Written by: Frank, MSX Research Institute

Has the situation with Hassett been settled? When the Federal Reserve begins to heed the White House's call, is it good or bad for Crypto and the US stock market?

On Tuesday Eastern Time, after a Cabinet meeting at the White House, there was a sense in the air that "the situation has been settled."

Trump jokingly remarked, "I guess there’s a potential Federal Reserve Chair here too… I can tell you, he’s a respected person. Thank you, Kevin."

And this Kevin is none other than Kevin Hassett, the Director of the White House National Economic Council, who was present at the time.

Meanwhile, Nick Timiraos, a reporter from The Wall Street Journal, known as the "new Federal Reserve press agency," revealed that the Trump administration has canceled a series of interviews for Federal Reserve Chair candidates originally scheduled to begin this week, indicating that Trump seems inclined to choose Hassett for the position.

1. A New Federal Reserve Chair on the Horizon?

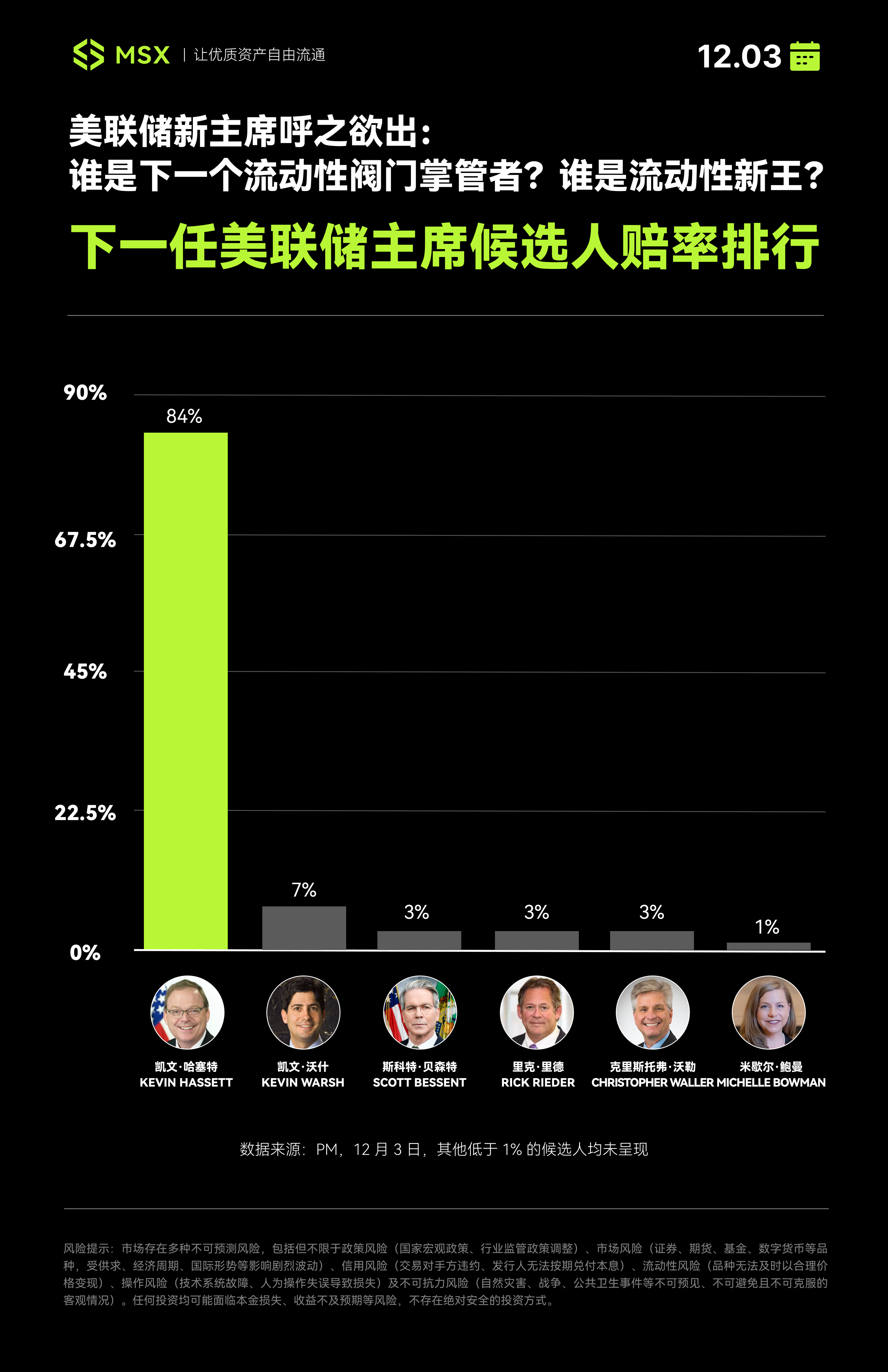

On the prediction market Polymarket, funds have already begun to vote.

As of December 3, in the pool "Who will Trump nominate as Fed Chair?" the total betting amount has exceeded $13 million, with Hassett leading the pack with an approximately 84% chance of winning.

In contrast, other previously popular competitors seem to have become "also-rans":

- Former Federal Reserve Governor Kevin Warsh was once a hot candidate but currently has only a 7% chance;

- Current Treasury Secretary Scott Bessent, although favored by Trump, has privately expressed no intention to run;

- Other establishment candidates, such as BlackRock executive Rick Rieder, current Federal Reserve Governors Christopher Waller and Michelle Bowman, all have chances below 3%;

