Original Author: 1912212.eth, Foresight News

On December 5, the company known as the "NVIDIA of China," Moore Threads, debuted on the Sci-Tech Innovation Board as the "first domestic GPU stock," opening at 650 yuan per share, a staggering 468.78% increase from the issue price of 114.28 yuan, with a total market value exceeding 300 billion yuan.

In this capital frenzy, a single lottery ticket (500 shares) netted over 267,000 yuan in wealth effect, igniting enthusiasm in the A-share technology sector. It's worth noting that the online lottery winning rate was approximately 0.03635%, meaning about 2,750 tickets were needed to win one.

Little known is that Li Feng, co-founder of Moore Threads and dean of Moore Academy, has emerged as a serial entrepreneur spanning fields such as chips and AI. He was previously thrust into the spotlight due to controversies in the cryptocurrency space.

Moore Threads' Wealth Myth

The rise of Moore Threads symbolizes China's breakthrough in the AI computing power sector, overcoming the "bottleneck" dilemma. Since its establishment in 2020, the company has completed eight rounds of financing, raising over 9.498 billion yuan, backed by more than 80 institutions including Sequoia China, Shenzhen Capital Group, Tencent, and ByteDance, forming a golden combination of "market-oriented VC/PE + state-owned venture capital + industrial CVC."

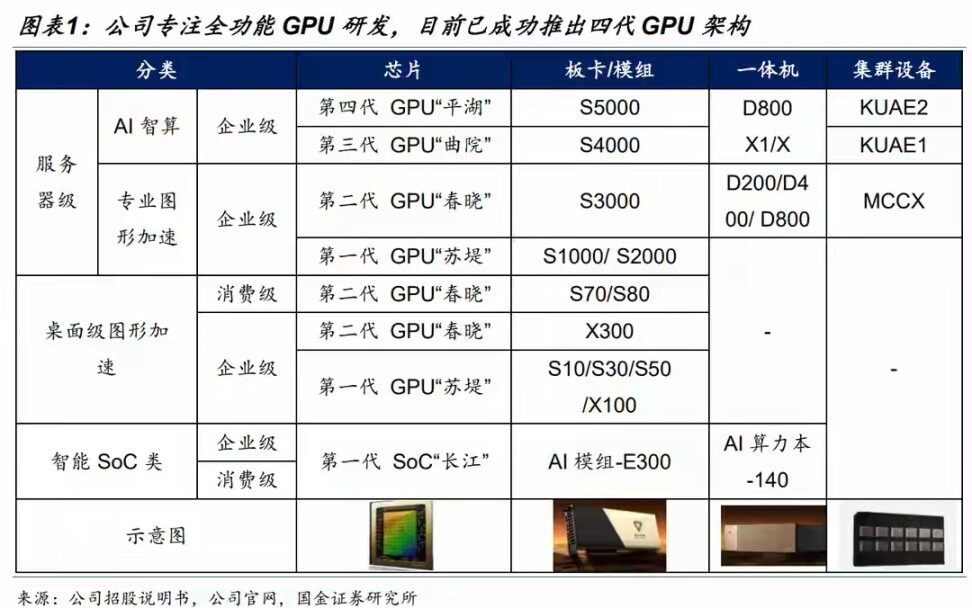

Its core products, the "Sudi" and "Chunxiao" fully functional GPU chips, have been applied in national projects such as the Gui'an AI Computing Center, forming deep collaboration with industry chain partners like Heheta and Weixing Intelligent.

Despite the company incurring a cumulative loss of 5.939 billion yuan from 2022 to 2025, with gross margins yet to turn positive, the capital market still holds high expectations for it.

On the first day of trading, E Fund reported a paper profit of nearly 1.9 billion yuan, while early investors like Tencent and ByteDance saw returns exceeding 35 times. Peixian Qianyao became the biggest winner of Moore Threads' listing with a staggering 6200 times return.

Behind this wealth feast is the market's strong expectation for the Chinese GPU industry to transition from "domestic substitution" to "global competition." Li Feng stated at the listing ceremony: "Moore Threads' mission is to establish China's own foundational technology in the field of graphics processing."

Li Feng is not only the co-founder of Moore Threads but has also ventured into multiple fields, including the cryptocurrency space.

