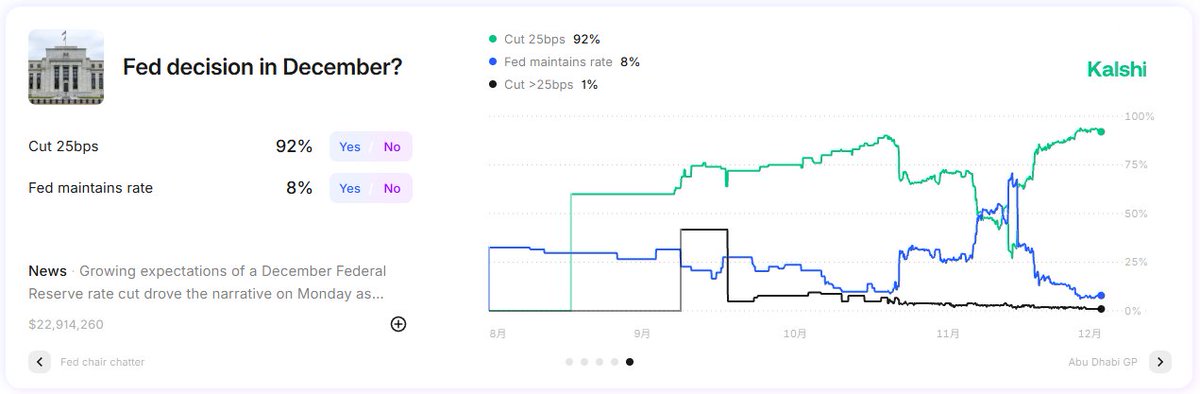

Although Bitcoin's price hasn't been good over the weekend, remaining below $90,000, the sentiment has been relatively stable these past two days, at least not collapsing during the lowest liquidity period. What investors are most concerned about right now should be the Federal Reserve's monetary policy on December 11. There is a very high probability of a rate cut continuing in December, and even Powell can't stop it, but the dot plot and Powell's speech are still worrisome.

This reminds me of the end of 2024, around Christmas time, when the market sentiment should have been good with the expected rate cut in December, especially with Trump winning the election. I was ready to celebrate, but Powell's speech led the market into a downturn, mainly due to expectations of rate cuts in 2025. At that time, the expectation was for two rate cuts, but in reality, there were four rate cuts throughout 2025.

I don't know what Powell will say next, but I believe that once the new Federal Reserve Chair is in place, even if we don't enter a rapid rate-cutting phase, it is highly likely that they will align with Trump's thinking and enter a true rate-cutting path. However, the December meeting and the dot plot will still be a headache.

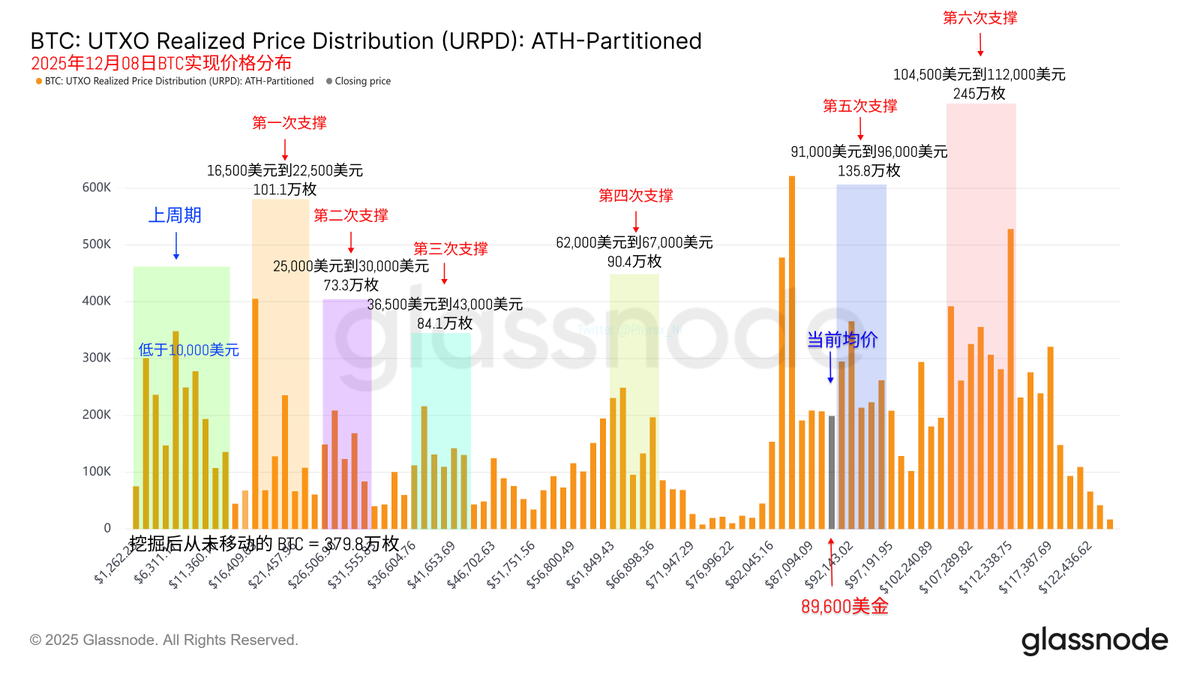

Looking back at Bitcoin's data, the turnover rate has finally decreased. Although this is partly due to the weekend, the drop in turnover rate also helps to cool the market's anxious sentiment. In fact, the current market is not much different from last week, with no negative data. The expectation remains that the Federal Reserve will cut rates in December, but the main reason for the market's decline is the poor expectations for various data, indicating that the economy may decline.

Another reason is the lack of optimism about continued rate cuts in January. But as I mentioned earlier, the expectation was for only two rate cuts in 2024, while in reality, there were four. The current dot plot cannot represent future trends. Faced with a not-so-optimistic economy, will the Federal Reserve prioritize controlling inflation or supporting the economy? The former is likely to trigger a recession, while the latter could still hold promise for 2026.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。