Today's homework is tough. Although I don't know the main reason for the decline, it seems to be related to China's ongoing crackdown on cryptocurrencies and the rising interest rates in Japan. The former is manageable; we can get used to it. The latter is currently the biggest problem, especially since Japan's real interest rates have already risen. Today, Bank of Japan Governor Kazuo Ueda also hinted at weighing the pros and cons of interest rate hikes and appropriately raising the policy interest rate when conditions are ripe.

The yen has long served as the world's largest low-interest financing pool, providing invisible liquidity for U.S. tech stocks, AI assets, and risk assets like $BTC. When Japan enters an interest rate hike cycle, it means that the cost of financing is increasing. Cross-border institutions, quantitative funds, and risk parity strategies that originally relied on yen carry trades will be forced to deleverage. The narrowing of the U.S.-Japan interest rate spread may lead to capital flowing back to Japan, potentially shrinking the valuation premium of U.S. assets.

Moreover, Japan's interest rate hikes and real interest rate actions may have just begun. As interest rates increase, the potential liquidity damage could be greater. However, the global focus remains on AI-driven tech stocks, and the current cost of yen borrowing is still not high. If the Federal Reserve can enter a rapid rate-cutting phase, it could hedge against some of the negative impacts of yen interest rate hikes.

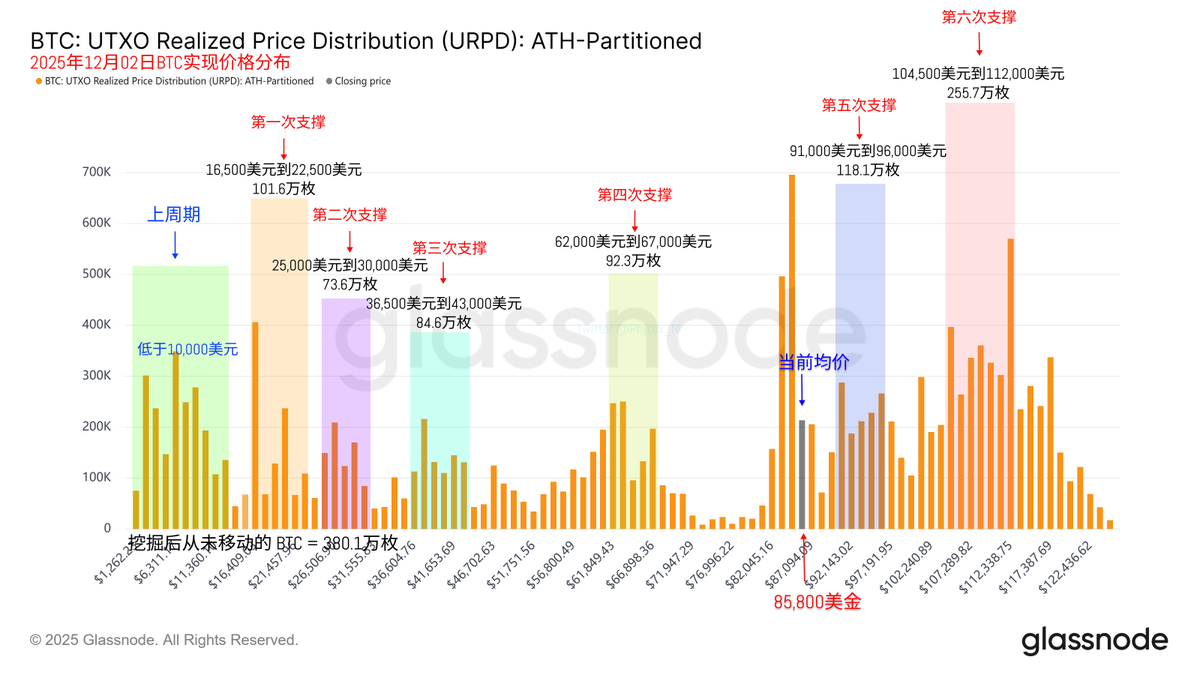

Looking at Bitcoin's data, today's price drop has caused panic, but the panic mainly comes from investors who bought in the last two days. Those holding positions around $90,000 are the largest part of today's turnover. Investors at other price levels seem to be relatively normal, with no obvious signs of panic. The restoration of confidence may still depend on the Federal Reserve.

However, from the perspective of the chip structure, it remains stable, with no signs of a large number of loss-making investors changing hands, especially for those with a holding cost above $100,000. This range still has the most positions recently and has not collapsed due to the price drop.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。