Original | Odaily Planet Daily (@OdailyChina)

Despite a recent market rebound, the crypto world remains shrouded in an indelible gloom since the "1011 crash." Particularly noteworthy is a batch of newly launched altcoins that seem to have been uniformly pressed with a "downward switch," frequently experiencing dramatic crashes: halving in a single day, dropping over 80%, surging at the open only to decline steadily, and concentrated sell-offs of airdrops… It is worth noting that these anomalies are mostly concentrated in new projects launched on Binance Alpha.

In just a few weeks, multiple instances of "mysterious declines" have occurred in succession. On-chain fund movements, market maker operations, and the team's responses and silence piece together the fragmented truth of this turmoil. Below, Odaily Planet Daily will summarize several of the most discussed and representative "stylized declines" cases recently.

Sahara AI: A Sudden Drop of Over 50%, Due to Mass Liquidation from Perpetual Contracts + Concentrated Short Selling

On the evening of November 29, Sahara AI's token SAHARA plummeted over 50% in a short time, and the price has not significantly recovered since, currently reported at $0.03869.

The next day, the Sahara AI team quickly released a statement attempting to reassure the market, with three main points:

- No team or investor sell-off: Everyone is still in the lock-up period, with a full year until the first unlock (June 2026).

- No issues with the smart contract: It has not been hacked, altered, or experienced any inexplicable token transfers.

- Business is adjusting but nothing is wrong: Internally consolidating resources, focusing on accelerating growth in viable areas.

These points sound quite "harmless," but the community's discussions are entirely focused elsewhere. KOL Crypto Fearless stated on X that the abnormal price drop of SAHARA was caused by "a certain proactive market maker being liquidated in succession": a market maker managing multiple projects was targeted by an exchange, leading to all related positions being risk-controlled, with SAHARA being one of the "collateral damage."

However, Sahara AI's official team quickly denied this explanation, emphasizing that their market makers are only Amber Group and Herring Global, both of which are operating normally, not under investigation or liquidation. The team's version is that the drop mainly resulted from mass liquidation in perpetual contracts + concentrated short selling. In other words, "it's not our problem, it's a structural crash of the market itself." Meanwhile, the team is still in direct communication with relevant exchanges and will disclose further verified information once available.

aPriori: 60% of Airdrop Taken, Token Has Fallen Nearly 80% Since Launch

aPriori is a high-funding project in the Monad ecosystem, and its token APR chose to "prematurely" TGE on the BNB Chain before launching on the Monad mainnet. On October 23, APR launched on Binance Alpha and Binance Contracts, initially surging above $0.7, but has since declined to $0.13. The weak price after opening had already raised community concerns, but the real trigger point emerged weeks later.

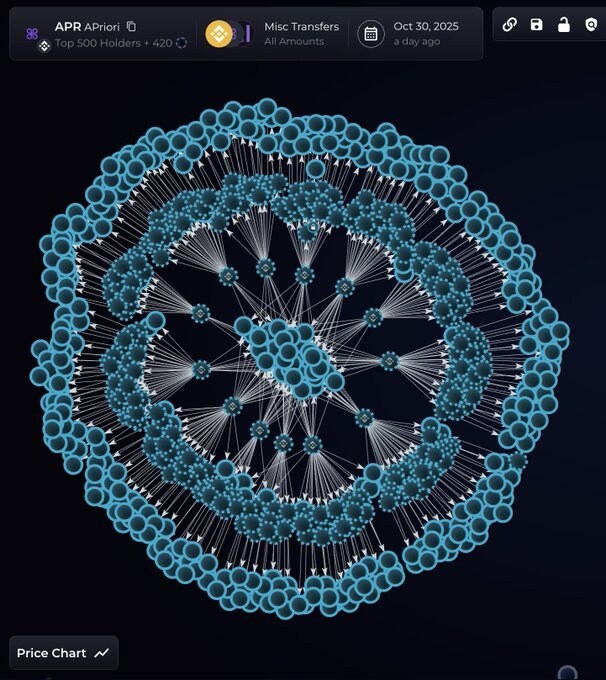

The most shocking news came: 60% of the project's airdrop was taken by the same entity using 14,000 addresses. On November 11, on-chain data disclosed by Bubblemaps showed that 60% of aPriori's airdrop tokens were claimed by the same entity through 14,000 interconnected wallets, which each received 0.001 BNB from Binance in a short time and then transferred the APR tokens to a new batch of wallets.

