Written by: insights4.vc

Translated by: Glendon, Techub News

Cryptocurrency collateral leverage reached a new high in the third quarter of 2025, exceeding the peak at the end of 2021 in dollar terms, but the market structure has fundamentally changed. On-chain lending now dominates, with significantly improved transparency and collateral quality compared to the opaque boom period of 2021. Meanwhile, the boundaries between credit and payments are blurring: fintech companies are launching their own stablecoins, while DeFi protocols are expanding upwards, offering bank-like applications aimed at retail users.

This report will independently analyze these trends, including the expansion of cryptocurrency leverage, the launch of Klarna's stablecoin KlarnaUSD, and Aave's entry into consumer finance through high-yield applications, and explore the implications of these trends on market structure, opportunities, and risks.

### Overview of Cryptocurrency Leverage in Q3 2025

Market size hits a new high: The outstanding balance of cryptocurrency collateral loans grew by approximately $20 billion in the third quarter, reaching about $73.6 billion by the end of September 2025, marking a historic quarterly high, with a quarter-on-quarter increase of about 38%, and approximately 6% higher than the peak at the end of 2021. Decentralized finance (DeFi) lending protocols contributed to the majority of this growth. The value of loans on DeFi platforms increased by about 55% during the quarter, reaching approximately $41 billion (a historic high).

Centralized cryptocurrency lending institutions (CeFi) contracted after the credit events of 2022 but have since expanded—outstanding loans rebounded by about 37% to approximately $24.4 billion—but the size of the CeFi lending market remains far smaller than the peaks of 2021-2022. Additionally, by the end of the quarter, approximately $8 billion to $9 billion of cryptocurrency collateral debt existed in the form of on-chain collateral debt positions (CDPs) stablecoins (such as DAI, LUSD). When combining DeFi lending, CeFi lending, and the supply of cryptocurrency-backed stablecoins, the total cryptocurrency collateral lending market slightly exceeds $73 billion, nominally recovering to levels close to the peak at the end of 2021.

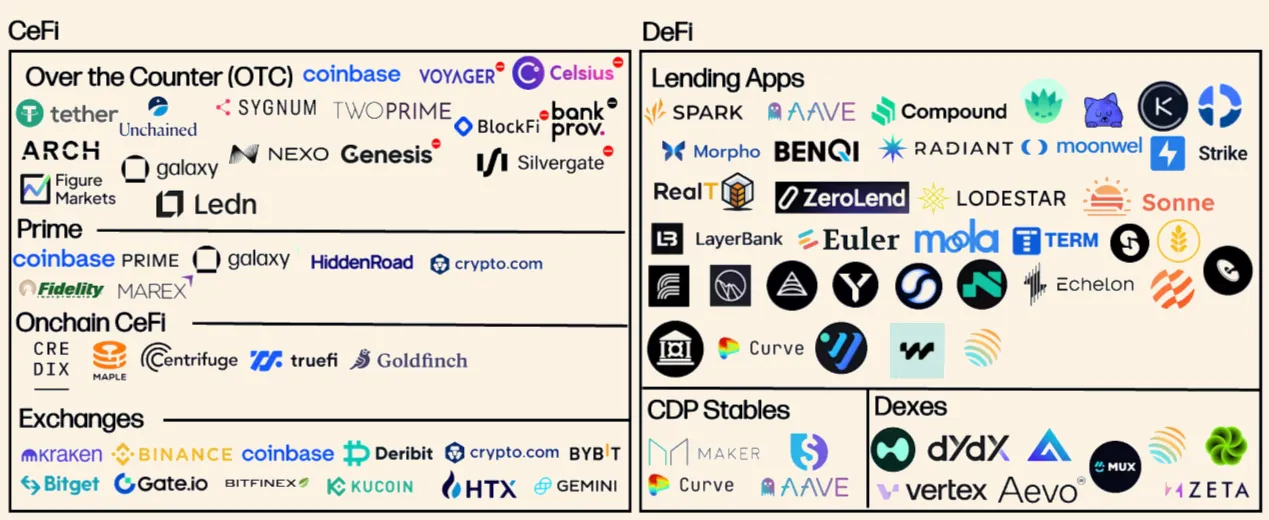

Cryptocurrency Lending and Credit Market Map (Source: Galaxy)

