Original Author: Star@Day1Gobal Podcast (X: starzq)

Currently, Polymarket and Kalshi are valued at $15 billion and $12 billion, respectively, with Kalshi's annual revenue expected to be $60 million, reaching a 200x PS.

Why are VCs willing to give such high multiples? This article attempts to provide some answers.

I have been following prediction markets for over a year and am curious about this question. I have done some research to try to answer it, as well as to understand what stage these two companies are currently in, how much room for growth they have, and to compare them with ByteDance:

Initially, VCs did not see the value in "news apps" and mostly passed on "ByteDance"; ultimately, "ByteDance" transformed into a "recommendation engine," using the tool of "recommendation" to almost redo all internet businesses, reaching a market value of $500 billion.

Could Polymarket and Kalshi use their "prediction" capabilities to replicate this in other industries? What are the possible ways to participate and position themselves?

Additionally, I recommend reading this article first https://x.com/starzq/status/1993486485170143499?s=20

【Table of Contents】

- Five Final Forms and Corresponding Valuations

- Where do Polymarket / Kalshi stand in A/B/C/D/E?

- Polymarket vs ByteDance: A Comparison of Financing and Valuation, which stage is it roughly equivalent to in ByteDance?

- Easter Egg: Ways to Position

Disclaimer: All discussions in this article are not investment advice, but merely a record of valuation thinking. Additionally, this article was completed by me and ChatGPT together.

1. Five Final Forms and Corresponding Valuations

In my view, the ultimate form of prediction markets can be roughly divided into five levels:

- A: Event Derivatives Exchange

- B: Parametric Insurance Infrastructure

- C: Decision & Governance "Truth Layer"

- D: AI Probability Data & World Prediction OS

- E: Prediction-native Social Media

The higher you go, the more abstract the narrative becomes, and the greater the valuation imagination.

Let's break it down layer by layer.

1.1 Form A: Event Derivatives Exchange

Keywords: YES/NO contracts, Fed, CPI, elections Valuation Imagination: Tens of billions to one or two hundred billion dollars

The story at this level is the easiest to understand:

- Transform questions like "Will there be a rate hike?", "Will CPI exceed 3%?", "Who will win the election?" into tradable standardized contracts;

- Each event corresponds to a pair of YES / NO shares, which settle to either $1 or zero;

- Price = Probability, 0.32 ≈ 32%.

From this level, the prediction market is essentially a "new asset class branch of CME / Binance":

- Users / Hedge funds / Market makers: Use event contracts to hedge macro risks (Fed, inflation, unemployment rate), or purely for speculation;

- Exchanges: Make money through transaction fees, clearing fees, and matching fees.

A very rough valuation logic:

- Assume achieving annual transaction volume of $100–300 billion;

- Fee rate (including implicit income) 0.1–0.2%;

- Annual revenue = $100–600 million;

- Valued as a "high-growth exchange / financial infrastructure" at 10–15x PS is relatively easy for the market to accept;

→ Corresponding valuation upper limit = $1–9 billion.

If you are a bit more optimistic and believe it can achieve:

- Over $500 billion in annual transaction volume

- Annual revenue of $500–1 billion;

Then purely at level A, it can support a $5–20 billion ceiling, already on par with mainstream crypto exchanges and some mid-sized CBOE / CME business lines.

1.2 Form B: Parametric Insurance Infrastructure

Keywords: Natural disasters / Floods / Agriculture / Business interruption Valuation Imagination: An additional layer of "50–200 billion dollars" on top of A

Layer B pushes "speculation / hedging" a step further, directly targeting the traditional insurance industry.

Parametric Insurance logic is:

- You are not insuring against "loss amount," but against a "observable trigger": Typhoon wind speed > 80 mph (this case shared earlier is very vivid) Rainfall > a certain threshold Certain index drop > X%

- Once the condition is triggered, it automatically pays out; otherwise, you get nothing.

The YES / NO contracts in prediction markets are essentially a "parametric trigger," just expressed differently. If a platform successfully operates at layer B:

- Upstream: Connect with insurance companies / reinsurance companies / corporate risk management departments;

- Downstream: Use event contracts to abstract various natural disaster / climate / business interruption risks;

- What it collects is not the full premium, but rather infrastructure / clearing / data usage fees;

Then it will transform into:

"The routing layer for global parametric risk + reinsurance matching platform," rather than just a "gambling platform."

How to think about valuation?

- Global P&C / Cat / Specialty insurance premiums are in the trillions of dollars;

- A small portion of that (e.g., 1–3%) can be abstracted into parametric forms;

- A portion of that can be priced and matched through platforms like Polymarket / Kalshi.

