Original | Odaily Planet Daily (@OdailyChina)

Following the public confrontation with Monad (see "The Great Argument Showcase Between Monad's Founder and Arthur Hayes"), "Black Brother" Arthur Hayes unexpectedly got into a spat with the king of stablecoins, Tether.

Following the public confrontation with Monad (see "The Great Argument Showcase Between Monad's Founder and Arthur Hayes"), "Black Brother" Arthur Hayes unexpectedly got into a spat with the king of stablecoins, Tether.

Arthur Hayes: USDT May Be "Underwater"

The incident began on November 30, when Arthur Hayes posted on X about Tether's third-quarter reserve proof released at the end of October, analyzing that Tether has a high proportion of volatile assets like gold and Bitcoin in its reserve assets, which could lead to a risk of "insolvency" for USDT due to the decline in these assets.

The Tether team is in the early stages of betting on a massive interest rate trade. Based on my understanding of their audit report, they believe the Federal Reserve will start cutting interest rates, which will significantly compress their interest income. In response, they began buying gold and Bitcoin—ideally, when "currency prices fall" (interest rate cuts), these assets should rise. But if their gold + Bitcoin positions drop by about 30%, Tether's equity will be wiped out, and USDT will theoretically become insolvent.

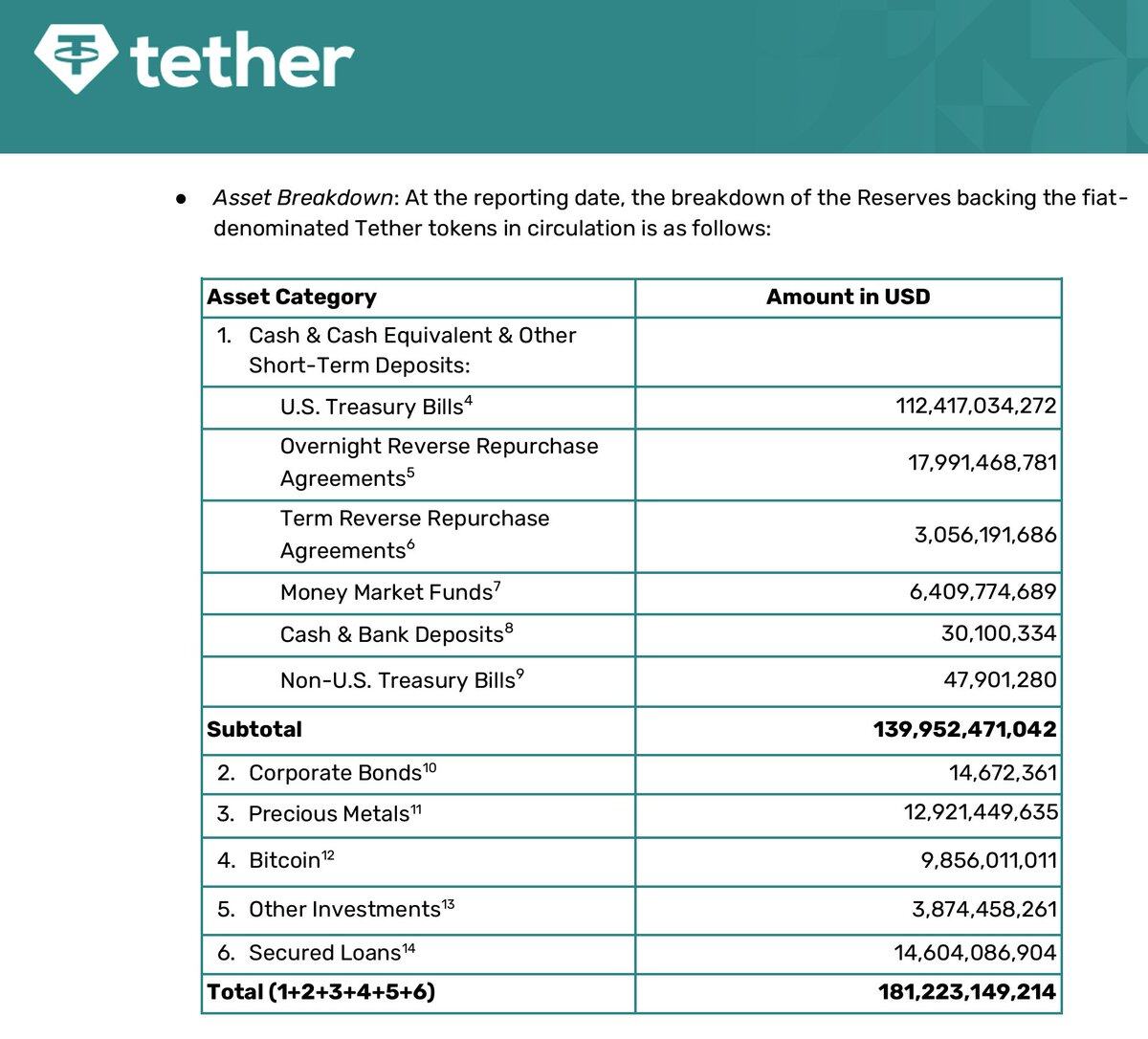

As shown in the image above, of Tether's total reserve assets of $181.223 billion, there are $12.921 billion in precious metal reserves (accounting for 7.1%) and $9.856 billion in Bitcoin reserves (accounting for 5.4%)—these two assets together account for 12.5% of Tether's total reserve assets.

