Written by: Seed.eth

ALT5 Sigma is experiencing a typical "DAT" battlefield.

This company, listed on NASDAQ and originally focused on blockchain financial infrastructure, made a high-profile announcement in August this year to transform into a Digital Asset Treasury (DAT) company, planning to raise up to $1.5 billion, betting on the governance token of World Liberty Financial (WLFI) backed by the Trump family.

However, just three months later, the backlash came swiftly: the stock price plummeted nearly 80% from $9, briefly falling below $2. Internally, the CEO was suspended, employees received warnings of lawsuits and regulatory investigations; worse still, ALT5 was exposed by the well-known media outlet The Information for alleged money laundering by its subsidiary in Rwanda, and this critical information was not adequately disclosed to the board and investors during the negotiation and publicity phase of the World Liberty deal.

ALT5 is more like an "amplified sample" that has stepped through all the risks of the DAT model: chaotic internal governance, extreme concentration exposure to a single token, delayed or even missing information disclosure, and a stock price collapse under regulatory shadows.

But it is not an isolated case; rather, it is a microcosm of the entire DAT industry transitioning from "wealth myth" to "a mess" in 2025.

From 4 to 142: Explosive Growth Followed by Differentiation

The deeper reason for the attention on ALT5's turmoil is that the number and scale of DATs have experienced "exponential growth" in 2025.

A report titled "Digital Asset Treasury Companies (DATCo)" released by CoinGecko in November shows:

The number of DAT companies surged from 4 in 2020 to 142 in 2025;

In 2025 alone, 76 new companies were added, the highest in history;

"Pure treasury-type" DATs generally mimic the Strategy (formerly MicroStrategy) model, which began heavily investing in BTC in 2020;

The vast majority of DAT assets are Bitcoin:

Companies holding BTC ≈ 142

Companies holding ETH = 15

Companies holding SOL = 10

This means: DAT = an industry centered around BTC as the core asset.

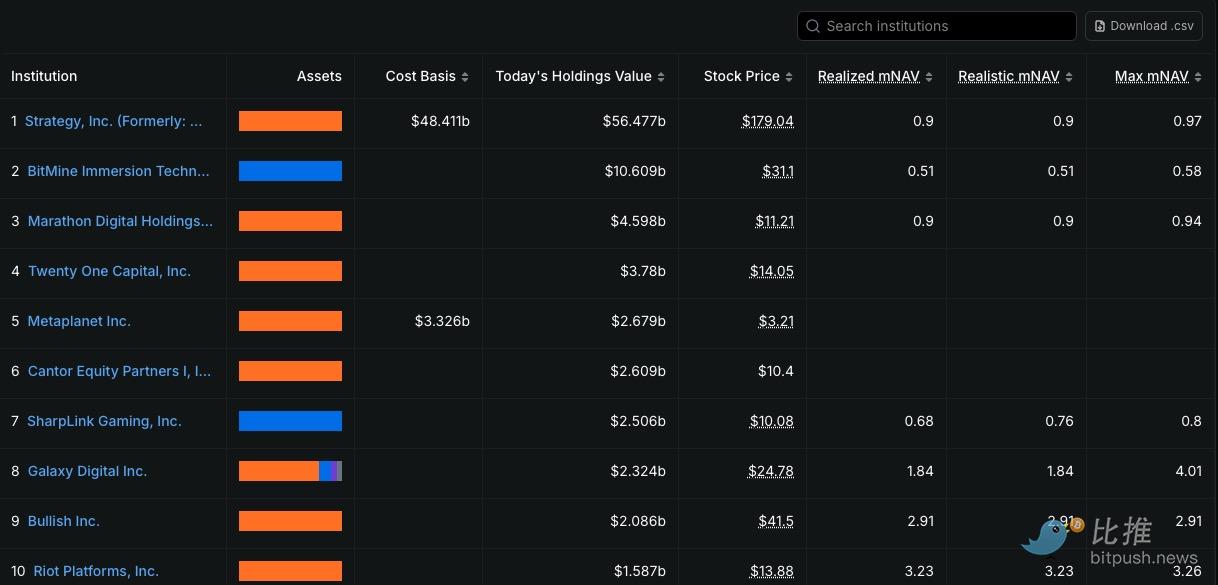

The latest data from DefiLlama shows:

Strategy remains the largest DAT globally, holding BTC worth $56.6 billion;

The second is BitMine, founded by Tom Lee, holding a total of approximately $10.6 billion in ETH and BTC.

This indicates that the DAT field has formed a typical structure of "huge heads and a broad tail."

However, behind the seemingly glamorous surface, risks are quietly accumulating.

As the overall crypto market retraced, the total market value of the DAT sector has evaporated over $77 billion from a peak of $176 billion, falling below the $100 billion mark.

Looking back at the first half of 2025, Bitcoin repeatedly hit new highs, and DAT companies exhibited astonishing high Beta properties—mainstream treasury stocks often rose several times more than Bitcoin, while the narrative-strong "altcoin treasury stocks" even saw tenfold increases.

