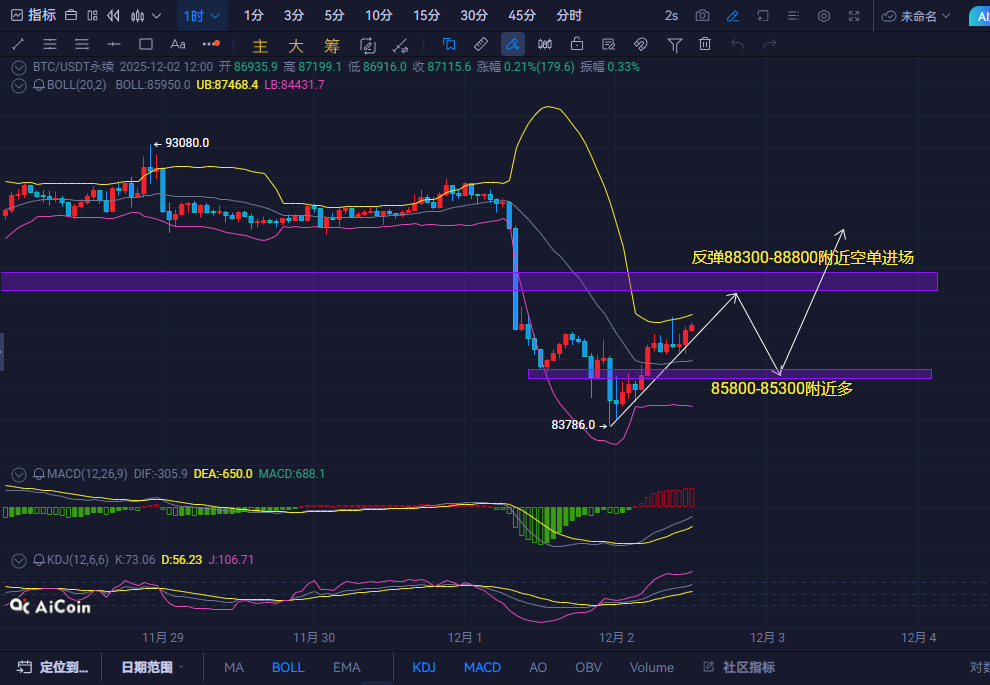

On December 2nd, the overall trend of Bitcoin was bearish, with a daily low of $83,786. A large bearish candle completely erased the previous gains, and after three consecutive days of closing in the red, a weak rebound occurred. In the 4-hour timeframe, the MACD is below the zero line, and the bearish volume bars are shrinking. A long lower shadow appeared on the candlestick, indicating strong support at $84,000. Therefore, the current Bitcoin market is in a typical range-bound state, and the strategy is to short at high prices and long at low prices.

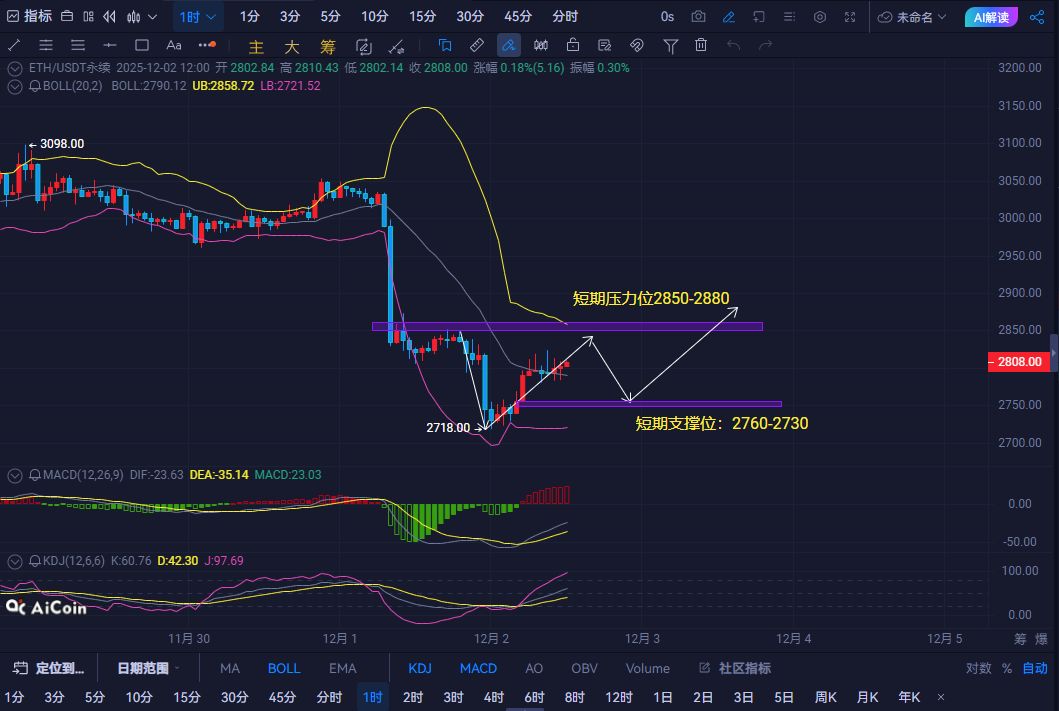

Ethereum also experienced a sharp market with a significant drop followed by a weak rebound yesterday, hitting a low of $2,818. From a short-term 1-hour perspective, the Ethereum price is within a descending channel, the MACD is in a low area, and the RSI is in a weak state. The daily chart also closed with a large bearish candle, and the EMA 7, 30, and 120-day moving averages are all in a bearish arrangement. However, it is important to note that the daily chart has reached the lower Bollinger Band, which may lead to a short-term rebound.

For Bitcoin, it is recommended to short around $88,300-$88,800, with a target of around $87,200-$85,800.

For Bitcoin, if it retraces to around $85,800-$85,300, enter long positions with a target of around $86,500-$87,100-$88,300.

For Ethereum, enter short positions around $2,850-$2,880, with targets around $2,810-$2,780-$2,750.

For Ethereum, enter long positions around $2,760-$2,730, with targets around $2,790-$2,850-$2,880.

The market is ever-changing, and these strategies are for reference only.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。