Written by: Frank, MSX Research Institute

This time, TradFi showed no hesitation at all, as Nasdaq is racing towards SEC approval for "stock tokenization."

"Tokenization will ultimately consume the entire financial system."

For Nasdaq, this is no longer an empty slogan, but the most urgent strategic task at hand.

On November 25, Matt Savarese, head of Nasdaq's digital asset strategy, stated in an interview with CNBC that the SEC approval for the tokenized stock program is a top priority and will be "pushed forward at the fastest speed." He also cautiously emphasized that Nasdaq is not trying to overturn the system, but rather to promote asset on-chain in a "responsible" manner within the regulatory framework.

But no matter how gentle the wording, actions do not lie.

While other giants are still cautiously observing or conducting marginal tests, Nasdaq, standing at the core hub of TradFi, seems to have made a lifelong commitment and is aggressively stepping on the gas.

1. It’s not Crypto that’s stepping on the gas, but Nasdaq

Rewind to three months ago on September 8, Nasdaq submitted a milestone rule change application to the U.S. Securities and Exchange Commission (SEC), with a core goal that appears quite radical at first glance: to allow investors to directly trade stocks of listed companies like Apple and Microsoft, as well as exchange-traded products (ETPs), in the form of blockchain tokens on Nasdaq's main board.

However, a close reading of the many details disclosed in this application reveals that beneath the radical surface, Nasdaq has provided a politically astute "hybrid architecture" solution, thanks to its deep understanding of where the SEC's red lines are. Thus, it did not choose to start from scratch, but rather cleverly separated "trading" from "settlement":

The crux of the entire application lies in treating the tokenized stock business as regular stock trading, where each tokenized stock transaction will be cleared and settled through a depository trust company (DTC), and "trade matching will still be completed in the same order book; even if the order includes tokenized stocks, it will not affect the priority of the exchange executing that order."

In other words, at the front end, everything remains the same; the investor's experience changes little, and trade matching is still completed in the same order book. Tokenized stock orders will not gain extra priority, trades will still count towards the National Best Bid and Offer (NBBO), and purchasers of tokens will fully receive all shareholder rights, including voting rights and liquidation rights.

The real revolution occurs at the backend settlement layer. Once a transaction is completed, Nasdaq will not follow the traditional old path but will pass the instructions to the DTC, initiating a brand new on-chain process:

- Locking and mapping: After the transaction is completed, Nasdaq passes the settlement instructions to the DTC;

- On-chain minting: The DTC locks traditional stocks into a dedicated account, and the system mints equivalent tokens on-chain;

- Instant distribution: Tokens are instantly allocated to the broker's blockchain wallet;

In short, the trading of tokenized stocks remains completely consistent with traditional stocks, only introducing on-chain mapping at the settlement layer. This design means that tokenized stocks are not floating outside the National Market System (NMS) but are seamlessly integrated into the existing regulatory and transparency framework, leveraging the existing massive liquidity pool while introducing blockchain as a new generation of settlement tools.