A key distinction from the previous cycle is the shift towards on-chain trading venues. By the end of Q3 2025, approximately 66-67% of cryptocurrency collateral loans were issued on-chain through DeFi lending protocols or CDP stablecoins, significantly higher than the peak of about 48%-49% in Q4 2021. In the on-chain trading space, decentralized lending applications currently account for over 80% of outstanding on-chain debt, while cryptocurrency-backed stablecoins account for only about 16%. In other words, most on-chain leveraged trading today involves borrowing existing stablecoins (such as USDT, USDC, etc.) using cryptocurrency as collateral on lending platforms, rather than issuing new synthetic stablecoins as was the case in 2021.

Currently, DeFi lending protocols account for over half (about 50%) of the cryptocurrency collateral loan market, while CeFi lending platforms have seen their share drop to about one-third (around 30%), with CDP stablecoins accounting for about 10-12%. Thus, on-chain platforms hold about two-thirds of the market share. This shift is significant as both transparency and risk control have improved—on-chain loans are visible in real-time and collateral is typically sufficient, whereas the previous CeFi boom was rife with hidden, under-collateralized loans. Consequently, surviving CeFi participants have also raised their standards (shifting to full collateralization or structured transactions), but the market focus has clearly shifted to more transparent DeFi platforms.

In the third quarter, multiple factors drove the expansion of DeFi lending. Incentive programs and airdrop "points" played a role. Many users kept their loan accounts open to earn rewards or gain potential token airdrop opportunities. For instance, some protocols offer a points system for borrowers, thereby increasing effective yields and encouraging leveraged operations. Additionally, the introduction of higher-quality collateral assets has made capital-efficient strategies possible. Pendle's Principal Tokens (PTs) are a typical example, being a low-volatility yield-bearing asset; users can use PTs as collateral to borrow stablecoins at a higher loan-to-value ratio with relatively stable collateral. This makes certain leveraged stablecoin "arbitrage trading" strategies (e.g., borrowing stablecoins against PTs for reinvestment to earn yields) more attractive.

Moreover, the market environment has been very favorable. The price increases of major crypto assets (BTC, ETH, SOL, etc. all saw gains this quarter) have boosted the value of collateral and may have stimulated borrowing activity. As asset prices rise, borrowers have greater borrowing capacity and confidence, while lenders are more willing to issue loans with top crypto assets as collateral. This positive feedback loop—higher crypto prices leading to higher collateral values, which in turn promotes borrowing—further drives the momentum of on-chain lending.

New Chains and Leverage Growth

Innovations in blockchain infrastructure have also played a role in driving this growth. New networks such as Plasma emerged in the third quarter, quickly attracting significant lending activity. In fact, within just about five weeks of its launch, the Plasma blockchain saw its outstanding DeFi loans exceed $3 billion by the end of October, indicating that users rapidly migrate funds to new platforms offering yield opportunities. As of October 31, Aave's deployment on Plasma accounted for about 69% of the borrowing share on that chain, making Plasma Aave's second-largest market (surpassing some established networks). This example shows that new chains (often offering low fees or specific incentives) can accelerate leverage growth by attracting liquidity and borrowers seeking advantages.

