Author: jiayi

Introduction

Every time the market declines, the same scene always appears: a group of people jumps out saying, "See, I told you it was a scam"; then when the market turns, the same group lines up, chasing highs and shouting bullish. This extreme back-and-forth of emotions has left me numb after eight years in this industry.

It's not that people are unwilling to believe in the future, but rather — when a bear market arrives, people become afraid to believe in the future.

But the fact is: when we talk about prices, we are actually talking about the future. Because prices are never "now," but rather the market's discounting of the future. If we continue to focus solely on prices, the future will slip away from us.

Moreover, there is a very real pattern in bear markets: what everyone sees is a decline; what I see is stratification. Emotions are receding, the industry is filtering, and the future is being rearranged.

At the same time, I am pondering, "Why are there more and more new projects, yet truly meaningful things are becoming fewer and fewer?" "We all know the industry is about to change, but how exactly will it change?"

That’s why I want to write this article. Not to pump up enthusiasm, nor to shout "the bull market will return," but to use the simplest and most genuine way — to help you see what is "currently happening in this industry" through Jiayi's eyes, and what "will happen in the future."

A bull market is noise; a bear market is a magnifying glass, a microscope, a truth-revealing mirror. In the fog of emotions, I want to help you stand at a higher vantage point to see where the future's path lies after the tide recedes.

1. Why do I say that the bubble is the biggest benefit in 2025?

In 2025, there is a very obvious fact that most people are unwilling to admit: we did not wait for the "shanzhai bull," but instead welcomed a round of systematic deflation ahead of time.

Many people interpret this as a bad thing, but if you extend the timeline, you will find — these years of "killing before rising" are actually the best period for the industry to grow into a truly mature structure.

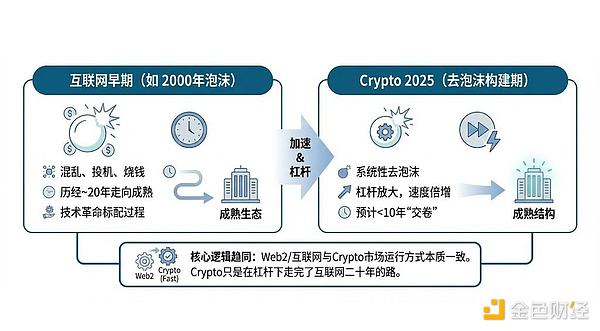

Why? Because all of this is exactly the same as the early days of the internet, only the speed has been amplified by crypto's leverage.

If you want to truly understand today's crypto, the simplest way is to — treat it as an "accelerated version" of the early internet.

Many people think that the chaos, bubbles, and speculation in crypto are the unique "original sin" of this industry. But if you extend the timeline, you will find that this is not a special case at all, but rather a standard feature of almost all technological revolutions —

The internet in 2000 was just as crazy.

I previously wrote an article discussing this logic: under the premise of amplified leverage efficiency, the market operation methods of Web2, the internet, and crypto are essentially converging. It's just that while the internet took twenty years to complete its journey, crypto may have to wrap it up in less than ten years. The same logic applies to financial markets.

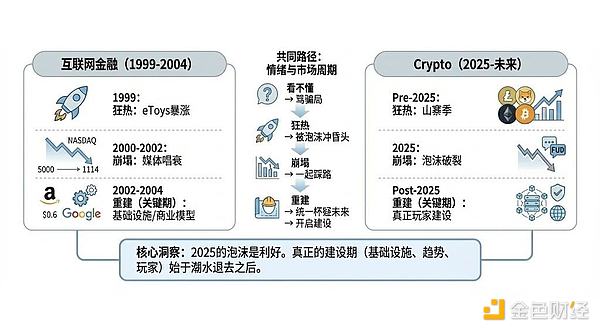

1.1 Internet finance went through the same "incomprehensible → frenzy → collapse → reconstruction"

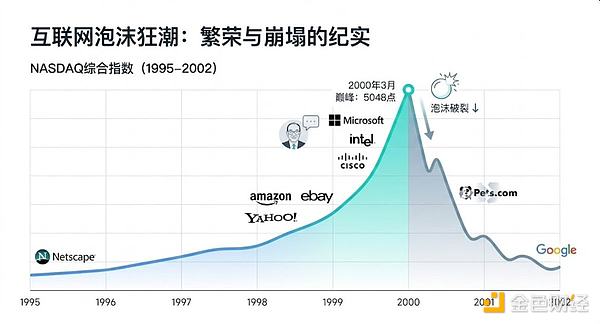

If you think crypto's volatility is dramatic, it's just because you've forgotten the first half of the internet's life.