It can be said that Trump's near "implicit" endorsement and Polymarket's "one-sided" betting seem to point to the same name—Kevin Hassett.

According to insiders, Hassett meets Trump's two most critical criteria for selecting a Federal Reserve Chair: absolute loyalty to the president and professional credibility in the market.

After all, Hassett is not a political novice; during Trump's first term (2017-2019), he served as the Chair of the Council of Economic Advisers (CEA), leading the research on tax cuts at that time. After the outbreak of COVID-19 in 2020, he briefly returned as a senior advisor, and when Trump returned to the White House in January this year, he naturally took on the role of Director of the National Economic Council (NEC).

In a sense, he has always been an "important think tank" and "key minority" in Trump's economic decision-making agenda.

In the field of academic research, as an economist deeply engaged in the market, Hassett's research spans tax policy, energy issues, and stock market investment, having published numerous papers on capital taxes, dividend taxes, and tax reform—this "fiscal-heavy, market-savvy" academic background allows him to be more flexible in addressing economic issues than traditional academic circles.

Of course, although Hassett seems to be "crowned," uncertainties still exist.

According to The Wall Street Journal, the only candidate who could potentially interrupt Hassett's ascension is current Treasury Secretary Bessent. Although Bessent has repeatedly stated he will not run, Trump recently privately told allies that he still greatly appreciates Bessent and is willing to consider him as a potential Federal Reserve Chair candidate.

However, this slight variable seems unable to stop the momentum behind Hassett's 84% chance.