CeFi-DeFi Double Counting

One point to note in the analysis is that there may be double counting of loans between CeFi and DeFi. Some centralized lending institutions have been utilizing DeFi protocols as sources of funds; for example, a CeFi platform might stake its BTC on Aave to borrow on-chain USDC, then lend those USDC to off-chain clients. In aggregated data, the same loan may appear twice: once in the DeFi outstanding loans and once on the balance sheet of the CeFi lending institution as receivables from its clients. Without clear disclosure, it is challenging to eliminate these overlapping portions. Galaxy researchers have noted this issue and emphasized that while on-chain lending statistics are transparent, CeFi reporting is inconsistent, and recent growth may partly reflect the circulation of funds between CeFi and DeFi ledgers. Therefore, the aforementioned key data should be taken as indicative—if this fund circulation is significant, the actual economically independent loan scale may be slightly lower. Nevertheless, the overall trend is clear: cryptocurrency leverage is growing again, but with more collateralization and on-chain drive than in the previous cycle.

KlarnaUSD and the Scale of Stablecoin Networks

The expansion of crypto credit is closely tied to the evolution of digital payment systems. Stablecoins, which were once primarily used for cryptocurrency trading, have now facilitated trillions of dollars in transactions and attracted the participation of mainstream fintech companies. The launch of Klarna's stablecoin KlarnaUSD highlights the trend of convergence between leverage, credit, and payments. As on-chain lending grows, stablecoin-based payment networks are also thriving, providing liquidity and collateral for DeFi.

Klarna's Stablecoin Strategy

Klarna, a globally recognized "buy now, pay later" (BNPL) and consumer payment provider, announced the launch of its dollar-backed stablecoin KlarnaUSD at the end of Q3 2025. This move marks a significant strategic expansion for the company, whose CEO had previously expressed skepticism about cryptocurrencies. Klarna has evolved from a BNPL specialist to a broader consumer fintech company (offering shopping apps, banking services, etc.), and issuing a stablecoin is part of its initiative to enter the global payment infrastructure space. KlarnaUSD is designed as a fiat-backed digital dollar for everyday payments and cross-border transactions within the Klarna ecosystem, and it may also be used by external partners. According to the company, the token will be fully backed 1:1 by its reserves of dollars. This means that reserves may be held in the form of cash or cash equivalents (such as insured bank deposits or short-term government bonds), but detailed disclosure of reserve composition and certification frequency is crucial for assessing risk. By launching a dollar stablecoin, Klarna effectively provides over 100 million users with a seamless, non-volatile way to transact on the blockchain, integrating the speed and low cost of crypto networks into a regulated fintech environment.

Technical and Reserve Setup

KlarnaUSD will operate on Tempo, a new payment-oriented blockchain co-developed by payment processor Stripe and cryptocurrency venture capital firm Paradigm. Tempo is an independent chain built specifically for large payment transactions, designed to provide fast, low-cost, and compliant stablecoin transfer services at scale. KlarnaUSD is issued through Bridge's "Open Issuance" mechanism, with Bridge being a stablecoin infrastructure platform (after Stripe's $1.1 billion acquisition of Bridge, it is now owned by Stripe). Bridge provides the backend for minting and redeeming stablecoins, compliance checks, and connections between traditional banks and blockchains. In practice, users can buy/redeem KlarnaUSD through Klarna's app, with Bridge handling the issuance of on-chain tokens when users deposit dollars and destroying tokens when users withdraw dollars.

KlarnaUSD is currently in the testing phase (conducted on the Tempo testnet as of Q3 2025) and is expected to launch on the Tempo mainnet in 2026. During this pilot phase, Klarna is working closely with Stripe's cryptocurrency team to integrate the stablecoin into its product processes and ensure robust risk management before a full public release. Reserve management will be a key aspect: Klarna needs to store the dollar reserves backing KlarnaUSD in trusted institutions and may provide regular certifications or audits like USDC or USDT to build user trust. The transparency of these reserves and regulatory oversight will likely follow emerging stablecoin frameworks (notably, new laws such as the U.S. GENIUS Act proposal and the European MiCA regulation set standards for issuers). Klarna's initiative indicates that as long as there are sufficient reserves and compliance with relevant regulations, corporate-issued stablecoins are gradually becoming a reasonable extension of fintech business models.

