The Convergence and Evolution of AI and Blockchain: Reconstructing Productivity and Production Relations in the New Digital Economy Paradigm

Authors: SanTi Li, Chunfeng Jun, Lisa, Naxida

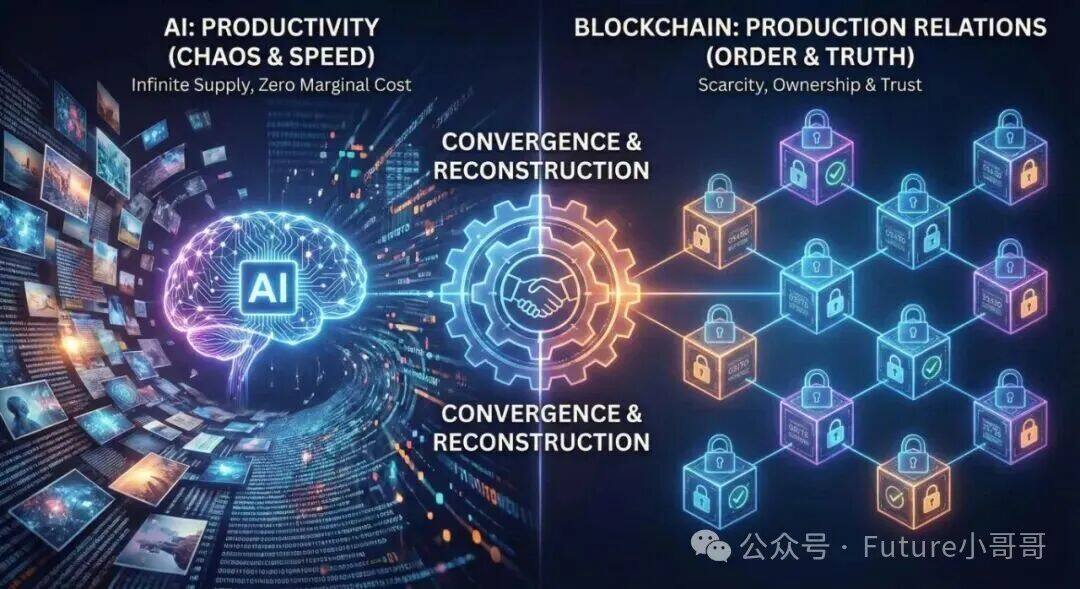

Abstract: The current market discussions on the relationship between artificial intelligence (AI) and blockchain digital currencies (Blockchain & Crypto) are often limited to a zero-sum game perspective of capital diversion. However, in-depth industry analysis and technological evolution paths indicate that the two are actually in a complementary and symbiotic relationship. Against the backdrop of AI driving exponential growth in productivity and the near-infinite supply of digital content, the reconstruction of production relations and rights confirmation mechanisms based on blockchain is not merely "the icing on the cake," but rather appears to be particularly necessary. This paper aims to deeply analyze why the widespread adoption of AI will become the core driving force and booster for blockchain technology to transition from marginal experiments to large-scale implementation, from dimensions such as the reshaping of trust mechanisms, the establishment of rights confirmation systems, the shift in economic paradigms, the importance of tokens as value carriers, and risk control.

1. The Digital Trust Crisis in the Context of AI Explosion

With the breakthrough advancements in AI technology in recent years, especially the widespread application of large language models (LLM) and generative AI (AIGC), the core economic significance lies in reducing the marginal cost of content production to almost zero. While this greatly unleashes societal creativity and productivity, it also poses unprecedented severe challenges to the existing internet ecosystem, leading to drastic changes in the information environment.