This layer brings the platform an additional potential for hundreds of millions of dollars in revenue:

- Conservative: An additional $100–300 million in infra fees per year;

- Aggressive: Achieving $500–1 billion.

Adding the portion from the A layer event exchange, the A+B combined ceiling could reach $10–30 billion.

1.3 Form C: Decision & Governance "Truth Layer"

Keywords: Truth price, policy sandbox, corporate prediction market Valuation Imagination: An additional "Bloomberg / MSCI style" premium, in the $30–80 billion range

If the prices in prediction markets prove to be closer to the true probabilities than:

- Polls

- Media

- Expert interviews

Then it can easily become a "probability dashboard" in various decision-making processes:

- Government: Before implementing a policy, check how the implied probabilities of related events change;

- Corporations: Internally budget, open employee prediction markets, and gather the "collective wisdom" of the organization;

- Investment institutions: Directly integrate event prices into strategies (e.g., the probability of excessive rate hikes / no hikes).

At layer C, the platform is no longer just selling "contracts," but:

- Probability data APIs;

- Decision & governance tools;

- Various "event indices," "risk factors," and associated index licensing.

This is somewhat like: Bloomberg + MSCI + a bit of Palantir.

If A+B can already contribute $500–1 billion in annual revenue, then layer C could potentially add:

- Several hundred million to over a billion dollars in data / tools / index licensing revenue;

- Forming a comprehensive "event & probability infrastructure" with $1–2 billion in annual revenue.

Using the logic of "high-stickiness data infrastructure + financial infrastructure" to give 15–25x PS, the valuation would naturally slide into the $30–50+ billion range.

1.4 Form D: AI Probability Data & World Prediction OS

Keywords: World model training, feedback data sets Valuation Imagination: Pushing towards the "hundred billion dollar" tier

Layer D is the most abstract but also the easiest to discuss seriously in recent years:

Prediction markets = A set of "probability datasets with monetary gains and losses, timestamps, and result feedback."

For AI, this is fundamentally different from ordinary text:

- Text: Can only learn "how humans speak" and "emotions";

- Prediction markets: Can learn "how people assign probabilities to events under different information sets"; each sample has a "post-truth" to compare against; naturally suitable for world model calibration and reinforcement learning.

If a platform truly succeeds at layer D:

- Open prediction task APIs for AI models;

- Provide agents with an environment of "continuous betting / being wrong / being rewarded";

- Evaluate and rank the predictive capabilities of humans and AI using a unified metric;

Then its role in the AI ecosystem would be close to:

"A probability version of data OpenAI + Kaggle + financial sandbox."

At this point, A/B/C bring "steady cash flow," while D brings:

- "High valuation, high premium" stories ——

- Also the key to pulling the entire narrative from hundreds of billions to a trillion.

1.5 Form E: Prediction-native Social Media

Keywords: Opinions + Positions + Timeline Valuation Imagination: Adding a layer of "ByteDance-style Attention premium" to the entire story

The final layer is the most imaginative: a new type of social media.

Traditional social media revolves around:

- People: Who you follow;

- Content: What you scroll through;

- Interaction: Likes / comments / shares.

In the prediction-native social media form, there is an additional dimension:

"How much are you betting on this matter?"

The same "topic card" can simultaneously carry:

- Events: For example, "Can Trump win?" "Will NVDA double next year?";

- Prices: Current implied probabilities on Polymarket / Kalshi;

- Opinions: Long analyses, short comments, memes;

- Positions: Who stands on which side, and what are their past prediction records.

User behavior will also shift from:

Seeing a topic → Liking / Watching

to:

Seeing a topic → Checking odds → Looking at KOL positions → Placing a small bet.

The biggest variable here, and what excites me the most, is that the entire content distribution system will be restructured, transitioning from the past "traffic model" to a "trading model":

- In the traffic model, rewards are given for "popularity" rather than "truth," often leading to a proliferation of those who craft small stories, while those with genuine insights struggle to gain visibility;

- In the trading model, since "betting on the truth" can yield rewards for successful predictions, it will attract both capital and traffic, creating a new flywheel: traffic may not necessarily lead to trading, but good trading will definitely bring traffic.

Content that involves trading will become a new content increment, and there is even a chance to build a new type of native social media.

At the same time, the "monetization methods" of prediction platforms will expand from A–D:

- Trading fees

- Insurance premiums

- Data service fees

to:

- Advertising / Brand budgets;

- Content subscriptions / Tips;

- Tools / Reports / Services aimed at high-net-worth individuals;

- Various "commercial entry points around prediction topics" (sponsored markets, co-branded events, offline conferences, etc.).