From Tether's reserve structure, it can be seen that Arthur Hayes may have objectively pointed out an extreme situation that Tether could face based on this structure, namely that if the reserves of gold and Bitcoin depreciate significantly at the same time, theoretically, the value of Tether's reserve assets will not fully cover the issuance scale of USDT.

This point was also mentioned by the well-known rating agency S&P last week when downgrading Tether and USDT's stability rating (see "S&P Gives Tether the Worst Rating, Which Other Stablecoins Does It Favor?")—“The value of Tether's Bitcoin reserves accounts for about 5.6% of the total circulation of USDT (Note: S&P is comparing circulation here, so the proportion data will be slightly higher than when comparing reserves), exceeding the 3.9% over-collateralization rate of USDT itself, which means that other low-risk reserve assets (mainly government bonds) can no longer fully support the value of USDT. If the value of BTC and other high-risk assets declines, it may weaken USDT's reserve coverage, leading to under-collateralization of USDT.”

Is USDT Still Safe?

Arthur Hayes is actually referring to the same situation as S&P, but the likelihood of this situation occurring is actually very low for two reasons.

- First, it is hard to imagine a sudden crash in the prices of gold and Bitcoin (referring to a drop of at least several percentage points in a very short time). Even if there is a sustained downward trend, Tether theoretically has time to sell off to replenish the reserve ratio of low-risk assets.

- Second, in addition to reserve assets, Tether itself also holds a large amount of proprietary assets, which are sufficient to serve as a reserve buffer for USDT, maintaining the operation of this cash machine business.