Cryptocurrency Past: The Absurdity and Controversy of Mallego Coin

Li Feng claims to have graduated from Tsinghua University and has ventured into various fields such as chips, 3D engines, artificial intelligence, gaming, smart hardware, VR/AR, digital agriculture, and biomedicine, founding and co-founding several technology companies.

At Moore Threads, he is not only a co-founder but also serves as the dean of Moore Academy.

Before achieving success, Li Feng was embroiled in controversy over the project "Mallego Coin" (MGD).

In 2017, during the ICO (Initial Coin Offering) frenzy, Li Feng, along with cryptocurrency moguls like Li Xiaolai and Xue Manzi, launched the project, touting it as "the first modern artwork based on blockchain in human history," raising 5,000 ETH through crowdfunding.

The project's white paper was filled with absurd claims, stating it would develop an AI cloud system, with each token linked to a self-learning "Alpaca" robot. It promised value appreciation through the system's remaining computing resources; the token distribution plan even reserved 10% until the year 2100. The team background was packaged as "composed of CEO, CTO, CFO, PhDs, returnees, and investment bankers," but was largely fictional. Despite this, with the backing of industry bigwigs and the market bubble, MGD completed its fundraising within a week of launch.

However, the project quickly faced scrutiny due to its sensitive name (containing inappropriate language) and was forced to rebrand as "Alpaca Coin MGD."

As regulations tightened, the project's popularity waned, and the token price remained low for an extended period.

Ultimately, this farce came to an end.

1,500 Bitcoins Borrowed and Not Returned, Now Worth 135 Million USD

If Mallego Coin is the absurd footnote of Li Feng's cryptocurrency career, then his debt dispute with OKX founder Star has thrust him into a moral controversy.

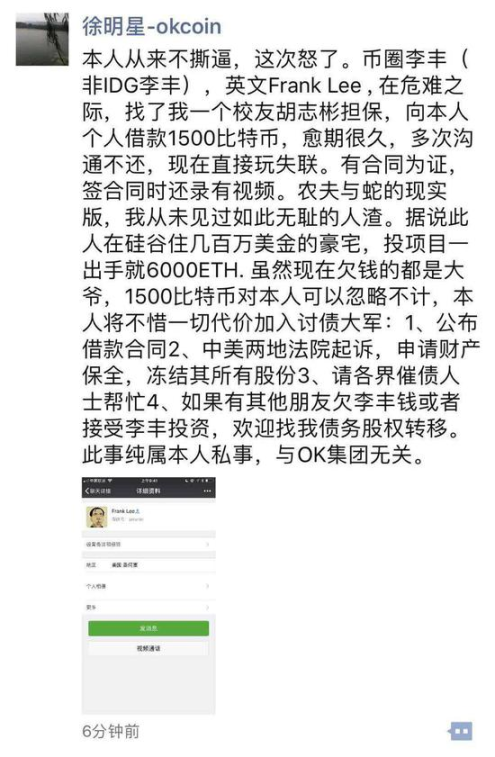

In June 2018, Star publicly accused Li Feng of borrowing 1,500 Bitcoins (then worth about 80 million yuan) and refusing to return them, even going missing. (According to insiders who spoke to Foresight News, Li Feng has since returned part of the funds.) He shared the loan contract and video evidence, calling Li Feng a "shameless scumbag," and announced lawsuits in courts in both China and the U.S., seeking asset preservation.

NEO Wang Zhenfei, founder of Charging Network, commented in the discussion: "I chased him for three years to get back a portion of the money; this person is absolutely garbage and a rogue."

In mid-2018, BTC was only about 7,000 USD, making the 1,500 BTC worth approximately 10 million USD at that time. By December 2025, with BTC priced around 90,000 USD, the total value had soared to 135 million USD.

Li Feng responded in a group chat, stating that the loan was actually Star's investment in the MGD project, and since the project had not launched, Star wanted to retract the funds.

Both sides hold firm to their claims.

Chinese law defines Bitcoin as a "specific virtual commodity," and civil loan disputes still face execution challenges. Star's debt collection efforts ended in futility due to Li Feng's "disappearance" and jurisdictional issues.

References:

[Xu Mingxing pursues debt from cryptocurrency "Mallego Coin founder" for 1,500 Bitcoins](https://www.528 BTC.com/bitcoin/17002.html)

Blockchain Figures | 52 Blockchain "Big Shots" You Should Know, All Printed on This Deck of Cards

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。