If:

- A+B+C+D pushes platform revenue to $1–2 billion/year;

- E contributes an additional hundreds of millions to over a billion dollars in advertising / subscriptions / services;

Then the entire story has the potential to reach $2–3 billion/year in revenue.

In the context of the overlapping domains of "Finance + Data + Social + AI," a $50–100 billion valuation is no longer a completely arbitrary figure, but a "optimistic scenario" that can be seriously discussed.

Because of this:

When at least three layers of A–E are solidified, and the other two have clear paths, achieving a "trillion-dollar market cap" is feasible.

2. Where do Polymarket / Kalshi stand in A/B/C/D/E?

With these five layers, we can more calmly position:

Where do Polymarket / Kalshi currently stand in A–E?

2.1 Kalshi: Strongest in A, C/E are just emerging shadows, B/D are almost blank

A: Event Derivatives Exchange (✓✓✓)

- Complete CFTC license, positioned as a "regulated event futures exchange";

- Highly financialized contract design: macro data like CPI, non-farm payrolls, unemployment rates, unemployment claims; political events like elections and congressional control; now also includes sports and entertainment topics.

- Integrated with multiple brokerages (Robinhood, Webull, etc.), embedding event contracts into traditional trading interfaces.

This line can be said to have already formed a clear prototype: a smaller version of CME + CBOE.

B: Parametric Insurance (× / Not yet formed)

- Currently, there is no evidence of Kalshi directly binding event contracts to "insurance / reinsurance" structures;

- It seems more like moving the "hedging that insurance companies originally did with derivatives" onto its own platform, but not truly reinventing the insurance products themselves.

C: Decision & Data Layer (✓ / Emerging stage)

- Macro traders and media are already using Kalshi prices as an "enhanced version of polls";

- However, it is still quite far from "governments and enterprises incorporating it into decision-making processes" and "forming standardized APIs and indices."

D: AI World OS (× / Completely a story)

- Currently, there are no publicly available product lines specifically for AI models to create world prediction data / training environments;

- This layer is entirely a story, remaining more in the realm of investment research imagination.

E: Prediction-native Social Media (✓- / Product has potential, but may not be fully priced in)

- Kalshi's own front-end UI integrates "topic cards + probabilities + news" much better than traditional brokerages;

- However, it has not yet built a complete content and social ecosystem like X or TikTok, leaning more towards tools rather than media.

Conclusion: Kalshi = Strongest in A, C/E have some embryonic forms, B/D are essentially blank. Its current valuation of $12 billion essentially reflects a price for a "prototype of a new asset class CME + some data stories."

2.2 Polymarket: Strong in A, C/E are highly anticipated, B/D are still in the story zone

A: Event Derivatives Exchange (✓✓✓)

- Uses a hybrid architecture of on-chain settlement + off-chain CLOB order book, with depth and trading experience already very close to mature crypto exchanges;

- In the political, sports, and macro sectors, Polymarket's activity level is among the strongest in the entire prediction market space;

- During the 2024 election cycle, a single sector has already generated billions of dollars in cumulative transactions, making it a leading application in the crypto space.

B: Parametric Insurance (× / Not yet operational)

- Currently visible markets still primarily focus on politics / sports / macro;

- There is no evidence of systematic weather insurance, climate insurance, or supply chain interruption insurance being abstracted into "insurance / reinsurance" businesses;

- This part remains more on the "can be done in the future" PPT page.

C: Decision & Data Layer (✓✓ / The clearest path among options)

In the past 12 months, Polymarket has done two very key things:

- Collaborated with X (Twitter) to become one of the official sources of prediction data;

- Reached a strategic investment + data distribution agreement with ICE, the parent company of the NYSE: ICE is investing up to $2 billion, giving a pre-investment valuation of about $8 billion; at the same time, it is agreed that ICE will distribute Polymarket's event data to global institutional clients.

These two steps essentially capture:

- Web2 traffic entry (X);

- TradFi paid data entry (ICE).

If the collaboration can continue to advance, Polymarket's story at layer C will become:

"Providing global event probability data and metrics infrastructure for individuals and institutions."

D: AI World OS (× / Concept exists, product not yet on the table)

- Both officials and media have been discussing "the value of prediction markets for training AI world models";

- However, there has not yet been seen a similar "prediction API / benchmark platform for LLM / agents."

This area is more of "the page that appears in pitches with AI," still a distance from true commercialization.

