Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.05 trillion, with BTC accounting for 58.7%, or $1.79 trillion. The market cap of stablecoins is $308.2 billion, which has increased by 0.85% in the last 7 days, marking the second week of positive growth for stablecoins, with USDT making up 60.2%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen. Specifically, BTC has dropped 3% over the past week, ETH has fallen 4.38%, SOL has decreased by 4.03%, while LUNC has increased by 62.7% and CHEEMS has risen by 11.15%.

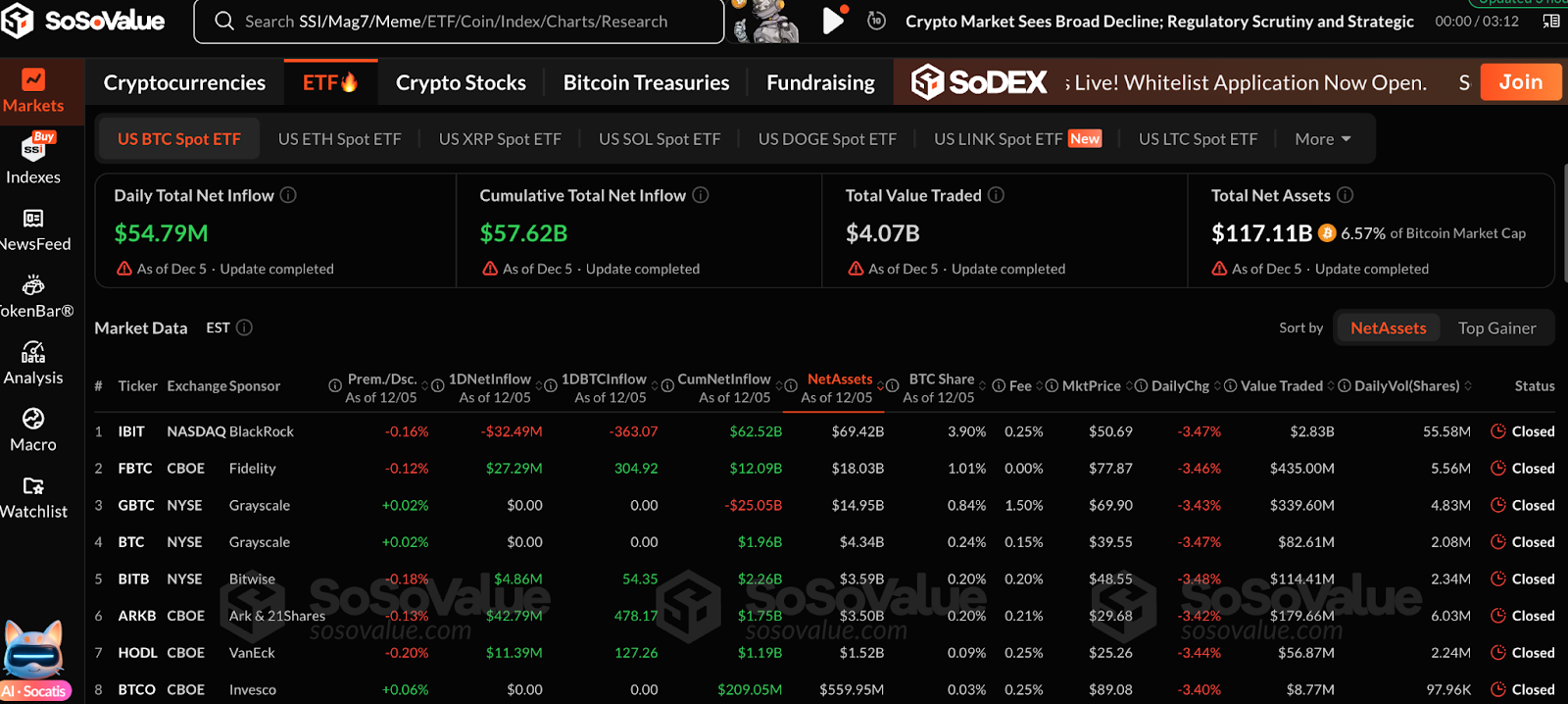

This week, the net outflow from the U.S. Bitcoin spot ETF was $88.1 million; the net outflow from the U.S. Ethereum spot ETF was $65.6 million.

Market Forecast (December 8 - December 14):

The current RSI index is 42.7 (neutral zone), and the fear and greed index is 22 (lower than last week, indicating general fear). The altcoin season index is 37 (neutral, unchanged from last week).

Market sentiment: We are currently in a critical window for structural repair and trend confirmation. After experiencing a panic sell-off in recent weeks, the market has seen a significant rebound, primarily driven by improved macro liquidity expectations (a surge in the probability of Fed rate cuts and the end of quantitative tightening) and short covering after panic selling. However, whether this rebound can evolve into a sustained trend still requires a breakthrough at key price levels for confirmation.

Based on the latest technical analysis, Bitcoin and Ethereum have fallen below the critical "bull-bear demarcation line," with the short to medium-term technical outlook shifting from bullish to neutral or even bearish. For the market to regain an upward trend, it must first effectively reclaim the following key positions:

BTC core range: $90,000-95,000

ETH core range: $3,000-3,500

SOL core range: $130-150

Risks: Pay attention to the Fed's dynamics on December 10; market expectations for rate cuts (currently at 82.8%) are a core driver recently, and any disappointment in these expectations could trigger severe volatility. Be wary of "fragile rallies": if prices rise but trading volume does not effectively increase, caution is warranted regarding the risk of a pullback.

