Original Author: Eric, Foresight News

What should be the reasonable price of ETH?

The market has provided numerous valuation models for this question. Unlike Bitcoin, which has already established itself as a commodity asset, Ethereum, as a smart contract platform, should be able to summarize a reasonable and recognized valuation system. However, it seems that the Web3 industry has yet to reach a consensus on this matter.

Recently, Hashed launched a website that presented 10 valuation models that may have relatively high market recognition. Among the 10 models, 8 showed that Ethereum is undervalued, with a weighted average price exceeding $4,700.

So how is this price, which is close to an all-time high, calculated?

From TVL to Staking to Revenue

Hashed categorized the 10 models into three reliability levels: low, medium, and high. Let's start with the low-reliability valuation models.

TVL Multiplier

This model suggests that Ethereum's valuation should be a multiple of its DeFi TVL, linking market capitalization directly to TVL. Hashed used the average market cap to TVL ratio from 2020 to 2023 (interpreted as the period from the start of DeFi Summer until the complexity of nested protocols became less severe), which is 7 times. By multiplying the current DeFi TVL on Ethereum by 7 and dividing by the supply, the price calculated is $4,128.9, indicating a 36.5% upside from the current price.

This rough calculation method, which only considers DeFi TVL and cannot accurately derive the actual TVL due to complex nesting, indeed deserves its low reliability rating.

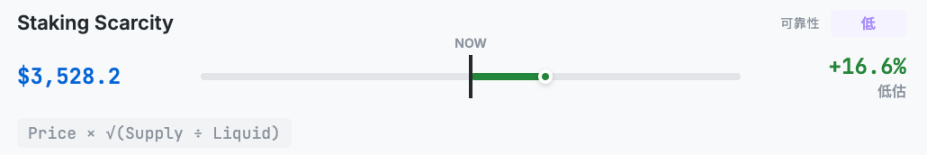

Staking-Induced Scarcity Premium

This model considers that Ethereum that cannot circulate in the market due to staking increases Ethereum's "scarcity." The price is calculated by multiplying the current price of Ethereum by the square root of the ratio of total supply to circulating supply, i.e., Price × √(Supply ÷ Liquid), resulting in a price of $3,528.2, which has a 16.6% upside from the current price.

This model was developed by Hashed, and the square root calculation is intended to mitigate extreme cases. However, according to this algorithm, ETH is always undervalued, not to mention the issues of the rationality of considering only the "scarcity" brought by staking and the additional liquidity from the release of staked ETH through LST, which is also quite rough.

Mainnet + L2 TVL Multiplier

Similar to the first valuation model, this model adds all L2 TVL and gives a 2x weighting due to L2's consumption of Ethereum. The calculation method is (TVL + L2_TVL×2) × 6 ÷ Supply, resulting in a price of $4,732.5, indicating a 56.6% upside from the current price.

As for the number 6, although not explained, it is likely derived from historical data. While it accounts for L2, this valuation method still purely references TVL data and does not improve significantly over the first method.

"Commitment" Premium

This method is also similar to the second model but adds Ethereum locked in DeFi protocols. The multiplier in this model is derived from the total amount of staked and locked ETH divided by the total supply of ETH, representing a premium percentage brought by "long-term holding belief and lower liquidity supply." By adding 1 to this percentage and multiplying by a "commitment" asset value premium index of 1.5, the reasonable ETH price under this model is calculated. The formula is: Price × [1+(Staked + DeFi) ÷ Supply]× Multiplier, resulting in a price of $5,097.8, indicating a 69.1% upside from the current price.

Hashed states that this model is inspired by the concept that L1 tokens should be viewed as currency rather than stocks, but it still falls into the issue of reasonable prices always being higher than the current price.

The biggest problem with these four low-reliability valuation methods is their lack of rationality due to their single-dimensional considerations. For example, higher TVL data is not always better; providing better liquidity with lower TVL could be an improvement. As for viewing non-circulating Ethereum as a form of scarcity or loyalty that generates a premium, it seems unable to explain how to value it once the price actually reaches the expected level.

Having discussed the four low-reliability valuation methods, let's look at five medium-reliability options.

Market Cap / TVL Fair Value

This model is essentially a mean-reversion model, calculating by assuming the historical average market cap to TVL ratio is 6 times. If it exceeds this, it is considered overvalued; if not, it is undervalued. The formula is Price × (6 ÷ Current Ratio), resulting in a price of $3,541.1, indicating a 17.3% upside from the current price.

This calculation method superficially references TVL data but actually refers to historical patterns, using a relatively conservative approach to valuation, which indeed seems more reasonable than simply referencing TVL.

