Original | Odaily Planet Daily (@OdailyChina)

What is the ultimate form of DeFi?

The answer is increasingly leaning towards "Lending + DEX," integrating the lending market with decentralized exchanges within the same product layer, allowing funds to be both lent and generate returns on-chain.

In the past, common DeFi models in the market included primitive and simple lending markets like Aave and Compound, independent AMMs like Uniswap and Pancake, or modular yield aggregators that lured users with high APYs, moving user funds between different protocols.

Although these models followed the development trend of DeFi, they always dispersed DeFi functions across different protocols, requiring users or strategies to bridge "multi-protocols," which not only complicated the experience but also reduced the flexibility of funds.

In contrast, "Lending + DEX" is the true DeFi Lego, integrating the lending capabilities of protocols with the deep liquidity of DEXs. In this model, a user's single amount of money can do "two jobs," serving as collateral for lending while continuously earning fees and incentives as an LP position on the DEX. The switching between different functions is smoother, asset interoperability is higher, and overall capital utilization is significantly improved.

On December 2, ListaDAO's Smart Lending launched the Swap function, perfectly embodying the "Lending + DEX" model. Smart Lending is a new lending model introduced by ListaDAO in early November, allowing users to deposit loan collateral into the liquidity pool of Lista DEX, which not only reduces the loan interest rate for users but also automatically earns LP fees from the collateral deposited in the DEX.

Why use Lista Smart Lending?

From the user's perspective, the operation of Smart Lending is not much different from traditional lending; users deposit collateral and obtain loans at a certain ratio. The only difference is that Lista will invest the collateral from Smart Lending into the liquidity pool (LP) of Lista DEX, and the trading fees earned from the collateral on the DEX will be distributed to the collateralized loan users.

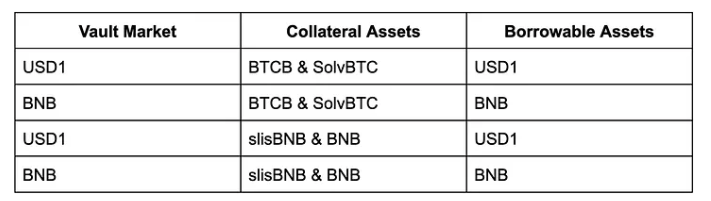

Currently, Lista's Smart Lending supports BTCB, SolvBTC, slisBNB, and BNB as collateral to borrow USD1 and BNB. There are a total of 4 vaults, and users can deposit at a fixed ratio or customize any ratio for deposits and redemptions.

For Borrowing Users: Loans at No Cost, with a 0.05% Yield

No matter how complex or good the model sounds, the interest rate is what truly matters. Most of the time, users only care about APY and low borrowing rates, and Lista's Smart Lending just meets user needs with more attractive rates.

In the Smart Lending model, the interest rate for borrowing USD1 is 0.03%. If combined with the current 0.1% yield from collateral (from LP fee income), borrowing users actually receive a yield of 0.07%.

Even on Lista, the current normal borrowing rate for USD1 is above 1%, and the borrowing rate for BNB is around 2.9%. In contrast, on Venus, the borrowing rates for USD1 and BNB reach as high as 6.4% and 2.08%, respectively.

Lista Smart Lending Rates

For Depositing Users: Up to 6% Fee Yield

In addition to attractive borrowing rates, the yield from Smart Lending is even more appealing, with future expectations of yields around 5-6%. Yes, you heard it right; borrowing on Lista in the future will not only be close to interest-free but may even pay you back.

Although the current yield from Smart Lending is only 0.1%, this is due to the fact that Lista DEX has not yet launched. On December 2, Lista DEX officially went live, aggregating multiple liquidity pools and autonomously selecting the best paths and prices for users. Previously, Lista DEX was only available within the Binance wallet, greatly limiting its reach to users. Now that it has launched a standalone UI, as more users utilize Lista DEX, the yield from collateral will significantly increase.

Currently, the LP APR for slisBNB/BNB on PancakeSwap is around 4-6%. If Lista DEX becomes one of the mainstream DEXs on BNB in the future, the yield from Lista's Smart Lending will also reach 6%.

Even if you are just a depositing user, Lista's Smart Lending will become an attractive option.

Moreover, as more funds are deposited into Smart Lending, the liquidity of the Lista DEX pools will deepen, bringing more tangible benefits to Swap users, including deeper liquidity and lower slippage.

Expanding BNBFi's Gameplay: slisBNBx

The ecosystem of Lista always has a synergistic effect. On December 2, in addition to launching the Swap function, Lista announced the addition of BNB/slisBNB smart LP in Smart Lending, allowing users to automatically mint slisBNBx with one click after adding LP.

With this certificate, users can essentially capture all the yields on the BNB chain, including Lista DEX fee income, BNB liquidity staking income, participation qualifications for Binance Launchpool, Megadrop, and HODLer. If users also leverage their positions, they will gain even more significant returns.

Simultaneously Meeting the Preferences of Two Types of DeFi Users, Improving Capital Efficiency

In DeFi, there are two distinctly different types of users based on their risk preferences. One type is high-risk collateral borrowing users, who either expand their returns through collateralized revolving loans or take out loans to buy more volatile crypto assets; the other type is low-risk LP users, who only engage in stable LPs, satisfied with 5-10% returns, occasionally taking a more aggressive approach to participate in APYs above 30%.

