Original |Odaily Planet Daily (@OdailyChina)

On December 1, documents from the Hong Kong Stock Exchange revealed that the licensed cryptocurrency exchange HashKey has passed its listing hearing, taking a crucial step towards going public. Its IPO is co-sponsored by institutions such as JPMorgan and Guotai Junan International; after the listing, the company's controlling shareholders will include Mr. Lu and related investment entities, with well-known institutions like Gao Rong Venture Capital, Fidelity, and Meitu also appearing among the shareholders.

HashKey's listing is seen as an important signal in the compliance process of the cryptocurrency industry, expected to attract more entrepreneurs to Hong Kong's digital asset ecosystem.

However, HashKey's own operational performance is far from optimistic: the prospectus disclosed that the company has incurred losses for four consecutive years from 2022 to 2025; as of June 2025, the registered user count is only about 138,000; the platform's weekly visit count is merely 2,203, less than one ten-thousandth of Binance; and daily trading volume remains at the million-dollar level. Additionally, its platform token HSK has fallen over 85% from its peak, with widespread dissatisfaction among investors in the community.

With continuous financial losses, sluggish user growth, and a shrinking market value of its platform token—what kind of valuation will the capital market give to such a HashKey?

Unprofitable Exchange: HashKey's Scale Dilemma

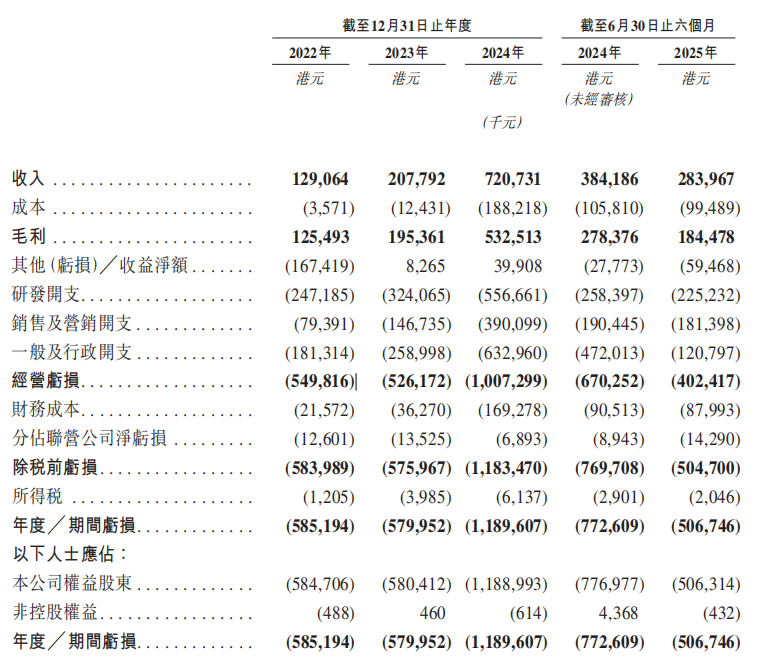

Exchanges are often referred to as the most profitable "water sellers" in the cryptocurrency market, but HashKey is clearly an exception. Although its gross profit appears substantial—HKD 125.5 million, HKD 195.4 million, HKD 532.5 million, and HKD 184.5 million for the years 2022 to the first half of 2025—the company has been mired in losses for four consecutive years, with net losses during the same period amounting to HKD 585 million, HKD 580 million, HKD 1.189 billion, and HKD 506.7 million.

Core Financial Indicators of HashKey

The main reason for HashKey's annual losses is the enormous expenditures outside of the exchange's direct business, with "R&D expenses" and "general and administrative expenses" being the major costs from 2022 to 2025. In 2024 alone, HashKey's R&D expenses exceeded HKD 556 million, and administrative expenses surpassed HKD 632 million, totaling nearly HKD 1.2 billion, far exceeding the annual revenue of HKD 720 million.

Overstaffing Issues and Lack of Tangible Results

In reality, HashKey's R&D technical team is extremely large.

The prospectus mentions that Wanxiang Blockchain provides technical development services for HashKey—“the number of personnel providing technical development services to the Group is expected to increase by about 40% from approximately 210 in 2024 to about 300 in 2025”, and states that “in the next three to five years, the R&D team will be further strengthened, expected to consist of 70 employees proficient in blockchain technologies such as zero-knowledge proofs.”

However, such a large number of technical personnel has not led to products gaining sufficient user recognition, with users frequently complaining on social media about "poor experience," "slow bug fixes," and "repeated delays in product features"… Setting aside subjective evaluations, the excessive investment in technology has not brought higher returns to HashKey; its heavily invested Ethereum L2—HashKey Chain has also performed poorly.

According to DeFiLlama data, HashKey Chain's TVL is only USD 1.12 million, with 24H fee income of USD 11, and only 6 ecological protocols included; meanwhile, according to L2beat data, HashKey Chain's TPS over the past day was 0.07, with a maximum TPS of 1.17, in contrast, Arbitrum's TPS over the past day was 31.95, with a maximum TPS of 68.82.

The dismal data indicates that this L2, marketed for compliance and RWA channels, is merely an "on-chain ghost town." This raises questions: where has the massive R&D expenditure over the years gone? And is it even necessary?

Compliance Expenditure Exceeds HKD 130 Million in the First Half of 2025

Compliance expenditure occupies a significant portion of HashKey's operating costs. Although HashKey is still considered a medium-sized trading platform in terms of trading volume and user scale, its market recognition often rivals that of top-tier platforms due to its possession of a Hong Kong compliance license, even being referred to as "the Coinbase of the East." However, compliance does not come without a cost—HashKey has made significant investments in management, operations, and compliance to meet Hong Kong's strict regulatory requirements.

