Today, I looked at the family office report released by Goldman Sachs for 2025. Coincidentally, I have also been chatting with some family office leaders in Hong Kong and Singapore this year, discussing some of their thoughts, as well as their asset allocation and strategies, which may be helpful for partners! 🧐

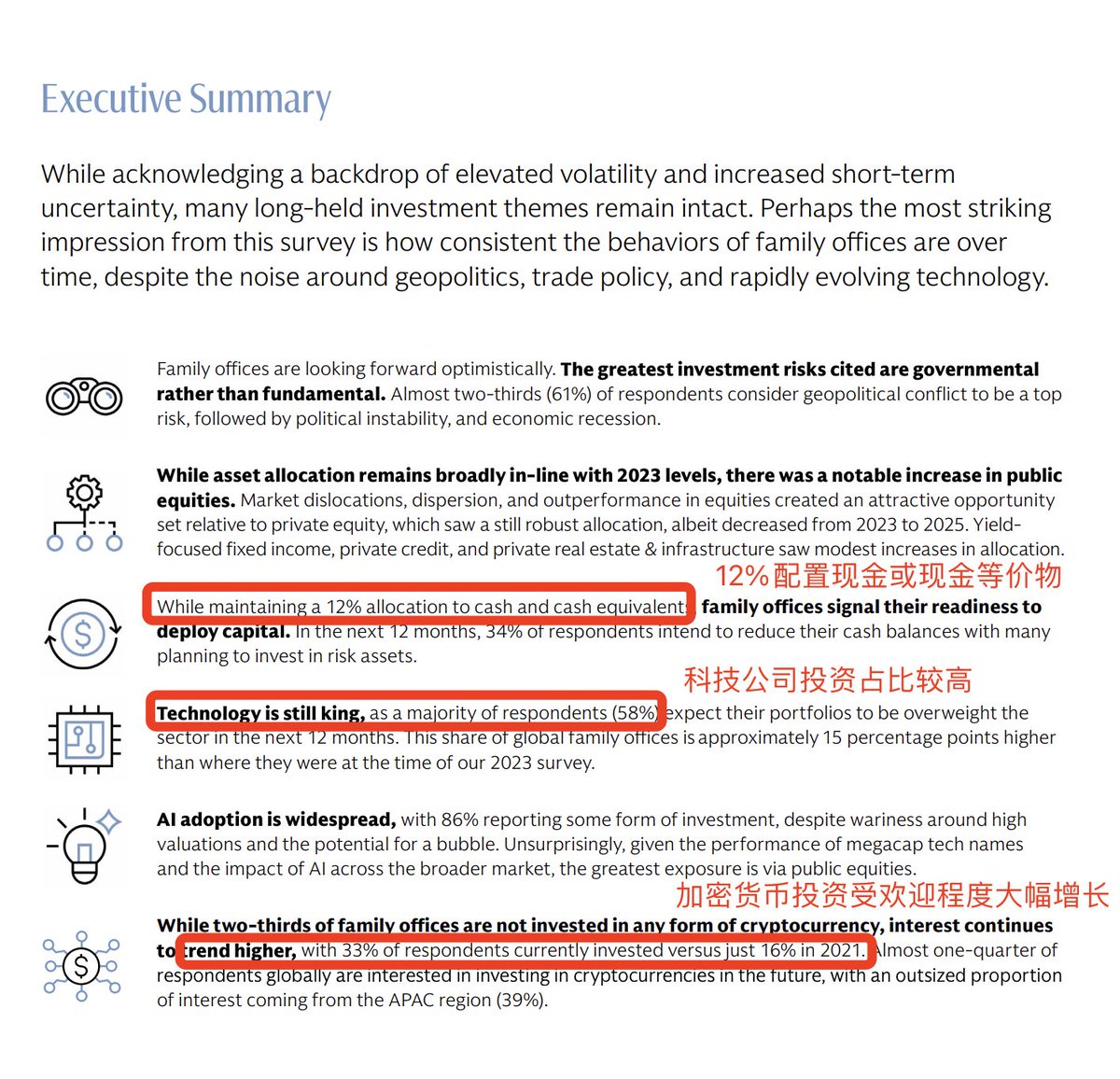

This time, Goldman Sachs surveyed a broad sample, researching 245 family offices globally, with an average asset management scale of over $1 billion. For these investment managers managing tens or hundreds of billions, outsiders may see them as glamorous, but from my personal experience, their investment psychological state this year can be described in two words: "tense."

