Trump's nominee for the Federal Reserve Chair, Hassett, openly supports significant interest rate cuts, while Treasury Secretary Basant personally leads the selection process. A quiet reshaping of the U.S. financial regulatory framework is underway.

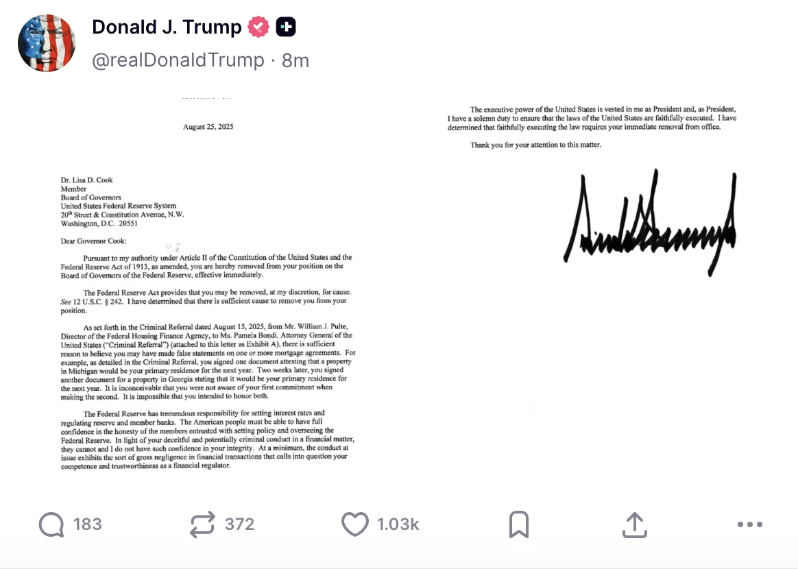

U.S. Treasury Secretary Basant announced the initiation of the selection process for the next Federal Reserve Chair, marking an escalation in the Trump administration's game with current Chair Powell. Reports suggest that Trump is drafting a letter to dismiss Powell, causing an immediate drop in the dollar exchange rate.

Trump's nominee for the CFTC Chair, Michael Selig, has passed preliminary voting in the Senate Agriculture Committee. If confirmed, he will become the sole commissioner of the agency. Meanwhile, Travis Hill's nomination for FDIC Chair has also been approved by the Senate Banking Committee.

I. The Tradition of Federal Reserve Independence and Political Shock

● Since its establishment in 1913, the independence of the Federal Reserve has been seen as the cornerstone of financial stability in the U.S. and globally. The original design of its system was intended to insulate monetary policy from short-term political pressures. However, this tradition is facing unprecedented challenges.

● The Trump administration has not only publicly criticized current Chair Powell but has also directly initiated the selection process for the next Chair. Trump's dissatisfaction with the Federal Reserve stems from multiple reasons. He believes Powell is too slow in cutting interest rates, which contradicts the White House's desire to stimulate economic growth through low rates.

● The current Chair insists on the principle of "independent operation" of the Federal Reserve, repeatedly refusing to align with the White House's policy direction in public, which has embarrassed Trump. He prefers that key positions be filled by individuals who align with him and are willing to publicly support his views.

II. Chair Candidates and Political Loyalty Tests

Trump's list of Federal Reserve Chair candidates has emerged, with a common characteristic among them being support for the President's policies.

● Kevin Hassett, Director of the White House National Economic Council, is seen as the top candidate. He holds a Ph.D. in economics from the University of Pennsylvania and is a conservative economist who supports free markets and trade.

As a close confidant of Trump, Hassett's main challenge is to prove his policy independence to the market. His advantage lies in his close relationship with Trump, but this is precisely the source of concern for the market.

● Former Federal Reserve Governor Kevin Warsh is also a significant competitor. He has deep connections within Republican circles and served as an advisor to former President George W. Bush. Warsh is viewed as a "hawkish representative," emphasizing inflation control and financial stability.

● Current Federal Reserve Governor Christopher Waller may serve as a "compromise option," being more independent than Trump's other candidates while still aligning more closely with Trump's team than Powell.

III. Systemic Overhaul: From the Board to Regional Federal Reserves

Trump's intervention in the Federal Reserve goes beyond the Chair position; it is a clear plan for a systemic overhaul of the entire Federal Reserve Board. This plan can be divided into three key steps, aimed at completely reshaping the central bank's decision-making structure.

● The first step is to control the seven-member Federal Reserve Board. Trump has successfully appointed two governors, and with the early resignation of a governor appointed by former President Biden, he quickly nominated his economic advisor to fill the third seat.

Removing opposition governor Lisa Cook is intended to free up the crucial fourth seat. If successful, Trump will be able to appoint four of his own, achieving a majority on the seven-member board.

● The second step is to indirectly control the Federal Open Market Committee (FOMC), which determines interest rate direction. The FOMC is composed of seven Federal Reserve governors and five regional Federal Reserve presidents.

