A few days ago, a piece of news refocused the market on #RWA US stock tokenization. A Nasdaq executive claimed, "We are fully advancing the tokenization of stocks, and SEC approval has been prioritized." US stock tokenization should be regarded as the greatest innovation in #Web3 since the DEFI Summer of 2020, without exception. With the recent CRS tax investigation wave on small US stock accounts (ranging from $100,000 to $500,000) in the domestic market, as well as tightening policies for opening US stock accounts, the #RWA method of US stock tokenization will likely become the preferred choice for most people investing in US stocks in the future!

Currently, many #RWA US stock products have emerged, and we have researched and experienced many of them, but the core issue remains liquidity. On the surface, they look appealing; you can open the app, see prices, and view candlestick charts, but when you actually want to buy? Either the slippage is ridiculously high, or there is simply no liquidity. You can see it but can't touch it; it's purely a "digital showcase." There are very few products that can truly achieve low slippage and smooth trading.

But #Bybit is different this time. I tried it when #xStock was just launched, using my Bybit account to directly buy tokens for Tesla and Apple. There was no need to set up a new wallet, no need to input a mnemonic phrase, no cross-chain bridge, and no explosive gas fees; it was as simple as buying #BTC. More importantly, the orders were executed, the prices were stable, and the slippage was almost negligible. The experience was incredibly smooth, indicating that there is real asset support behind it, not just hot air.

Why do I say #Bybit is ahead in #RWA?

First, it is not chasing trends but has already made arrangements.

While others are still discussing whether "#RWA is the next trend," #Bybit has already allowed users to trade US stock tokens in real-time for several months. I checked on-chain data and third-party audit information, and Bybit TradFi's xStock has real stocks as underlying assets, with regular audits, not the kind of "self-proclaimed assets that are actually just paper" counterfeit projects.

Second, the depth is quite good.

I tried placing an order for "Apple stock tokens" on other platforms for $1,000, but I couldn't get a single order filled; the price difference was 5%, and no one was willing to take it. But on #Bybit, I placed a limit order to buy $5,000 of AAPL, and the execution price was almost in line with the market price. This is the advantage of a centralized order book, where liquidity is concentrated and matching is efficient. This is crucial for quantitative traders or investors looking to make short-term trades.

Third, the speed and experience are overwhelming.

Binance Wallet has recently started offering stock tokens, but honestly, the process is too cumbersome: you have to create a wallet, authorize, cross-chain, confirm… by the time you finish, the market has already changed. On Bybit, I completed my order in 10 seconds—log into my account → select TradFi → place an order → execute. For institutions, high-frequency traders, and even ordinary retail investors, this level of efficiency is a significant advantage.

Fourth, product diversification.

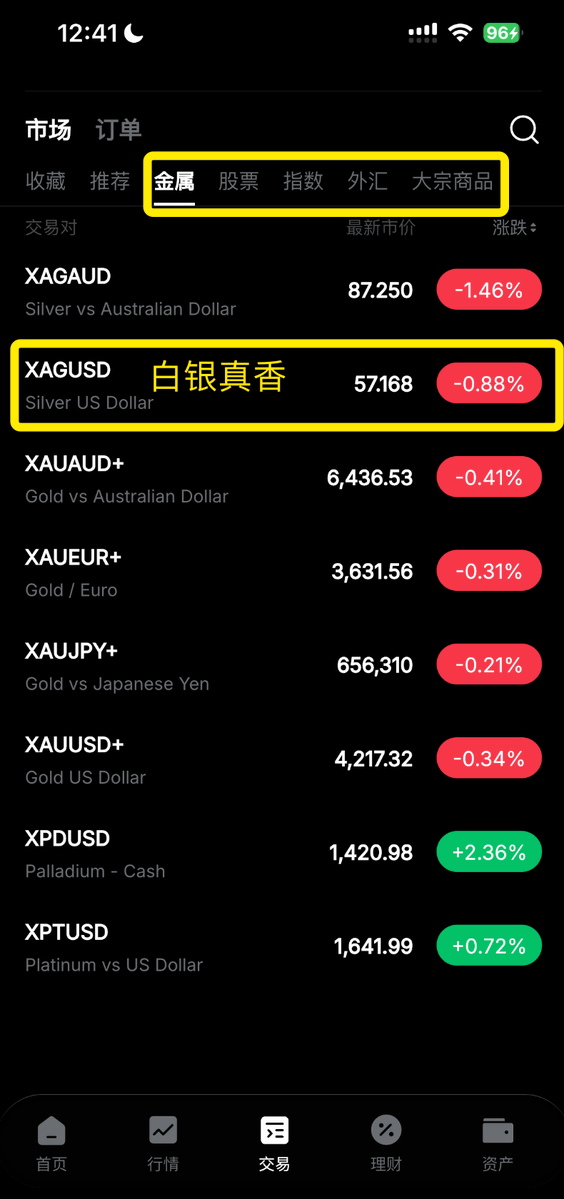

Recently, we learned that silver has reached a new high, and Japan's interest rate hike has led to a surge in the yen. These phase-specific opportunities are real arbitrage opportunities. You need to find a platform that can trade cryptocurrencies, US stocks, commodities (like silver and gold), and the foreign exchange market (such as recent yen arbitrage). Currently, only #Bybit offers a single exchange for round-the-clock asset trading.

What excites me the most is that #Bybit stock tokens can actually "mine," providing dual benefits of mining and dividends. Bybit Alpha is about to launch the "Stock Token Liquidity Pool (Alpha Farm)," which will completely change the game.

Previously, we could only buy stock tokens low and sell high to earn the price difference. But now, I can deposit $AAPL and $TSLA xStock into the pool to act as an LP, and the transaction fees paid by others will be directly distributed to me. It's like receiving "toll fees" while holding stocks.

Moreover, since these tokens are backed by real assets, the pool's risk is relatively low. For those who want to hold US stocks long-term but do not want to open an overseas brokerage account, do not want to pay high fees, and still want to earn stable LP mining income, this is simply a compliant, efficient, and interest-earning solution.

Overall, US stock #RWA is currently the most efficient opportunity to participate in global quality assets, no longer limited by traditional financial barriers. No need for an SSN, no need for an overseas address, no need to wait for account approval, and no worries about CRS tax investigations. A #Bybit account can cover it all—crypto + US stocks + commodities + foreign exchange—allowing for one-click, round-the-clock global asset allocation, simple and fast! 🧐

You can use my #Bybit invitation code for registration benefits: https://partner.bybit.com/b/84410

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。