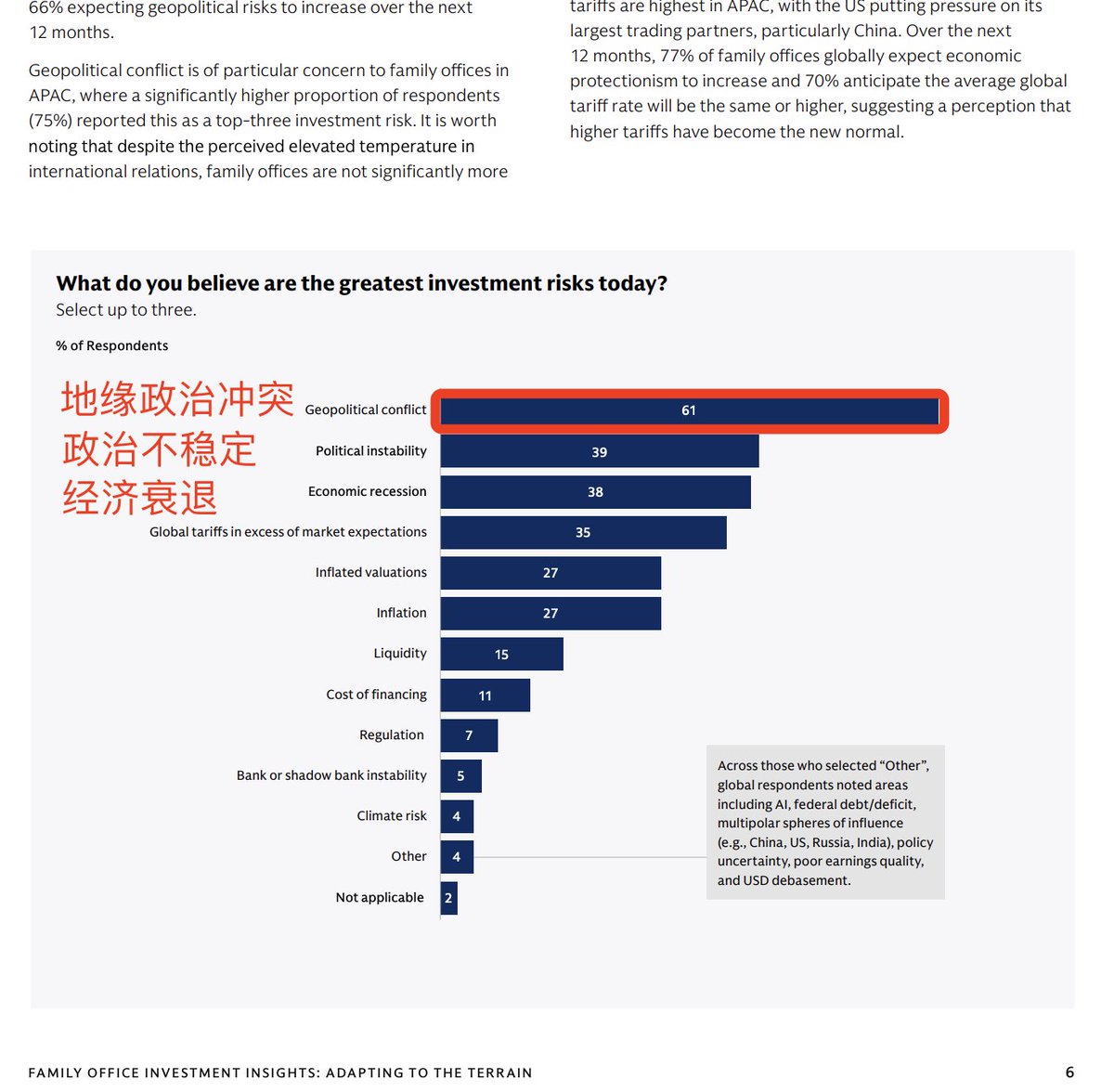

For these seasoned old money and new money individuals, they are not worried about inflation or stock market fluctuations; what they fear is—global order failure, making the world unpredictable. Goldman Sachs' report lists this as the biggest investment risk today, with 61% citing geopolitical conflict as the top concern, followed by political instability and economic recession (as shown in Figure 1).

