Original | Odaily Planet Daily (@OdailyChina)

Recently, spot ETFs for XRP, DOGE, LTC, HBAR, and other assets have quietly landed in the U.S. market, while similar products for AVAX, LINK, and others are currently in the approval process. Since November began, the approval pace for altcoin ETFs has significantly accelerated. Compared to the decade-long wait for Bitcoin ETFs, these similar products have completed the entire process in just a few months, which is remarkable. For example, the DOGE and XRP spot ETFs launched by Grayscale were listed on NYSE Arca on November 24. All of this seems to indicate that the compliance process for altcoin assets is moving towards a more institutionalized new phase.

The recent surge in altcoin ETFs can be attributed to two key mechanisms that perfectly complemented each other from the end of October to mid-November, combined with the concentrated processing of backlogged approval documents following the end of the government shutdown, which collectively propelled this wave of listings.

General Listing Standards Implemented: The "Institutional Highway" for Altcoin ETFs Officially Opens

First, on September 17, 2025, the SEC officially approved the "General Listing Standards for Commodity Trust Shares" proposed by three major exchanges (Nasdaq, NYSE Arca, Cboe BZX). This rule changed the approval logic on the exchange side.

In the past, any cryptocurrency asset wishing to list an ETF had to submit a 19b-4 rule change and wait for over 240 days for the SEC's step-by-step review. The new general standard changed this logic:

As long as any of the following conditions are met, the asset can "automatically apply the standard and enter the listing process":

- It has at least 6 months of trading history in a CFTC-regulated futures market and has an effective market surveillance agreement;

- The existing listed ETFs have an exposure rate to the asset of over 40%.

This means that eligible altcoins no longer need to "knock on the door" separately but can directly enter the fast lane set by the system. The review period on the exchange side has been shortened from 240 days to 60–75 days, improving efficiency by 3–4 times. On October 3, REX-Osprey took advantage of this to submit 21 single-asset and staking ETFs for registration in one go, marking the beginning of a batch processing era. However, this rule's benefits were temporarily "frozen" in October.

Retaliatory Cleanup After the Government Shutdown: SEC Moves from "Frozen" to "Full Speed Ahead"

In October 2025, the U.S. federal government experienced a shutdown lasting over a month, leading to severe staff shortages in the SEC's review department, causing all cryptocurrency ETF applications (including Dogecoin, Litecoin, Solana, etc.) to be forcibly shelved, totaling over 130 cases. After the shutdown ended, in order to showcase a "new government, new atmosphere" in the shortest time possible, the SEC released two significant guidance documents in November:

- On November 13, the SEC published the "Orderly Resumption Framework for Review After the Shutdown," clarifying the priority for processing backlogged applications;

- On November 14, the SEC further released the "Application Guidelines for Section 8(a) in Cryptocurrency ETFs," allowing issuers to proactively remove "delay amendment clauses" for the first time.

The most decisive factor among these is Section 8(a). It means that as long as the SEC does not issue a stop order within 20 days after the S-1 effective filing, the ETF is automatically approved.

This effectively provides the market with an "automatic approval" mechanism, compressing the previously multi-step SEC review process, which often took months, down to a minimum of 20 days, improving efficiency by over 12 times.

Thus, when the "general listing standards on the exchange side" and the "8(a) fast track on the registration side" took effect simultaneously, the over 130 applications accumulated in October were released in a concentrated manner in November—leading to a natural explosion of altcoin ETFs.

Performance of Altcoin ETFs: Overall Limited by the Market, SOL Performs Slightly Better

