Today I felt a bit tired, and I fell asleep halfway through writing. I dozed off for about half an hour before waking up. The market sentiment was quite grim on Monday, especially since Japan's interest rate hike is now irreversible. Even if there is no hike in December, the yield on Japanese bonds has effectively increased, leading to a lackluster risk market on Tuesday during the day. While I was on the plane during the day, I was wondering why the market had no reaction at all despite the end of the balance sheet reduction.

However, when the U.S. market opened, it surged directly. The U.S. stock market rose, and Bitcoin also benefited from it. Additionally, the Federal Reserve injected $13.5 billion into the market today to provide some liquidity, but there is still no actual easing, and liquidity has not fully recovered. Personally, I believe the current rise is still driven by sentiment, especially since the balance sheet reduction has ended.

In my system, we are still in a rebound phase, and a full reversal is still a distance away, pending the cancellation of the SLR. Once the SLR is canceled, we will be close to full easing. Moreover, Trump announced today that there is only one candidate left for the Federal Reserve Chair, which should be announced in the next couple of days, with Harsent being the most likely candidate.

Market sentiment is currently betting that the Federal Reserve will fully enter an easing state, so buying the dip has begun. However, since this is sentiment-driven, it is uncertain how long it can last without real liquidity support.

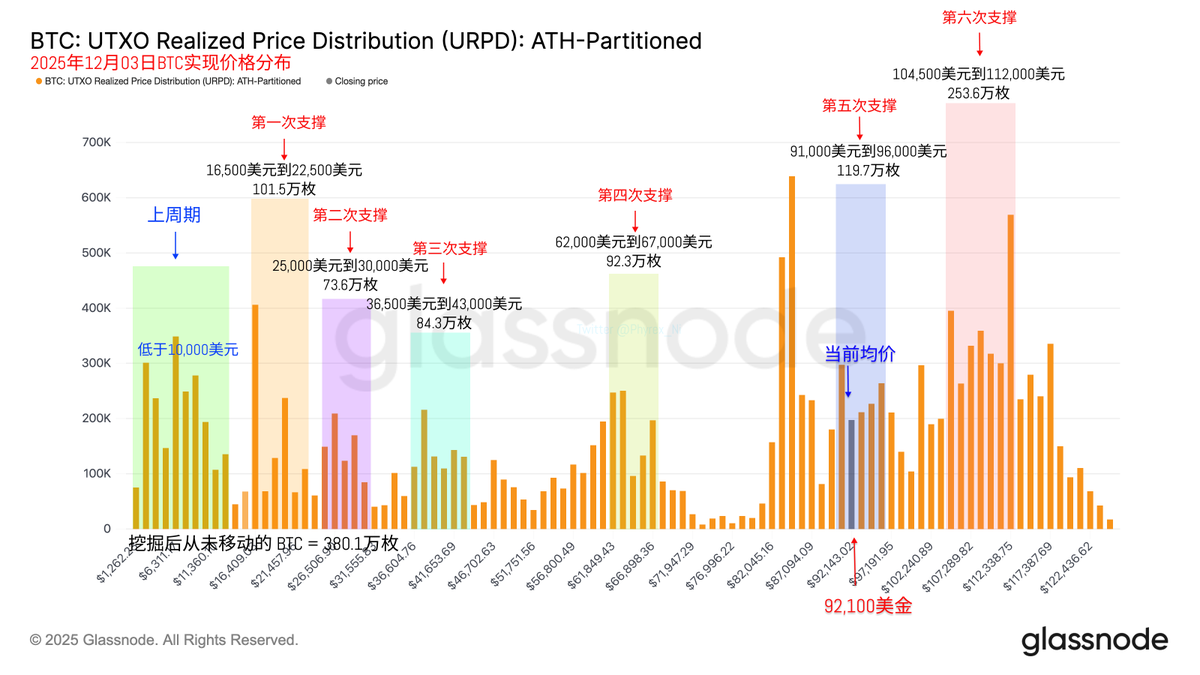

Looking at Bitcoin's data, today's turnover rate is not very high, and investors' reactions to the rising prices are not particularly strong. The main players in turnover are still short-term dip buyers, especially those who bought below $90,000, who are the most likely to exit. Other investors' reactions seem relatively normal.

As mentioned earlier, the sentiment among investors is still quite positive with the price increase, and there are no signs of "last rebound, escape quickly." Most investors are not very sensitive to price changes, and the overall chip structure remains stable. However, it should be noted that today's rise is more sentiment-driven, and liquidity issues have not been fully resolved.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。