With the development of blockchain technology and the influx of users, RWA tokenization is becoming one of the hottest narratives in Web3 today. However, the mainstream market is more focused on traditional financial assets such as bonds, real estate, and gold. Although these assets bring some incremental value to the crypto industry, their models still rely on traditional frameworks, making it difficult for ordinary users to participate deeply due to their cautious attitudes.

At the same time, the music and intellectual property sectors are experiencing explosive growth. According to Goldman Sachs, the global music industry is expected to double in size by 2035, reaching $200 billion. The global IP licensing market is projected to reach approximately $48.2 billion by 2033, with a compound annual growth rate of 8.5%. However, in this vast market, copyright management remains opaque, settlements are slow, and value is primarily intercepted by intermediaries, indicating that IP copyright RWA holds enormous potential.

Against this backdrop, BeatSwap has emerged. BeatSwap has chosen a path distinct from traditional financial assets on-chain, aiming to create a truly Web3-native infrastructure suitable for the global IP economy, transforming content copyrights into tradable, financeable, and settleable IP copyright RWA, and achieving on-chain risk management through patented algorithms.

A Full-Stack RWA Infrastructure for the Global IP Economy

BeatSwap prides itself on being "the world's first Web3 full-stack IP copyright platform," with its ecosystem consisting of four core modules that cover the entire lifecycle of IP from creation, rights registration, fan engagement to trading.

The first is Oracle, the core of the BeatSwap ecosystem. This module permanently records the metadata of IP works on-chain, including basic information about the work, information about the lyricists and composers, rights holders, daily streaming play counts, and royalty settlement history. This reliable data not only helps rights holders monitor the usage of their works in real-time but also integrates with external streaming platform data to achieve automatic royalty settlements.

According to official disclosures, BeatSwap is pioneering a Web3-native DePIN model tailored specifically for the global IP economy. Participants can contribute to existing digital platforms by integrating its Oracle SDK without needing any hardware to create content. This means that BeatSwap will also become a full-stack DePIN network that can be used to verify IP data.

The second core module is the social platform Space, designed by BeatSwap as a Web3 social space for creators and fans, covering all types of creators in music, film, games, etc. Creators must complete KYC and confirm rights to their content before publishing works, ensuring that all content can be linked to confirmed rights data on Oracle. Interactions such as likes, comments, and follows by fans in Space are recorded on-chain and collectively form the creator's exposure index (Exposure Score). The exposure index is calculated based on 50% fan interaction metrics and 50% creator-staked BTX, reflecting both fan enthusiasm and the creator's community engagement.

In fact, the "chart economy" already exists in Web2, where fans engage in various online and offline activities to boost the rankings of stars or products on major charts, thereby increasing their commercial value. However, these fans often contribute out of love and do not benefit from the increased commercial value of the stars. BeatSwap links fan behavior to earnings, allowing participation to contribute and contribution to yield economic returns.

Additionally, RWA Launcher and BeatSwap are both core modules of BeatSwap, with the former used to convert IP into RWA assets, and the latter allowing IP RWA to be traded like any other on-chain asset.