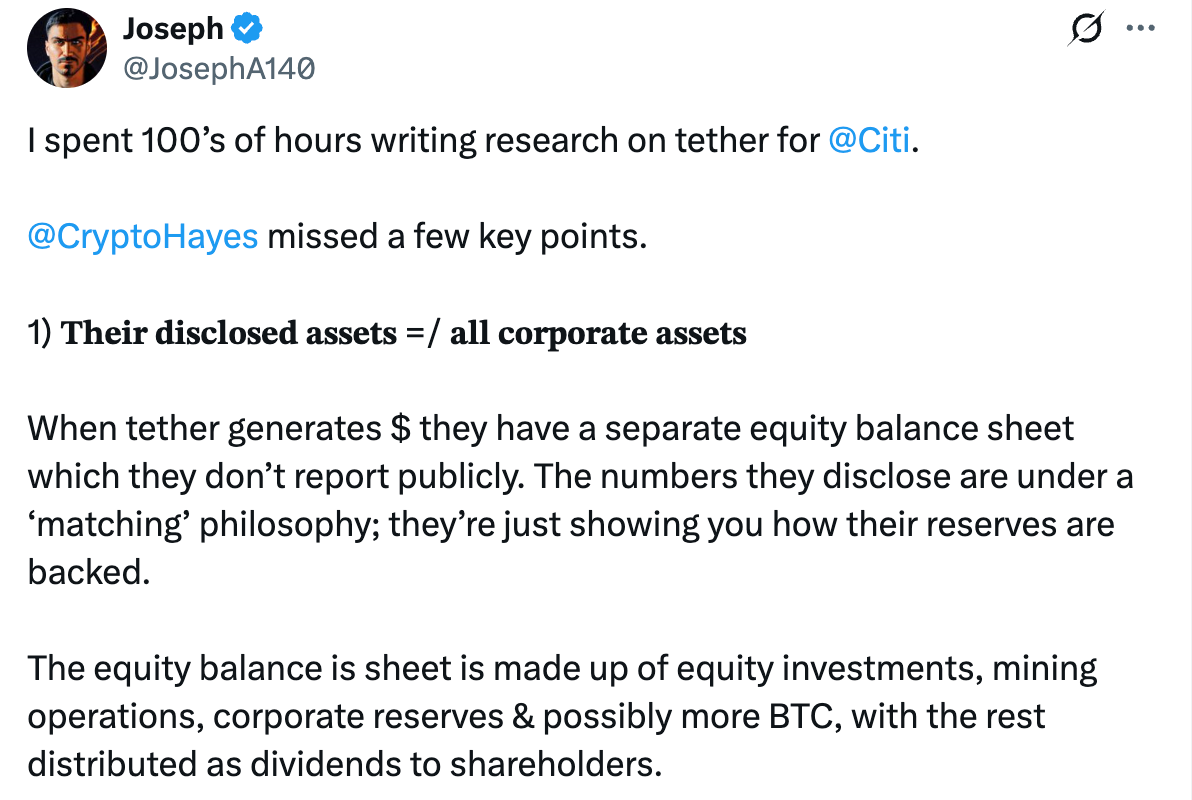

Joseph, former head of cryptocurrency research at Citigroup, also mentioned regarding the second point that the assets disclosed by Tether do not equal all the assets they hold—when Tether generates profits, they will have a separate equity asset balance sheet, which will not be publicly disclosed along with the reserve status; Tether is highly profitable, and its equity value is very high, allowing them to cover any gaps on the balance sheet by selling equity; Tether will not go bankrupt; on the contrary, they have a money printing machine.

