The reason why the problems in the U.S. real estate market began to worsen in 2025 is not due to a single factor, but rather a chain of "immigration + housing prices + rent + housing supply" being simultaneously pressured from four directions by high interest rates.

Immigration has been the strongest demand-side support in the past two years, with the U.S. net population increasing by over 6 million in the past three years, most of which is concentrated in the rental market. They have indeed supported rent prices, causing landlords to be unwilling to lower prices even in a high-interest-rate environment. However, this demand is characterized by low liquidity; immigrants are willing to rent but do not have the means to buy, resulting in an extreme structure where rents rise, housing prices do not fall, and transaction volumes are severely constrained.

While housing prices remain high, which seems strong, the fundamental driving force is not purchasing power but rather supply being squeezed by immigration demand. Local families are simultaneously shut out by prices and interest rates, leading to a sharp decline in transaction rates due to a mismatch in supply and demand. At the same time, rents are rising, but the increase in rent is completely disproportionate to the rise in interest rates. Landlords' rental return rates have long been swallowed by financing costs, and the increase in rent has not improved their cash flow; rather, it is more to offset interest pressure. This means that the resilience of rent is not a reflection of a healthy real estate market, but rather a transfer of pressure onto tenants.

The housing supply side is even worse. The construction volume in the U.S. has been insufficient for the past decade, and high interest rates have made builders reluctant to start new projects due to high financing costs, weak buyer affordability, and a lack of sustained price increases. This has ultimately led to a near-freeze in the supply side, with no new additions and no ability to lower prices through increased production. The tighter the supply, the harder it is for prices to fall, but with weaker demand, transactions worsen, leaving the entire market stuck in a structural equilibrium that is almost impossible to self-repair.

With housing prices unable to fall, rents unable to decrease, transaction volumes unable to rise, and supply unable to expand, the market is held up by rental demand solely supported by immigration. When any link in this chain begins to loosen, such as tightening immigration policies, slowing rent increases, builders completely halting work, or worsening affordability for local families, it will quickly shift this chain from a state of not collapsing but barely holding on to a full downward trend.

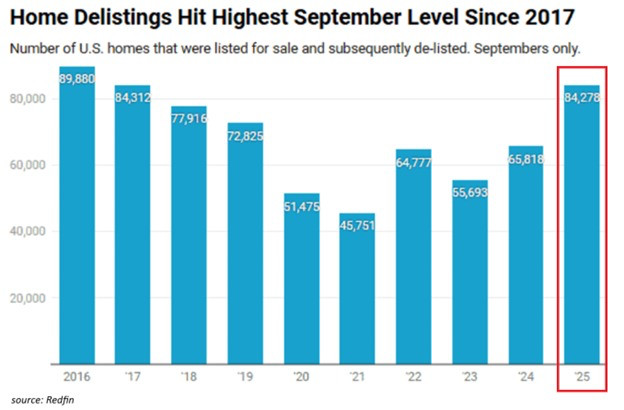

Currently, the number of homes taken off the market has reached a new high since 2017, which is the first sign that this chain is beginning to loosen. Immigration demand is no longer sufficient to support housing transactions, the rise in rent cannot offset financing costs, builders are unwilling to expand production, and local families are exiting the market. The real estate sector has entered a phase of passive contraction, which is where the Federal Reserve's high interest rates truly begin to impact the systemic part of the economy.

The continued maintenance of high interest rates by the Federal Reserve may indeed lead the U.S. economy toward recession.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。