Metcalfe's Law

Metcalfe's Law is a principle regarding the value of a network and the development of network technology, proposed by George Gilder in 1993 but named after Robert Metcalfe, a pioneer of computer networks and founder of 3Com, in recognition of his contributions to Ethernet. The content states that the value of a network is equal to the square of the number of nodes within that network, and the value of the network is proportional to the square of the number of connected users.

Hashed states that this model has been empirically validated by academic researchers (Alabi 2017, Peterson 2018) for Bitcoin and Ethereum. Here, TVL is used as a proxy indicator of network activity. The calculation formula is 2 × (TVL/1B)^1.5 × 1B ÷ Supply, resulting in a price of $9,957.6, indicating a 231.6% upside from the current price.

This is a relatively professional model, also marked by Hashed as having strong historical correlation and academic validation, but still considers TVL as the sole factor, which seems biased.

Discounted Cash Flow Method

This valuation model is currently the most company-like way of viewing Ethereum, treating Ethereum's staking rewards as income and calculating current value through the discounted cash flow method. Hashed provides the calculation method as Price × (1 + APR) ÷ (0.10 - 0.03), where 10% is the discount rate and 3% is the perpetual growth rate. This formula is clearly problematic; the actual calculation should be Price × APR ×(1/1.07+1/1.07^2+…+1/1.07^n) as n approaches infinity.

Even using the formula provided by Hashed, it cannot yield this result. If calculated with a 2.6% annualized rate, the actual reasonable price should be around 37% of the current price.

Valuation by Price-to-Sales Ratio

In Ethereum's case, the price-to-sales ratio refers to the ratio of market cap to annual transaction fee income. Since fees ultimately flow to validators, there is no concept of price-to-earnings ratio in the network. Token Terminal uses this method for valuation, with 25 times being the valuation level for growth tech stocks, which Hashed refers to as the "industry standard for L1 protocol valuation." The model's calculation formula is Annual_Fees × 25 ÷ Supply, resulting in a price of $1,285.7, indicating a 57.5% downside from the current price.

The above two examples show that using traditional valuation methods, Ethereum's price is severely overvalued. However, it is clear that Ethereum is not an application, and adopting this valuation method seems fundamentally flawed in the author's view.

On-Chain Total Asset Valuation

This valuation model appears to be nonsensical at first glance but seems to make some sense upon further reflection. Its core idea is that to ensure network security, Ethereum's market cap should match the total value of all assets settled on it. Therefore, the calculation method is straightforward: the total value of all assets on Ethereum, including stablecoins, ERC-20 tokens, NFTs, etc., divided by Ethereum's total supply. The result is $4,923.5, indicating a 62.9% upside from the current price.

This is currently the simplest valuation model, and its core assumption gives a feeling that something seems off, but it is hard to pinpoint what exactly is wrong.

Yield Bond Model

The only high-reliability valuation model among all the valuation models is one that Hashed claims is favored by TradFi analysts who assess cryptocurrencies as an alternative asset class, which values Ethereum as a yield-bearing bond. The calculation method is to divide Ethereum's annual revenue by the staking yield to calculate the total market cap, with the formula being Annual_Revenue ÷ APR ÷ Supply, resulting in a value of $1,941.5, indicating a 36.7% downside from the current price.

This is the only valuation model considered high reliability, possibly due to its widespread adoption in the financial sector, and it serves as another example of Ethereum's price being "undervalued" through traditional valuation methods. Therefore, this may be a good piece of evidence that Ethereum is not a security.

Valuing Public Chains May Require Considering Multiple Factors

The valuation system for public chain tokens may need to consider various factors, and Hashed weighted the above 10 methods based on reliability, resulting in a value of around $4,766. However, given the potential inaccuracies in the discounted cash flow method, the actual result may be slightly lower than this figure.

If I were to value Ethereum, my core algorithm might focus on supply and demand. Since Ethereum is a "currency" with practical uses, whether for paying gas fees, purchasing NFTs, or forming LPs, ETH is required. Therefore, it may be necessary to calculate a parameter that can measure the supply and demand relationship of ETH over a certain period based on the level of network activity, and then combine it with the actual transaction costs on Ethereum to derive a fair price by comparing it to historical prices under similar parameters.

However, based on this method, if the growth in activity on Ethereum does not keep pace with the decline in costs, there is reason for ETH's price to stagnate. In fact, the level of activity on Ethereum has, at times over the past two years, exceeded that during the 2021 bull market. However, due to the decline in costs, the demand for Ethereum has not been high, leading to an actual oversupply of Ethereum.

Nonetheless, the only aspect that this historical comparison-based valuation method cannot account for is Ethereum's potential. Perhaps at some point, when the DeFi boom re-emerges on Ethereum, we will need to factor in a "market dream rate."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。