In 1999, as long as a company had ".com" in its name, it could raise funds. eToys surged 900% on its first day of trading, and investors were as crazy as during the early days of crypto's shanzhai season.

Then the bubble burst.

The Nasdaq fell from over 5000 points to 1114 points; media covers screamed "internet scam"; everyone said the internet was finished.

That emotional state was almost identical to today's crypto:

Those who don't understand call it a scam

Those who do understand are also swept away by the bubble

In the end, everyone tramples together

Then everyone uniformly doubts the future itself

But ironically — the real internet era began the moment the bubble burst. When the tide recedes, we not only know who was swimming naked. It also helps us filter out the true players most likely to swim to the other shore.

In 2002, Amazon's stock price was only $0.6. Google had not yet gone public. The companies that were left behind built the real infrastructure, business models, and profit methods during those years when they were least visible.

What crypto resembles most right now is the period of 2002–2004: not the hottest years, but the most critical years.

The bubble burst cleared away the noise, and the trend, direction, infrastructure, and real players began to enter the "construction phase."

This is why I say: the bubble in 2025 is a benefit. Because truly important things will only emerge after the bubble.

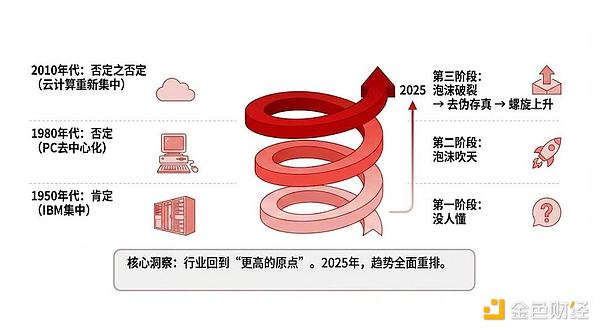

1.2 The negation of negation: the industry does not rise in a straight line, but spirals upward

I particularly like the concept of "negation of negation" because it perfectly describes the evolution of technology and industries.

"Negation of negation": the development of things is never a straight line upward. It is more like "moving upward in circles": every time you think you have returned to the starting point, you are actually at a higher level.

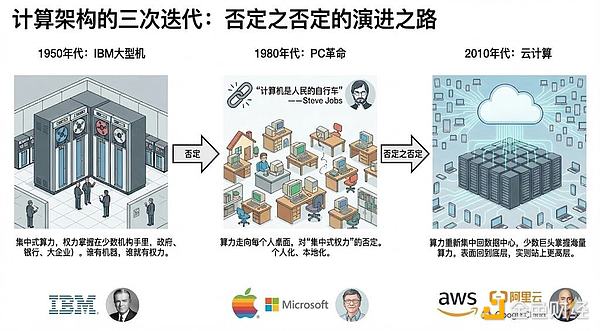

The most typical example is the three iterations of computing architecture.

1950s: IBM mainframe — centralized computing power was concentrated in very few institutions — governments, banks, large enterprises. This was the first concentration: whoever has the machines has the power.

1980s: PC revolution — decentralization. Steve Jobs said, "Computers are the people's bicycles." Computing power moved from data centers to everyone's desktops, and everyone owned their own computers, which was a negation of "centralized power." Computing began to decentralize, becoming personal and localized.

2010s: Cloud computing — the "negation of negation," standing at a higher level. AWS, Alibaba Cloud, and various public clouds concentrated computing power back into data centers. On the surface, this looks like a return to the "mainframe era"; yet it is a few giants controlling massive computing power.

It seems that cloud computing has returned to "mainframe centralization," but it is fundamentally not the same level: terminal sovereignty comes from PCs, elastic computing power comes from the cloud, merging the advantages of two generations of technology.

Crypto and internet finance are currently experiencing the exact same path:

First stage: no one understands, but the direction is vaguely there

Second stage: everyone is frenzied, the bubble is inflated (we just went through this)

Third stage: bubble burst → eliminating the false and retaining the true → spiraling upward (this is 2025)

Do you think the industry "has returned"? In fact, it is not returning to the starting point, but to a higher "starting point." Trends, technology stacks, capital structures, and regulatory paths are all being rearranged in this round.

