Traders are often lonely, all wanting to walk this path to reach the shores of their inner aspirations. Some seek mentors, some use EAs, and some become self-taught. You and I are all pilgrims; there’s no need for regret, we are all on the path of pilgrimage.

Hello everyone, I am trader Gege. The tree wants to be still, but the wind does not stop. November has come to an end, and those hanging on the tree are waiting for the "north wind" to rise again. There are no markets that only rise without falling, nor are there markets that only fall without rising. Similarly, there are no trades that only profit without losses. Continuing from the last article, let’s review the previous thoughts: a bearish outlook below 95,000 was given, with a strategy to short at 93,500, but the market only touched the 93,000 line. As for the bullish outlook, Gege estimated at the time that the market would briefly break below 90,000 before rebounding and then falling again. However, over the weekend, the market did not break but instead plunged directly in the morning with the help of news. What news? I won’t elaborate here; I believe everyone has seen the news. When the wall falls, everyone pushes; the worse the market, the more negative things come along. After experiencing several rounds of bull and bear markets, one becomes accustomed to it.

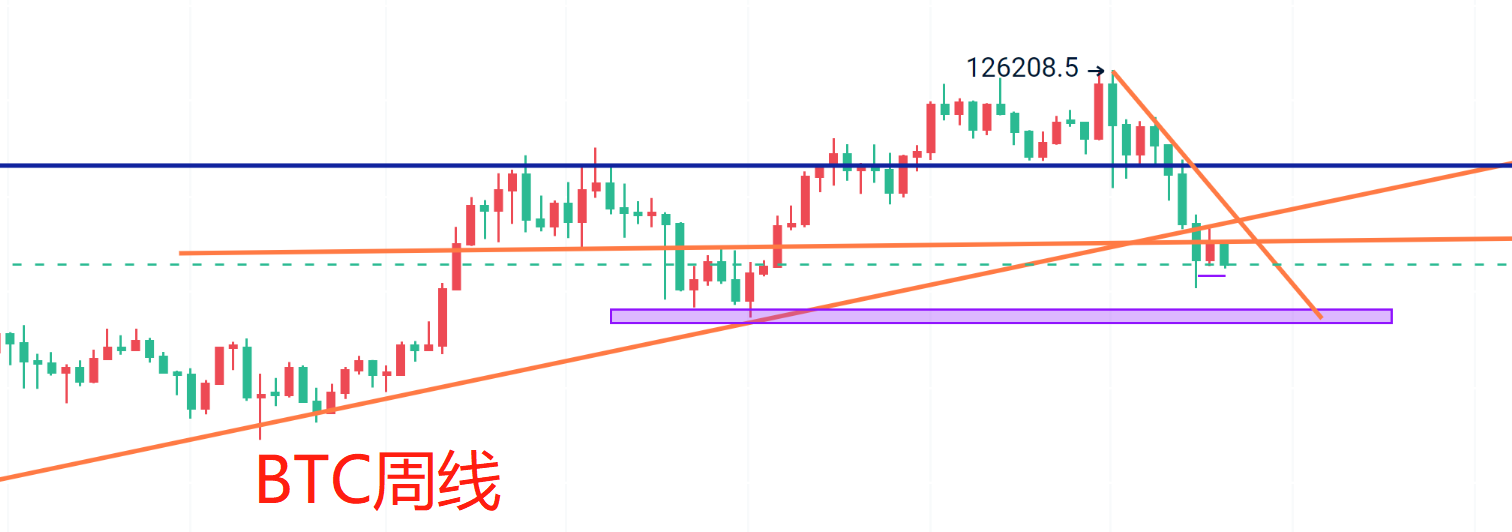

Today, both the monthly and weekly charts are closing. In the article on the 24th, regarding this month’s forecast (December may see a bottom or break below, which will provide good accumulation opportunities, looking for a wave of rebound and upward trend), Gege still maintains the same view. After looking at the monthly close, the direct drop reinforces Gege's previous thoughts; the drop after the close increases the probability of a rebound in the latter half. Focus on the highs and lows of the previous K-line; if it breaks, refer to the low points around March-April, where the cost price of micro strategies is also nearby.

On the weekly level, the previous K-line closed positively, and the closing price is around 90,000. According to technical analysis, this week’s oscillation range should be around 88,000-94,000. Unfortunately, the negative news has changed the direction, requiring further adjustments to slightly corrected indicators. Currently, the upper boundary of the market has returned to 90,000-91,000, followed by the 95,000 line. The major boundary given on the 24th at 98,000-99,000 was estimated to be difficult to break in the next 8 weeks, so let’s hold off on that for now and observe as we go. The short-term support at the 4H level can be referenced at around 85,000, but for a more cautious approach, consider the support area above 83,000. After all, negative news in a bull market is an opportunity to buy, while negative news in a bear market should be treated with caution.

In summary, for the short term, look to buy around 83,600-83,000. For medium to long-term positions: first, consider buying around 80,000 plus or minus 1,000 dollars. If it breaks, use 74,000 as a boundary; if it doesn’t break, buy around 76,000-75,000, and if it breaks, buy around 73,800-72,800. That’s all for today.

The suggestions are for reference only. Ensure proper risk control when entering the market, and manage your profit and stop-loss spaces accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we’ll see you next time. I wish everyone success in their trading and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today’s brief update ends here. For more real-time advice, find Gege.

Written by / I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。