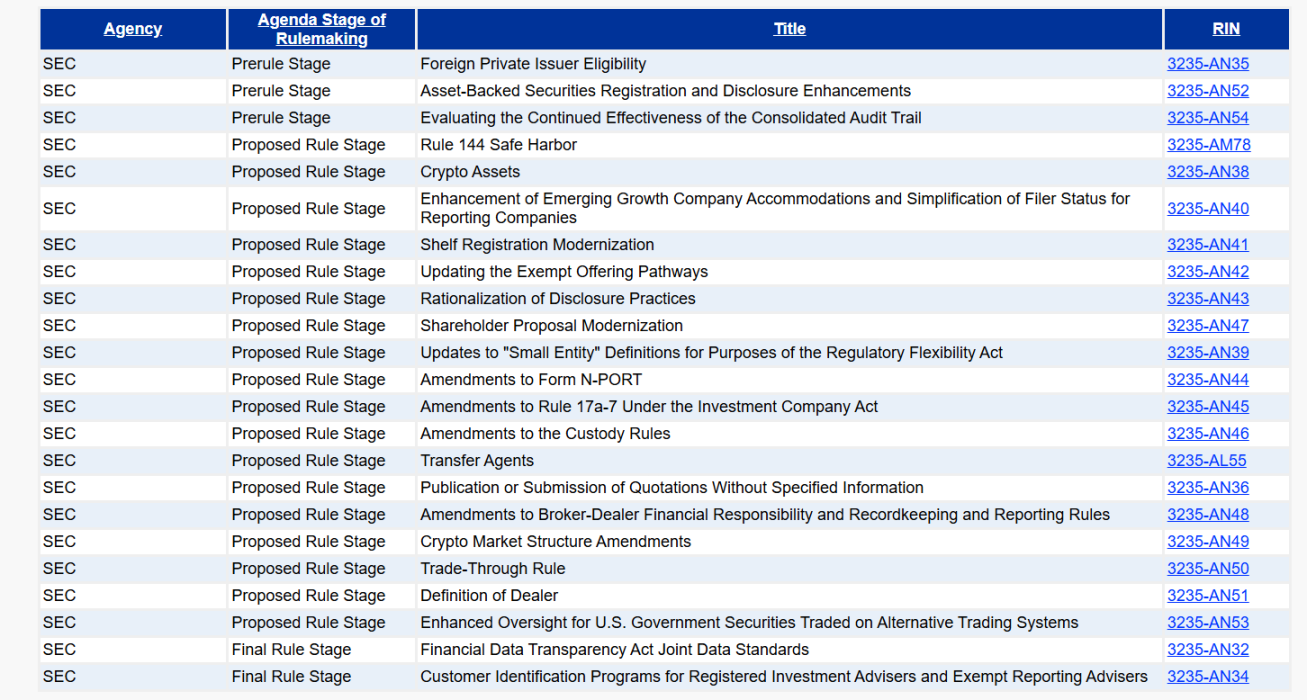

Interestingly, just days before Nasdaq submitted its application (on September 4), the SEC had just released its annual agenda, clearly stating its intention to reform cryptocurrency policies, including "restructuring cryptocurrency regulation" and "reducing overly complex rules criticized by Wall Street."

This timing "coincidence" is hard not to make one think that Nasdaq has precisely timed its move, sensing a subtle shift in regulatory winds. It can even be said that Nasdaq is well aware of the SEC's bottom line, thus balancing "innovation" and "stability" in its design.

Chuck Mack, Senior Vice President of Nasdaq North America Markets, articulated the essence of this "hybrid architecture" in an interview: "We are not trying to replace the existing system, but rather to provide the market with a more efficient and transparent technological option. Tokenized securities are simply the same assets expressed in a new form on the blockchain."

Ultimately, in Nasdaq's design, tokenization is not about "starting anew," but rather a gentle yet firm upgrade of the underlying infrastructure—utilizing the existing market structure and trading system while allowing blockchain to become the new generation of custody and settlement tools.

According to the plan, as long as the DTC's infrastructure is in place, U.S. investors may officially see the first batch of tokenized securities trading settled on Nasdaq by the end of the third quarter of 2026.

At that time, Wall Street's ledger may turn a new page entirely.

2. Why is Wall Street so radical now?

In fact, Nasdaq is not the first to "eat the crab," but its entry marks the competition entering a decisive stage.

Looking across Wall Street, a silent movement towards on-chain has already begun: JPMorgan launched the Onyx platform to promote inter-institutional settlement, BlackRock issued tokenized treasury bond funds BUIDL on Ethereum, and Citigroup is also exploring cross-border payments and custody of tokenized assets.

So why is Nasdaq taking the lead now?

A statement from BlackRock CEO Larry Fink may reveal part of the truth: "Since the invention of double-entry bookkeeping, the ledger has never been so exciting." It can be said that looking back at hundreds of years of financial history is essentially a "history of the evolution of accounting technology":

- In 1602, the Amsterdam Stock Exchange was established, marking the birth of the world's first stock market, with paper certificates becoming the basis of trust;

- In 1792, the Buttonwood Agreement was signed, and the New York Stock Exchange was established, ushering Wall Street into the era of paper contracts and manual shout matching;

- In 1971, Nasdaq was founded, creating the world's first electronic stock trading market;

- In 1996, the Direct Registration System (DRS) was launched, marking the practical entry of U.S. stocks into a paperless era;

And now, blockchain has become the latest holder of this baton; when technology accumulates to a critical point, transformation naturally occurs.