2. Hassett's Background: A Radical Dove with "Absolute Loyalty" to Trump

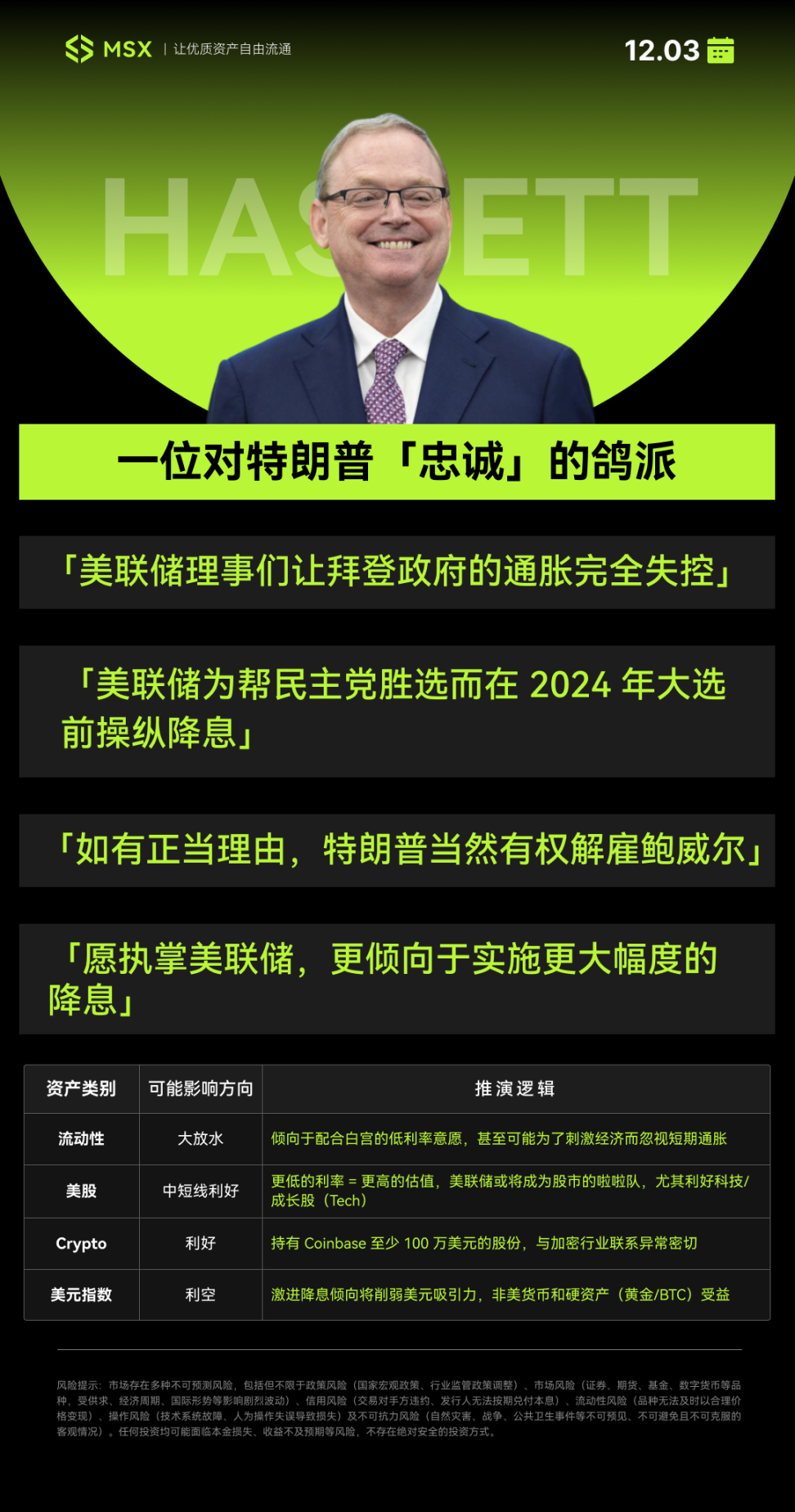

If one were to summarize Hassett in one sentence, it would be a radical dove with "absolute loyalty" to Trump.

It is well known that in recent years, current Federal Reserve Chair Powell has often used phrases like "data-dependent" and "decisions made at each meeting," and has thus been mocked as a "data-dependent" chair. If Hassett takes over, we are likely to welcome a "White House-dependent" chair.

Objectively speaking, during Trump's first term, even as the Chair of the Council of Economic Advisers, Hassett was a staunch defender of the Federal Reserve's independence, but by 2024, in order to align with Trump's campaign pace, he has transformed into one of Powell's sharpest critics.