APR "Wash Trading" Address Bubble Map

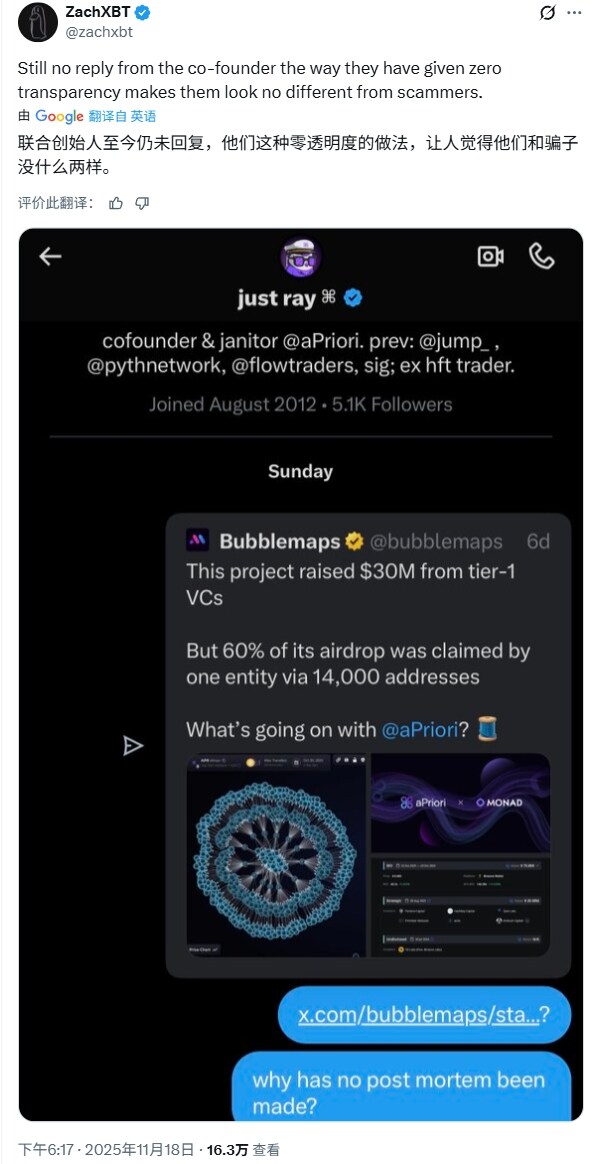

However, what frustrated the community more than the data itself was the complete lack of response from the project team. On November 14, Bubblemaps stated they had already contacted the aPriori team seeking an explanation regarding "60% of the airdrop being claimed by the same entity through 14,000 addresses," but had yet to receive a response.

Additionally, blockchain detective ZachXBT also posted on X that he had privately messaged aPriori's co-founder for an explanation regarding the "wash trading" issue, but had not received a reply as of November 18.

Meanwhile, the official X account has stopped updating, and Discord administrators have nearly vanished, with community sentiment gradually shifting from disappointment to anger:

- "Has the project team run away?"

- "Is the team off to work on the next project?"

- "How can a high-funding project do this?"

Until November 21, the team finally spoke up, but the content did not genuinely address the core questions, merely stating "no evidence was found of the team or foundation claiming the airdrop," and attempted to shift attention to the Monad mainnet airdrop, claiming to provide the Monad community with "a large amount of non-locked APR airdrop." This statement did not quell the doubts but was instead interpreted by many community members as "dodging the issue."

Worse still, on the day the Monad mainnet launched, the aPriori token airdrop event received almost no attention, and subsequent official channels fell silent again. From a high-funding star project to a rapid loss of community trust, this process took less than a month.

Irys: An Entity Claimed 20% of the Token Airdrop Through 900 Wallets and Has Sold $4 Million

Irys is an L1 public chain focused on "data intelligence" that raised nearly $20 million, but its airdrop and on-chain behavior before the mainnet launch have raised market concerns about "wash trading" and cashing out.

One Day Before Launch: 900 Addresses Concentrated for Deposits

On November 28, on-chain data analysis platform Bubblemaps revealed that the day before the IRYS mainnet launch, a total of 900 addresses received ETH transferred from Bitget exchange within several time windows. These addresses exhibited highly consistent characteristics:

- No prior on-chain history (new wallets);

- Received similar amounts of ETH;

- All claimed the IRYS airdrop on the launch day.