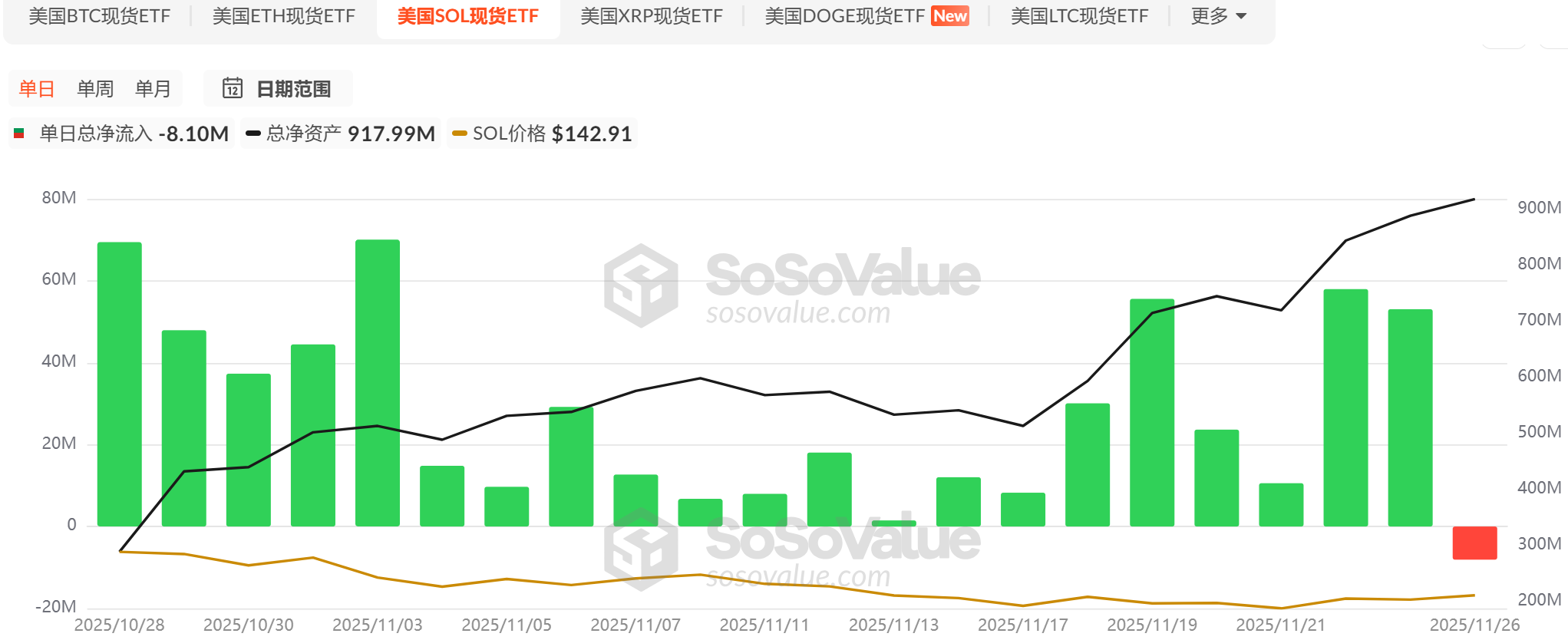

The Solana ETF is the first altcoin ETF to successfully launch recently. According to sosovalue data, as of now, 6 issuers have launched SOL spot ETFs, including Bitwise, Grayscale, 21Shares, etc. Since its launch on October 28, the SOL ETF has seen a continuous net inflow for 21 days, with a cumulative scale exceeding $600 million; on November 26, it experienced its first net outflow, with a single-day net outflow exceeding $800,000.

