Original|Odaily Planet Daily (@OdailyChina)

Amid market fluctuations, the stock price of "BTC treasury company leader" Strategy continues to decline. Although the company recently announced the establishment of a $1.44 billion dividend reserve to support dividends and interest payments, it failed to restore market confidence—combined with previous news of a potential removal from the MSCI index, its stock price once plummeted nearly 10%.

However, from the perspective of shareholder structure, Strategy still attracts some long-term capital, including institutions like Deutsche Bank, which has an asset management scale of $1.6 trillion. Odaily Planet Daily will outline the representative shareholders of Strategy in this article for reference by relevant market participants. Also recommended reading: With the establishment of a $1.44 billion dividend reserve, the stock price plummeted 10% again; what are the real issues with Strategy?

Unveiling the Shareholder Composition of Strategy (MSTR): Nearly 50% Held by Public Companies and Retail Investors

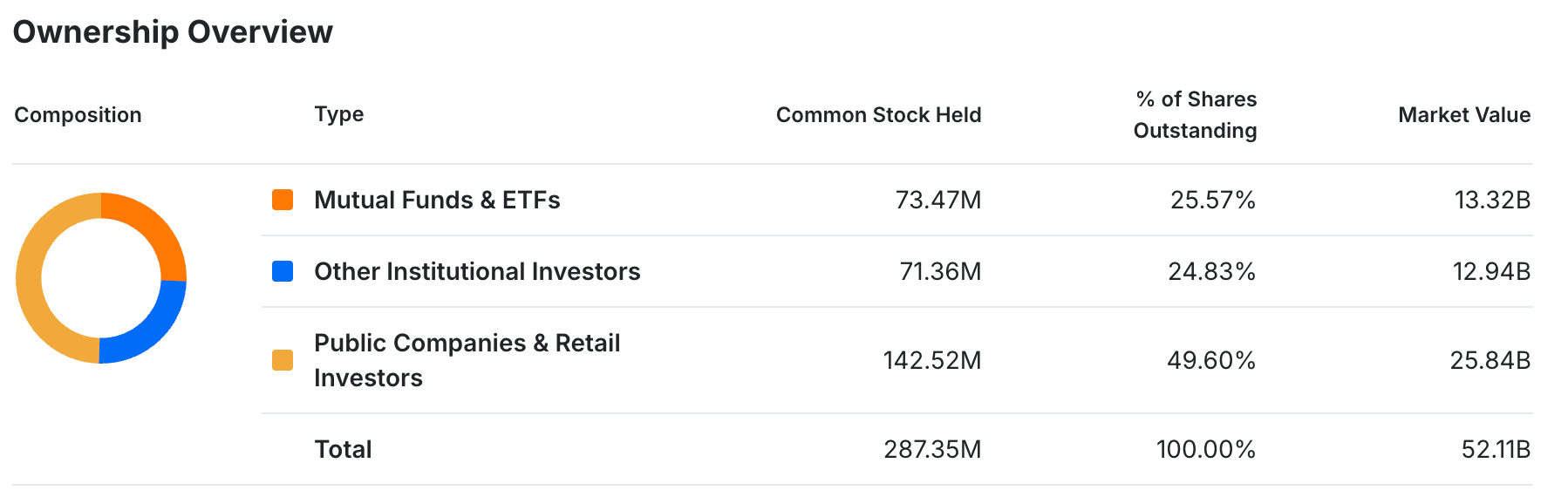

According to Investing website information, as of the end of Q3 this year, the common stock holdings of Strategy are primarily composed of mutual funds and ETFs, institutional investors, public companies, and retail investors, among which:

- Mutual funds and ETFs account for 25.57%;

- Institutional investors account for 24.83%;

- Public companies and retail investors account for 49.6%.

- Currently, the total number of Strategy (MSTR) shares is approximately 287 million, with a total market value of around $52.1 billion.