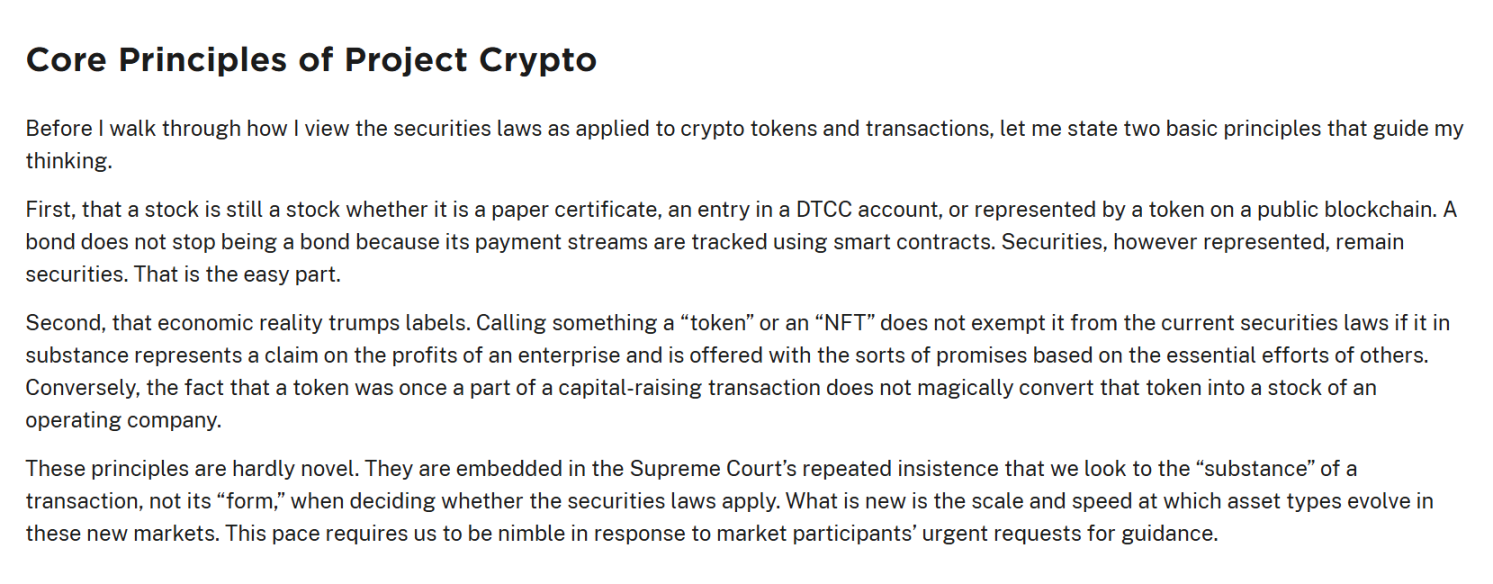

Even more interestingly, the regulatory winds are also undergoing subtle changes. On November 12, the SEC's official website published the full text of Chairman Paul S. Atkins' latest speech, in which a segment was interpreted by the market as a "pre-approval" for the tokenization of U.S. stocks:

"Whether stocks are presented in the form of paper certificates, recorded in depository trust and clearing company (DTCC) accounts, or represented as tokens on a public blockchain, they are essentially still stocks; bonds do not cease to be bonds simply because their payment flows are tracked by smart contracts. Regardless of the form presented, securities are always securities, and this is easy to understand."

Source: SEC official website

In short, in the eyes of regulators, tokenized securities are still securities, but as long as the legal essence of the securities is not changed, technological upgrades are no longer a forbidden zone.