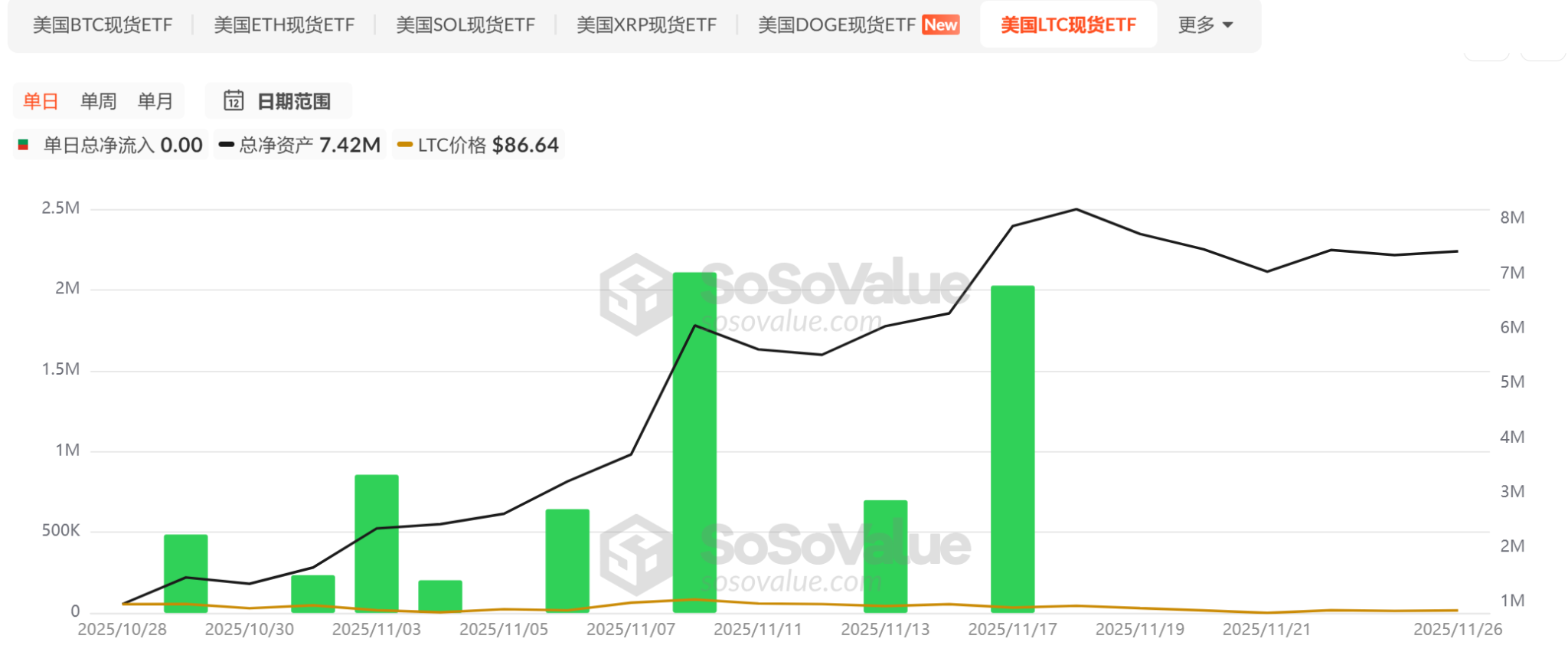

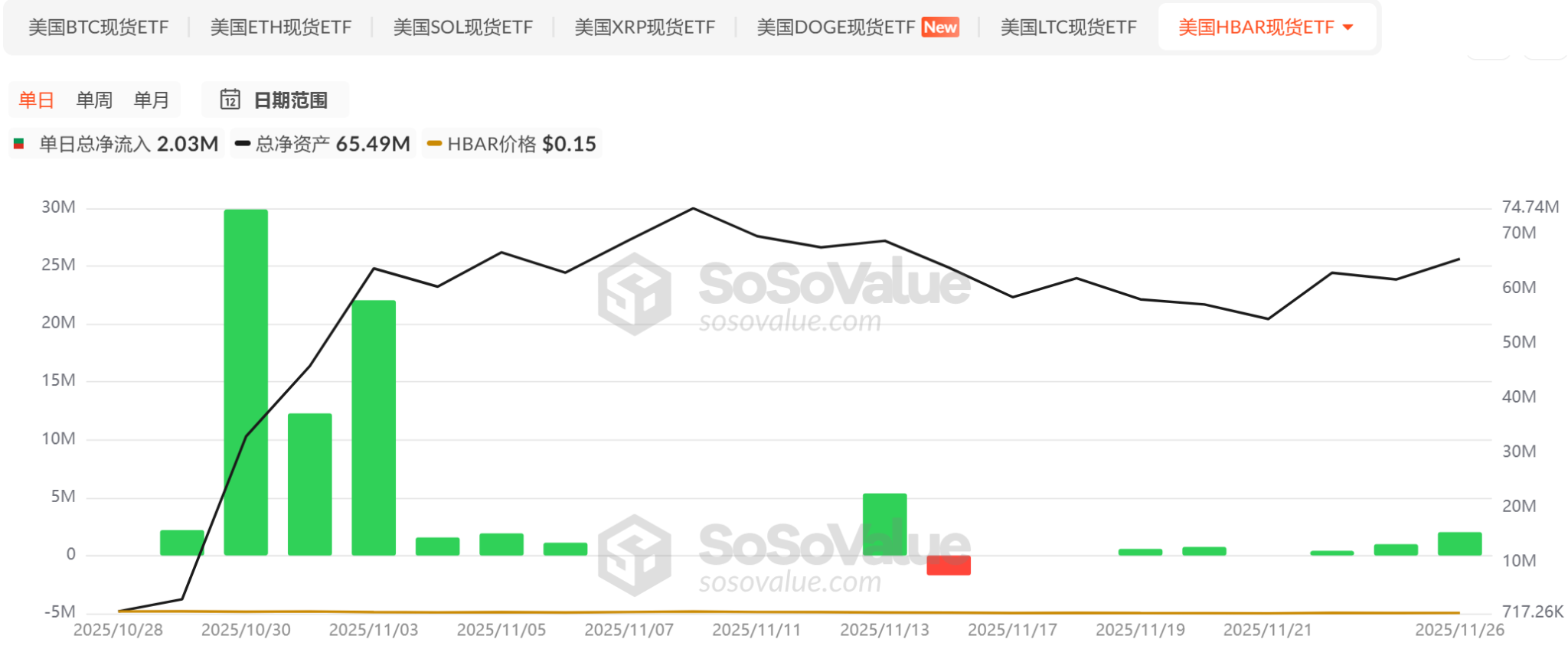

Both the LTC and HBAR spot ETFs were issued by Canary and launched simultaneously on October 29, but their issuance scales are far below that of the SOL spot ETF. The former has a cumulative net inflow of $7.26 million, while the latter has a cumulative net inflow of $79.46 million. Although both saw net inflows in the first few days after launch, the net inflows over the past week have been negligible or even non-existent.

