Family, "Crypto Dialogues" is back with everyone!

In each issue, we aim to invite hardcore industry leaders to dissect market logic, share practical trading experiences, and uncover opportunities that others may have missed.

Today's theme is very timely — "Key Signals for Insight into Market Turning Points," and our guest is a familiar face on our platform, Teacher Dooo! As an industry OG who has grown alongside the platform, and a hardcore influencer in the dynamic square who speaks through data, his sensitivity to secondary market K-lines, on-chain data, and market news is nothing short of "radar-level." For many years, he has insisted on using data to debunk lies and find the truth.

Today, he is sharing valuable insights without reservation, so without further ado, the interview officially begins!

The first question must address what everyone is most concerned about: Is this drop triggered by a single event, or is it a systemic decline caused by multiple factors?

Dooo: Thank you, Research Institute. I lean more towards multiple factors at play; it’s not as simple as a single negative event.

First, let me correct a small slip of the tongue: it’s "macroeconomic expectation reversal"! The market had originally bet that December would kick off a rate-cutting cycle, but the Federal Reserve's stance has been very hawkish lately, with officials consistently making "hawkish" statements. People are slowly realizing that even if there is a rate cut, the extent is likely to be minimal, and it may even be accompanied by tighter policies, which naturally puts pressure on risk assets.

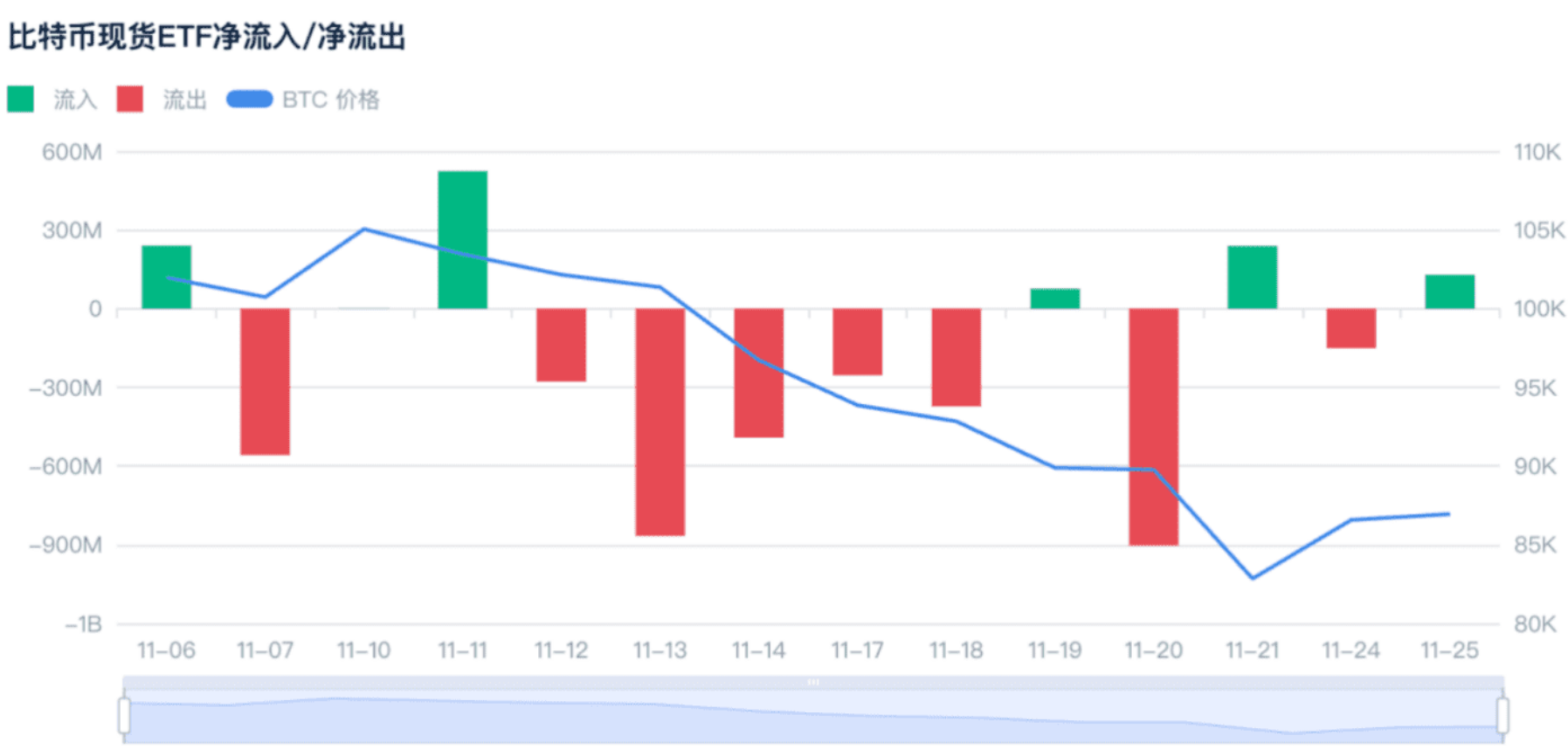

Now, Bitcoin is increasingly resembling a "macro asset," highly sensitive to interest rate changes, and this wave of impact is unavoidable. Additionally, the capital side is genuinely retreating; institutions like ETFs have been withdrawing — the outflow from the U.S. Bitcoin spot ETF in November reached a staggering $3.8 billion, setting a record for monthly outflows, and it has been a continuous large outflow, representing "passive selling," which has been quite decisive.