This is also what has caught the market's attention and pleased Trump the most: Hassett's dramatic shift in stance towards the Federal Reserve, which is not merely verbal. For example, he has publicly criticized the Federal Reserve's decisions as "full of partisan bias":

- The Federal Reserve's reluctance to cut interest rates is because "the Democratic government wants to blame inflation on external factors";

- The Federal Reserve's sudden rate cut before the 2024 election is to boost Harris's chances of winning;

- This past summer and just last November, he has repeatedly criticized the Federal Reserve for not cutting rates enough or fast enough;

"I believe the American people can expect Trump to choose someone who can help them get lower auto loan rates and more easily obtain mortgages at lower rates. The market's reaction to the rumors about me reflects this," can be said to encapsulate that while these statements have been collectively rebutted by the Federal Reserve's decision-makers, they have deeply pleased Trump. This unconditional political alignment has earned him loyalty that other competitors (like Warsh) cannot match.

However, Hassett's "compliance" has also raised concerns among former colleagues, including some who helped him garner support in Congress, feeling uneasy about his public politicization of the Federal Reserve. Wall Street is also concerned about whether Hassett will have the backbone to say "no" when inflation rises again and Trump demands further rate cuts.

Currently, the answer seems to be negative.

But precisely because of this, for the liquidity-hungry risk asset market, a "soft-eared" Federal Reserve Chair may be just the favorable news they have been dreaming of.

3. If Elected, Who Will Benefit?

Although the Federal Reserve does not directly regulate securities or commodities and cannot directly intervene in SEC regulatory affairs, it controls the "master switch" of global funding costs.

If Hassett takes office, it will not just be a simple matter of cutting interest rates; we may welcome the most friendly Federal Reserve Chair in history for Crypto and US stocks.

The most direct impact is undoubtedly on interest rates.

It can be said that Hassett's ascension is "very favorable" for the market's expectations of interest rate cuts, as he has publicly criticized current rates as too high and advocated for larger and faster cuts, especially in response to Trump's economic expansion policies. Once he is in power, the Federal Reserve may tolerate higher short-term inflation in exchange for a looser liquidity environment.

This is precisely the script that risk assets yearn for. Lower interest rates typically mean a weaker dollar, reduced funding costs, and a sharp increase in market risk appetite:

- For US stocks: Low interest rates will directly boost the valuation models of tech stocks (especially in the AI sector), and the Nasdaq may enter a new expansion phase;

- For Crypto: As the most liquidity-sensitive asset, the flood of dollars has always been the foundation for Bitcoin's rise;

Secondly, Hassett can be considered a "true insider" in the Crypto industry.

As early as June this year, Bloomberg reported that Hassett disclosed he holds at least $1 million (up to $5 million) in shares of Coinbase and has received at least $50,000 in compensation for his role on the Coinbase Academic and Regulatory Advisory Committee.

Interestingly, the disclosed documents show that Hassett's total family assets are valued at least $7.6 million, which means that the Coinbase stock, valued between $1 million and $5 million, undoubtedly constitutes a significant portion of his personal wealth, indicating that he is a true stakeholder. This "interest binding" is rare for a potential Federal Reserve Chair.

Finally, Hassett's loyalty is reflected not only in verbal attacks but also in the absolute execution of Trump's new policies.

For example, shortly after Trump returned to the White House, he issued an executive order to establish a "Digital Asset Market Working Group" within the National Economic Council (NEC), with the core task of proposing regulatory and legislative recommendations to promote America's leadership in digital assets (Crypto) and financial technology. As the NEC Director, Hassett is a key promoter of this agenda.

The group clearly recognizes that Crypto technology is an important variable in the future structure of the US economy, which means that Hassett not only understands traditional finance but is also the core executor of integrating Crypto into the national economic strategy.

In Conclusion

In summary, if Polymarket's predictions come true, we are about to welcome a "non-typical" Federal Reserve Chair:

He holds millions of dollars in crypto assets, believes in the magic of low interest rates, and more importantly, he heeds the White House's call.

For traditional economists who uphold "Federal Reserve independence," this may be a nightmare, but for liquidity-hungry Crypto and US stock investors, Hassett's ascension may signify that the "master valve" of liquidity frenzy is being reopened.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。