We are currently focusing on the four rapidly growing areas in the #Web3 market, which are also the hottest investment tracks in both primary and secondary markets. These are the directions most likely to explode with tenfold potential by 2026 (observed solely through data 📊):

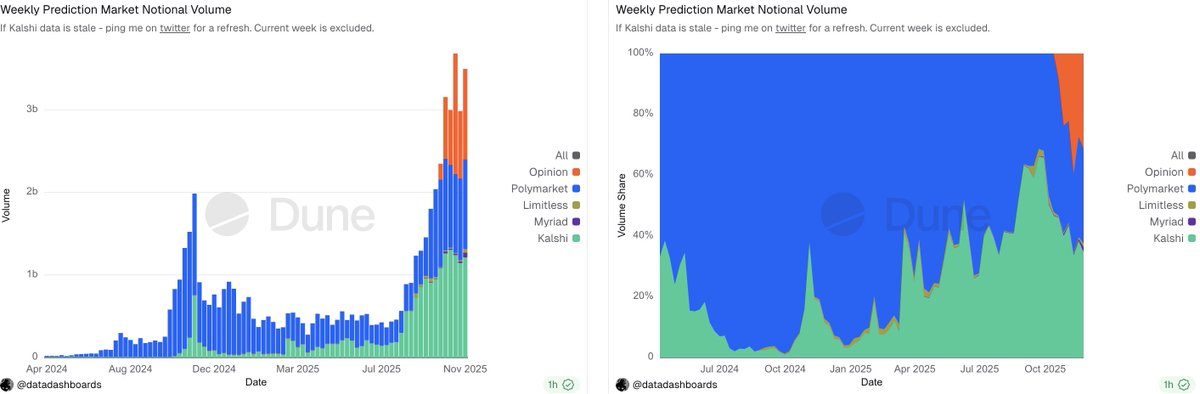

1️⃣ Prediction Markets (as shown in Figure 1), with the World Cup next year, the growth momentum of prediction markets will reach its peak, and the opportunities are self-evident. Pay attention to aggregation platforms, long-tail markets, and innovations in vertical segments. Currently, the three major platforms, @Polymarket, @Kalshi, and @opinionlabsxyz, dominate the trading volume in the prediction market.

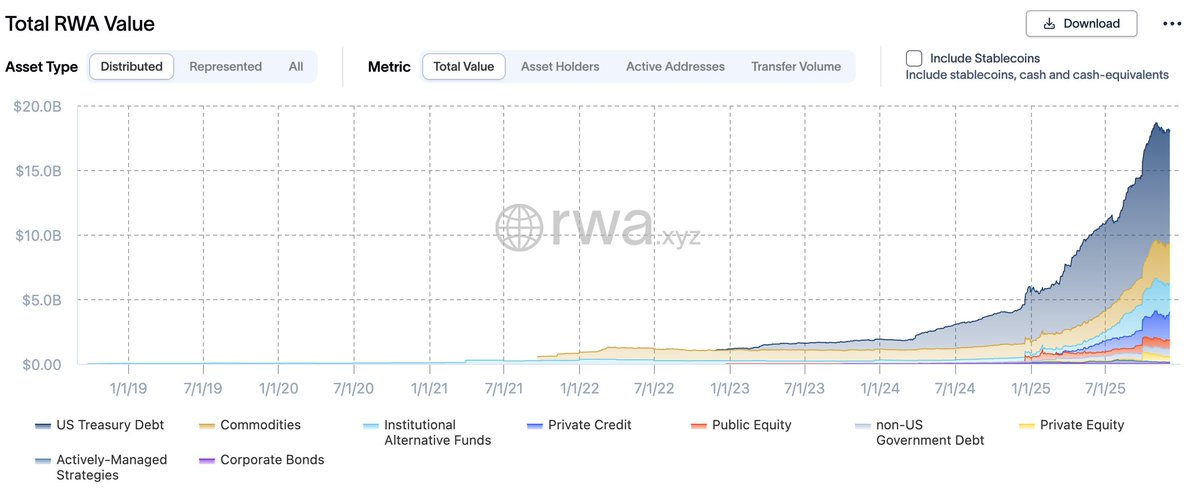

2️⃣ #RWA Market (as shown in Figure 2), RWA innovation is currently less than 5%. Derivatives such as government bonds, U.S. stocks, foreign exchange, real estate, commodities, and volatility products will shine brightly. After the introduction of the U.S. "Cryptocurrency Market Structure Bill" and the "Innovation Exemption Bill," innovation in this area will experience explosive growth. @OndoFinance remains a leader in this field, and data shows that U.S. Treasury and stock data 📊 continue to maintain a leading position.

3️⃣ Stablecoin Market (as shown in Figure 3), digital banking + payments will be the new strategies and plays in this field. There are still 1.4 billion people globally without bank accounts, lacking access to traditional financial systems; combined with the arrival of the #AI era, an efficient and fast global payment system has become a necessity. In the payment agency field, there are still no strong leading projects emerging. I remain optimistic about @circle and have recently purchased a large amount of its stock, believing in its merger wave and payment integration.

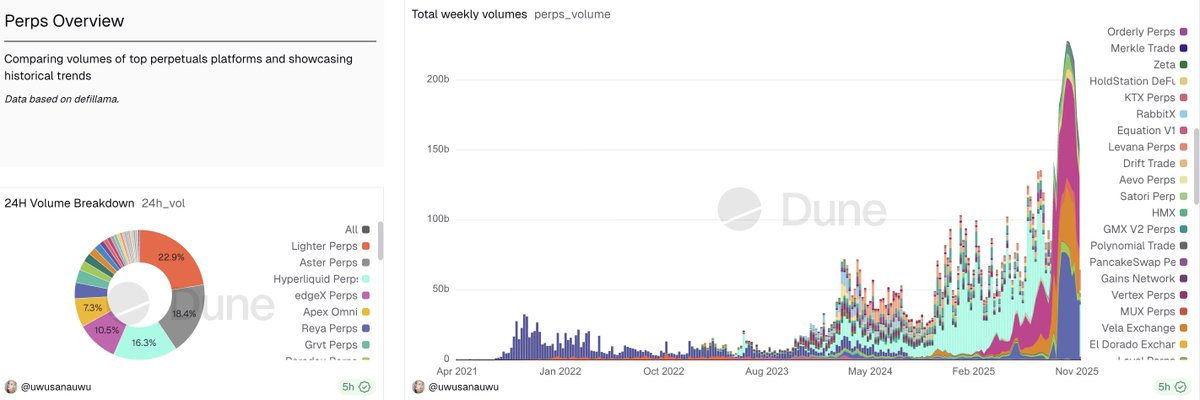

4️⃣ On-chain Derivatives Market (as shown in Figure 4), this area has great potential. In addition to our traditional perpetual contracts and options, the future will also allow for the quick and convenient nesting of #RWA and other financial assets. This will give rise to numerous arbitrage strategies, including many Delta-neutral strategies, stablecoin arbitrage strategies, and AI-based automated trading and arbitrage, etc. Currently, the core players are mainly these five: @Lighterxyz, @HyperliquidX, @AsterDEX, @edgeX_exchange, @OfficialApeXdex.

This should be what we currently see as high-growth tracks that maintain momentum even in a sluggish crypto market or amidst discussions of a bear market. Perhaps this will be the most dazzling star in the next cycle, worthy of attention 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。