CoinW Research Institute

Recently, Lighter has seen a rapid increase in trading volume in the decentralized perpetual contract DEX market, with its daily, weekly, and monthly cumulative trading volume surpassing Hyperliquid, making it the fastest-growing decentralized perpetual contract DEX during this period. However, from the perspective of capital structure, Lighter's TVL and open interest have not expanded in sync with trading volume, indicating a significant deviation between trading activity and capital accumulation, which also reflects the current characteristics of its user structure and trading behavior. At the same time, Lighter completed a $68 million financing in November, receiving support from institutions such as Founders Fund, Ribbit Capital, and Robinhood. Under the combined effect of capital inflow and the approaching TGE, its points mechanism and airdrop expectations are becoming the main catalysts for increasing user activity on Lighter. Against this backdrop, the CoinW Research Institute will conduct a systematic analysis of Lighter's current development status from the dimensions of trading performance, mechanism design, and potential risks.

1. Lighter's Trading Volume Continues to Lead

1. Daily / Weekly / Monthly Trading Volume Ranks Among the Top

According to DefiLlama data, Lighter currently ranks first in daily and weekly trading volume among decentralized perpetual contract DEXs. Its daily trading volume is approximately $11.9 billion, and its weekly trading volume exceeds $64.3 billion. In the past 30 days, Lighter has achieved approximately $297.7 billion in perpetual contract trading volume, leading Hyperliquid's $251.1 billion, firmly holding the top position in the sector.

Source: defillama,https://defillama.com/perps

2. Total TVL Scale is Relatively Low

Despite Lighter's recent rapid increase in trading volume, its capital accumulation remains relatively limited. Data shows that Lighter's total TVL is $1.22 billion, significantly lower than Hyperliquid's $4.28 billion and Aster's $1.4 billion. Compared to its high trading volume, this relatively low TVL indicates that Lighter exhibits characteristics of amplified trading but insufficient capital accumulation. The divergence between its TVL and trading volume may be closely related to Lighter's current incentive structure. Lighter adopts a zero-fee model and has not yet conducted a TGE, leading some users and strategic traders to prefer high-frequency trading to increase their participation weight, driven by points and potential airdrop expectations. This means that the platform's trading activity largely relies on rapid capital turnover rather than support from long-term capital accumulation.

3. Abnormal Ratio of Trading Volume to Open Interest (OI)

Under the structure of significant trading volume growth and low TVL accumulation, Lighter's ratio of trading volume to open interest (OI) also shows a clear difference compared to competitors. OI is typically used to measure the true position size on perpetual contract platforms, reflecting capital accumulation and trading continuity. Therefore, the trading volume / OI ratio can objectively measure the structure of the platform's trading behavior. Currently, Lighter's OI is approximately $1.683 billion, with a trading volume of about $11.9 billion, resulting in a trading volume/OI ratio of approximately 7.07, significantly higher than Hyperliquid's 1.72 (OI $5.92 billion, trading volume $10.2 billion) and Aster's 3.02 (OI $2.62 billion, trading volume $7.92 billion). This deviating ratio indicates that the platform's trading behavior leans more towards a short-cycle, high-turnover high-frequency trading model. As the TGE approaches, subsequent changes in the incentive structure will directly affect the matching degree between trading volume and OI, and whether the trading volume/OI ratio can return to a healthier range (generally below 5) will become an important indicator for assessing Lighter's true user retention, trading quality, and long-term sustainability.

2. Lighter's Innovation and Differentiation

1. Zero Fees and Paid API Strategy

In terms of fee structure, Lighter has adopted a different approach from mainstream decentralized perpetual contract platforms, which is one of its innovations. Lighter implements a zero-fee policy for ordinary users, charging no trading fees for either placing or taking orders, significantly lowering the entry barrier and overall trading costs. At the same time, Lighter has not completely abandoned revenue; instead, it focuses on professional needs. For ordinary users, the system defaults to using limit orders with a delay of about 200 milliseconds, and market orders with an execution delay of about 300 milliseconds, with both types of orders incurring zero fees. However, professional traders and market makers sensitive to execution speed can opt for a premium account, accessing a low-latency matching channel through a paid API. The performance of premium accounts connected via API is stronger, with limit and cancellation delays reduced to 0 milliseconds, and market order delays of about 150 milliseconds, while incurring limit order fees of 0.002%, market order fees of 0.02%, and corresponding trading volume quotas.