Look at this chart, all red bars; Bitcoin's price has been dropping within these red bar ranges, which is quite distressing. Besides institutions, on-chain data also shows that many long-term holders and whales are selling off in large quantities, which is not a good sign.

Lastly, panic is spreading in sentiment. Friends trading U.S. stocks should feel it; market sentiment is very fragile right now. The previous government shutdown in the U.S., the escalating U.S.-China trade war, and the high valuations in the AI sector have all piled up, causing investors' risk appetite to plummet to freezing point. The voices of "collapse" are rampant on social media, and the fear index has dropped to 10; although it has improved slightly recently, it still hasn't recovered.

When looking at these factors together, it’s like a big net, with almost all aspects pointing towards a decline, so defining it as a systemic downturn is quite reasonable.

Hearing your breakdown, I realize this correction is far more complex than I imagined! How does it compare to previous major corrections like 312 and 519?

Dooo: There are indeed several key differences. First, the "protagonist" of this drop is completely different from before. The famous corrections like 312 and 519 were mostly driven by panic selling from retail investors, triggered by some sudden negative news, leading to a liquidity crunch. But this time is different; we see institutions actively and rationally retreating — the continuous net outflow from ETFs is the best proof. The logic of institutions is completely different from that of retail investors; they are not panicking but are making proactive decisions to reduce their positions based on macro conditions and risk-reward ratios. This retreat is calm, orderly, and ongoing.

Moreover, the mindset of long-term holders seems to have changed. Previously, observing those ancient whales and long-term holders, they were the ballast of the market, buying more as prices fell. But this time, on-chain data shows that even some OGs are selling. This is understandable; as Bitcoin's size has grown, early participants' assets have appreciated to a considerable scale, and choosing to take profits to improve their lives is reasonable. However, this also means that the most steadfast "believers" in the market seem to be starting to waver.

Additionally, the rebound strength is simply too weak. In the past, after a sharp drop, there would often be a strong V-shaped reversal, as there were many shorts to cover and sidelined funds eager to enter. This time, after finally seeing two consecutive green candles, the trading volume has not significantly increased, which feels more like a technical correction within a downtrend, not the beginning of a reversal. Market confidence is too fragile; everyone is on the sidelines, and no one dares to invest heavily.

So I believe this time is not just a simple deleveraging; it feels more like a structural reassessment that the crypto market is undergoing against the backdrop of the global macro economy and institutionalization. Its complexity and depth exceed any previous instance.

So the internal structure has changed so much! Setting aside the superficial ups and downs, how do you view this market situation?

Dooo: I think this is "a systemic adjustment within an institutional bull market." Marked by the Bitcoin spot ETF, the crypto market has entered a new era dominated by institutions, which is completely different from the previous retail bull market. The scale of institutional capital and the patience for long-term layouts determine that the peak and duration of this cycle may exceed our expectations; right now, it’s just a significant pullback within this great wave.

In my humble opinion, its "systematic" nature impacts almost all aspects of the market, from ETFs to stablecoins, from whales to retail investors. The market is squeezing out bubbles and clearing risks; this is a process of finding and building a bottom, not the beginning of a "collapse."

This grueling process of finding and building a bottom is something only those who have experienced it know how torturous it is! I want to ask you, how do you respond when the market continues to decline? Do you have any practical experiences to share?

Dooo: Personally, I mainly follow a few principles, the most crucial being to never impulsively go all-in to catch the bottom. I build positions in batches based on support levels, gradually averaging down my cost — this is just my own experience from past mistakes and does not constitute any investment advice.

One last question! You mentioned "looking at data, not listening to stories," which is key to determining the next steps. After this round of decline, what signals should investors focus on to judge whether the market is about to reverse?

Dooo: Actually, I’ve already mentioned my general judgment direction; to summarize, it’s about looking at data, waiting for signals, and not making blind guesses.

The core is macro signals; pay close attention to U.S. macro data, such as interest rate cut dynamics and non-farm payroll data. Currently, the latest market speculation has pushed the probability of a rate cut to 85%, which is a solid positive sign.

Next is the flow of funds, particularly watching whether ETF, meaning institutional funds, are really coming back — this is the most direct and hardcore signal, representing that Wall Street's "smart money" is starting to reallocate to Bitcoin. Don’t just focus on daily inflows; look at longer periods, such as the net inflow trend over a week, or whether there are any large inflow signals exceeding $1 billion in a single day. Also, keep an eye on objective sentiment indices, like the fear index, which can intuitively reflect market sentiment.

Finally, pay more attention to on-chain data signals, such as looking for whale addresses holding over 1,000 BTC and monitoring their net inflows and outflows; or on a macro level, whether the number of small balance addresses is increasing, which can reflect whether retail investors are gradually entering the market.

To summarize: macro easing + institutional inflow + retail calm + on-chain accumulation — when these signals come together, that’s the real reversal. What we need to do now is to maintain patience and not rush to guess the bottom; data won’t lie.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

This article only represents the author's personal views and does not reflect the stance or views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。