E: Prediction-native Social Media (✓ / Possibly a unique card for Polymarket compared to Kalshi)

- In terms of product form, Polymarket is closer to a "prediction version of Reddit + TradingView": each market has a long comment section, icons, and price trends; the community atmosphere is more Crypto Native, mixing memes, analysis, and betting;

- The collaboration with X, if it really moves towards deep integration in the future (for example, directly embedding odds into Tweet cards), would create a completely different path at layer E — "building a social timeline around predictions."

Conclusion: Polymarket = A has already emerged, C/E have very concrete touchpoints, B/D are still highly abstract options. At a valuation of $15 billion, it essentially means: the market has already assumed it is "the one most likely to occupy A+C+E in this round of crypto prediction markets."

3. Polymarket vs ByteDance: A Comparison of Financing and Valuation, which stage is it roughly equivalent to in ByteDance?

Another interesting thing is that a few days ago, I shared an interview that I believe has the deepest understanding of [prediction markets], featuring Jeff Yass, the founder of SIG, the largest options market maker in the U.S., and currently a major market maker for Kalshi.

SIG is more familiar to Asian users for its $5 million investment in ByteDance in 2012, which has now yielded over a billion dollars, a true grand slam.

Friends familiar with ByteDance should know that initially, VCs did not see the value in "news apps" and mostly passed; ultimately, ByteDance transformed into a "recommendation engine," using the tool of "recommendation" to almost redo all internet businesses, reaching a market value of $500 billion.

(There are also many early employees of ByteDance on Twitter, who probably didn't expect their options from ten years ago to be worth so much money, haha.)

Could Polymarket and Kalshi use their "prediction" capabilities to replicate this in other industries, starting from social media?

I find it interesting to consider, if Polymarket really has the opportunity to become a "prediction version of ByteDance" in the future, what stage is it currently at compared to ByteDance?

3.1 ByteDance: The Curve from $500 Million to $500 Billion

According to public information, ByteDance's valuation has roughly gone through the following process:

- 2014 Series C: Raised $100 million; valuation around $500 million, at which point Toutiao had just proven the effectiveness of its content recommendation model;

- 2016 Series D: Raised $1 billion; valuation around $11 billion;

- 2017 Series E: General Atlantic led a $2 billion investment; valuation around $22 billion;

- 2018 SoftBank $300 million Series E+: Valuation directly raised to $75 billion, becoming one of the most valuable unicorns at the time;

- Around 2020: New round of financing + equity buyback, valuation around $180 billion;

- 2024–2025: In employee buybacks and OTC trading, the mainstream valuation range is around $300–500 billion.

It can be simply summarized as:

- $500 million: Toutiao has just started;

- $11–22 billion: The information flow advertising model has been validated, and Douyin begins to explode;

- $75–180 billion: TikTok + Douyin dual engines start to define a new generation of "Attention OS";

- $300–500 billion: A global super platform + multi-business matrix.

3.2 Polymarket: Accelerating from Tens of Millions to "Hundreds of Billions"

Looking at Polymarket:

- 2020–2022: Several rounds of seed + Series A, raising millions to tens of millions of dollars, with a valuation in the tens of millions to $100 million range;

- 2024: Reports mention a round of financing with a valuation exceeding $1 billion ("unicorn" starting point);

- June 2025: Founders Fund and others enter, with market rumors of a valuation in the $1–1.2 billion range;

- October 2025, ICE takes a stake: Up to $2 billion investment, with terms giving an estimated $8 billion pre-investment valuation, with some media reporting a post-investment valuation of $9 billion.

- Some secondary trading and rumors: Numerous sources have indicated that Polymarket is negotiating the next round of financing at a "valuation of $15 billion."

Looking at the numbers alone: Polymarket's current valuation range of $8–15 billion is in the same order of magnitude as ByteDance's during 2016–2017 ($11–22 billion).

3.3 However, from the perspective of "business maturity," Polymarket is still far from ByteDance in 2016–2017

The key difference lies here:

- ByteDance 2016–2017: Toutiao was already a leader in China's information flow advertising, with very solid cash flow from advertising; Douyin was just taking off, and the S-curve of short videos was just beginning; the valuation included both "steady cash flow" and "Douyin options."

- Polymarket 2025: Product: Demonstrated strong demand for event prediction, with explosive growth during the election cycle, and the X/ICE collaboration opened two important entry points; Revenue: Still primarily in the "subsidizing liquidity, market-making rewards + initial fee experiments" stage, with many GMVs not yet converted into stable, high-quality revenue; Regulation: Just passed DOJ/CFTC scrutiny, returning to the U.S. through the acquisition of a licensed exchange, which only happened in the last 12 months.