The zero-fee strategy effectively promoted user growth in the early stages but has also raised concerns about the sustainability of its business model. Its approach bears some similarity to traditional zero-commission brokers, attracting users by lowering barriers at the front end while monetizing through higher-tier services or order flow at the back end. For example, Robinhood's main revenue does not come from charging commissions to retail investors but from payments made by market makers for order flow and execution priority. In this model, although retail investors do not see fees on the surface, market makers typically cover costs by slightly widening the spread between the buy and sell prices, leading to a slightly worse execution price for retail investors, which constitutes the implicit cost of the spread. However, unlike traditional securities markets, cryptocurrency perpetual contract users' trading is more strategic, with a significantly higher sensitivity to spreads, slippage, and execution speed. If the platform compromises on matching resource allocation to maintain zero fees, resulting in wider spreads or lower execution quality than competitors, it may weaken the retention of professional users. Additionally, while APIs are seen as an important future revenue source for Lighter, feedback from the current community indicates that its API documentation, integration process, and opening pace still need improvement, and whether a stable revenue-generating fee system can be successfully established remains to be observed.

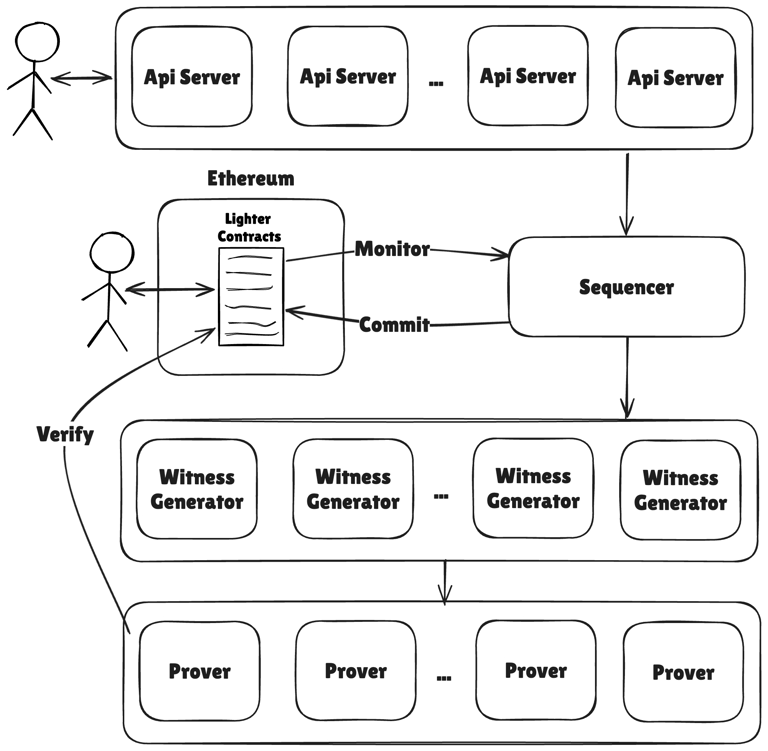

2. Dedicated zk-rollup Architecture

In terms of technical route selection, Lighter has not adopted a generic Layer 2 but has built a zk-rollup architecture optimized for trading scenarios. It encapsulates core logic such as matching, clearing, and liquidation within its self-developed "Lighter Core," generating zk-SNARK proofs through a customized proof engine for trading loads, and then submitting the compressed on-chain state to the Ethereum mainnet. Compared to generic zkVMs, this architecture sacrifices some generality but is more targeted in proof generation speed, latency stability, and execution efficiency for high-frequency order books. Its design goal is to achieve processing speeds close to centralized exchanges while ensuring verifiability, meaning completing order matching and providing confirmable execution results within milliseconds.

