Could rate cuts be a key tailwind for crypto in 2026?

The Fed's rate path heading into next year is the clearest it's been in years. December 2025 delivers another 25bp cut, taking fed funds to roughly 3.5-3.75%. The forward curve prices at least 3 more cuts through 2026, putting us in the low 3s by year-end if the path holds.

But rate cuts are only part of the picture. QT ends on December 1. The TGA is set to draw down rather than refill. The RRP has been fully depleted. Together, these create the first net positive liquidity environment since early 2022.

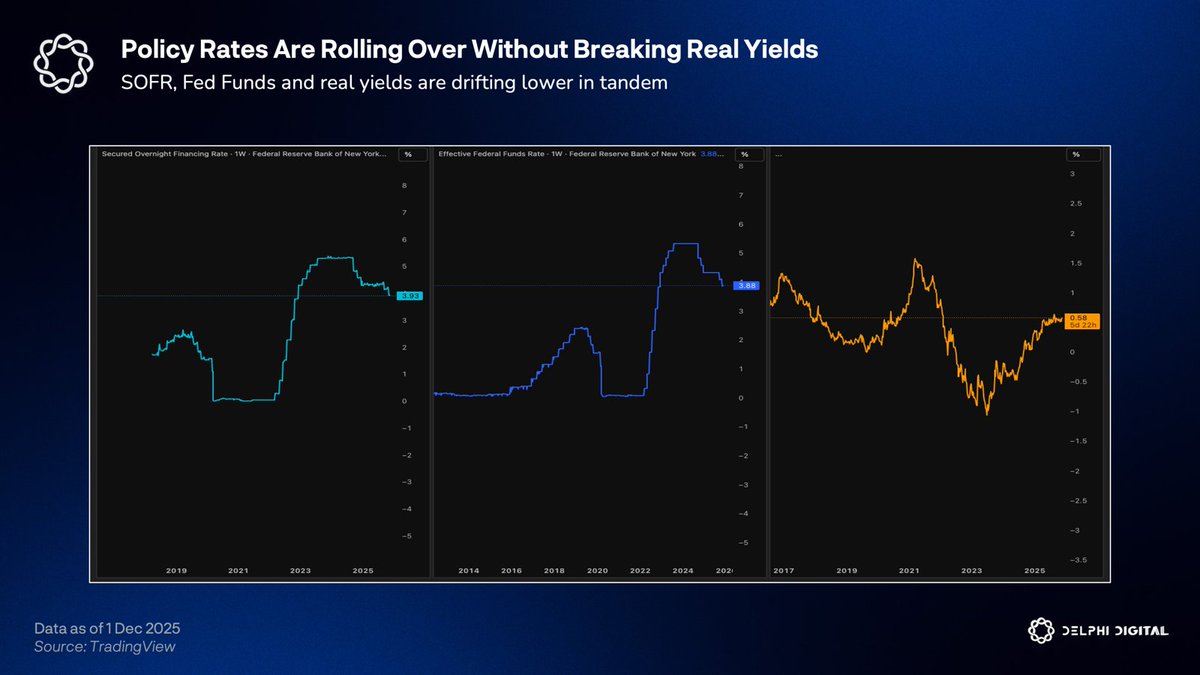

SOFR and fed funds have drifted toward the high 3% range. Real rates have rolled over from their 2023-2024 peaks. But nothing has collapsed. This is a controlled descent rather than a pivot.

2026 is the year policy stops being a headwind and becomes a mild tailwind. The kind that favors duration, large caps, gold, and digital assets with structural demand behind them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。