Ecosystem Partners: Stripe, Bridge, and Paradigm

The launch of KlarnaUSD is supported by three key partners, each playing a critical role in the stablecoin's implementation:

Stripe: As one of the largest payment processors globally, Stripe enables the instant distribution of KlarnaUSD by integrating it into its existing merchant network and API, allowing millions of online retailers to accept this stablecoin through familiar integrations. Merchants do not need to learn blockchain technology; they simply need to enable stablecoin payment functionality, while Stripe's infrastructure handles payment processing, compliance, and fraud control.

Bridge (a Stripe subsidiary): Bridge provides the core infrastructure for the issuance and management of KlarnaUSD, including reserve custody, minting/burning, wallet control, and on-chain compliance features (such as freezing and blacklisting). It connects the banking system with the Tempo blockchain, ensuring that each token is backed 1:1 by dollars. Bridge is applying for a national trust bank license in the U.S., marking its move towards regulated institutional-grade stablecoin operations.

Paradigm: Paradigm is a leading crypto venture capital firm that co-launched the Tempo blockchain with Stripe, possessing deep on-chain expertise and ecosystem resources. Its involvement positions KlarnaUSD as an open, interoperable stablecoin capable of integrating with DeFi platforms and other blockchains, highlighting the trend of convergence between fintech, venture capital, and crypto infrastructure in this model.

Annual Transaction Volume of Stablecoins Reaches $27 Trillion

When announcing the launch of KlarnaUSD, the company emphasized a staggering figure: the annual transaction volume of global stablecoins is estimated to have reached $27 trillion. This figure (derived from a McKinsey study) likely measures the total transaction volume of all stablecoin on-chain transfers within a year. It reflects the immense scale of these digital dollar networks. For reference, $27 trillion is on par with the transaction volume of major credit card networks. For example, Visa's total payment volume for fiscal year 2024 is approximately $16 trillion, and even when adding Mastercard (around $10 trillion), it approaches $20 trillion. In other words, despite the vastly different usage patterns, the dollar value processed by the stablecoin network annually is already comparable to the sum of Visa and Mastercard systems. The transaction volume of stablecoins also far exceeds traditional cross-border remittances, which amount to about $0.8 trillion to $1 trillion globally each year, even surpassing the GDP of the United States.

However, caution is warranted when interpreting this $27 trillion transaction volume. The transaction volume of stablecoins does not equate to the economic payment transaction volume in retail terms, as most of this volume originates from the internal flow of funds within the cryptocurrency market. For instance, a single dollar stablecoin can be transferred dozens of times daily between exchanges, DeFi protocols, and wallets, inflating the original transaction volume metrics. These transfers include arbitrage trading, liquidity provider fund flows, and internal fund transfers, rather than merely purchases of goods or services.

In contrast, the transaction volume of card networks primarily reflects end-user spending on goods/services or cash withdrawals. Therefore, while the scale of stablecoins has reached levels comparable to mainstream payment networks, a significant portion of this $27 trillion transaction volume consists of financial activities within the crypto ecosystem (trading, collateral transfers, yield farming), rather than new commercial activities. Nevertheless, its growth trajectory remains impressive and has the potential to surpass traditional networks by the end of this decade (as predicted by McKinsey), indicating that even a small portion of stablecoin transaction volume shifting to retail payments and cross-border uses could pose challenges to traditional payment channels.

Impact of Stablecoin Regulatory Mechanisms on Leverage and Credit

The rise of corporate-issued stablecoins like KlarnaUSD could significantly impact the on-chain credit landscape. First, if KlarnaUSD gains widespread adoption (for example, if millions of Klarna retail users start holding it for payments, or merchants begin settling with it), there will naturally be a demand to earn yields on idle balances. Just as holders of USDC or USDT seek out DeFi lending markets to earn interest, KlarnaUSD could also become a new financing asset within DeFi. We may see KlarnaUSD integrated as collateral or a lendable asset in money market protocols (such as Aave, Compound, etc.). This would facilitate a leverage cycle: users (including Klarna's corporate treasury) could deposit KlarnaUSD into DeFi lending pools to earn yields, which in turn would support more on-chain lending activity.