Tether's Response

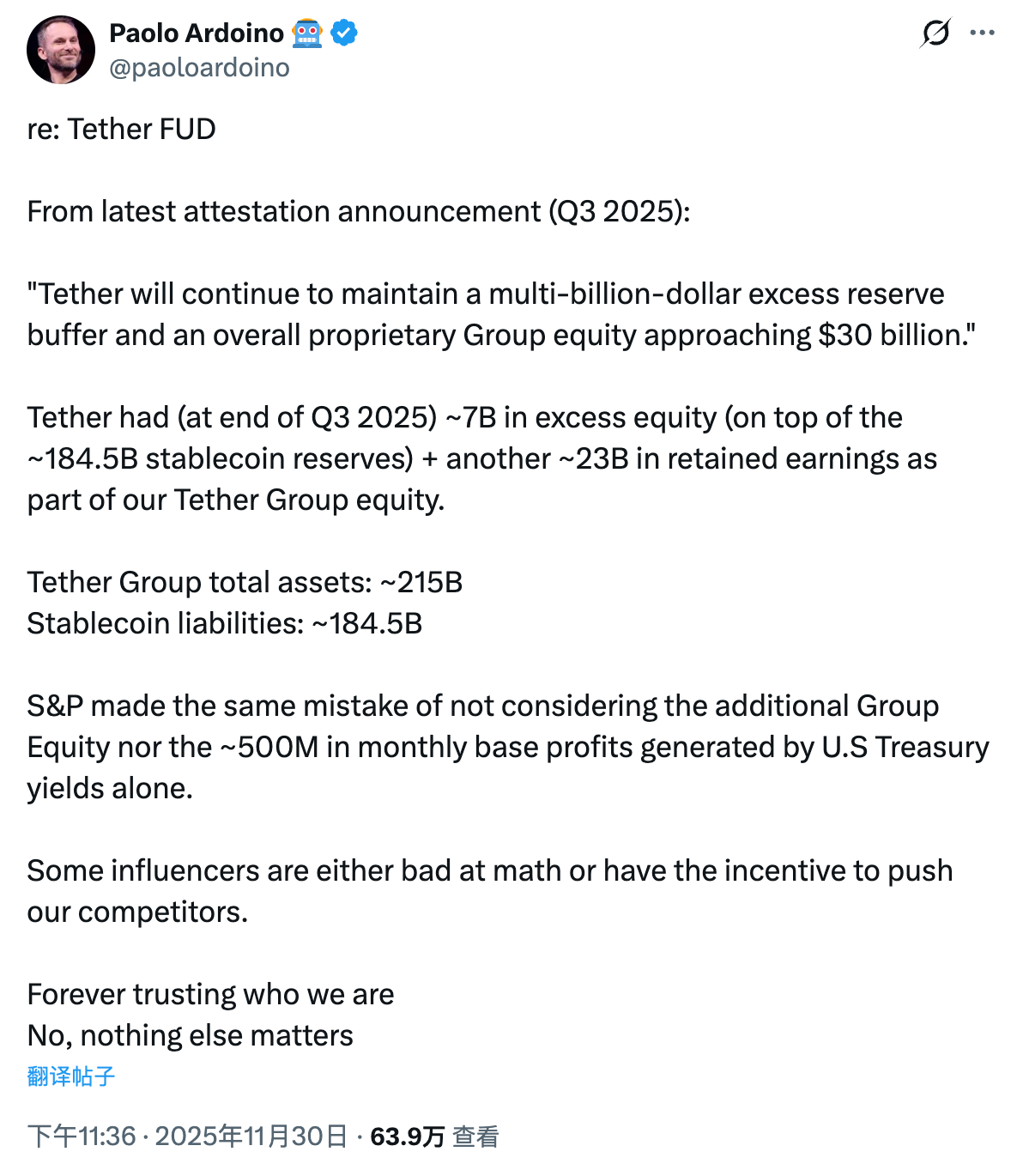

Last night, as the related FUD (Fear, Uncertainty, Doubt) escalated, Tether CEO Paolo Ardoino responded in a post, stating that by the end of the third quarter of 2025, Tether will have about $7 billion in excess equity (in addition to approximately $184.5 billion in stablecoin reserves) and an additional approximately $23 billion in retained earnings, which together constitute Tether Group's proprietary equity.

The comparison of assets and liabilities is clear:

- Total assets of Tether Group: approximately $215 billion;

- Stablecoin liabilities: approximately $184.5 billion;

S&P also made the same mistake, not accounting for these additional group equities and not considering the approximately $500 million in basic profits generated monthly solely from U.S. Treasury bond income.

Interestingly, Paolo Ardoino concluded with a remark: “Some influencers either have poor math skills or impure motives.”

- Note from Odaily: Arthur Hayes and his family office investment firm Maelstrom are one of the main investors in the interest-bearing stablecoin Ethena (USDe), which has predicted multiple times that USDe will become the largest stablecoin by issuance scale.

After Paolo Ardoino's direct response, Arthur Hayes also replied again, but his remarks were somewhat sarcastic: “You guys are making so much money, I’m so jealous. Do you have a specific dividend policy? Or a target over-collateralization rate set based on asset types (discounted by their volatility)? Clearly, when your liabilities are in dollars and your assets are in U.S. Treasury bonds, there are no issues, but if your assets are illiquid private investments, once an unexpected situation occurs, people may question your claims of over-collateralization.”

After this exchange, neither side continued to respond. This morning, Arthur Hayes did post again, but it was just to shout about the market rebound.

From the photos shared by Arthur Hayes, it seems that after cursing Monad and Tether, he is in a good mood…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。