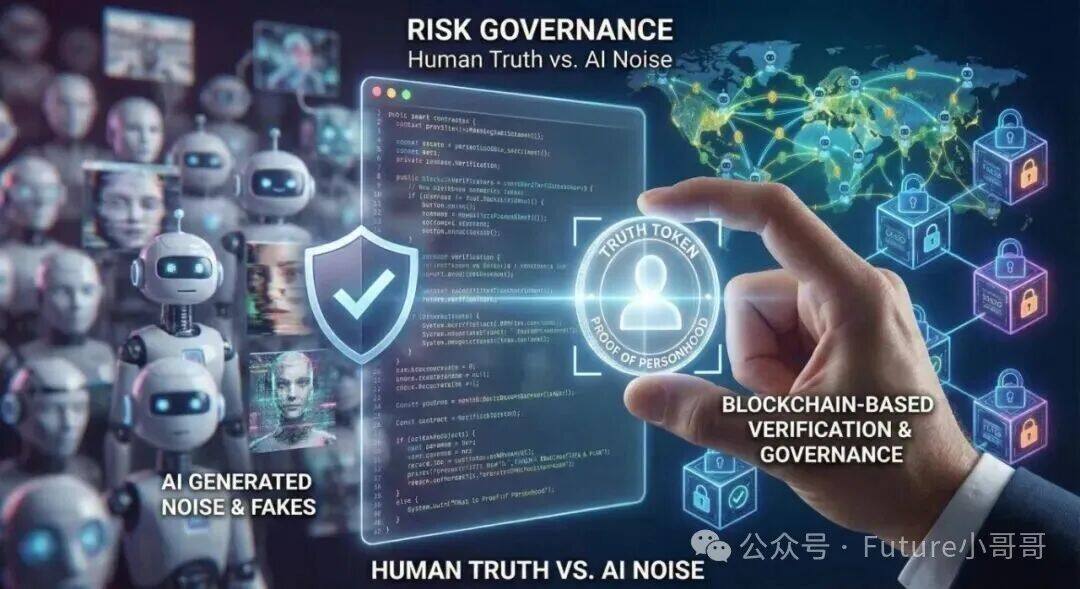

- Entropy Increase and Distortion of the Digital Information Ecosystem: With the proliferation of synthetic media and deepfake technologies, the internet is facing the tangible risk of the "Dead Internet Theory." Under this theory, most of the internet's traffic and content will be generated by robots. When the cost of fabricating videos, audio, and text is extremely low and can achieve pixel-level realism, the traditional epistemological assertion of "seeing is believing" faces a comprehensive threat of failure in the digital realm. Political elections may be disrupted by fabricated scandal recordings, and financial fraud can be targeted at individuals through real-time face-swapping technology; these are no longer science fiction scenarios from "Black Mirror," but imminent real threats.

- Worsening Information Asymmetry and Cognitive Overload: When the rate of machine-generated content far exceeds human creation by several orders of magnitude, high-quality real information faces the risk of being overwhelmed. Humans will experience exponentially increasing costs in filtering through vast amounts of machine-generated information, which may carry specific biases or misleading content. This information overload not only reduces decision-making efficiency but may also lead to divergences in social consensus. Especially for the new generation growing up with AI, their trust in AI will be much higher than that of the generation that invented AIGC, thus increasing their likelihood of being misled or blindly following.

- Spiritual Scarcity Brought by AI Convenience: It is well known that the greatest value distinction between humans and robots lies in the inspiration that humans possess, which is difficult for AI to imitate. However, human laziness is also a factor in technological advancement; due to the significant increase in convenience, reliance on AI may make inspiration an absolute "luxury" in the future. Those creators with inspiration are facing ruthless plunder and dilution of their intellectual property by the rapid AIGC of AI (many current derivative creations are generated through "rewriting" without authorization). Without technological means for protection, human originality will be exhausted.

In this context, the first wave of primary systemic risk facing the digital society is not the awakening or rebellion of artificial intelligence, but rather the collapse of the foundational social trust. Establishing a system that can effectively distinguish truth from falsehood, establish information sources, and provide immutable verification mechanisms has become a necessary condition for maintaining the healthy operation of the digital ecosystem, and this is precisely where blockchain technology comes into play.

2. Blockchain Rights Confirmation: Evolution from "Optional Component" to Digital Infrastructure

In the "infinite supply" model constructed by artificial intelligence, scarcity will become the core anchor point of digital asset value. Without scarcity constraints, the value of digital content will approach zero with the infinite increase in supply, much like the flooding of diamonds. Blockchain technology, as a decentralized distributed ledger, fundamentally establishes digital scarcity and ownership through cryptographic means, thereby reassigning value to digital assets.

- Institutionalization of Data Provenance: As the threshold for content generation decreases, distinguishing between "human creation" and "AI generation" becomes crucial. In 2022, commissioning a designer to create a cartoon drawing could sell for hundreds, while by 2025, similar non-high-precision custom content can be completed in seconds. On-chain proof of high-value data (such as news reports, artistic creations, legal contracts, academic papers, identity information) will become the industry standard. Every digital file will need to be accompanied by an unforgeable "birth certificate" and "transfer record." Digital content lacking cryptographic signatures and on-chain timestamps will face severe trust depreciation. The combination of the C2PA (Coalition for Content Provenance and Authenticity) standard and blockchain technology will build a credible verification layer for digital content, making the source and modification history transparent to all.