If Klarna or its banking partners provide convenient deposit and withdrawal channels, it could effectively inject fresh capital into the DeFi system, potentially increasing liquidity and lowering borrowing costs for borrowers. Secondly, KlarnaUSD will enter a competitive space dominated by Tether (USDT) and USD Coin (USDC). Currently, these two stablecoins are the primary stablecoins used as collateral and loan liquidity in DeFi. Supported by the large fintech company Klarna, KlarnaUSD can coexist with them by carving out niche markets (for example, favored in certain payment scenarios or regions) or directly compete with them once it gains sufficient trust and liquidity. Unlike USDC or USDT, which target crypto-native users, KlarnaUSD may attract more non-crypto users to utilize stablecoins. This could expand the participant base in on-chain finance; for instance, Klarna app users may only need to integrate to deposit their KlarnaUSD into Aave without needing to understand what Aave is, simply due to higher savings rates. This scenario would increase the pool of funds available in the DeFi lending market.

Aave App: A New Banking Product Driven by DeFi

The final piece of the puzzle regarding how DeFi is packaged for end users has been completed by Aave. As one of the largest DeFi lending protocols, Aave launched a significant strategic initiative in Q3 2025—the Aave App, a consumer-facing mobile application that offers bank-like services (savings accounts, payments) fully powered by DeFi. This development reflects the trend of DeFi projects vertically integrating user experiences and could significantly accelerate retail participation in the on-chain lending market. This article will delve into Aave's new application, its features and mechanisms, and its impact on the scale and risks of cryptocurrency leverage.

DeFi-Based "New Bank"

The Aave App is positioned as a high-yield savings product, with an operational experience similar to that of a regular digital bank account. It allows ordinary users to deposit funds (via bank transfer, debit card, or stablecoin) and earn interest without directly interacting with crypto wallets or smart contracts. Essentially, Aave leverages its decentralized liquidity market to provide yields to retail customers through a simplified interface.

Key features of the Aave App include:

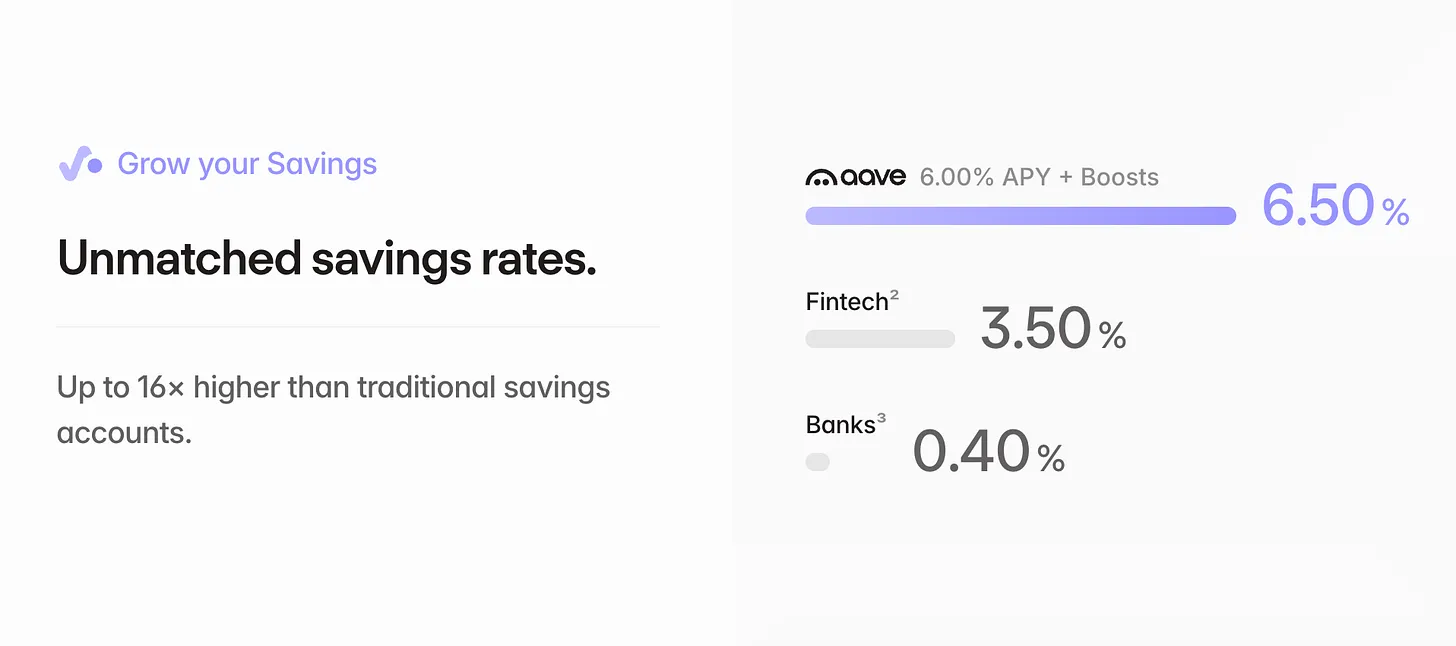

Highly Attractive Yields: The app claims annual savings rates of up to approximately 9%, far exceeding typical bank rates (which are around 0.5% to 4% in many markets). This advertised rate includes some rewards—users who complete identity verification (KYC), set up recurring deposits (automatic savings), or refer friends can unlock higher annual interest rate tiers, reaching up to about 9%. The base rate available to all users is also quite substantial (reportedly around 5% to 6.5% at launch), even surpassing many money market funds. The interest in the Aave App accumulates in real-time with compounding (interest calculated per second based on deposit balance), enhancing the modern fintech application experience of "money always at work."

High Balance Protection: To alleviate trust concerns, Aave offers users deposit protection of up to $1 million. This loss protection is significantly higher than typical bank deposit insurance (for example, the maximum insurance amount from the Federal Deposit Insurance Corporation (FDIC) in the U.S. is $250,000). While public information does not detail the specific mechanism, it is likely that Aave reserves funds or purchases insurance to provide protection in the event of certain losses (such as smart contract failures or custodial institution bankruptcies). This feature aims to enhance consumer confidence, indicating that even if funds ultimately flow into DeFi, there is a safety net.

However, it is important to note that this is not government-backed insurance but rather a contractual guarantee provided by Aave or its affiliates. The $1 million limit indicates that Aave's target customers are affluent retail depositors, aiming to differentiate itself from emerging banks by offering protection well above typical thresholds. Nonetheless, the robustness of this protection (what specific risks are covered and which entity provides the guarantee) remains to be seen.

Extensive Connectivity and Convenience: The Aave App has integrated with multiple banks and payment networks, supporting over 12,000 banks and debit cards for account funding. This means users can link existing bank accounts for transfers via ACH or open banking APIs (potentially using banking connection services like Plaid or Stripe) or make instant deposits using debit cards. This extensive connectivity makes the registration process very convenient, as users do not need to hold cryptocurrency in advance; they can directly fund the app from fiat accounts. The app also supports direct deposits of stablecoins, allowing cryptocurrency users to deposit USDC or other supported stablecoins as needed.

It is worth noting that KYC (Know Your Customer) verification is part of the registration process—Aave requires identity verification, which aligns with its provision of quasi-banking products and ensures compliance with regulatory requirements (as mentioned earlier, completing KYC verification can also yield an increased annual percentage yield as a reward). The Aave App aims to create a standard fintech savings application experience by abstracting the complexities of crypto, where "cryptographic technology operates in the background," and users do not need to interact directly with it. The withdrawal function supports on-demand use, with no lock-in or penalties. Aave emphasizes that users can withdraw funds at any time without waiting or adhering to any additional terms, addressing pain points faced by some centralized finance yield platforms due to withdrawal restrictions.