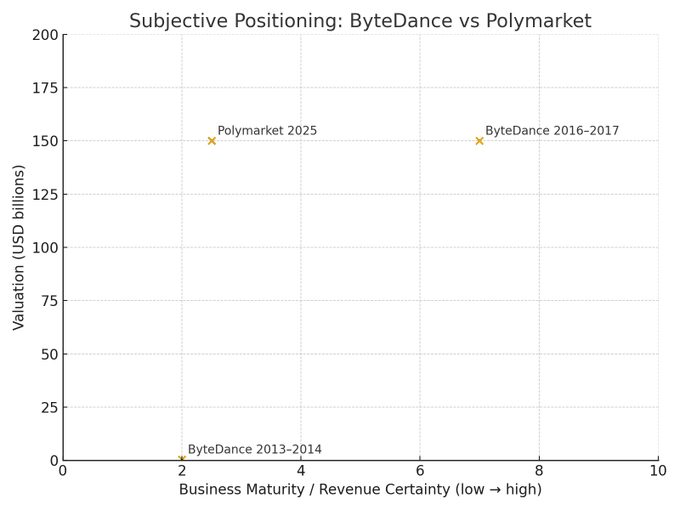

If we were to plot this on a two-dimensional coordinate system (purely subjective):

- X-axis = Business Maturity / Revenue Certainty;

- Y-axis = Valuation Scale;

It would roughly look like this:

- ByteDance 2013–2014: Business just starting, valuation $500 million;

- ByteDance 2016–2017: Business and cash flow highly certain, valuation $11–22 billion;

- Polymarket 2025: Business certainty ≈ ByteDance 2013–2014, but valuation has already jumped to the 2016–2017 level.

The market is already pricing Polymarket from the perspective of "Layer A almost defaults to success + Layer C/E has a clear path." At the same time, it has pre-paid a portion of the "option fee" for B (insurance) and D (AI).

4. Easter Egg: Layout Methods

TL:DR Four types of layout methods

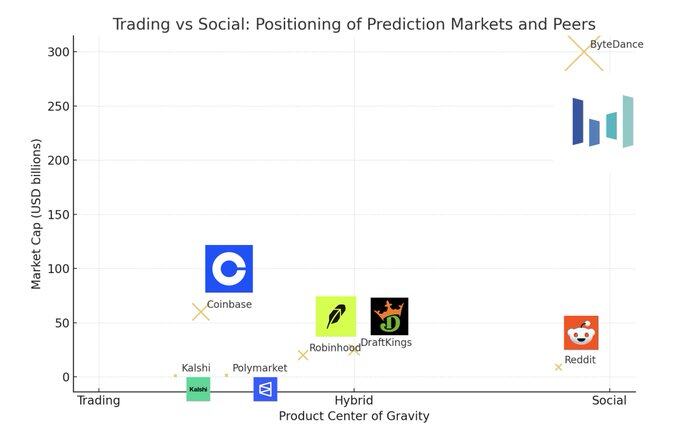

- Interactive prediction markets in the market, especially those not yet TGE, such as @Polymarket, @opinionlabsxyz, @42space (@Kalshi is only open to U.S. users)

- Yap: Polymarket will also reward content creators, please quickly go to the official website to bind your X account

- Primary investment: Many people may not know that the Pre-IPO platform Jarsy has listed Polymarket and Kalshi's Pre-IPO equity, valued at $17.8 billion and $13.8 billion respectively, not cheap; those who are particularly optimistic can research it. At the end of the article, we have attached our previous interview with the Jarsy Founder. Additionally, consider laying out xAI; if prediction markets can become a new type of social media, I believe the giants most likely to benefit are X, Robinhood, Coinbase, Reddit, and Meta (Facebook), as they have all found new business increments. X is now part of xAI, which is a company that Musk values highly, currently valued at $171 billion, and can be purchased on @PreStocks. Jarsy also has xAI, but due to different platform mechanisms, the valuation is a bit higher.

- Secondary investment: Following the logic above, if prediction markets can become a new type of social media, they are likely to become an important increment for Robinhood, Coinbase, Reddit, and Meta in the future, especially for Robinhood and Coinbase, which are both currently valued at hundreds of billions. Both Robinhood and Coinbase have already partnered with Kalshi, while Reddit and Meta have more diversified businesses; I think decisions can be made when there are signs of entering the prediction market.

Finally, I will conclude with a tweet from the Founder of 1confirmation, who believes that prediction markets will bring positive EV within 10 years in the current crypto space filled with negative EV. https://x.com/NTmoney/status/1993473872914751758?s=20

On one side is trading, on the other side is social, with more and more players entering, continuing to pay attention to this track.

Once again, I declare: All discussions in this article are for informational purposes only and are not investment advice; DYOR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。