Even if all seven governors are controlled, it does not fully dominate the FOMC. However, by law, the appointment of regional Federal Reserve presidents requires approval from the Federal Reserve Board. Trump's majority can refuse to reappoint those regional Federal Reserve presidents who do not align with White House policies.

● The third step is to create a "rate-cutting majority" that allows the Federal Reserve's monetary policy to fully serve the White House's political agenda. Trump's policy preferences have never been hidden; he desires a Federal Reserve that can significantly cut rates for him.

A fully controlled Federal Reserve will become the most powerful tool for the President to implement his economic policies. At that point, interest rate decisions will no longer primarily be based on economic data such as inflation and employment but will consider the White House's short-term political needs more.

IV. The Battle for Crypto Regulation and the Role of the CFTC

While attempting to reshape the Federal Reserve, the Trump administration is also redefining the financial regulatory landscape, particularly in the cryptocurrency sector.

● Michael Selig has been nominated as CFTC Chair, representing a significant adjustment in the power dynamics of crypto regulation.

● Selig is currently the chief advisor for the SEC's cryptocurrency working group, and during his nomination hearing, he expressed support for establishing a clear and innovation-friendly regulatory framework for the crypto industry.

New legislation under consideration in Congress aims to formally grant the CFTC primary regulatory authority over the digital asset spot market. This aligns with the SEC's recent statements, indicating that it is developing "token classification" standards based on the Howey test.

● The division of regulatory responsibilities is slowly taking shape: the SEC focuses on securities-like tokens; the CFTC is responsible for the digital commodity spot market. This has been a long-standing contentious boundary in the crypto industry, now formally outlined for the first time in Washington.

If confirmed, Selig will lead the CFTC during a critical period. Lawmakers are currently planning for the CFTC to take the lead in cryptocurrency regulation. Related bills in both the House and Senate will grant the agency broader regulatory powers in the cryptocurrency sector.

V. FDIC Regulatory Shift and Easing of Bank Restrictions

● Alongside the CFTC nomination, there is a leadership change at the Federal Deposit Insurance Corporation (FDIC). Trump's nominee, Travis Hill, has been approved by the Senate Banking Committee and is officially the FDIC Chair candidate.

● Hill has served as the acting Chair of the FDIC since January 20, 2025, previously holding the position of Vice Chair during the Biden administration. Under his leadership, the FDIC has begun to adjust its stance on banks' cryptocurrency activities.

● Compared to the previous administration, Hill has relaxed restrictions on banks participating in crypto activities. He has rescinded guidance requiring banks to notify the FDIC in advance before engaging in crypto activities. This change reflects the Trump administration's overall friendlier stance towards cryptocurrencies.

● Hill's policies are also evident in the removal of "reputational risk" from the bank review standards. Traditionally, regulators would consider the reputational risks that bank activities might pose, but the FDIC under Hill no longer includes this as a formal assessment criterion.

VI. Market Reactions and Global Impact Concerns

● Wall Street has expressed widespread concern over Trump's intervention in the Federal Reserve. JPMorgan CEO Jamie Dimon warned investors that interfering with the Fed's independence would have negative consequences.

● Investors are beginning to adjust their expectations for the Fed's interest rate path. Although the market previously anticipated three rate cuts in 2025, the chance of a first cut in September is currently only 21%. The dollar index recently fell to a three-year low, with funds accelerating their flow into lower-valued non-U.S. markets.

● Emerging markets may be the first to be impacted. Deutsche Bank strategists have warned that if Powell is forced to resign early, it could trigger panic selling of the dollar and U.S. Treasuries.

● A deeper risk lies in the possibility that if the Fed's rate-cutting decisions become politically driven rather than based on economic logic, it will lead to a dual distortion effect. Short-term capital returning to the U.S. will raise financing costs for emerging markets; meanwhile, a long-term weakening of the dollar's credit could trigger a reallocation of global reserve assets.

● According to a survey, 70% of central banks are considering reducing their dollar asset allocations due to the deteriorating political environment in the U.S. One-third of the 75 central banks globally plan to increase their gold holdings in the next one to two years, and 40% will continue to purchase gold over the next decade.

As the nominated CFTC Chair Selig emphasizes the need for a "clear and innovation-friendly regulatory framework," as FDIC acting Chair Hill eases restrictions on banks' crypto activities, and as Hassett's position as the top candidate for Federal Reserve Chair solidifies, the U.S. financial regulatory landscape is undergoing a silent reconstruction.

Trump's personnel arrangements are not just about individual positions but point to a more coordinated and directly responsive financial regulatory matrix to the White House's will. Global markets are closely watching every unusual fluctuation in the dollar exchange rate, while central banks reassess their foreign exchange reserve compositions, with historical lessons looming large, and the triangular balance of U.S. financial power is being redefined.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。