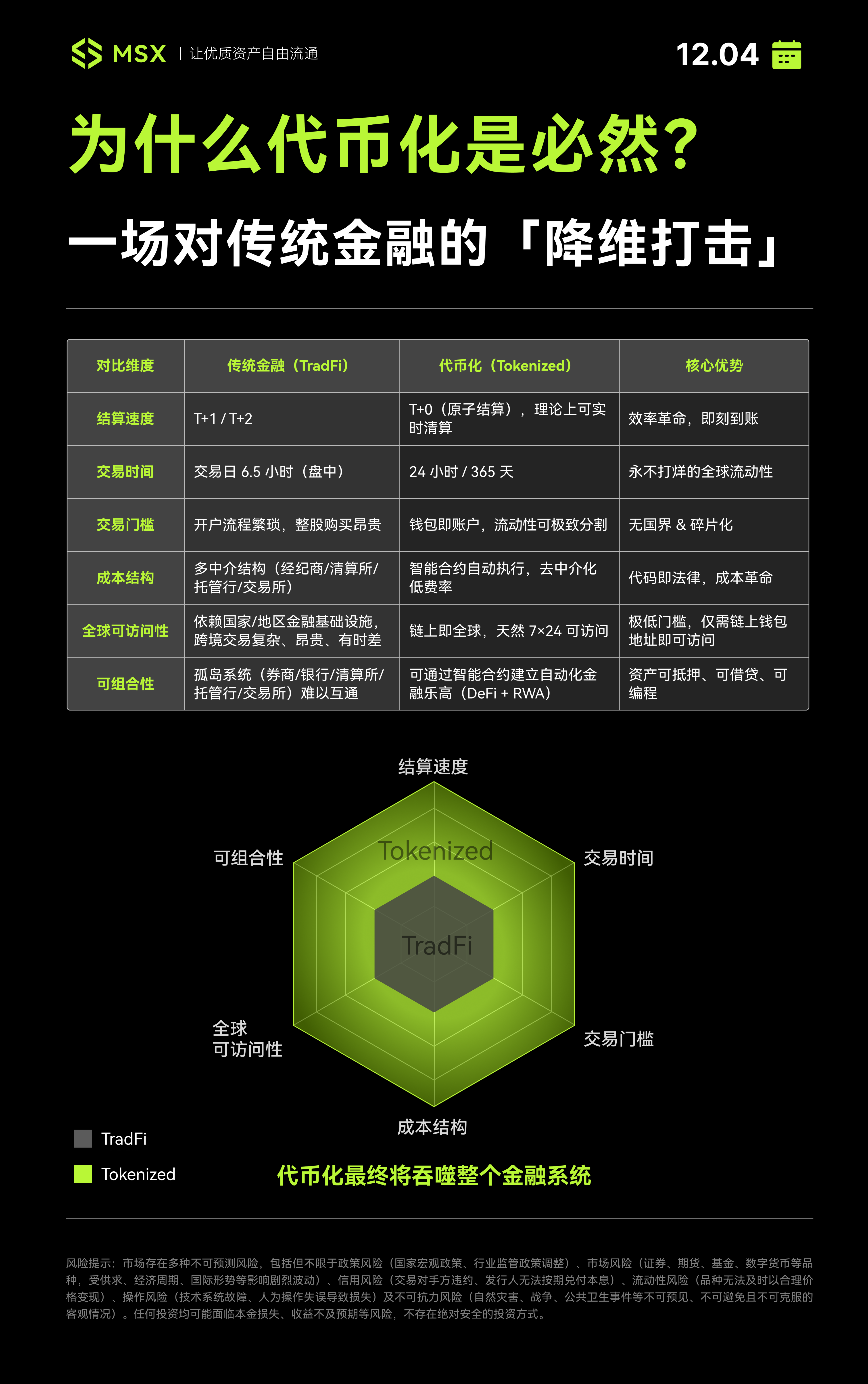

It is precisely because of the dual support of technology and regulation that Nasdaq is eager to promote tokenization to address three core pain points in the capital markets that cannot be resolved under the traditional framework:

- Settlement efficiency: Moving from T+1 or even longer to T+0 (real-time settlement), completely eliminating counterparty risk, which analysts estimate could save hundreds of millions of dollars in operational costs for global infrastructure each year;

- 24/7 trading: Breaking the 6.5-hour market opening limit to achieve 7×24 global liquidity, addressing severe liquidity fragmentation issues;

- Asset programmability: Writing dividends, voting, and compliance checks into smart contracts, expanding automated governance and more combinatorial space;

But beyond technological advancement, I believe there is a more critical point, namely this is essentially a reconstruction of the profit distribution model. After all, under the existing TradFi system, Nasdaq is actually at the bottom of the value chain:

Investors must trade through brokers or dealers, who take a large share of the trading fees, financing interest, and capital flow (2C business); while Nasdaq, as an exchange, earns more from matching, clearing, and listing service fees (2B business).

To put it figuratively, brokers are eating the meat, while Nasdaq can only drink the soup.

However, once U.S. stock tokenization occurs in the future, directly issuing and circulating based on Nasdaq's own chain or permissioned chain, the situation will instantly reverse. It will cut into the entire chain of data and revenue from issuance to circulation to settlement. At that point, Nasdaq will no longer just be a matching platform; its value capture method will shift from a single "fee-based" model to "direct commissions + value-added services + network effect revenue."