2025 is the most important signal before the next round begins.

2. 2025 is the prologue, 2026 is the main text: the true trends of the industry are taking shape

Whoever solves the directional issue of "the complete integration of Crypto and traditional finance" will own the world for the next five years.

The feeling of 2025 is actually quite strange.

The K-line looks like a bull market, but the sentiment feels like a bear market; regulation is advancing, but expectations are declining; narratives are flying everywhere, yet making money is harder than any other year.

In the future, I boldly predict that pure Crypto Native innovation will face bottlenecks. Real breakthroughs and effective innovations will emerge in the direction of "the complete integration of Crypto and traditional finance," which can simultaneously address the financial market needs of both Web2 and Web3 through composite innovation.

2.1 Everything happening in 2025 points to the same thing: the industry is "restructuring its framework"

Bitcoin surged to $126,000, mainstream assets followed suit, but shanzhai coins were increasingly lukewarm. The secondary market seemed to be rising, but the final account balance did not increase… This was the most magical experience of 2025.

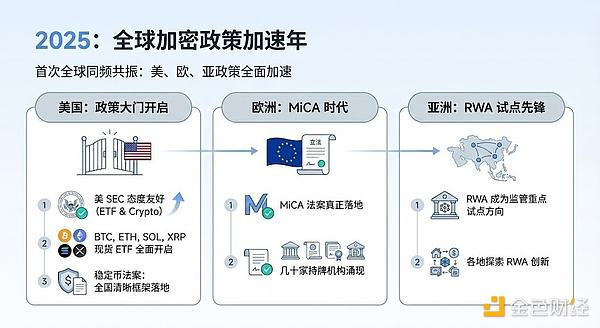

But when you look at 2025 from a "structural" perspective, the year suddenly becomes very clear: this is the first time that the U.S., Europe, and Asia have all accelerated policy changes in the same year:

For the first time, the U.S. SEC's attitude towards ETFs and Crypto has become friendly

BTC, ETH, SOL, and XRP successively opened spot ETFs. The door has been opened

The stablecoin bill has provided a clear framework nationwide for the first time

Europe's MiCA has truly landed, with dozens of licensed institutions emerging

RWA has become a key pilot direction for regulators in various regions

Crypto has been institutionalized into the global financial system for the first time. The earliest Crypto OGs hoped for Crypto to enter mainstream finance. Do you remember the title of our article? When we talk about prices, we are actually talking about the future. The market's resurgence requires a new story for redemption, which I personally believe is "the complete integration of Crypto and traditional finance."

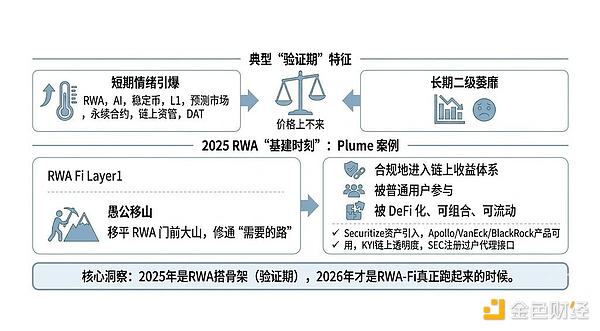

2.2 On the track level: high enthusiasm, weak prices, this is a typical "verification period"

RWA, AI, stablecoins, L1 (which lasted less than a month), prediction markets, perpetual contracts, on-chain asset management, DAT… each of these terms can ignite a short-term emotional response. Emotions aside, prices are not rising. The short-term excitement has turned into a longer-term secondary market lethargy.

In 2025, RWA: the underlying infrastructure is complete, and the regulatory framework is beginning to take shape, creating "implementable" conditions for the future development of RWAFi.

Let’s hype up Plume's contributions to the implementability of RWA. I mention Plume not because I invested in it, especially since its recent secondary market performance has been quite average. However, I firmly believe that PLUME best represents the "infrastructure moment" that RWA has experienced this year.

First, Plume allows real-world assets to:

Compliantly enter the on-chain yield system,

Be participated in by ordinary users (not just institutions),

Achieve on-chain distribution (collaborating with traditional financial brokers),

Be DeFi-ified, composable, and liquid.

