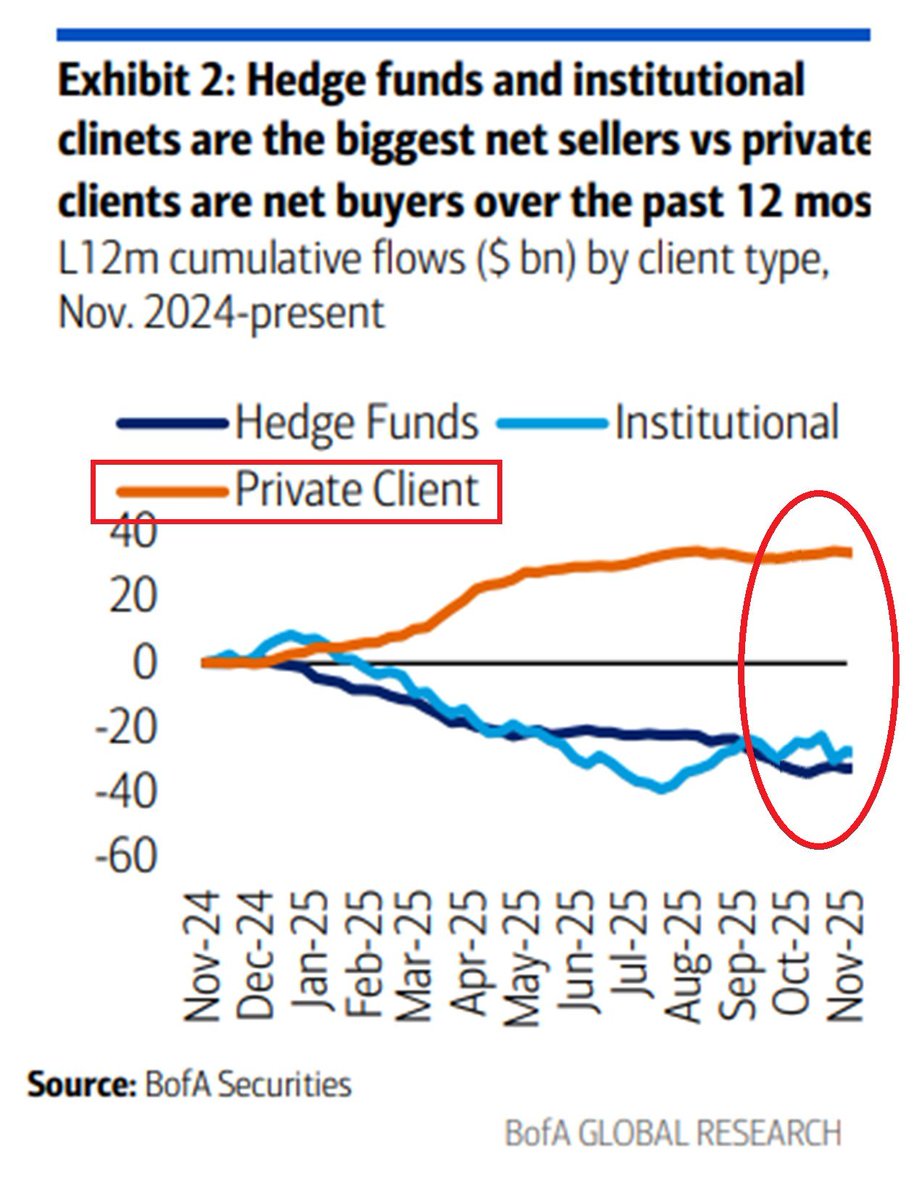

From the end of 2024 to November 2025, hedge funds and institutions have been continuous net sellers, while private clients have been consistently buying.

This indicates that professional funds have significantly reduced their risk exposure over the past 12 months, while retail funds have actively increased their positions by taking advantage of the pullbacks. For institutions, the concern should be the impact of the Federal Reserve's monetary policy on liquidity, selling at high points, while retail investors have been buying at low points, with retail often picking up the pieces after institutional sell-offs.

However, from the current trend, retail buying has shown signs of weakening momentum, and the overall curve has started to flatten. Institutions and hedge funds are also showing similar patterns, with institutional users gradually indicating intentions to bottom-fish, while hedge funds seem to be starting to build positions at the bottom.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。