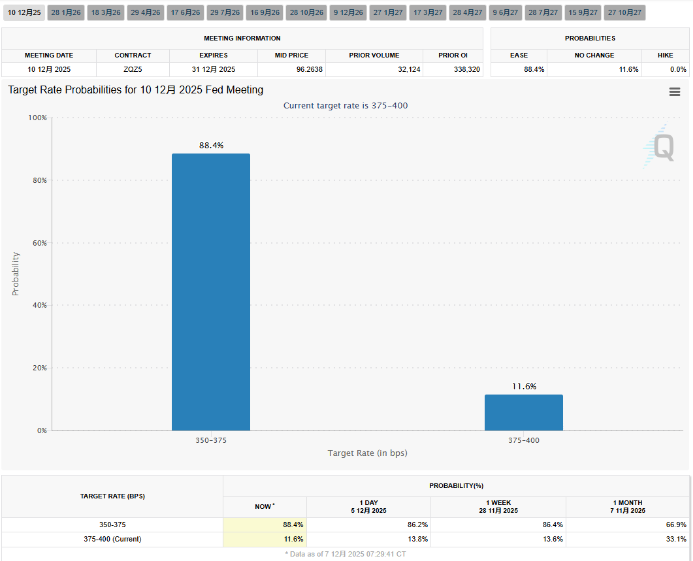

According to the latest market data, the probability of the Federal Reserve cutting interest rates by 25 basis points at the upcoming December meeting has reached 88.4%. Behind this seemingly "set in stone" decision, there are intense policy disagreements within the Federal Reserve.

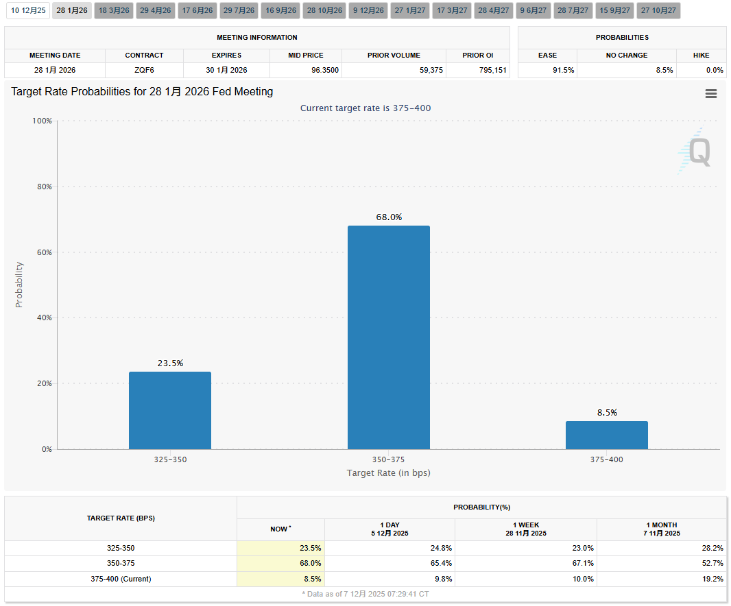

As the December interest rate decision approaches, market expectations for a rate cut continue to heat up. The probability of the Federal Reserve cumulatively cutting rates by 25 basis points by January next year is 65.4%, while the probability of a cumulative cut of 50 basis points is 24.8.

1. Market Expectations and Rate Cut Probability

● The latest data from the Chicago Mercantile Exchange's "FedWatch" tool shows that the probability of the Federal Reserve cutting rates by 25 basis points at the December meeting is as high as 88.4%, while the probability of maintaining the current rate is only 11.6%.

● This data reflects that the market almost unanimously believes the Federal Reserve will take action this week. The interest rate futures market further predicts that by January next year, the probability of the Federal Reserve cumulatively cutting rates by 25 basis points is 68%, while the probability of maintaining the current rate is 8.5%.

● The Federal Reserve began this round of rate-cutting cycle in September 2024, and after three rate cuts, it lowered the federal funds rate by a total of 100 basis points. It started to maintain the rate unchanged in January 2025 and continued until mid-year this year.

2. Internal Policy Disagreements

● In stark contrast to the market's high consensus, there are significant policy disagreements within the Federal Reserve. Among the 12 voting members of the Federal Open Market Committee, 5 have expressed opposition or skepticism towards further easing of monetary policy, while 3 members of the board support a rate cut.