- Proof of Personhood and Anti-Witch Hunt: In an era where automated bots can pass the Turing test and flood the internet, the economic and social value of verifying users' "real identities" is increasingly prominent. Traditional CAPTCHAs have gradually become ineffective, unable to block more advanced AI agents. Identity verification systems based on biometric features and zero-knowledge proofs (ZKP) may become the key infrastructure for distinguishing human users from AI agents. This is not only to prevent airdrops from being exploited but also to prevent online voting and public opinion guidance from being manipulated by zombie machine networks.

In summary, artificial intelligence creates infinite productive supply, while blockchain technology provides credible scarcity constraints and identity anchors. The two logically form an indispensable complementary gear in the closed loop of the digital economy: AI is responsible for making the world "faster," while blockchain is responsible for making the world "truer."

3. Reconstruction of Business Paradigms: Autonomous Agent Economics

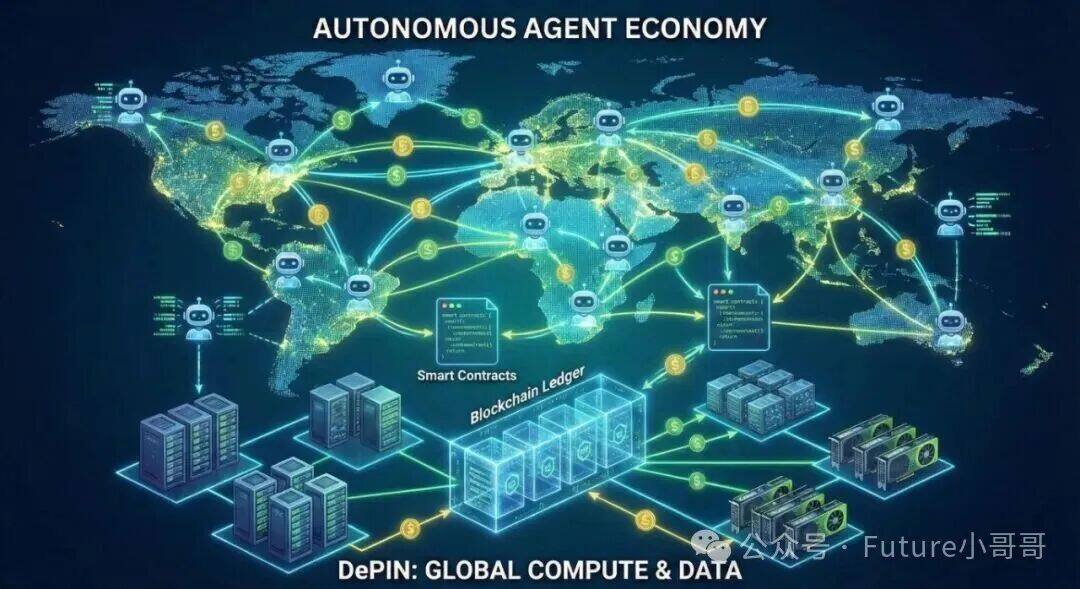

The combination of artificial intelligence and blockchain heralds the emergence of a new economic interaction model—the potential rise of the Machine-to-Machine (M2M) economy. This is not merely a change in payment methods but a fundamental transformation in the nature of economic entities.

Future internet interaction entities will no longer be limited to humans; billions of autonomous AI agents will become the indigenous inhabitants of cyberspace. Traditional financial infrastructures (such as bank accounts, KYC processes, credit card payment networks) are designed for humans and lack the capability to serve non-human entities, nor can they meet the demands for high-frequency, micro, and round-the-clock machine transactions.

- Machine-Native Currency Systems: Cryptocurrencies are naturally suited as value exchange mediums for machine logic. AI agents cannot open bank accounts but can instantly generate wallet addresses through code and manage private keys. They can use stablecoins (like USDC) or specific functional tokens for data procurement, API calls, or computing power leasing. This payment method is not constrained by traditional financial intermediaries, business hours, or high cross-border transaction fees.