Understanding Now

Review of Major Events of the Week

On December 1, Bloomberg reported that the prediction market platform Kalshi faced a class-action lawsuit for conducting sports betting activities without any state gambling licenses and for making misleading statements to users regarding market-making activities;

On December 1, David Sacks, the White House cryptocurrency and AI director, publicly questioned The New York Times' investigation into his conduct during his tenure as the head of White House AI and cryptocurrency affairs, arguing that the paper spent months pursuing unfounded allegations;

On December 5, according to lookonchain monitoring, Circle issued an additional 500 million USDC just one hour ago, bringing the total issuance to 10 billion USDC over the past month;

On December 3, U.S. President Trump stated during last night's cabinet meeting that he might announce his choice for the Federal Reserve chair early next year, adding that Treasury Secretary Basant does not want the position. He has evaluated 10 candidates for the Fed, with only one choice remaining. Trump also mentioned that a potential Fed chair was present at the White House meeting when introducing Hassett. Additionally, Trump reiterated his criticism of Powell, stating that even JPMorgan CEO Dimon said Powell should lower interest rates;

On December 4, Vanguard, the world's second-largest asset management company, reversed its stance, and Bank of America advised interested investors to allocate 1%-4% of their portfolios to digital assets;

On December 4, Cointelegraph reported that the official website of the meme coin PEPE was attacked and is currently redirecting users to malicious links;

On December 5, Meta is considering cutting its metaverse department's budget by 30% next year, with its stock price rising by 3.4%;

On December 5, the China Internet Finance Association, in collaboration with multiple departments, issued a new risk warning regarding the prevention of illegal activities related to virtual currencies. This marks three years since the last cryptocurrency risk warning in 2022. Over the past five years, the association has issued four significant announcements at key points of market speculation;

The U.S. Commodity Futures Trading Commission (CFTC) has allowed listed spot cryptocurrency products to trade on its registered futures exchanges for the first time, marking a significant breakthrough in the U.S. regulatory framework. Bitnomial exchange plans to launch a CFTC-regulated leveraged retail spot platform on December 8;

On December 4, the Ethereum mainnet successfully activated its 17th major upgrade, "Fusaka," marking Ethereum's official entry into a "twice-a-year hard fork" accelerated development rhythm;

Binance founder CZ stated that his future work focus will shift to the BNB Chain ecosystem and serving as a cryptocurrency advisor to multiple governments; co-founder He Yi has officially taken on the role of co-CEO of Binance.

Macroeconomics

On December 3, the U.S. ADP employment change for November was -32,000, with an expectation of +10,000 and a previous value of +42,000;

On December 4, the number of initial jobless claims in the U.S. for the week ending November 29 was 191,000, the lowest since the week of September 24, 2022. The expectation was 220,000, and the previous value was revised from 216,000 to 218,000;

On December 5, the U.S. core PCE price index for September was reported at 2.8%, with an expectation of 2.9% and a previous value of 2.9%;

On December 6, according to the Fed rate observer, the probability of a 25 basis point rate cut in December is 82.8%.

ETF

According to statistics, from December 1 to December 5, the net outflow from the U.S. Bitcoin spot ETF was $88.1 million; as of December 5, GBTC (Grayscale) had a total outflow of $25.001 billion, currently holding $14.964 billion, while IBIT (BlackRock) currently holds $69.453 billion. The total market cap of U.S. Bitcoin spot ETFs is $117.67 billion.

The net outflow from the U.S. Ethereum spot ETF was $65.6 million.

Envisioning the Future

Upcoming Events

Bitcoin MENA will be held from December 8 to 9 at the Abu Dhabi National Exhibition Centre (ADNEC);

Solana Breakpoint 2025 will take place from December 11 to 13 in Abu Dhabi.

Project Progress

Chainlink: The rewards distribution period for the first season will end at 22:00 on December 9. Participants must allocate Cubes during the distribution period to claim tokens during the claiming period (starting December 16);

Aster's S4 buyback will start on December 10, with 60-90% of the fees generated in the S4 phase being used for token buybacks.

Important Events

On December 11 at 3:00 AM, the U.S. will announce the Federal Reserve's interest rate decision (upper limit) as of December 10;

On December 11 at 9:30 PM, the U.S. will announce the number of initial jobless claims for the week ending December 6 (in ten thousand);

On December 12 at 1:00 AM, the Federal Reserve will release data on the financial health of U.S. households from the third quarter funding flow report for 2025.

Token Unlocking

Movement (MOVE) will unlock 161 million tokens on December 9, valued at approximately $7.43 million, accounting for 1.62% of the circulating supply;

CARV (CARV) will unlock 16.11 million tokens on December 10, valued at approximately $2.16 million, accounting for 1.61% of the circulating supply;

Linea (LINEA) will unlock 1.44 billion tokens on December 10, valued at approximately $12.3 million, accounting for 2% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. We analyze market trends through our "Weekly Insights" and "In-Depth Research Reports"; leveraging our exclusive column "Hotcoin Select" (AI + expert dual screening) to identify potential assets and reduce trial-and-error costs. Each week, our researchers will also engage with you live, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。