● Such disagreements are quite rare in recent Federal Reserve meetings. Since 2019, there have not been three or more dissenting votes in any FOMC meeting.

● Historically, it is extremely rare for multiple board members of the Federal Reserve to oppose a rate decision simultaneously. In July of this year, Vice Chair for Supervision Michelle Bowman and Federal Reserve Governor Christopher Waller voted in favor of a 25 basis point rate cut.

According to U.S. media reports, this is the first time in over 30 years that two Federal Reserve governors have expressed differing opinions in a vote regarding interest rate decisions.

3. Clash of Hawkish and Dovish Views

● Cleveland Fed President Loretta Mester represents the hawkish stance, believing that current inflation is still "too high" and poses greater risks to the economy than a slowdown in the labor market. She emphasized that monetary policy should continue to exert pressure on inflation and pointed out that the current level of interest rates is "almost non-restrictive," suggesting that further rate cuts may be premature. Mester expects U.S. inflation to not reach the Federal Reserve's 2% target until at least one or two years after 2026.

● In contrast, New York Fed President John Williams delivered a relatively dovish speech. He stated that the market's estimate of the "neutral interest rate" may be too high, and if this assessment holds, the Federal Reserve still has room to continue cutting rates without undermining efforts to curb inflation.

● Federal Reserve Governor Philip Jefferson explicitly supports a rate cut in December, stating, "Unless something unexpected happens, I expect we will cut rates in December." Jefferson pointed out that the policy stance ultimately depends on the "voting structure" rather than the "distribution of views," so even if there is resistance, a rate cut could still become the majority decision.

4. Key Challenges Facing Decision-Making

● Federal Reserve Chair Jerome Powell stated in June that the Fed is fully capable of waiting and considering adjustments to its policy stance after further understanding the potential trajectory of the economy. However, the current economic data environment presents additional challenges for decision-making.

● Chicago Fed President Austan Goolsbee expressed concerns about the path of rate cuts. He mentioned that due to the government shutdown, there is a temporary lack of official inflation data, which may prevent decision-makers from timely identifying price risks, making him increasingly uneasy about continuing rate cuts.

● Goolsbee emphasized that there are risks associated with adopting an accommodative policy in the absence of key information. Such data deficiencies are relatively rare in the history of Federal Reserve decision-making, increasing the uncertainty of this meeting.

5. Economic Background and Policy Considerations

● The Federal Reserve needs to balance multiple factors when assessing policy. On one hand, there are signs of a slowdown in U.S. economic growth. The Fed noted in its July policy statement that economic growth in the U.S. has "slowed somewhat" in the first half of this year.

● If this trend continues, it may provide a basis for future rate cuts. The assessment of the economic situation in the meeting statement was also adjusted from "expanding at a robust pace" in June to "economic activity growth slowed in the first half of this year."

● On the other hand, inflationary pressures still exist. The economic projections summary released by the Federal Reserve in June showed an increase in its expectations for U.S. inflation and unemployment rates from 2025 to 2027. Specifically, the median forecast for the increase in the personal consumption expenditures price index for this year rose from 2.7% in March to 3%, significantly above the Federal Reserve's long-term inflation target of 2%.

6. Outlook on Policy Path and Market Impact

● Federal Reserve Chair Powell stated at a press conference in July that implementing a moderately restrictive monetary policy seems appropriate. He noted that the Federal Reserve has not yet made a decision regarding September's monetary policy, which will depend on the employment and inflation data released before the next meeting.

● Regarding the future policy path, Powell emphasized the art of balance: cutting rates too early will not solve the inflation problem; cutting rates too late may harm the labor market.

● This indicates that the Federal Reserve needs to confirm that the observed impact of tariffs on inflation is fully reflected before implementing rate cuts. As the impact of tariff policies becomes clearer and downward pressure on the economy and employment increases, there is still hope for one to two rate cuts within the year.

After the decision is announced, global markets will face a new round of volatility. Regardless of the outcome, this game surrounding the December interest rate reflects the Federal Reserve's difficult balancing act between the persistence of inflation and the risks of economic slowdown.

Every word spoken by Powell at the press conference will be analyzed word by word, and the number of dissenting votes among FOMC members will serve as a thermometer to measure the intensity of this internal central bank struggle.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。