- Agent-to-Agent (A2A) Economic Networks: The future commercial landscape will transcend B2B and B2C models, evolving towards an A2A (AI Agent-to-AI Agent) model. For example, an AI agent responsible for itinerary planning may need to purchase real-time data from another agent responsible for weather forecasting and pay a deposit to a third agent responsible for ticket booking. These service exchanges involving micropayments and high-frequency trading can only achieve economic feasibility through high-performance, low-friction blockchain networks. Smart contracts will automatically execute these complex business logics without human intervention.

- Collaboration of Decentralized Physical Infrastructure Networks (DePIN): AI operations require substantial computing power (GPU) and data. Through DePIN networks (such as io.net, Render), AI agents can directly lease idle computing power from individuals or enterprises worldwide and settle in real-time with tokens. This somewhat breaks the monopoly of centralized cloud service providers (AWS, Google Cloud), reducing the operational costs of AI while also providing real utility scenarios for blockchain (though the initial sources of computing power for projects and participants may still come from the original giants, subsequent leasing can allow for independent choices to dismantle absolute monopolies).

**

**

4. Crypto Digital Currency: The Value Carrier and Symbiotic Engine of Rights Confirmation in the AI Era

Blockchain is not just a database; it is a value network. After clarifying the technical aspects of anti-counterfeiting proof (Point 2) and the commercial aspects of agent interaction (Point 3), we must delve into the core of assets and finance. Property rights are the premise of transactions and pricing. In the "infinite supply" model constructed by artificial intelligence, relying solely on technical means for "anti-counterfeiting proof" is far from sufficient; we can truly tokenize (Tokenization) and financialize (Financialization) these rights through Crypto, which has also given rise to the concept of RWA (Real World Asset).

Tokens serve as the smallest granularity carrier of rights confirmation and the lifeblood of rights transfer, forming the indispensable digital property foundation in the AI era. This elevates the relationship between AI and Crypto from a simple "tool overlay" to a deep "symbiotic evolution."

- Tokenization: Transforming Abstract Rights into Programmable Digital Assets. Crypto utilizes NFTs (Non-Fungible Tokens) and SFTs (Semi-Fungible Tokens) technology to convert abstract intellectual property (IP), ownership, copyrights, unique datasets, fine-tuned model parameters, and even the ownership of an AI Agent into unique, immutable on-chain assets.

- IP-NFTs as Value Anchors: The unique style or original works of every human creator can be minted as NFTs. When AI needs to use these works for training or style transfer, it is no longer an untraceable plunder but must obtain authorization for the NFTs through on-chain protocols. Tokens here serve not only as copyright certificates but also as proof of revenue rights. For example, RWA music projects like Opulous and Audius tokenize the rights to an artist's album, establishing revenue-sharing agreements with fans in advance.

- Data Assetization (Data Tokens): High-quality data from individuals or enterprises is no longer static files but assets that can be packaged into tokens for trading. Each time an AI model calls data, it essentially consumes the rights represented by that token, generating refined revenue and rights protection.

- Crypto: Realizing Instant Settlement and Circulation of Rights Confirmation Value. Rights confirmation is meaningless if not linked to value distribution. Digital currencies provide the only execution layer for rights confirmation in the AI era.

- Micropayments and Streaming Payments: In the high-speed operation of AI, rights confirmation often occurs at the millisecond level (for example, when AI quotes a sentence or generates an image). Traditional fiat currency systems cannot handle such small amounts (0.0001 USD) and extremely high-frequency copyright revenue sharing. Digital currencies (Crypto) enable smart contracts to automatically "stream" revenue to token holders at the moment rights confirmation occurs, achieving a closed loop of usage equals rights confirmation, and rights confirmation equals settlement.

- Building an Incentive Layer: Why are humans willing to spend effort verifying the authenticity of AI content? Why are nodes willing to contribute computing power to maintain network consensus? Because there is Crypto as an incentive. Tokenomics rewards participants who maintain the rights confirmation system with digital currencies, thereby constructing a self-operating, AI-attack-resistant trust network. This is also the core value of public chain systems and their corresponding projects; the internal or local circulation models of alliance chains and private chains are difficult to promote on a larger scale.

- The Co-evolution of AI and Crypto: A Double Helix Ascension

- AI Needs Blockchain Crypto: Without the rights confirmation and payment facilities provided by blockchain systems, AI creators and users can easily fall into a dead end of rampant piracy, data exhaustion, and inability to monetize. The smarter AI becomes, the clearer property boundaries are needed to avoid disputes. The current novelty of AI creation is due to the accumulation of data and creative sharing over the past few decades; as this accumulation approaches depletion, whether new creators can fill the gap heavily relies on detailed protection of rights.