If Nasdaq further launches its own on-chain trading venue (permissioned chain DEX), it could almost replicate the perfect closed loop of top-tier crypto centralized exchanges: User places order → Matching completed → Ledger recorded on-chain → Clearing and settlement → Custody of assets, a complete one-stop service.

This means that the vast cake originally scattered across "bank custody funds + clearinghouse settlement + broker front-end client" could all be integrated onto the same chain. For existing heavyweight players in TradFi (brokers, custodians), this is undoubtedly disruptive, but for Nasdaq, this is a historic opportunity to have the meat cooked in its own pot.

3. Next, where will the storm sweep?

Objectively speaking, as of today, U.S. stock tokenization is no longer just a narrative but has become a powerful historical tide.

Slogans can be deceiving, but actions do not lie. While Nasdaq is stepping on the gas, various factions have already entered the fray, from Robinhood launching tokenized private equity to Kraken listing U.S. stock tokens via XStocks, from Galaxy Digital moving its own stocks onto the public chain to SBI Holdings laying out on-chain trading in Japan. Whether they are crypto-native enterprises or traditional financial giants, all are vying for the first-mover advantage in the emerging track of tokenized stocks.

But dramatically, just as Nasdaq is making rapid progress, a counterattack from the crypto-native world has also emerged. On October 16, Ondo Finance, a leading RWA issuance protocol, sent an open letter to the SEC urging it to delay the approval of Nasdaq's rule change application, citing "transparency" and accusing Nasdaq of being vague in its description of the settlement process.

Source: Ondo Finance

This inevitably brings to mind that the discussion is not just about compliance; it also reflects Ondo's competitive anxiety about its ecological position potentially being squeezed—if Nasdaq directly issues the most credible and liquid native tokenized stocks (like Tokenized-AAPL), then protocols like Ondo, which focus on "intermediary issuance and underwriting," will undoubtedly see their survival space greatly compressed.

To put it bluntly, why would investors buy assets packaged by "middlemen" instead of directly purchasing Nasdaq's native tokenized stocks?

With the entry of formal players like Nasdaq, the barriers to upstream asset issuance will be flattened, and all RWA issuance protocols will face a similar "de-intermediation" impact. This represents a deeper crisis in the second half of the RWA track, where simply issuing tokenized stocks is no longer appealing.

Especially as DEXs like Hyperliquid begin to encircle U.S. stock liquidity through HIP3's perpetual contracts, the allure of merely holding tokenized stocks is diminishing. However, this is not the end of the U.S. stock tokenization track; rather, it is a historic opportunity for "downstream protocols."

Nasdaq is responsible for "creating assets" (issuance and settlement), but it cannot monopolize all "playing assets" (trading and applications) scenarios. Even if there are concerns that Nasdaq will launch an official DEX that squeezes the survival space of other protocols, just as there are both Uniswap and Hyperliquid on-chain, the future of trading, derivatives, lending, and market-making services based on Nasdaq tokenized U.S. stocks will be a blue ocean of innovative freedom.

Decentralized protocols and compliant trading platforms that are close to traffic entry points and build trading capabilities around on-chain composability may actually be the ones to truly benefit from this wave of dividends. Of course, no one can ensure that the final winners will definitely be MSX, but this "downstream dominance" mindset is indeed correct.

In Conclusion

Interestingly, on December 1, The Economist published an article discussing "How RWA Tokenization is Changing Finance," presenting a rather symbolic analogy:

If history can serve as a reference, the current stage of tokenization is roughly equivalent to the internet in 1996—at that time, Amazon had only sold $16 million worth of books, and today, among the "Magnificent Seven" tech giants dominating U.S. stocks, three had not even been born yet.

From yellowing paper certificates to the electronic SWIFT system in 1977, and now to atomic settlement on blockchain, the evolution curve of financial infrastructure is replicating and even surpassing the speed of the internet.

For Nasdaq, this is a gamble of "being revolutionized if it does not self-revolutionize"; for the crypto industry and new RWA players, this is not only a brutal reshuffle of survival of the fittest but also a historic opportunity comparable to betting on the next "Amazon" or "Nvidia" in the 1990s.

The future is still far away; the arrow has just been shot.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。