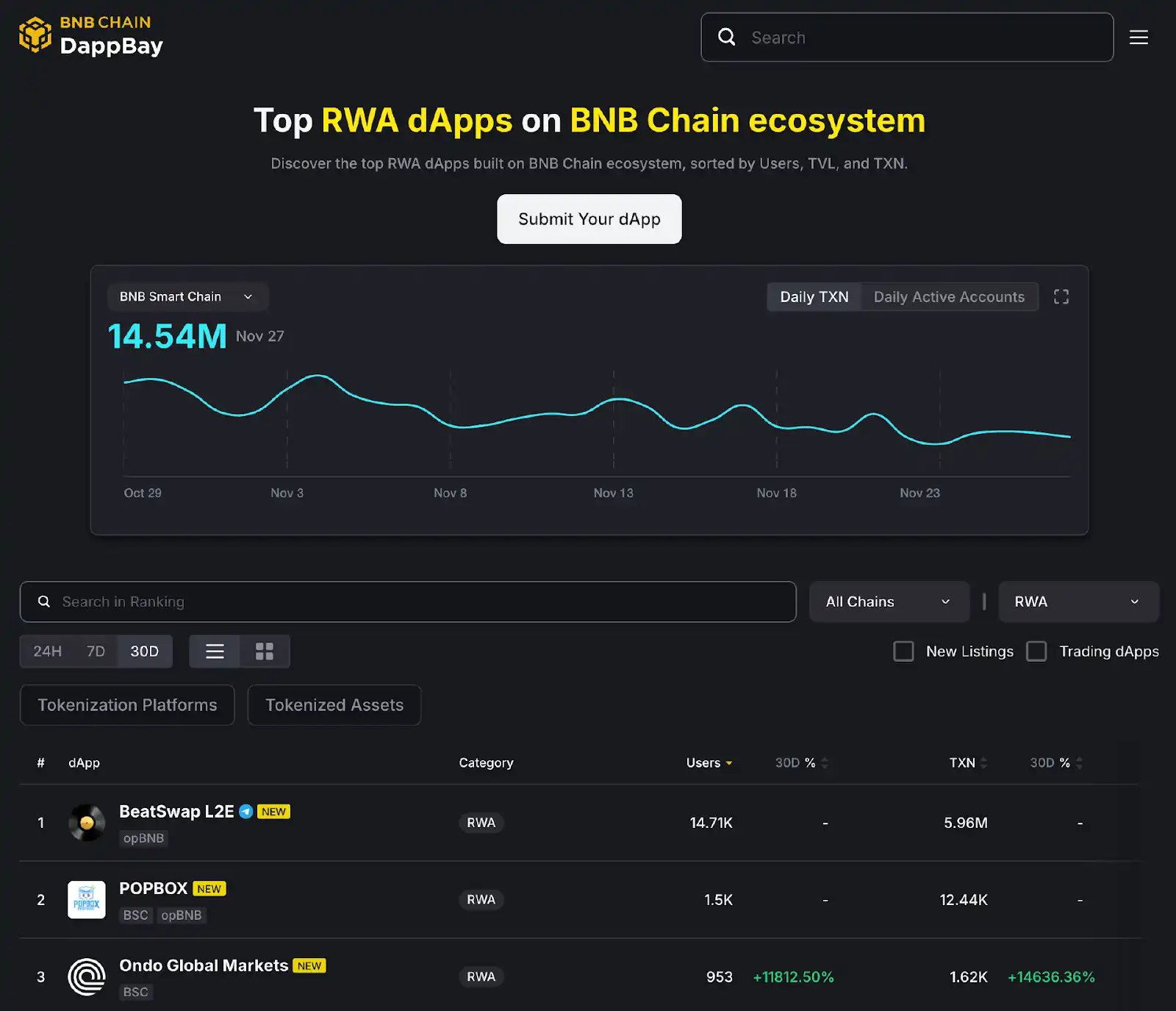

BNB Chain DappBay RWA Category Leader

Innovation in technology and concepts must ultimately be realized in specific products. In the process of promoting the industrialization of music copyright RWA, BeatSwap's licensing mining product "Licensing to Earn (L2E)" has stood out remarkably. With its unique economic mechanism and real use cases, BeatSwap L2E has successfully topped the RWA category rankings in BNB Chain DappBay, becoming the most outstanding project among similar products.

Image source: BNB Chain

L2E is BeatSwap's licensing mining module, centered on introducing the IP Licensing Index (IPL), which is a non-transferable, non-redeemable index token minted on the opBNB mainnet, used to measure users' real contributions to the IP ecosystem, with its issuance completely tied to user behavior.

These behaviors are written to the chain in real-time, and a snapshot of all IPL holders will be taken monthly, with the BTX reward pool distributed according to the proportion of IPL, achieving "earnings through participation." In other words, IPL represents contribution, and contribution determines the BTX reward ratio. Furthermore, leveraging the high scalability and low-cost characteristics of the opBNB network, BeatSwap can support the smooth execution of massive copyright transactions, while its verifiable proof of participation system ensures that every reward is transparent, fair, and auditable, making "listening to music is mining" feasible both technically and economically.

