Source: CoinShares Research

Written by: James Butterfill

Translated by: Shaw Golden Finance

Over the past two years, Digital Asset Treasury (DAT) companies have become one of the most talked-about sectors in the cryptocurrency market. Since CoinShares operates a blockchain stock index, this is also a topic we often delve into. With the rapid growth of the DAT sector and its credibility, its positioning has become increasingly blurred. The recent market correction has put pressure on some large DATs, so it is necessary to re-examine the original intention of DAT, its development history, and what the recent market downturn and shrinkage in net asset value mean for its future development.

The Original Intention and Core Positioning of DAT

To understand the current situation, we need to look back at the initial motivation for the creation of DAT. The core goal of DAT is to serve multinational companies that have multiple currency income sources and need to manage capital and foreign exchange risks. For these companies, Bitcoin provides an attractive hedging tool to effectively address the risks of quantitative easing, rising government debt, and long-term currency depreciation. Incorporating Bitcoin into the balance sheet is not a speculative act but a capital management strategy, as evidenced by the initial announcement of Strategy in August 2020. Additionally, this aligns with the growing interest of many enterprises in distributed ledger technology and the potential efficiency gains from integrating blockchain infrastructure into existing operations.

Strictly speaking, DAT refers only to companies that hold Bitcoin or other crypto assets on their balance sheets. The market has gradually set an implicit threshold: companies must hold a significant proportion of cryptocurrency (usually over 40% of net asset value) to be classified as DAT. As the pace of cryptocurrency purchases accelerated and valuations soared, they often overshadowed the core business of the companies. Strategy is the most obvious example: an initiative originally aimed at diversifying capital has effectively turned into a leveraged Bitcoin investment tool. Many newcomers have also followed similar practices, issuing stocks not to develop their businesses but to accumulate more digital assets. However, over time, this has weakened interest and capital inflow into the sector, raising questions about the sustainability of these strategies. Subsequently, these companies began to utilize various financing channels as much as possible to rapidly increase their cryptocurrency holdings, hoping that price increases could compensate for the lack of growth in their core businesses.

The Behavioral Logic and Challenges of DAT Amid Market Correction

The recent correction in the cryptocurrency market has exposed these structural flaws. There are many factors leading to this decline, including the lack of robust operational businesses to support their capital management strategies, capital shifting to other blockchain-related stock investments (such as mining businesses), and the overall decline in cryptocurrency prices. For many such companies, their traditional businesses are in a loss-making state, which may bring some selling pressure, although this pressure is usually small relative to their digital asset holdings. Bitmine (BMNR) is a typical example: in its last fiscal quarter, the company's operating cash outflow was only $5 million, while its Ethereum (ETH) reserves were worth over $10 billion. The operating cash flow of Japan-based Metaplanet is also negligible compared to its $2.7 billion Bitcoin holdings.

On the other hand, dividend and interest payments may lead to more urgent selling demands, especially in cases where liquid fiat currency resources are scarce. However, most DATs finance themselves through stock issuance, with relatively low debt burdens. The only exception is Strategy, which has an outstanding debt of $8.2 billion and has issued $7 billion in dividend-preferred stock. Strategy's liabilities generate about $800 million in cash flow commitments each year, and the company has funded this through further financing. To alleviate concerns about its solvency, Strategy has once again utilized its market issuance (ATM) mechanism, issuing $1.4 billion as reserves to pay preferred stock dividends and interest. DAT companies will use all available means to avoid selling their digital asset reserves, and so far, the main DAT companies we are monitoring have not conducted any large-scale sales this year.

However, the question remains: what happens when mNAV (market value to net asset value ratio) falls below 1? Contrary to what most people think, this situation is not entirely hopeless. Companies holding cryptocurrencies can still enhance their per-share cryptocurrency holdings by reversing their accumulation strategies. In this case, the company would sell cryptocurrencies and repurchase stocks, thereby increasing the per-share token holdings. Although this approach is reasonable, we believe that management teams striving to scale their businesses are unlikely to proactively reduce their cryptocurrency holdings, which may lead to stagnation in their holdings until the financing environment improves. Ultimately, companies trading below their cryptocurrency net asset values may become attractive acquisition targets, as better-capitalized firms may view them as a way to acquire digital assets at below-cost prices.

Has the DAT Bubble Burst?

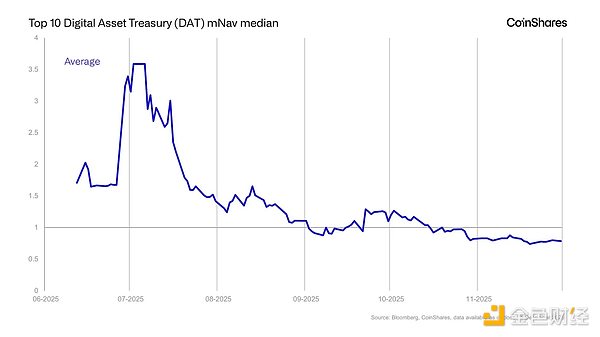

In many ways, it has. In the summer of 2025, many of these companies were trading at three, five, or even ten times their net asset values, but now they hover around one time or even lower. Moving forward, the market direction will diverge: either falling prices trigger disorderly sell-offs, leading to a market crash; or companies continue to hold assets, waiting for prices to rebound. We lean towards the latter, especially considering the improving macroeconomic backdrop and the potential for interest rate cuts in December, which will more broadly support the cryptocurrency market.

However, in the long run, the DAT model needs to evolve. Investors' tolerance for equity dilution and highly concentrated assets with a lack of substantial income sources will decrease. The original intention of quality companies to diversify fiat currency risks has been overshadowed by numerous companies that have leveraged the public stock market to build large assets rather than develop real businesses, undermining the credibility of the entire industry.

Encouragingly, a group of stronger companies has begun to incorporate Bitcoin into their balance sheets for strategic purposes. However, according to the current informal definition, these companies should not be considered DAT at all. Ironically, those companies that most align with the original intention of currency hedging/foreign exchange management strategies, such as Tesla, Trump Media Group, and Block Inc., are currently excluded from this label.

Future Development Directions of the DAT Concept

The bursting of the DAT bubble does not mean the end of the DAT concept. On the contrary, we expect the market to undergo a re-adjustment. Investors will increasingly differentiate between the following:

Speculative DAT: where the core business is secondary, and its value almost entirely depends on token holdings.

Asset Reserve-Oriented DAT: which incorporates Bitcoin or other digital assets as part of a rigorous foreign exchange and capital reserve strategy.

Token Investment Companies: enterprises holding a diversified token investment portfolio, potentially similar to closed-end funds rather than traditional companies.

Strategic Enterprises: which add Bitcoin to their balance sheets as a macro hedging tool but do not seek to be classified as DAT.

The practices of the past year indicate that the term "DAT" can simultaneously represent everything and nothing, thus the industry will move towards clearer classifications.

Conclusion

The birth of DAT stemmed from a reasonable idea: enterprises shifting their capital reserves from fiat currency to digital assets for diversification. However, the rapid expansion of token reserves, equity dilution, and the relentless pursuit of increasing per-share token quantities have undermined this original intention. As the bubble bursts, the market is reassessing which companies truly fit the DAT model and which are merely riding the wave.

The future of DAT lies in returning to fundamental principles: rigorous financial management, reliable business models, and realistic expectations regarding the role of digital assets on corporate balance sheets. The next generation of DAT companies will be closer to the originally envisioned model: stable, globalized businesses that strategically, rather than speculatively, utilize digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。