So for them, a 10% drop in the S&P 500 overnight may not be terrifying, as U.S. stocks have historically shown long-term growth. What they are most concerned about is waking up one morning to find that two countries have suddenly gone to war, global supply chains have broken down, the dollar system is under pressure, and asset pricing systems have become unanchored.

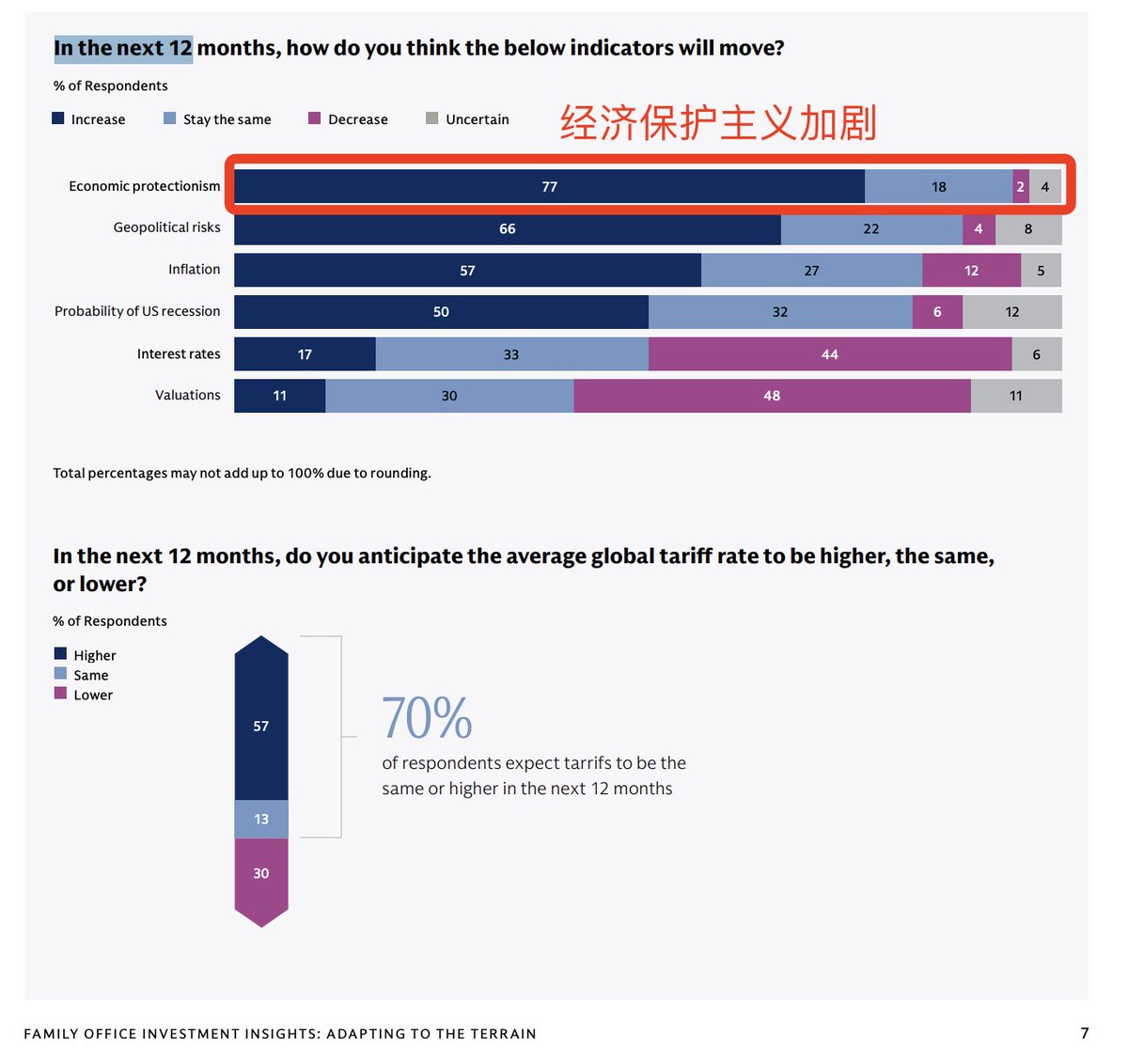

The report also mentions that 77% believe economic protectionism will continue to escalate. Essentially, this means trade protectionism, and de-globalization will become a major trend, leading to a more chaotic, more right-wing, and more closed world in the future.