Here are a few developments from the past two months: Securitize's assets have been introduced into the on-chain yield system; products from Apollo, VanEck, and BlackRock can be utilized in on-chain strategies; Bluprynt's KYI brings "issuer transparency" on-chain; it has become a registered transfer agent with the SEC, connecting to the regulatory-level grassroots interface with the SEC/DTCC. These things may sound dull, and users might not know how to engage with the secondary market's FOMO. But essentially, you only need one sentence:

As the world's first RWA Fi Layer 1, Plume has essentially flattened the mountain in front of RWA, paving the "road needed" for RWA to land.

With teams like Plume building the framework for RWA in 2025, more excellent assets under the RWA-Fi system will have the opportunity to truly take off in 2026.

3. AI × Crypto: There are not many truly valuable parts, but the value density is extremely high

To put it bluntly, and I fear offending someone, the AI sector looks lively, but there are actually very few valuable things.

3.1 Too many false propositions

Taking the grand narrative of LLM, which has caused the most FOMO in the market, as an example, I believe traditional AI's large language models have matured to the point where "Crypto simply cannot compete."

ChatGPT, Claude, Gemini, DeepSeek — these models are backed by real global capital, with computing power, data, distributed training systems, and engineering teams amounting to billions of dollars.

Does Web3 want to "recreate an LLM"? It's not that it's impossible; it's that physical laws do not allow it. And what is it that traditional AI's large language models cannot satisfy you with? Web3 does not need to reinvent the wheel. I suggest that projects of this type stop burning cash on technology and quickly seek real demand scenarios as a way out. After all, a typical characteristic of 2025 is: users are harder to deceive.

I hope one example helps everyone understand why most AI projects in 2025 easily become "hollow" as they go along.

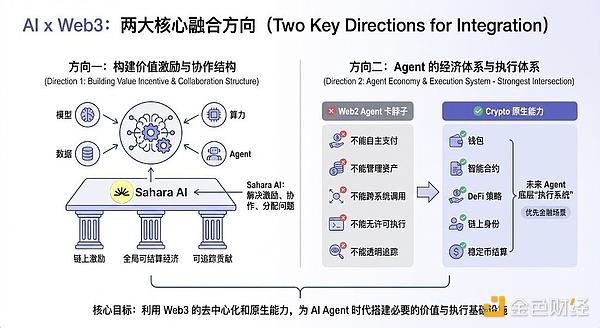

3.2 Building the foundation for composite innovation addressing the financial market needs of Web2 and Web3

The first direction: building a "value incentive and collaboration structure for AI" around on-chain incentive mechanisms that traditional AI lacks, a globally settlable economic system, and a traceable contribution network. After all, models, data, computing power, and agents all require incentives, collaboration, and distribution. This is the problem Sahara AI aims to solve.

The second direction: the economic and execution systems of agents, the true strongest intersection of Web3 and AI. It still revolves around better solving the automatic decision-making, execution, trading, and settlement needs based on the limitations of agent capabilities in the Web2 world.

In the Web2 world, agents' capabilities are currently constrained by:

Inability to make autonomous payments

Inability to manage assets

Inability to call across systems

Inability to execute tasks without permission

Inability to transparently track behavior

In the Crypto world, these are all native capabilities:

- Wallets

- Smart contracts

- DeFi strategies

- On-chain identities

- Stablecoin settlements

This is the direction that most people in Web3 AI projects are currently building: establishing the underlying "execution system" for the future agent era. Starting with execution related to financial scenarios is clearly the most urgent and significant market need.

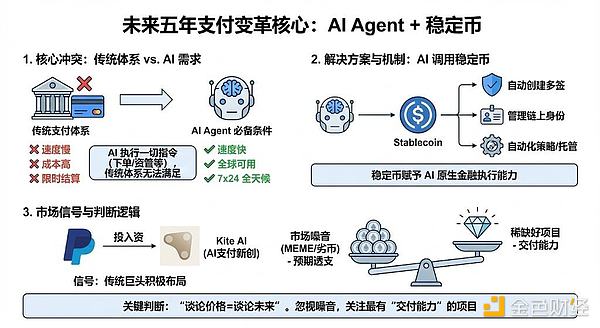

3.3 The third direction: AI payments, the most disruptive direction in the next five years

If I had to summarize the super trend of the next five years in one sentence, it would be the innovation of payment methods driven by AI agents. When agents begin to execute all instructions from users to application terminals, such as selecting, placing orders, asset allocation, and strategy management, payments will no longer be the endpoint of user actions but rather the "underlying capability" of agent operations.