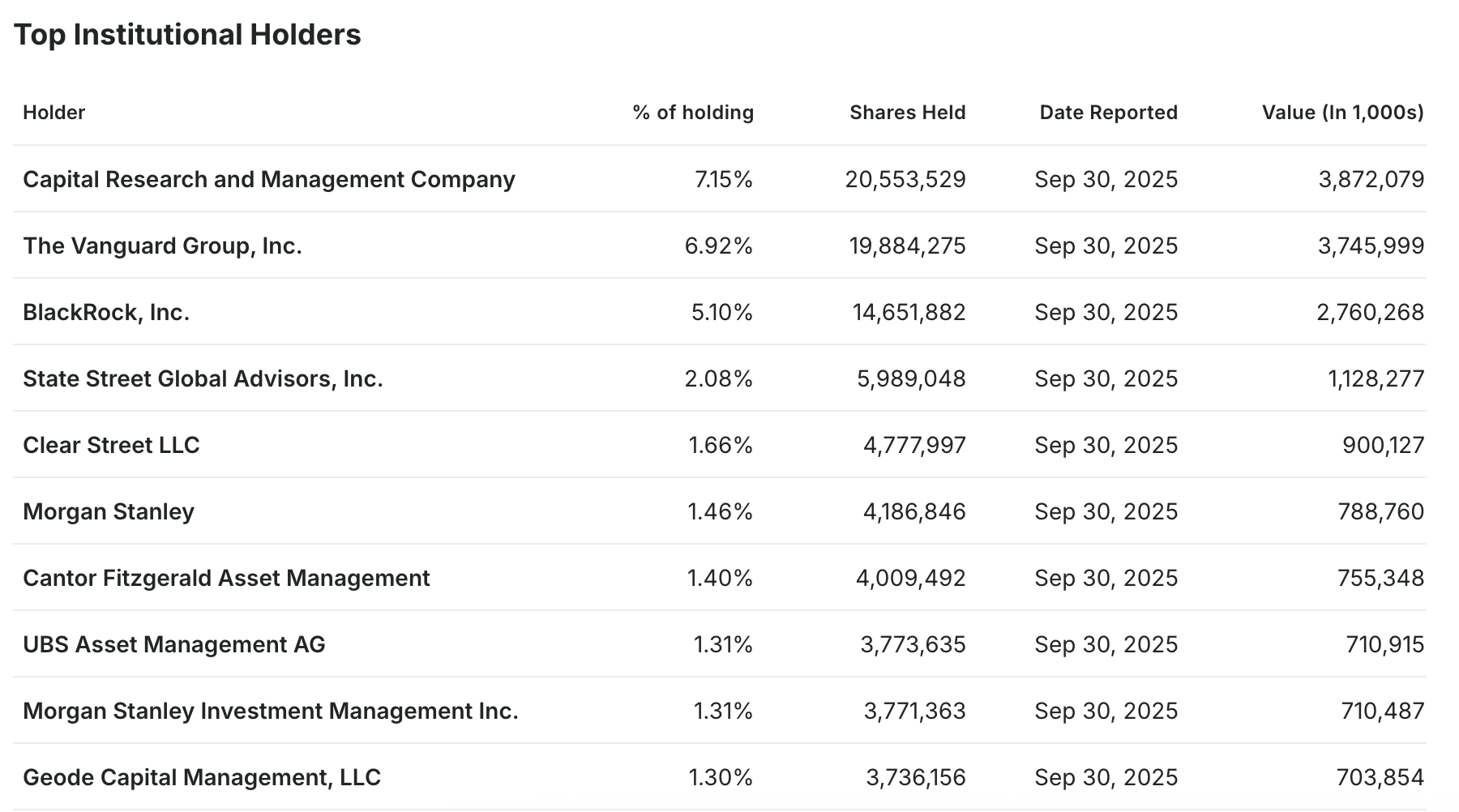

Among institutional investors, Strategy's shareholders include globally renowned companies such as Vanguard Group, BlackRock, Morgan Stanley, and UBS Asset Management.