This dedicated solution provides the technical foundation for Lighter's proposed verifiable matching and fair execution but also increases system complexity and presents more potential risks. For instance, after Lighter's public mainnet went live on October 2, it experienced severe outages during the market's sharp fluctuations on October 10, with core components such as the database failing consecutively, preventing some users from submitting orders or adjusting positions during extreme market conditions, resulting in trading and LP losses amounting to tens of millions of dollars. In the aftermath, Lighter announced technical fixes and point compensations, but the market remains highly concerned about its stability under extreme TPS and the sustainability of its self-developed rollup architecture.

Source: Lighter,https://docs.lighter.xyz/

3. LLP Dual Purpose

In liquidity design, Lighter adopts a public funding pool model similar to Hyperliquid's HLP. Users who deposit assets into the LLP will receive LP shares and proportionally participate in the platform's market-making profits, fee income, and capital fee distribution. For ordinary users, the advantage of the LLP is that they can share in the returns from platform growth without actively market-making, while also bearing a certain level of counterparty risk. It is worth noting that Lighter plans to further expand the use of LLP in subsequent iterations, incorporating LP shares into the margin range. This means that the same funds can simultaneously serve two roles: participating in market-making to earn profits and being used as margin when users open positions, achieving the effect of utilizing one fund for two purposes. This design aims to enhance capital utilization efficiency and ensure more thorough asset circulation within the protocol.

However, this dual purpose may also bring greater risks. In a one-sided market, the LLP, as a counterparty, may face unrealized losses, causing the net value of the capital pool to decline; if some users then use LLP shares as margin for trading, their position losses will further be deducted from the LLP, amplifying the decline of the capital pool. This can be understood as market-making losses and margin losses compounding, easily forming a negative cycle, which in extreme cases may even affect the overall solvency of the protocol. Therefore, most mature perpetual protocols separate LP capital pools from margin assets to avoid the same funds being reused. For Lighter, if it plans to truly open the dual purpose of LLP in the future, it must establish more prudent and transparent rules regarding collateral rates, risk buffers, and emergency mechanisms for extreme market conditions to avoid systemic risks.

3. Incentive-Driven Trading Peaks and Uncertainty in Retention

1. Under Airdrop Expectations, Lighter Still Needs Market Validation

At the current stage, Lighter's trading scale is largely driven by its points mechanism and potential airdrop expectations. The zero-fee structure reduces participation costs, while the TGE expectations further reinforce users' short-cycle trading behavior. Combining the previous analysis of TVL and the ratio of OI to trading volume, it can be observed that there is a significant gap between Lighter's daily trading frequency and capital accumulation; it currently aligns more with incentive-driven trading rather than natural demand. This growth model, dominated by short-term incentives, makes it difficult for the current trading volume and activity to directly reflect the platform's true retention situation. Therefore, Lighter's key observation window will emerge after the TGE. As airdrop expectations are realized, user behavior may change. If trading volume and activity remain stable after the incentives decline, it indicates that its product experience, matching performance, and fee structure have sustained appeal to users; conversely, if core metrics significantly drop after the TGE, it suggests that early data contained a high proportion of incentive components, and user stickiness still needs further cultivation.

2. The Next Stage of Competition Among Decentralized Perpetual Contract DEXs

As the user structure of decentralized perpetual contract DEXs matures, growth driven solely by points or airdrops is gradually weakening. Taking Aster as an example, the market began to reassess its trading depth, order execution quality, and stability under volatile conditions after the incentives declined; meanwhile, Lighter is still in the pre-TGE stage, and its trading performance and user retention after the TGE will require time for validation. Additionally, it is worth noting that for larger trading funds, slippage control, matching delays, and system availability under extreme conditions are more decisive than the incentive mechanisms themselves. This also means that the differences in the platform's foundational capabilities will be further amplified in the subsequent cycles. In this context, the next stage of competition among perpetual contract DEXs may no longer be primarily determined by airdrops and other incentive measures, but will rely more on whether each platform can provide stable and predictable trading channels for large and sustained capital inflows. For Lighter, which is still in the pre-TGE phase, its ability to effectively attract higher-quality capital inflows after the gradual withdrawal of incentives will become an important indicator for assessing its long-term competitiveness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。