However, when both policy and liquidity tightened in the fourth quarter, nearly a trillion dollars in market value evaporated from the crypto market, and DAT stock prices began a delayed and brutal "correction." Strategy fell 36% in November alone, Metaplanet retreated nearly 80% from its peak, and ALT5 became a "sample-level" case of a crash.

This exposes the fundamental weakness of DAT: its value relies entirely on treasury assets, not on business cash flow. When coin prices fall, its market value, financing ability, and market confidence will collapse in sync.

Bitwise CIO Matt Hougan recently pointed out in a tweet that in the first six months of this year, DAT stock prices exhibited highly synchronized rises and falls, resembling a basket of "crypto high-leverage indices"; but moving forward, differentiation will occur, "companies that can continuously increase their per-share holdings will trade at a premium; DATs with weak management and poor asset structures will continue to trade at a discount, and may even face acquisition or liquidation."

In other words, the collective frenzy period of DAT has ended, and the industry is entering a "screening period."

The Truth Behind Differentiation: Valuation Illusion, mNAV, and Hidden Risks

The valuation system of DAT has always relied on an important metric: mNAV (market NAV)

That is: the book value of treasury assets converted into per-share value, compared with the stock price to see if the company is "discounted."

However, several industry institutions have clearly pointed out:

mNAV creates a "false sense of security."

Galaxy Digital emphasized in a report in July:

Just because the books show how many coins are held does not mean they can be sold at that price. Especially for altcoin treasuries, with poor liquidity and high slippage, selling itself is a price disaster.

Animoca Brands pointed out:

mNAV completely ignores the debt structure of DAT. Many companies rely on convertible bonds and PIPE financing; although the book treasury appears large, the portion truly belonging to shareholders is continuously diluted.

Breed VC also reminded:

DATs without a main business will see operational losses continuously erode treasury value; while the book assets look impressive, the actual free assets are decreasing year by year.

Bitwise CIO Matt Hougan added:

The costs and risks of DAT are "compounding over time," rather than static.

For ordinary investors, the issues with mNAV can be simply understood in four statements:

Book value ≠ realizable value

Treasury assets ≠ assets shareholders can access

Liabilities, dilution, and expenses will erode the treasury

Governance and regulatory events can turn discounts into traps instantly

Therefore, mNAV can only serve as a starting point, not as a "value anchor" for DAT; "structural risks" are the most important mainline.

In other words, the DAT industry is being forced to "return to operational logic"—scale, cash flow, governance, and transparency are becoming new competitive barriers.

How Can DAT Save Itself?

In the face of plummeting stock prices and regulatory pressure, DAT companies are trying different paths for self-rescue.

One of the most common actions is to directly sell part of the treasury assets to alleviate debt or maintain operations. For example, Japan's Metaplanet sold some Bitcoin positions after a significant drop in stock price this autumn to pay off short-term debts, which temporarily stopped the bleeding in its stock price. However, this approach can only solve immediate problems and weakens the "treasury story" itself, making it difficult to restore long-term confidence.

In contrast, some financially stronger companies choose to replicate Strategy's path—continuing to increase holdings during the retracement. Strategy (formerly MicroStrategy) continued to buy BTC through convertible bonds during the past two downturns, resulting in an increase in "per-share holdings," which made it one of the first companies in the industry to recover its premium during the rebound in 2024-2025. Similar strategies have also been adopted by larger DATs like BitMine, but for small and medium-sized companies, this path requires strong financing capabilities, and the cost of failure is extremely high.

Another trend is closer to "transformational self-rescue." Some mining-related DATs, such as Core Scientific, Hut 8, and Iris Energy, are outsourcing their computing power or technical capabilities to AI, nodes, clearing, and custody businesses to reduce dependence on a single coin price. They are beginning to transition from "treasury-driven valuation" to "cash flow-driven valuation," and although the transformation is still in its early stages, it at least provides a new narrative support for treasury stocks.

Regulatory pressure is also changing the behavior of DATs. This year, the U.S. SEC has requested several DATs to provide detailed disclosures on treasury pricing methods, convertible bond structures, and audit arrangements. Influenced by regulatory signals, large DATs like Strategy and BitMine have begun to introduce more frequent treasury proofs and even collaborate with the Big Four for real-time audits. While the increase in transparency brings short-term costs, it may become the only path to earn investors' trust in the future.

Overall, the "self-rescue" of DATs is heading down three distinctly different paths:

Companies capable of continuous financing choose to increase their positions against the trend, attempting to sustain the "growth treasury" narrative;

Companies with technological or resource advantages are transitioning towards operational capabilities, striving to break free from single reliance on coin prices;

Meanwhile, small and medium DATs lacking cash flow and financing channels can only survive by selling off assets.

The operational logic of the industry has shifted from "just buy coins to rise" to "competition based on scale, transparency, and governance capabilities."

In the future, the DATs that can truly navigate through cycles are likely to be those holding highly liquid core assets, possessing stable business and acquisition capabilities, and continuously improving in governance and disclosure.

More small and medium DATs, after losing liquidity, financing, and narrative, will ultimately be eliminated in the cracks of market volatility and tightening regulations.

This means that with the end of the frenzy era, the DAT industry is facing a real "race for survival" —

Who can survive? It will depend on things beyond the treasury.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。