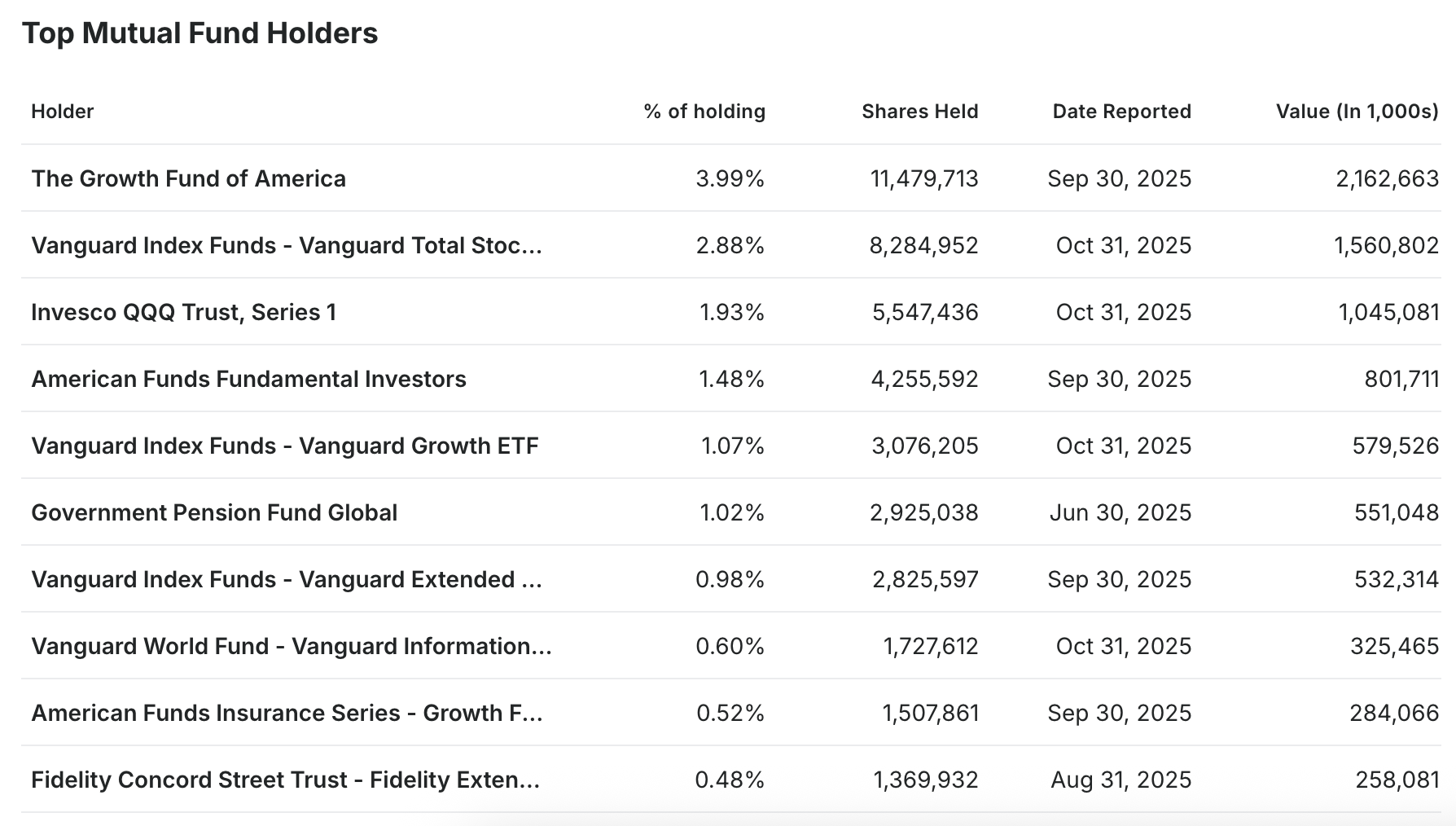

In mutual funds, the shareholder list of Strategy is also quite impressive, with the top holders being well-known funds in the industry.