Yield Generation

How does Aave sustainably provide an annual percentage yield (APY) of about 5-9%? At the front end, deposits made by users in the Aave App are likely directed to Aave's decentralized lending market (as well as potential related DeFi yield strategies). When users deposit dollars (or stablecoins) in the App, these funds are converted into stablecoins (if not already converted) and provided to liquidity pools on Aave (potentially spanning multiple blockchain networks where Aave operates) to earn interest from borrowers. Therefore, the yields provided to users are primarily driven by on-chain borrowing demand: borrowers on Aave pay interest (for example, borrowing USDC for leveraged trading or borrowing stablecoins for mining), and this interest is used to pay the annual yield on deposits.

As of Q3 2025, the average borrowing rate for on-chain stablecoins is in the mid-single digits (at the end of the quarter, the weighted stablecoin borrowing rate is approximately 4.8%-5.0%). Aave may optimize the market for liquidity deployment—for instance, if Aave's yield on Polygon or other chains is higher than on the Ethereum mainnet, the backend may allocate more user funds to these markets. In addition to the base borrowing rate, there may be other sources of yield or incentives: Aave may enhance yields through native token rewards (although Aave's recent liquidity incentives have been relatively modest) or by integrating with other yield opportunities (for example, some funds may be used for yield from liquid staking tokens or for lending pools of real-world assets that sometimes offer higher rates). Another possibility is that Aave is subsidizing initial yields (as a marketing expense) to attract users, essentially a promotional rate. Mentioning that certain actions can yield additional annual percentage rates (for example, automatic savings can increase the annual yield by 0.5%) indicates that some of the yields are not entirely market-driven but are Aave's autonomous rewards.

In the long run, sustainable yields will depend on market conditions: if the crypto market is active and leverage demand is strong, borrowing rates (and deposit annual yields) will remain high; if demand decreases, rates may fall. The current base yield of about 5-6% may reflect natural borrowing demand (perhaps driven by factors such as the incentive points mentioned earlier) and the comprehensive results of efficient cross-chain deployment. Aave's acquisition of fintech developer Stable Finance indicates that they have built the infrastructure to manage these deployments and may hedge or underwrite certain risks. In terms of liquidity and withdrawals, Aave Labs (the company behind the application) may maintain a certain buffer fund or use its own liquidity to ensure users can withdraw instantly. If a large number of users withdraw simultaneously, Aave may temporarily prioritize processing withdrawals from the underlying DeFi (which may involve blockchain transaction times or slippage) to maintain a smooth user experience.

Under extreme pressure, such as a DeFi market crash or soaring borrowing costs, the risk lies in the spread between the interest paid by borrowers and the yields promised to users by Aave potentially widening or even reversing. The application is likely to include disclaimers regarding interest rate fluctuations. If the on-chain market "freezes" (for example, due to liquidity depletion or smart contract suspension), Aave would have to pause new activities or even halt withdrawals until the underlying funds are restored. These are known risks of integrating DeFi into retail products, and how Aave responds to stress scenarios will be a key test. Nevertheless, with a diversified market and potential capital reserves, the application can generally provide daily liquidity, essentially serving as a DeFi yield entry point with a smoothing layer.

Competitive Landscape

The Aave App enters a highly competitive market that includes both traditional fintech products and crypto-native offerings:

Traditional Banks and New Digital Banks

Traditional banks still offer very low savings rates (typically below 1% annual interest), and even high-yield savings accounts or time deposits rarely exceed 4-5%. Fintech neobanks (such as Chime, Revolut, or N26) sometimes partner with banks to offer higher yields, but these are usually single digits and often come with caps or additional conditions. The approximately 5-9% yield offered by the Aave App directly challenges the yields of these traditional banks. Additionally, Aave's $1 million deposit insurance far exceeds the coverage limits of most fintech companies or banks (the U.S. deposit insurance limit is $250,000, and in the EU, it is €100,000). However, the downside of this model lies in regulation and trust: banks have decades of regulatory oversight and government guarantees, and many risk-averse customers may prefer banks even with lower yields. The Aave App may initially attract users seeking high yields and tech-savvy individuals rather than ordinary savings account holders, at least until it proves itself over time.

