We are about to experience a honeymoon period in the market, which is likely to be divided into two phases: the first phase is from this week to December 10, and the second phase is from December 10 to Christmas. Overall, the trend may show an initial rise followed by a decline.

Currently, three major certain directions will create market opportunities:

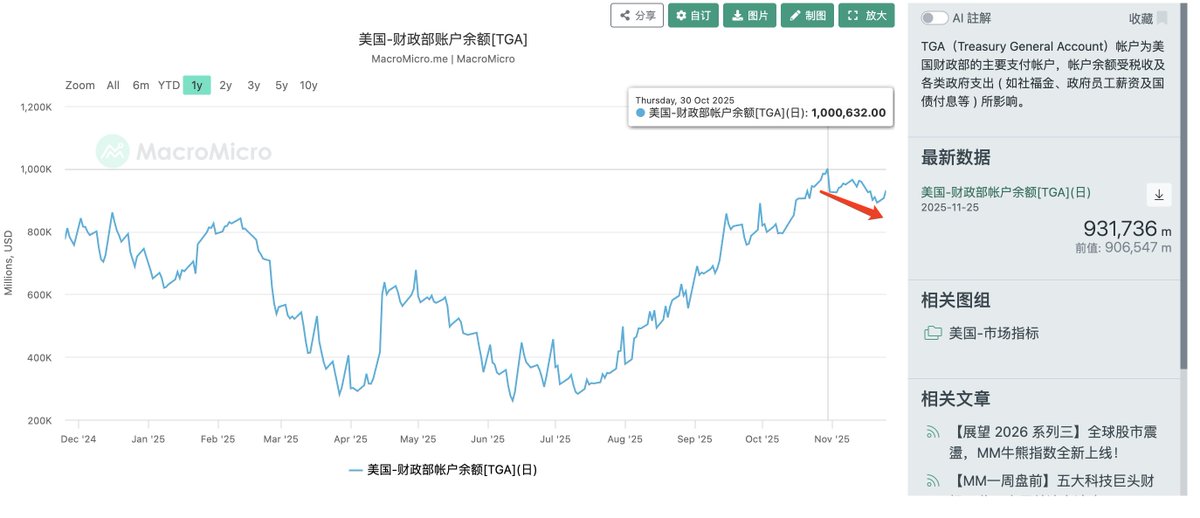

1️⃣ The U.S. Treasury's TGA account will replenish market liquidity, with an estimated release of around $300 billion in liquidity over the next 3-6 weeks.

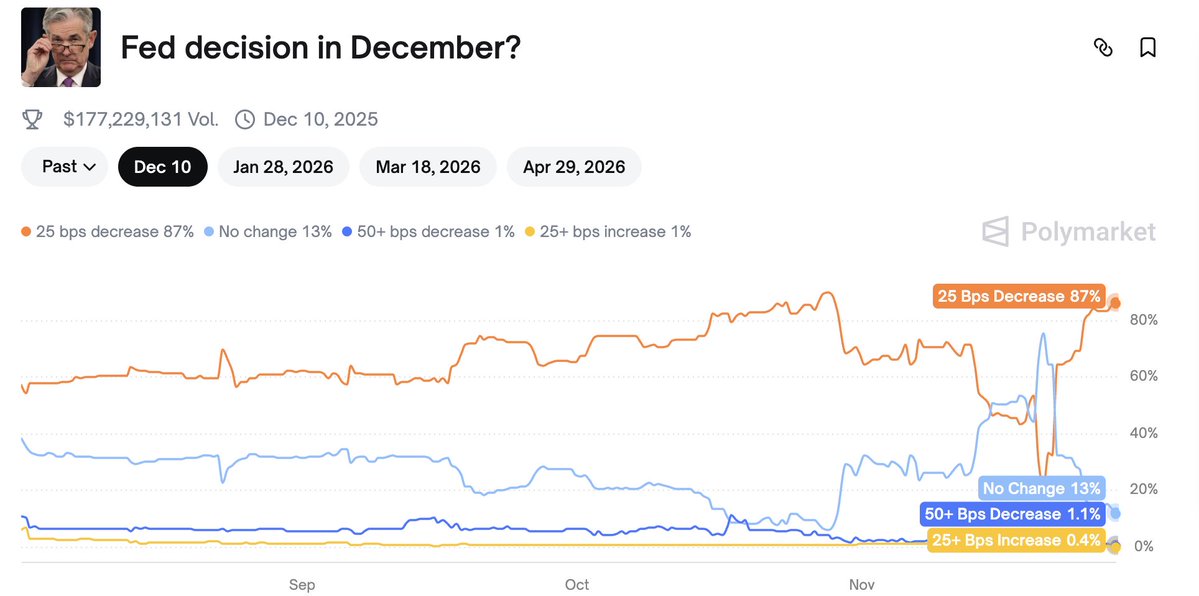

2️⃣ The probability of an interest rate cut on December 10 has significantly increased. Currently, the probability of a 25 basis point cut in December on Polymarket has risen to 87%, and the market will start to speculate on the potential benefits of the rate cut.

3️⃣ On December 1, the Federal Reserve began to stop reducing its balance sheet and announced a new round of Treasury bond purchases in January to alleviate market pressure.

In addition, recent geopolitical and external market conditions are relatively calm. This brief window period is worth looking forward to, but it is important to note that after December 10, the implementation of the interest rate cut until Christmas is historically a time when market liquidity is relatively tight, and the market may reverse. This could be a good time to take profits! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。