Next, aside from the usual asset management institutions, we will focus on introducing some representative shareholders to help everyone better understand the many "mysterious shareholders" behind Strategy, known as the "first concept stock of BTC" and "leader of the DAT trend."

Central Banks and Large Banks: The "Invisible Tycoons" of Strategy Stock Holdings

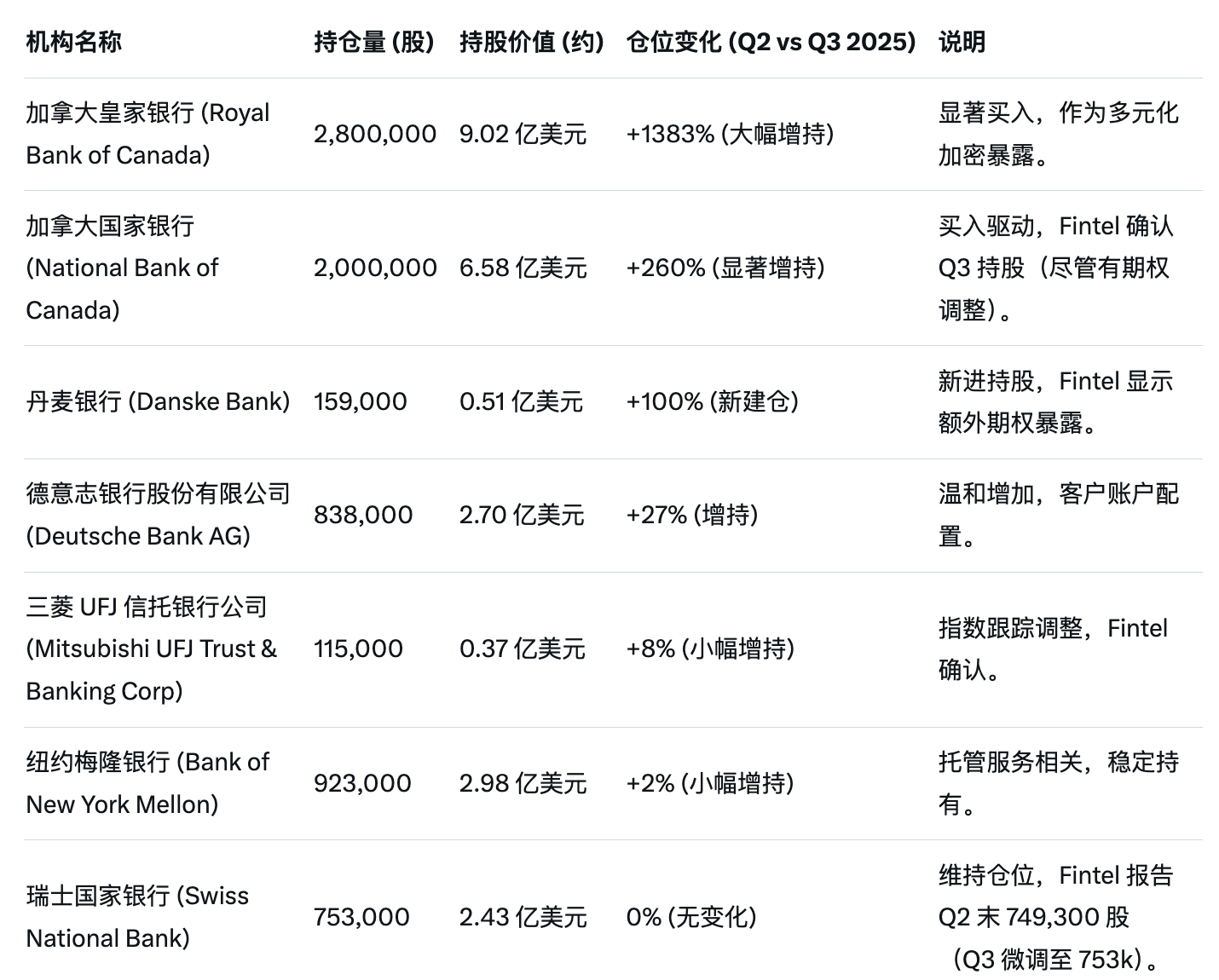

Among the shareholders of Strategy, a particularly unique group is the central banks and large banks of various sovereign nations. Although the main reason for central banks holding Strategy stock is often to implement diversified investment strategies or to increase indirect exposure to BTC assets, their holdings are an undeniable fact and represent a direct "vote with their feet."

According to Stockzoa website information, as of the end of Q3, the information on central banks and large banks holding Strategy stock is as follows:

In addition to the banks mentioned above, some central banks have exited their holdings of Strategy stock shortly after holding it due to market fluctuations or their own asset allocation requirements. For example, the Norwegian central bank held approximately $500 million in MSTR shares at the beginning of the year, subsequently increased its holdings to about 2.98 million shares, and ultimately liquidated all shares in Q2 this year, valued at about $1.2 billion, with a loss of about $200 million; the Saudi central bank (Saudi Arabian Monetary Authority) also disclosed holding 25,600 shares of MSTR, indirectly holding BTC asset exposure, but may have since liquidated.

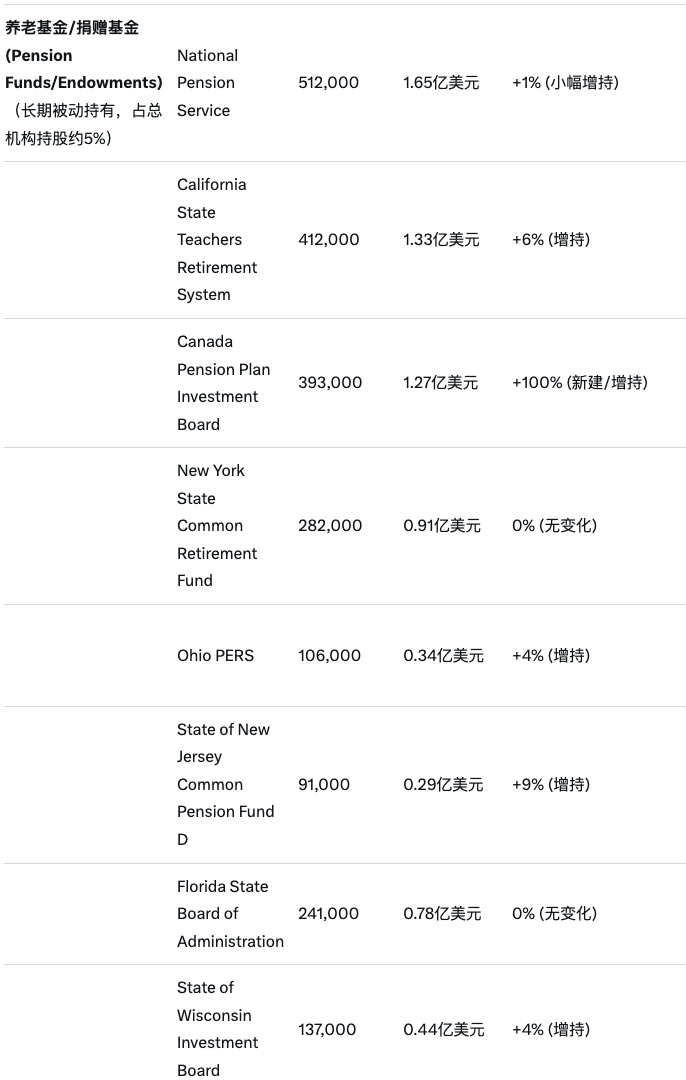

Pension and Endowment Funds: Potential Players Among Strategy's Q3 Shareholders

Apart from banking institutions, pension funds and endowment funds are also one of the "main forces" among Strategy stockholders. Moreover, due to their massive capital scale, the future hope for increased holdings of Strategy stock may still depend on their performance.