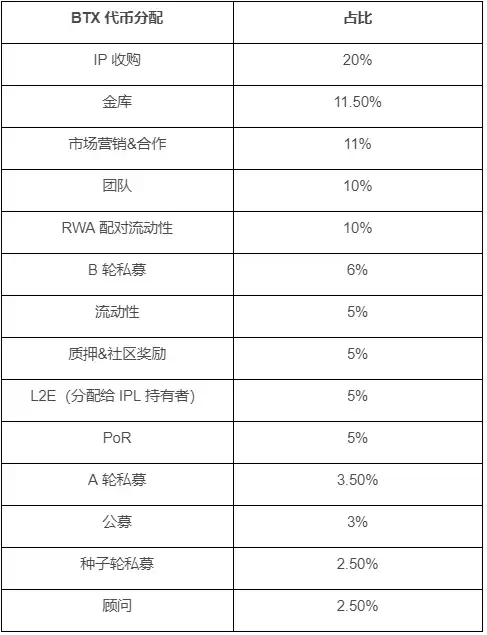

From a macro perspective, the core of BeatSwap's economic model consists of RWA tokens, the platform's native token BTX, and IPL, forming a mutually reinforcing value closed loop.

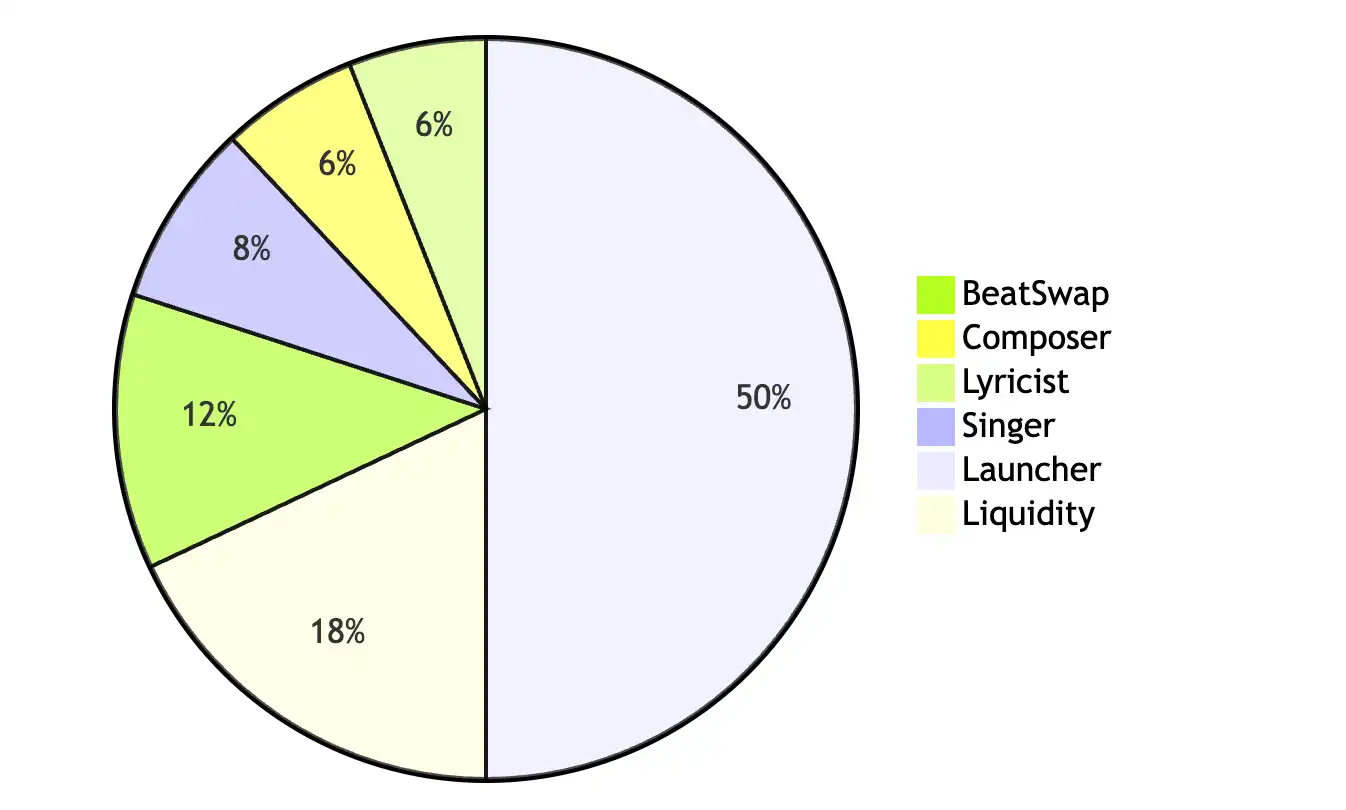

BeatSwap standardizes each IP work into 2,000 RWA IP tokens, representing the neighboring rights of that work. Half of these are sold to the public through RWA Launcher for work financing and market exposure; 18% is injected into the protocol by BeatSwap to provide liquidity for initial trading. Among the creator community, composers, lyricists, and singers hold 6%, 6%, and 8% of the RWA tokens, respectively, with the option to hold long-term to share in the growth of the work or trade freely in the market. The remaining 12% is used by BeatSwap for exclusive copyright management and does not enter the public market.

Image source: BeatSwap

This distribution structure ensures that the interests of creators, investors, and the platform are highly aligned. Investors are not merely purchasing collectibles but "IP equity shares" with real cash flow. By simply staking RWA tokens, users can receive daily income from the actual play counts of corresponding works on global streaming platforms.

To ensure continuous liquidity for copyright assets, BTX plays a key driving role in the ecosystem. All transactions, exchanges, and LP pairings of RWA tokens are settled in BTX. As more songs are released and more RWA assets go live, more "RWA–BTX" liquidity pools will form on DEX. The more songs that go live, the larger the liquidity pool, the stronger the demand for BTX trading, and the greater its value support. At the same time, a large amount of BTX will be released to key participants such as users listening to music, musicians creating content, market participants providing liquidity, and RWA token holders bearing rights risks through platform activities.

In the overall distribution system of BTX, IPL holders will receive a total of 5% of the BTX token distribution. User behaviors on the platform, such as playing songs, unlocking paid content, sharing works, participating in licensing, and interacting with creators, can all accumulate IPL. This not only records contributions but also determines each user's BTX reward ratio.