These addresses ultimately claimed about 20% of the IRYS airdrop quota.

Further Analysis: Typical Sybil Cluster

Bubblemaps categorized these 900 addresses into 20 deposit batches, with about 50 addresses per batch. Investigations showed:

- Time: From November 21 to 24, Bitget initiated 20 rounds of deposits;

- Highly consistent pattern: Each batch transferred small amounts of ETH, with address generation, activation, and operational paths nearly identical;

- Characteristics: Addresses were simultaneously active in a short time, with similar behavioral paths.

This behavioral pattern fits the typical "Sybil cluster" characteristics, indicating a planned and organized operation.

Transaction Path: From Airdrop to Exchange

Further tracking of 500 addresses revealed they followed a completely consistent process:

- Claim IRYS airdrop;

- Transfer all tokens to a new address (the "washing address" step);

- The new address then transferred IRYS to Bitget exchange;

- Most likely sold directly on the exchange;

As of now, approximately $4 million worth of IRYS tokens have flowed into Bitget exchange through this path.

IRYS "Wash Trading" Address Bubble Map

Irys Official Response: Airdrop Sybil Cluster Does Not Involve Team or Investors

In response to the recent on-chain analysis showing the IRYS airdrop Sybil cluster incident, the project team conducted an internal investigation and verified the situation through multiple channels with partners and exchanges. The official response indicated:

- Unrelated to the team or investors: Investigations show that the wallets of the Sybil cluster claiming the airdrop are not associated with the team wallets, foundation wallets, or investor wallets. The IRYS tokens held by the team, foundation, and founders have not been sold and remain subject to lock-up and unlocking rules.

- Reflection on airdrop design and anti-Sybil measures: The project adopted various anti-Sybil mechanisms before its launch, successfully filtering out some obvious arbitrage, but still failed to completely prevent the Sybil cluster. The team stated that these vulnerabilities are issues with the airdrop design itself, rather than execution errors by partners, and promised improvements in the future.

- Future plans: The team will regularly update project progress, including network growth, ecosystem development, and major company dynamics. At the product and ecosystem level, they will continue to optimize protocols, expand integration scenarios, promote data applications, and support long-term users and developers.

The official emphasized that this incident will not affect the operation of the IRYS mainnet, nor will it change the project's long-term development goals. The team aims to earn community trust through continuous construction and transparent communication, rather than relying solely on verbal explanations.

Tradoor: Top Ten Holding Addresses Account for 98% of Total Supply, Plummeting Nearly 80% in a Short Time

The Binance Alpha project Tradoor saw its token TRADOOR surge to an all-time high of $6.64 on December 1, but within the next 24 hours, it rapidly fell nearly 80%, dropping to $1.47; the current price is reported at $1.39.

On-chain data shows that Tradoor has a very low level of decentralization: only 10 addresses control 98% of the total supply, with one address holding as much as 75% of the tokens. The remaining circulating supply is almost negligible, with the total amount in the DEX liquidity pool being less than $1 million, meaning that even a slightly larger order could cause the price to crash.

Additionally, the delay in airdrop and issues with the staking mechanism have exacerbated the crisis of user trust: the originally promised airdrop has been postponed from "soon" to February 2026, combined with vulnerabilities in the staking mechanism, leaving retail investors with almost nowhere to hide during the market crash. Notably, the TRADOOR crash occurred during the sleeping hours of 4 to 5 AM domestically, and by the time most retail investors woke up, the losses were already irretrievable.

"Taking profits is the way to go"

As crypto trader Ansem previously stated on X, the main value accumulation phase of the crypto industry is "basically over," and the vast majority of tokens ("95% of junk") are unlikely to gain sustained value in the future. The true value capture in the future will come from stablecoins and blockchain infrastructure built by traditional fintech companies like Stripe, Coinbase, and Robinhood on their own chains, rather than from most token projects currently on the market.

Therefore, even if the current crypto market shows a clear rebound, high-profile altcoins may experience a brief surge, and investors might even "make a wave." However, this does not mean one can let their guard down, nor should they blindly pursue several times or dozens of times in profits—"stylized declines" in altcoins will still occur. In the current environment, "taking profits" remains the most prudent strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。