Author: FinTax

1. Introduction

The official website of the U.S. government shows that the Internal Revenue Service (IRS) submitted a proposal to the White House on November 14. This proposal is titled "Broker Digital Transaction Reporting," and its core content is to implement the "Crypto-Asset Reporting Framework" (CARF) introduced by the Organization for Economic Cooperation and Development (OECD). Once CARF is implemented, the IRS will be able to access data on overseas crypto asset accounts held by U.S. citizens. Currently, the White House is reviewing the proposal, and taking this opportunity, this article will outline and introduce the CARF framework—What is CARF? How has it developed? Has it started implementation?

2. What is CARF

The "Crypto-Asset Reporting Framework" (CARF) is a global tax transparency standard proposed by the OECD in 2022. Its core mechanism requires member countries to automatically exchange information about their citizens' holdings and transactions of crypto assets to effectively curb cross-border tax evasion.

The regulatory subject of CARF is very clear; it does not regulate the crypto assets themselves but rather the "entities providing crypto asset services." Under its framework, any institution that provides commercial services such as trading, custody, exchange, and management of transferable crypto assets to the public may be considered a Reporting Crypto-Asset Service Provider (RCASP) and must assume reporting obligations. Typical RCASPs include centralized exchanges, custodial wallet service providers, OTC and brokers, issuers providing stablecoin buying or redemption services, and those institutions that, while claiming to be DeFi, have identifiable and operational entities behind them (such as centralized front ends and yield management platforms).

According to the CARF framework, RCASPs need to carry out the following tasks for users (including institutional and individual users): (1) customer due diligence to identify their tax residency status, etc.; (2) record and track user accounts, categorizing and statistically analyzing information related to crypto asset exchanges, disposals, acquisitions, and transfers, with these records and data to be retained for at least five years. Each year, RCASPs will submit due diligence information and asset information to the tax authorities of their jurisdiction. Subsequently, there will be an automatic international exchange of information between tax authorities—this effectively builds a global tax information network in the crypto asset field, filling the gaps in the existing automatic exchange standards for financial account tax information (CRS) in the crypto domain.

The CARF rule system consists of three main parts:

(1) CARF Rules and Related Commentary

These rules and commentary are designed around four key elements: i) the scope of covered crypto assets; ii) entities and individuals required to comply with data collection and reporting requirements; iii) transactions that must be reported and the related information that must be reported; iv) due diligence procedures for identifying crypto asset users and controllers and determining relevant tax jurisdictions for reporting and exchange purposes; countries can transform these rules into domestic law to collect and exchange relevant reporting information of their crypto asset service providers with other countries with agreements.

(2) Bilateral or Multilateral Tax Agreements

Agreements or arrangements between competent authorities for the automatic exchange of information based on CARF rules and related commentary.

(3) Electronic Reporting Format

The electronic format (XML format) used by competent authorities to exchange CARF information, as well as the electronic format used by reporting crypto asset service providers to report CARF information to tax authorities (as stipulated by domestic law).

3. Development and Implementation of CARF

From its initial launch to widespread acceptance, the development of CARF reflects the international community's embrace of the trend toward transparency in crypto taxation.

2022: At the beginning of 2022, the OECD released a consultation document on the proposed rule scheme, and in October, it published the final version of the Crypto-Asset Reporting Framework, proposing a unified global standard for cross-border information exchange of crypto assets, marking the preliminary formation of CARF rules.

2023: The OECD released the initial version of the XML Schema, FAQs, and due diligence and reporting operational guidelines, establishing executable technical and procedural rules for CARF.

2024: The OECD released the final version of the CARF XML Schema, and countries began preparing domestic legislation and integration work.

CARF itself is an international standard set by the OECD and does not have direct legal effect; it must be implemented through countries' commitments to join, legislative transformation, and system integration. In other words, the timeline for CARF's implementation in different countries/regions depends on the specific commitments of each country. According to OECD data, as of November 2025, 74 jurisdictions have officially committed to implementing CARF in 2027 or 2028, with 53 jurisdictions having signed CARF bilateral or multilateral competent authority agreements (CARF MCAA). Among them, the European Union passed the DAC8 directive (Directive 8 on Administrative Cooperation) in 2023, requiring EU member states to start collecting information from January 1, 2026, and to complete the first round of cross-border information exchange by September 30, 2027, while other countries/regions are also gradually advancing CARF.

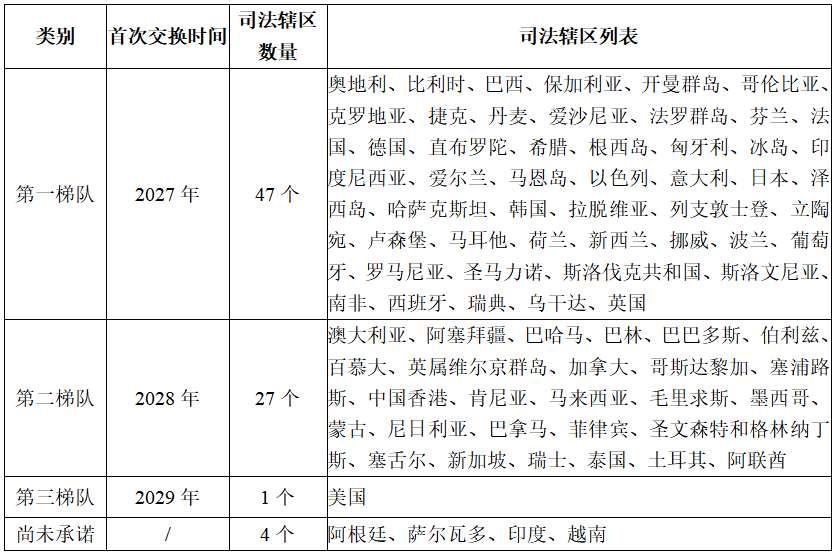

According to official disclosures from the OECD, as of November 24, 2025, the commitment status of various jurisdictions is as follows:

4. Conclusion

CARF is hailed as the CRS of the crypto world, aiming to establish a unified global framework for tax information exchange, addressing the regulatory issues of crypto asset taxation, and providing tax authorities with more third-party data on taxpayers' crypto activities. This framework requires RCASPs to comply with detailed KYC requirements, ensuring accurate and timely reporting of relevant information to tax authorities. The gradual implementation of CARF demonstrates a trend toward transparency in global crypto taxation and a clearer regulatory landscape for crypto, while promoting tax fairness, enhancing public trust, and increasing government revenue, it also imposes higher compliance requirements on intermediaries and taxpayers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。