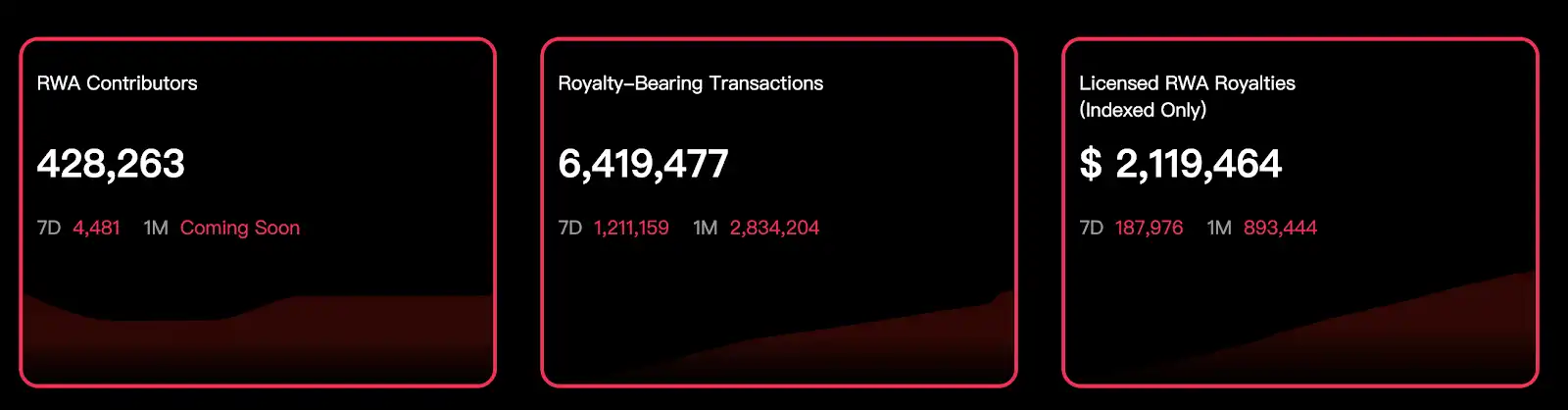

Because IPL treats every ecological participation behavior as a "contribution asset," BeatSwap has managed to secure the top position in the RWA category rankings on BNB Chain DappBay. On-chain data shows that BeatSwap's cumulative transaction count has exceeded 6.4 million, with over 420,000 users, surpassing Ondo among similar projects. Additionally, BeatSwap has successfully released 660 songs, including K-POP, electronic music, independent music, and experimental music, becoming the most complete and fastest-growing platform in the music copyright RWA sector.

Data source: beatswap.io/dashboard

International Patents: How to Properly Manage and Trade RWA

In the current narrative, RWA is seen as one of the most promising growth engines. However, when traditional assets, especially those with real cash flow, are directly introduced on-chain, the limitations of existing technological systems become apparent. The AMM mechanism designed based on cryptocurrencies does not have the capability to handle complex RWA.

To ensure that RWA can be correctly traded, accurately priced, and settled securely on-chain, BeatSwap has chosen an unprecedented path. BeatSwap has submitted an international patent application to the United Nations World Intellectual Property Organization (UN WIPO) for the "Collateralized Liquidity Management System and Method for Real-World Asset Decentralized Exchanges" (International Application No.: PCT/KR2025/015673).

BeatSwap's patent application is not aimed at positioning itself but is designed as a foundational infrastructure tailored for the RWA era. The traditional AMM model is designed for high-volatility assets, suitable for typical crypto assets like ETH and DeFi tokens, and can support the market with a simple curve model. However, when applied to RWA, structural flaws immediately become apparent. RWA values fluctuate slowly and do not possess hourly price volatility attributes, while AMM liquidity pools quickly respond to every trading action, leading to price deviations from true value. For instance, the real value of a music work may change very little, but the AMM mechanism could cause the price to distort instantly due to a few trades.

More critically, RWA has collateral, cash flow, and payment cycles. Once collateral assets depreciate, cash flow delays occur, or market redemption pressures arise, traditional AMM cannot execute any risk management actions. There are no liquidation, no penalty mechanisms, no price stabilizers, and no dynamic adjustments based on users' risk exposure. This "no-risk-control AMM" is clearly incapable of handling real-world assets.

BeatSwap discovered that to truly integrate assets like IP copyrights into the on-chain financial system, a completely new AMM structure must be created—one that can understand risk, manage collateral, and track cash flow. Therefore, they chose to apply for a patent to solidify this structured mechanism, not only to protect their innovative achievements but also to lay the groundwork for future institutionalization in the industry.

According to the patent description, the BeatSwap AMM is a risk-adjusted hybrid AMM that combines collateral ratio, price volatility, and liquidity slope, making liquidity no longer a passive provision but dynamically changing based on risk. When the playback data of a certain IP work fluctuates, copyright revenue declines, or collateral assets depreciate, the system automatically adjusts the price curve of the pool, bringing the price back in line with its real value. The patent also designs a complete risk disposal mechanism. When the collateral value drops into a danger zone, the system triggers automatic penalties, price corrections, or even liquidation mechanisms to protect the market from the impact of disorderly trading. Traditional AMMs are helpless in such situations, while BeatSwap's system can execute safety valves like traditional financial clearing institutions to prevent systemic risks in the market.

BeatSwap's patent not only makes IP copyrights the first type of RWA that can be stably traded in an AMM but also provides a technical template for more categories of real assets in the future.

When the industry looks back at the history of RWA, this patent is likely to be seen as an important turning point. It marks a key step from RWA being mapped onto the chain to being correctly traded and managed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。