In traditional lending markets, it is challenging to meet the needs of both types of users simultaneously, but Lista Smart Lending perfectly achieves this. Users who prefer collateral borrowing to amplify their capital leverage can enjoy low rates and passively earn fee income in Smart Lending, while LP users can obtain stable fee income from Lista DEX while also using borrowed funds to continue adding LP.

Clearly, Lista's Smart Lending enhances the flexibility of user funds, adapting to different user needs and significantly improving capital efficiency.

Lista Smart Lending's Risk Control

After the recent chain finance explosions, hundreds of millions of dollars fled from the chain, leaving users with many aftereffects regarding on-chain finance and the Curator model. So, does Lista's Smart Lending, which sounds like users can "eat and take," really ensure safety? Will there be similar explosion issues?

It is normal for users to have these concerns, but Lista has already taken risk control to the extreme.

First, the vaults of Smart Lending are not managed by Curators but are uniformly dispatched by Lista officials to Lista DEX, so there is no risk of Curator explosions.

3% Price Decoupling Risk Control Mechanism for Collateral

Secondly, users may worry about whether using collateral as an LP position could lead to liquidity loss in extreme market conditions. For example, in the solvBTC and BTCB pool, what happens if the solv protocol explodes or is hacked, and solvBTC decouples?

To address such risks, Lista has set a 3% price decoupling risk control mechanism, meaning that if 1 solvBTC is valued at or below 0.97 BTC, Lista DEX will no longer allow solvBTC to be exchanged for BTCB to prevent BTCB from being drained. In such extreme cases, users can only redeem collateral at a fixed ratio, preventing all their collateral from becoming worthless solvBTC.

Additionally, the 3% anti-decoupling ratio can be dynamically adjusted. If Lista officials discover issues with the solv team, they will proactively lower the anti-decoupling ratio to ensure that users' other collateral does not suffer losses.

The Rigid Redemption Principle of slisBNB

What if it is not the tokens of other projects that explode, but Lista's slisBNB? Don't worry; Lista has thought of this as well.

slisBNB is Lista's liquidity staking certificate, and Lista has staked all BNB with validators on the BNB Chain, ensuring rigid redemption capability. Even if Lista is liquidated, users can still redeem their BNB.

Benchmarking Fluid, Lista is Undervalued

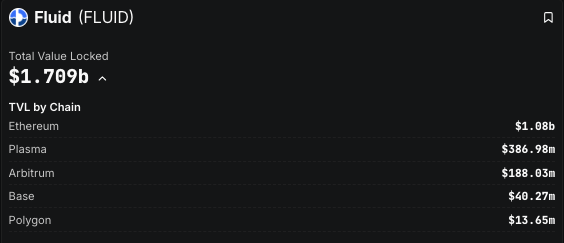

If you are a user deeply involved in DeFi, you may notice that the model of Lista Smart Lending is very similar to Fluid. Fluid is indeed the pioneer of this model, and Lista has improved upon it and introduced it to the BNB Chain. By benchmarking against Fluid, it is clear that Lista is undervalued.

According to official data from Fluid, the total supply of borrowable liquidity on Fluid is approximately $21 million, with $5.34 million borrowed, resulting in a capital utilization rate of about 25%. In contrast, Lista's Smart Lending currently has a total supply of borrowable liquidity of about $4 million, with approximately $1.2 million borrowed, resulting in a capital utilization rate of about 30%.

Lista's Smart Lending has only been launched for two weeks, but its capital utilization efficiency has already surpassed Fluid, indicating that this model is popular on the BNB Chain. Once Lista DEX is fully launched, its scale will expand rapidly.

According to CoinGecko data, Fluid currently has a market capitalization of $217 million, while Lista's market capitalization is only $45 million, clearly indicating that the LISTA token is undervalued. Fluid is currently based in the Ethereum ecosystem, with over 60% of its TVL accumulated on the Ethereum chain, while Lista is primarily building within the BNB Chain ecosystem. As the first DeFi protocol to launch this model on the BNB Chain, the value of the LISTA token has been underestimated.

It is believed that as Smart Lending and Lista DEX grow, the LISTA token will also usher in a new round of token value discovery.

Smart Lending Drives the Lista DeFi Flywheel

Since the launch of Lista Lending this year, Lista's TVL has skyrocketed, generating $4.9 million in fees for the Lista protocol in 2024, and exceeding $9.5 million so far in 2025. This indicates a strong and continuously growing demand for loans within the BNB Chain ecosystem.

At the same time, Lista Lending's TVL on BSC has surpassed $870 million, with total borrowings exceeding $570 million, revitalizing the value on the BNB chain and significantly improving the capital efficiency for users on the BNB Chain. Now, Lista's Smart Lending and Swap will empower the BNB Chain ecosystem even further, elevating Lista's protocol revenue to new heights.

The core lies in Lista's "Lending + DEX" DeFi Lego flywheel:

The efficient capital utilization of Lista's Smart Lending reduces borrowing costs for users. Lower borrowing costs will attract more TVL, and the growth of TVL will increase the liquidity depth of the DEX, leading to more transaction fees. The generation of more transaction fees will enhance the yield of Smart Lending, and the increase in yield will further boost the attractiveness of Smart Lending…

In this way, user funds can complete a closed loop within the Lista protocol. When users enter Lista, they can not only experience a DEX with low slippage but also seamlessly integrate collateralized loans and LP deposits, resulting in a smooth process, asset interoperability, and capital efficiency. This is the magic of "Lending + DEX," and the power of the DeFi Lego flywheel that Lista is building.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。