According to the prospectus, in the first half of 2025, HashKey's compliance-related expenditures reached approximately HKD 130 million, covering compliance personnel, professional service fees, insurance, and other ancillary expenses.

For exchanges, compliance has always been a key development direction, and leading exchanges often make substantial investments in compliance, which brings multiple benefits: reducing legal risks, expanding channels for institutional and individual users, gaining more open publicity space, and enhancing corporate image.

If an exchange can obtain a license in a market ahead of others or exclusively, the corresponding compliance costs become particularly worthwhile. HashKey recognized this early on, officially obtaining a license from the Hong Kong Securities and Futures Commission (SFC) in September 2022, becoming one of only two licensed virtual asset trading platforms in the region (the other being OSL).

However, as Hong Kong's regulatory policies for crypto assets continue to clarify, the scarcity of compliance licenses has gradually diminished. Recently, the number of trading platforms approved by the SFC has increased to 11, with the other 9 platforms obtaining approval concentrated between 2024 and 2025, aside from OSL and HashKey.

In the future, Hong Kong is likely to see more compliant exchanges, which means that the license itself no longer constitutes a sufficiently wide moat, but gradually becomes a basic condition for industry entry. In the long run, competition among platforms will focus more on product capabilities and user experience.

In other words, this "necessary expenditure" may bring diminishing marginal returns to HashKey over time. If it cannot effectively optimize its cost structure, the high compliance expenditures may become a financial burden in the future.

Returning to the investment perspective, cash flow and profitability are often the core concerns of stock market investors. HashKey has been in a state of financial loss for four consecutive years, and the return effects of key expenditures are gradually weakening, making it a question to observe whether it can win the confidence of Hong Kong stock investors after its listing.

HSK Drops Over 86%—Will the "Platform Token Dilemma" Recur for HashKey in Hong Kong Stocks?

Although HashKey is about to welcome new investors in Hong Kong stocks, holders of its platform token HSK are already facing significant pressure.

Last week marked the one-year anniversary of HSK's launch; however, CoinGecko data shows that the token has fallen over 63% since its issuance, with a decline of more than 86% from its peak. This means that any investor who purchased HSK at any point in the past year and held it until now is generally at a loss.

The prospectus defines HSK as an ecological utility token, which can be used to pay for transaction and computation fees on HashKey Chain, and serves as an incentive for employees, users, partners, etc., while clearly stating that it does not have financing functions.

HashKey has invested significant resources in distributing HSK, with related costs amounting to HKD 9.9 million, HKD 70.8 million, and HKD 176.7 million from 2022 to 2024. However, the actual usage of HSK is not active: the usage rate for the entire year of 2024 was only 1.71%, further dropping to 0.49% in the first half of 2025. This not only affects overall financial performance but also reflects the limited ecological activity of HashKey Chain at present.

Regarding the decline in HSK's price, the prospectus attributes it mainly to changes in market sentiment and investor expectations. HashKey had promised to use 20% of its net profit for the repurchase and destruction of HSK, but has yet to execute any repurchase, explaining it as "not yet meeting the repurchase conditions." As for the specific repurchase conditions, execution methods, and scale, HashKey has not publicly detailed them, raising doubts in the market about the feasibility of its repurchase commitment.

Typically, when cryptocurrency exchanges move towards traditional capital markets, they gradually downplay their association with platform tokens. While HashKey has not explicitly severed ties with HSK, the continued low price of the token suggests that HSK may not be central to its future strategic layout.

To some extent, early supporters of HSK have borne part of the costs during HashKey's development process.

Hong Kong stock investors may not be familiar with this background, but HSK's performance can still serve as a window for observation: while platform tokens and company stocks belong to different asset classes, their value support and market confidence mechanisms are still worth careful consideration by every potential investor.

What Valuation Can HashKey Achieve?

When examining HashKey's listing prospects, the challenges it faces are quite significant: product experience needs improvement, trading depth is insufficient, and the on-chain ecosystem lacks competitiveness, coupled with ongoing profitability pressures. Even the compliance narrative that once differentiated it in the market has lost its luster due to the gradual proliferation of licenses. Against this backdrop, HashKey's decision to push for a listing at this time raises questions about how its valuation should be assessed.

As early as last October, Reuters reported on HashKey's preparations for an IPO, with a target fundraising amount of up to USD 500 million. However, according to insiders, the related financing process has not gone smoothly. Today, a crypto KOL analyzed that HashKey's valuation may fall within the USD 2 billion range. Although this figure is far below the nearly USD 50 billion valuation at Coinbase's IPO in 2021 and lower than Upbit's approximately USD 10.3 billion market value, if achieved, it could still be regarded as a medium-sized target worth attention in the Hong Kong stock market.

Despite the fact that, from a fundamental perspective—including product strength, profit model, and core advantages—HashKey's listing story is indeed not optimistic, when viewed in the current macro environment: the overall cryptocurrency market is under pressure, regulation is tightening, and incremental funds are scarce, if HashKey can successfully land on the Hong Kong stock market, it still holds symbolic significance. It may not only bring a rare compliant exit and liquidity path for the industry but also provide a close-up window for traditional capital markets to observe the crypto ecosystem. In this sense, its listing itself may have transcended mere company financing and carries a certain signal of breaking the deadlock.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。