- Crypto Also Needs AI: AI creates vast amounts of digital assets and high-frequency trading scenarios, providing Crypto with unprecedented utility and liquidity. This symbiotic relationship indicates that Crypto is the "physical law" and "economic system" of the AI era. The combination of the two will reconstruct the production relations of the digital world, allowing the productivity dividends of AI to be fairly returned to every participant through rights confirmation mechanisms.

5. Risk Governance: A Paradigm Shift from "Moral Self-Discipline" to "Technical Constraints"

The current development of artificial intelligence is highly concentrated among a few tech giants (such as OpenAI, Google, Meta), perpetuating the centralized black box logic of the Web 2.0 era. In this model, the public can only hope that companies maintain a "Don't be evil" moral self-discipline. However, historical experience shows that centralized power often comes with risks of monopoly, data abuse, and algorithmic bias.

Blockchain technology introduces a governance logic of "cannot do evil," enforcing system behavior through open-source code, cryptographic proofs, and mathematical contracts:

- Zero-Knowledge Machine Learning (ZKML): As an important branch of privacy computing, ZKML allows for the verification of the AI model's reasoning process according to established algorithms without disclosing underlying sensitive data (such as medical records, financial transactions) and core model parameters through mathematical proofs, ensuring the transparency and auditability of algorithmic decisions. This is crucial for AI applications in high-risk areas such as medical diagnosis and credit assessment, addressing the "black box trust" issue.

- Public chains that have experienced multiple bull and bear cycles tend to have a certain degree of credibility assurance. NEAR has fully transitioned to AI as the first AI public chain, while Render and others have also shifted from game rendering to AI computing power. ETH, BSC, Solana, Cardano, Avalanche, Algorand, Hbar, Conflux, etc., each have their unique domain advantages, technical characteristics, and shortcomings. Emerging public chains like Monad are also facing a new round of challenges in token economics. In response to the VC long-cliff model that has troubled the primary market in recent years—where institutional tokens are locked, but the project's ecological incentives and airdrop portions inadvertently circulate early, leading to excessive selling pressure—the market still needs 1-2 years to verify the balance between its token release curve and ecological value capture.

- Data Sovereignty and Value Distribution: Addressing the widespread issues of data infringement and "data harvesting" in large model training. Blockchain projects can return data ownership to users, allowing them to selectively authorize data for training and receive compensation. This reconstructs production relations, enabling data contributors to obtain reasonable value returns through token (Token) economic models, thereby incentivizing higher quality data supply and avoiding the tragedy of data exhaustion.

6. Conclusion: Embracing "Entropy Reduction" Balance, Reshaping the Future in Digital Civilization Order

The essence of AI tends toward entropy increase—the explosive generation of information, accelerated diffusion speed, and increased uncertainty about the future; while the essence of blockchain tends toward entropy reduction—establishing immutable order through consensus mechanisms, anchoring unique factual truths, and solidifying execution rules.

A robust digital world cannot be composed solely of chaos (though vibrant) or order (though stable). The deep integration of artificial intelligence and blockchain is essentially an inevitable result of the digital ecosystem seeking dynamic balance. AI provides the driving force, while blockchain offers the compass of direction and secure foundation. This serves as an opportunity to further increase large-scale application development.

For investors and industry practitioners, a profound understanding of this integration trend also means grasping the core dividends of digital economic development over the next five to ten years. The focus should not be limited to the AI concept itself but should also extend to the Web3 infrastructure layer that provides payment settlement, computing power scheduling, data proof, and rights confirmation services for the artificial intelligence ecosystem. The development and regulation of blockchain and digital currency compliance have also reached a necessary stage; the future is here, and the wave of this technological integration is on the verge of explosion.

Risk Warning: This article is for learning purposes only. The projects mentioned are described relatively objectively and do not constitute investment advice. Readers are advised to DYOR.

Author: Future Xiao Ge

PNU Master's in Engineering, long-term institutional investor; special contributor to mainstream media and brokerages, recipient of the Korean BK21 award, head of CFT for R&D collaboration projects for new energy products like Tesla, GM, FF, etc. Comprehensive experience in multiple fields of blockchain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。