Similarly, according to Stockzoa website information, as of the end of Q3 (compared to Q2), the information on pension funds and endowment funds holding Strategy stock is as follows (compiled from Grok):

This mainly includes national pension funds, state pension fund associations, industry foundations, Canadian pension funds, and other institutional organizations.

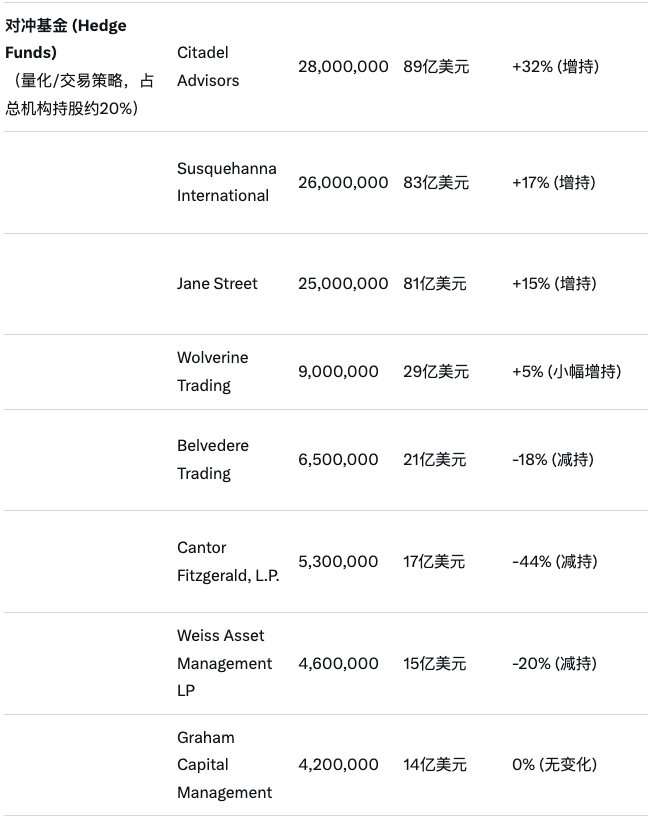

Hedge Funds: The "Shark-like Predators" Among Strategy Shareholders?

Among Strategy's shareholders, hedge funds may be the most sensitive to market trends and changes. Therefore, in Q3, although most hedge funds chose to increase their holdings of MSTR stock, crypto brokerage firms and established hedge funds like Cantor Fitzgerald, L.P. and Weiss Asset Management LP still opted to reduce their stock holdings.

According to Stockzoa website information, as of the end of Q3 (compared to Q2), the information on hedge funds holding Strategy stock is as follows (compiled from Grok):

Data Perspective on Changes in Strategy Shareholders: Institutions Remain the Main Holders, with Increased Holdings Far Exceeding Reductions

Aside from the above group classification perspective, changes in Strategy's institutional shareholder data also reveal some hidden information.