Centralized Cryptocurrency Yield Platforms

In the previous cycle, CeFi lending platforms like Celsius and BlockFi offered retail yields on cryptocurrency deposits (around 5-10%), but these models collapsed in 2022 due to high-risk rehypothecation and lack of transparency. The Aave App can be seen as a next-generation DeFi-native solution. It aims to provide similar or even higher yields but employs non-custodial, transparent collateral (all deposits are ultimately stored in visible smart contracts, and loans are also over-collateralized). Notably, Aave's solution avoids the maturity mismatch issues that plague centralized finance lending platforms (long-term loans with instant withdrawals). By utilizing on-chain liquidity markets designed for instant liquidity (with floating rates), the Aave App's model is more robust, though not entirely risk-free. Additionally, there are other participants, such as exchanges (for example, Coinbase offers a USDC savings product with an annual yield of about 5%, or various yield programs). These options are simpler but offer lower yields and require custody. The Aave App attempts to combine the trust-minimized characteristics of DeFi with a user-friendly interface, which, if executed well, could become a powerful differentiating advantage.

Other DeFi-Driven Retail Applications

Aave is not the only project attempting to package DeFi as a service for mainstream users. For example, some startups and protocols have launched debit cards or bank-like platforms linked to DeFi yields (one example mentioned in industry news is a staking service on Ethereum that launched a crypto cash card similar to an American Express card, as well as a "digital banking" application from the Mantle network that offers integrated cryptocurrency banking accounts). Additionally, projects like Compound Treasury provide institutions with a fixed 5% yield on USDC (but not aimed at retail users), while projects like Maple or Goldfinch target the institutional lending market, indicating that the bridge between traditional capital and cryptocurrency yields is deepening.

Aave's advantage lies in being a top protocol with a large liquidity base and community. By directly targeting retail users, Aave can undermine smaller intermediaries that act as entry points to DeFi. If the Aave App succeeds, it could capture market share that would otherwise belong to third-party fintech companies integrating the Aave API. In fact, Aave is engaging in forward integration of distribution channels. This could change the economic landscape: Aave would not need to pay all yields directly to fintech partners or users but could use the application to manage yields (potentially maintaining a certain spread in the future or using yields to drive the use of the Aave protocol, benefiting the entire ecosystem). Furthermore, this could open up new revenue streams for Aave Labs (the company) beyond protocol fees.

Impact on Systemic Leverage and Risk

By lowering the barrier for retail users to access on-chain yields, applications like Aave can significantly increase the flow of funds into DeFi lending. Even a slight shift of traditional savings towards these products can expand lending capacity, and as liquidity grows, rates may decline over time. On the other hand, retail-focused DeFi platforms concentrate technology, smart contract, and custody risks within their user base, which may not fully understand these risk exposures. As deposit scales grow and begin to compete with bank savings, regulators and existing banks may respond by tightening regulations on yield products or directly participating in the construction of DeFi infrastructure. The regulatory treatment of such applications, which lie between banking and investment products, remains uncertain, posing a key risk in the medium term.

Conclusion

Cryptocurrency collateral leverage has rebounded to peak levels seen in the previous cycle, but its nature has changed: compared to 2021, it is more on-chain, more collateralized, and more transparent. Data from Q3 2025 shows that the market size is slightly larger than the previous peak (approximately $74 billion, compared to a peak of $69 billion), with DeFi protocols bearing most of the load, while CeFi lending institutions operate more conservatively. This evolution stems from both opportunity and necessity—higher cryptocurrency prices and savvy incentive mechanisms have opened the door to growth, while past failures have prompted the industry to adopt more favorable practices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。