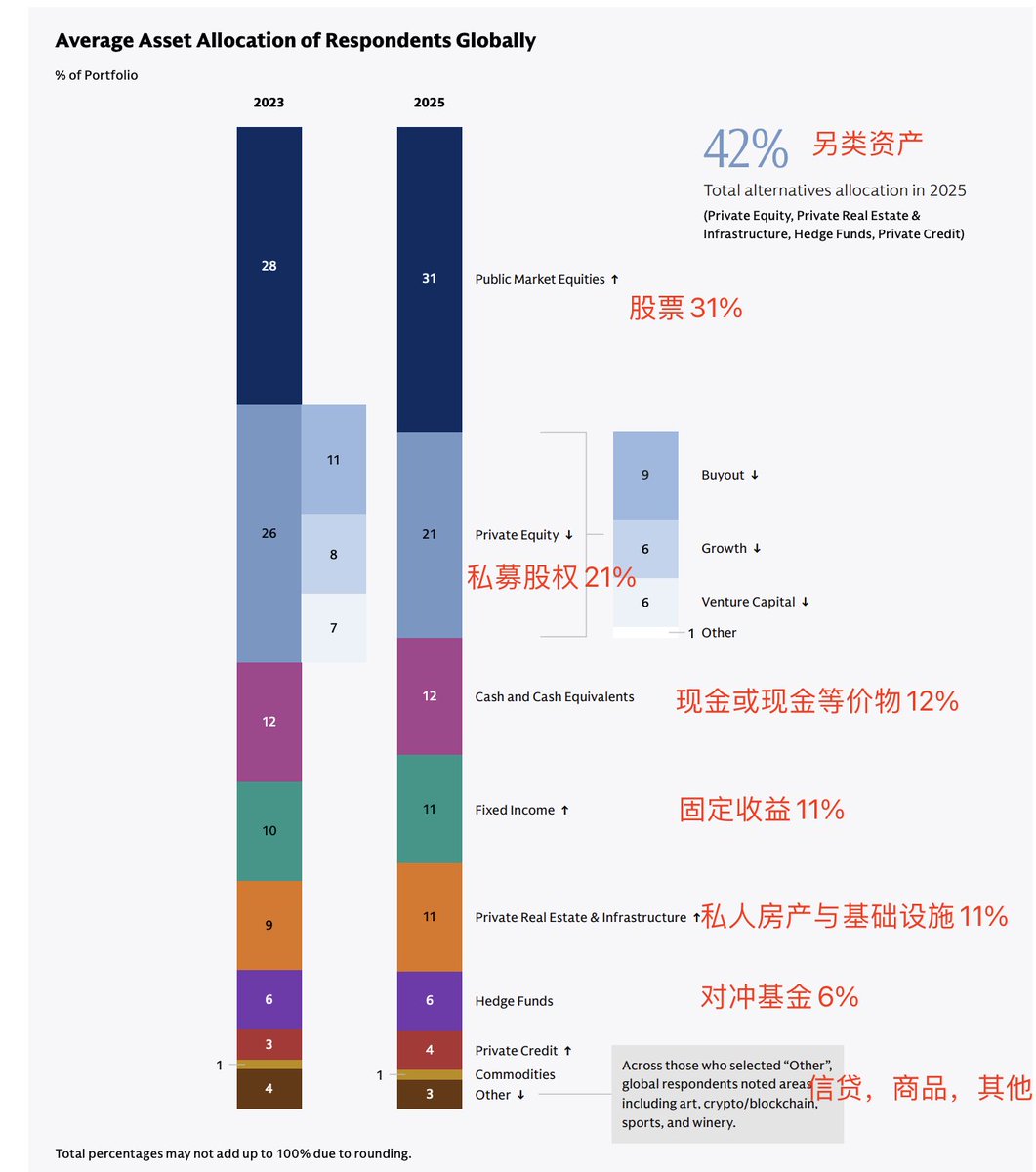

📝 Given this risk appetite and mindset, the investment strategies of family offices are worth deep research and consideration. Let's take a look at their allocation strategies (Figures 3 and 4):

1️⃣ Cash—12% (Counterintuitive logic)

This differs from the normal investment intuition of most people, who might hoard cash during turmoil. But for these elite family offices, they understand the essence of capital; in a potentially chaotic world, cash is the least valuable asset. The report states they average only 12% cash allocation. This may differ slightly from my actual discussions, but not significantly; the situation I encountered in the Asia-Pacific region is generally around 25%.