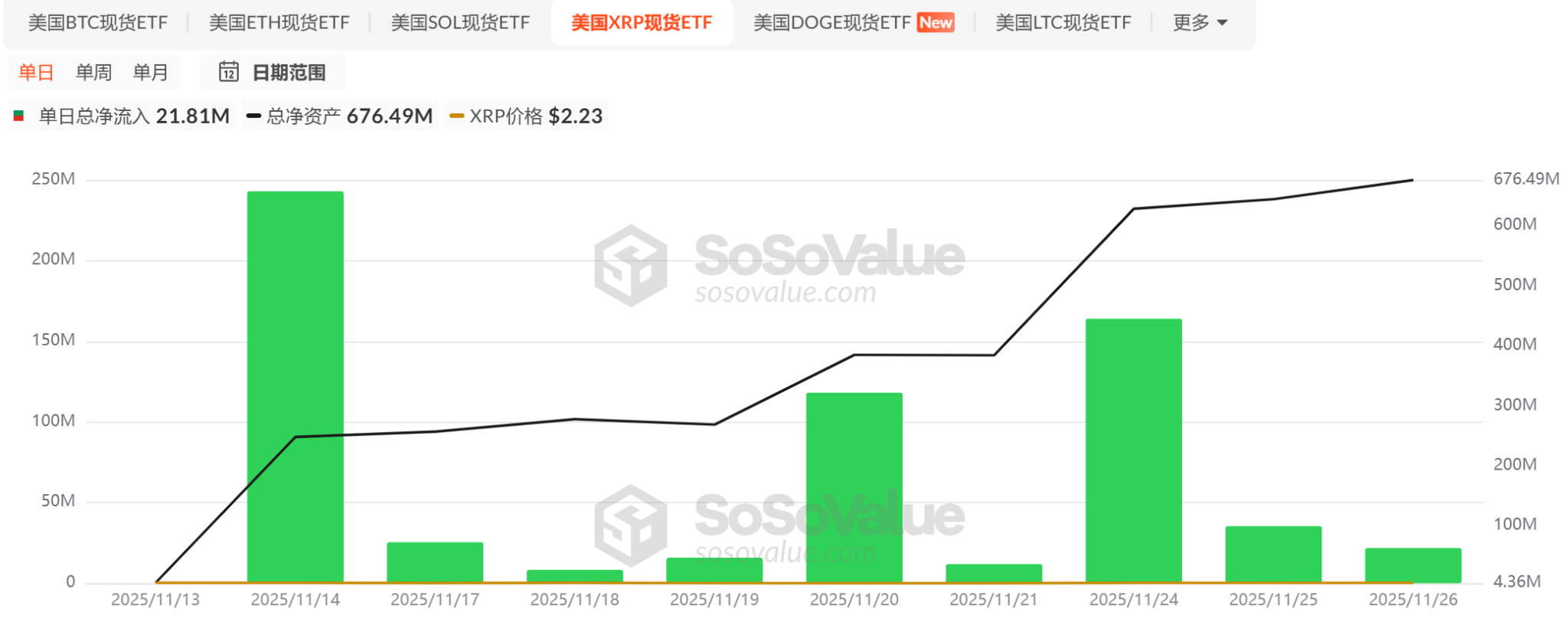

The XRP spot ETF launched on November 13, and currently, there are 4 issuers with a cumulative net inflow of $64.39 million. In terms of launch time and issuance scale, it performs below SOL and HBAR.

However, the overall market environment in November has not been friendly. Although BTC briefly stopped falling on November 22, it still hovers in a weak rebound range, and risk appetite has not quickly recovered. The emergence of altcoin ETFs has not brought strong price recovery to these altcoin assets. Perhaps the true significance of altcoin ETFs lies in the fact that the U.S. regulatory system has, for the first time, normalized "cryptocurrency assets" as a scalable asset class within the ETF mechanism, incorporating them into the institutional pipeline. However, market prices will ultimately be determined by a complex interplay of macro liquidity, asset fundamentals, risk appetite, and other factors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。