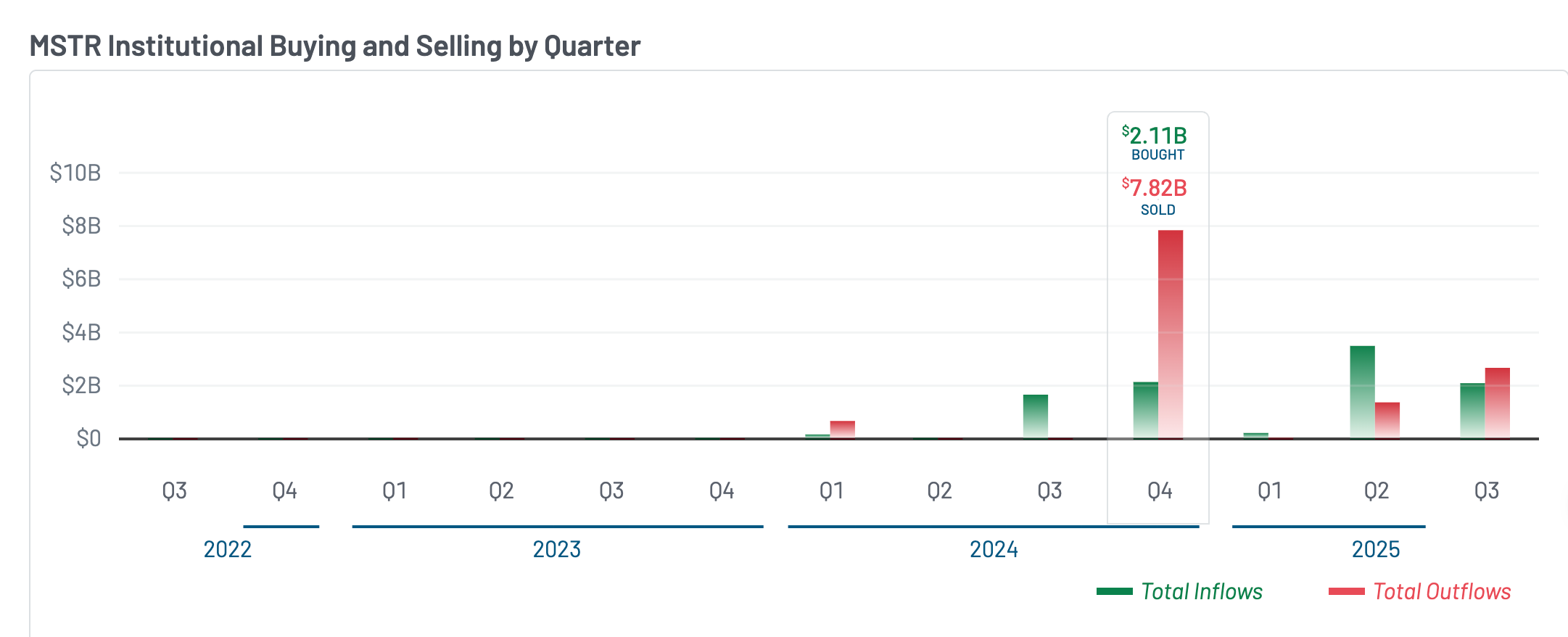

Strategy Stock Trading Data Relatively Balanced, Far Below Historical Peaks

According to Marketbeat website data, Strategy stock inflows and outflows reached a record 7.82 billion shares sold and 2.11 billion shares bought in Q4 2024, with a buy-sell ratio approaching an astonishing 1:4; in contrast, this figure dropped to 2.64 billion shares sold and 2.07 billion shares bought in Q3 this year, with a buy-sell ratio of about 1:1.25, indicating a relatively balanced buying and selling data. From this perspective, Strategy stock has not entered a so-called "panic selling phase," but is instead experiencing normal fluctuations.

Behind the Institutional Holding Data: The Number of Institutions Increasing Holdings is Twice That of Institutions Reducing Holdings

According to Nasdaq official data, the current institutional holding ratio of Strategy stock is approximately 55.84%, with a total of 1,293 holding institutions, among which 646 have increased their holdings; 505 have reduced their holdings; and 142 have maintained their positions.

Additionally, the number of shares increased by institutions is about twice that of shares reduced by institutions (30.51 million shares: 16.26 million shares), indicating that the market can normally absorb the buying pressure of Strategy's stock; while more institutions chose to remain unchanged, the number of shares held by these institutions reached 102 million, accounting for about two-thirds of the institutional holding ratio, highlighting institutional investors' confidence in Strategy's future.

In summary, despite the significant drop in stock price, the fundamental holdings of Strategy and the structure of institutional holdings have not deteriorated significantly. As the market gradually warms up, there may be a potential for a rebound, leading to a new upward trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。