For these elites, they treat cash as "bullets ready to fire at any moment." This cash is meant for opportunistic buying and increasing positions, never for "hoarding."

2️⃣ Stocks—31% (Embracing core quality assets, the foundation for inflation resistance)

Stocks are their "regular ammunition." You want me to hold a lot of cash? Isn't that just waiting for inflation to erode purchasing power? Ordinary families hold cash because it provides a sense of "security." (At this moment, I thought of Buffett 😂)

But the wealthy's sense of security comes from two words: appreciation and inflation resistance! Even in a chaotic world, they believe that the profitability of quality companies can still transcend cycles. Especially U.S. tech stocks, which are the "tax machines" of the modern economy.

3️⃣ Alternative Assets—42% (The true anti-fragile weapon)

For most ordinary people, encountering "alternative assets" is relatively rare, but for crypto users, it is not unfamiliar, as crypto itself is a "typical alternative asset," and the gold that has surged 📈 in recent years also falls into this category.

The reason wealthy individuals are keen on investing in alternative assets is essentially to hedge, creating a seesaw effect, applying the barbell principle to hedge against the risks of fiat currency and stocks in chaotic times.

This includes:

· Gold

· Private equity

· Private real estate

· Physical assets

· Infrastructure

· Energy

· Complex hedging products

Especially gold, which has always been their ballast. Ordinary people may think gold is useless, but the logic of top billionaires is simple: "When geopolitical turmoil occurs and traditional rules fail, only gold is a non-sovereign, no-default-risk, globally recognized currency." However, in recent years, they have also gained more confidence in #BTC, which will be discussed later!

🎯 Next, let's talk about specific investment directions and sectors (Figures 5 and 6, additional images in the comments):

1️⃣ #AI: 86% are already on board—this is their bet on the future

AI is not a bubble; it is a price trend deliberately created by the wealthy.

Because they understand better than anyone that when global order begins to destabilize, the aging population accelerates, and supply chains are reshuffled, the only thing that can enhance productivity and reshape the industrial system is #AI + robots.

What we ordinary people see is the rising stock prices of Nvidia or Google. They see: "The industrial revolution of the next 30 years." More importantly, 38% of families are directly investing in the primary market. They are not buying stocks but are betting early on these yet-to-be-listed companies, such as AGI companies, enterprise-level #AI models, #AI healthcare, #AI humanoid robots, and #AI infrastructure (computing power, electricity, data centers). They are not focused on how much a quarter rises but on being in the right position at the moment of a paradigm shift, having their own place in it.

2️⃣ Crypto Assets: From 16% → 33%—this is not gambling, but buying insurance

Many retail investors think the wealthy buy crypto for the price increase. This is a big mistake. They do not buy altcoins or meme coins. I spoke with several family offices in the Asia-Pacific region, and they were very straightforward: "Crypto is not speculation; it is insurance against the uncertainty of the global monetary system."

Data 📊 shows that in 2021, only 16% of family offices dared to touch crypto. By 2025, that number has doubled. The Asia-Pacific region is even more dramatic, with 39% having allocated to crypto.

The reason is simple: no matter how strong the dollar system is, it is not eternally unchanging. Crypto provides a hedging tool that does not rely on sovereign credit. For families with billions in assets, this is very reasonable.

In summary, the future is a time for professional harvesting. The era of making money through luck is over. We ordinary people cannot replicate their positions, but we can adopt their logic. You cannot buy a $10 million gold vault, nor can you invest in a private fusion company.

But you can completely replicate their core thinking:

① Don’t hoard cash (cash is just a tactic, not a strategy)

As long as liquidity is sufficient, the rest should be invested in productive assets.

② Embrace technology long-term (especially the entire industrial chain of #AI)

This is not speculation; it is a trend of the times.

③ Allocate moderately to "non-sovereign risk assets"; this does not mean going all in—crypto, gold, and small proportion allocations are logically reasonable.

④ Learn "professional thinking"; don’t "gamble on feelings" about things you don’t understand—either learn or hand it over to someone more professional than you.

⑤ You cannot avoid the storms, but you can learn to surf.

In summary, keep flexible, embrace technology, stay away from worthless paper, and bet on the future. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。