In such a world, security, verifiability, global availability, extremely low costs, second-level settlements, and 24/7 programmable cash flows will all be essential conditions for AI agents.

Traditional payment systems cannot achieve this. However, with AI combined with stablecoins and on-chain identity systems, everything becomes feasible. In the future, you will see more and more AI applications allowing agents to

Automatically call stablecoins

Create multi-signatures

Set up custodianship and strategies

Manage on-chain identities

Seamlessly integrating value transfer itself, just like calling an API.

Even giants like PayPal, which have been in traditional payments for decades, are beginning to accelerate their layout, investing in the next generation of projects with "AI-native payment capabilities," such as Kite AI. Many people might say: Kite isn't really providing payment technology services to AI agents on a large scale yet; is it just hot air?

Let’s return to the title, "When we talk about prices, we are actually talking about the future." The real question has never been "How many agents has it served today?" but rather in the AI-driven future economic model:

Who is already building the foundational capabilities needed for the future? Who is laying the groundwork for the value network of the AI era?

Just like after Coinbase released the 402 protocol, dozens of "cryptographic new projects" emerged within days. Bad coins will prematurely overdraw the market's expectations because when everyone discusses prices, they represent the future in their hearts. The industry's efficiency in issuing tokens, along with the prosperity promoted by MEME and junk shanzhai projects, has made it even more challenging for entrepreneurs. However, good projects in the market are always scarce, and in this regard, raising the entrepreneurial threshold is not necessarily a bad thing.

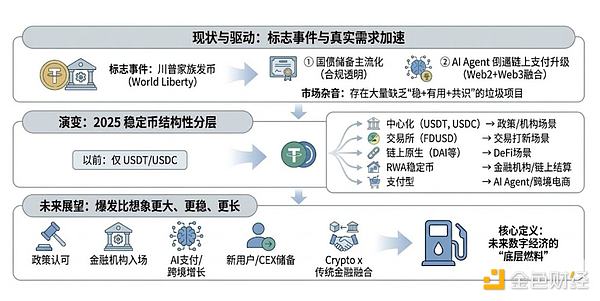

4. Stablecoins: The most early-recognized but most worthy ALL-IN sector in 2025

To be frank, if there is one sector that should be "quietly but definitely taken seriously" in 2025, it is stablecoins. I believe it is still in the early narrative stage, and the market does not really understand it, while the vast majority of stablecoin-related projects that emerged in 2025 are neither stable nor applicable as coins; I personally think the market has not yet entered a true FOMO stage.

- The most eye-catching stablecoin event this year: the Trump family issued a coin.

Yes, the Trump family has clearly issued a stablecoin: World Liberty / World Finance. The less content, the bigger the event.

- The real demand scenarios for stablecoins in 2025 are quietly accelerating.

1. Government bond reserves becoming mainstream → Compliance accelerates. All leading stablecoin issuers are basically moving towards transparency in reserves and compliance.

2. On-chain payments are being "forced to upgrade." Please refer to the AI payment content in the previous section.

On-chain payments are the infrastructure driven by the demand for the development trend of AI agents. Note that this market is not limited to the Web3 market. As I mentioned earlier, the future trend market will definitely be a larger market that integrates both Web2 and Web3.

Once on-chain payments mature, the ceiling for stablecoins will be directly broken.

3. The first appearance of "structural stratification" in stablecoins.

Previously, stablecoins seemed to have only one logic: "Is it USDT or USDC?"

But starting in 2025, structural stratification has emerged:

- Centralized stablecoins (USDT, USDC) → Policy/institutional scenarios

- Exchange stablecoins (FDUSD) → Trading and new listing scenarios within exchanges

- On-chain native stablecoins (DAI, USDL, etc.) → DeFi scenarios

- RWA stablecoins → Financial institution scenarios, on-chain settlements

- Payment stablecoins → AI agents, cross-border e-commerce scenarios

- In the virtual landscape of stablecoins, the vast majority are "garbage projects eager to cash in on hot topics."

Whenever a sector begins to gain visibility, a bunch of "pseudo-themed projects" will first emerge. To issue stablecoin concept tokens, teams naively believe they have come up with a genius scenario, and then the market starts mass-producing shells. A clean slate of TVL subsidy activities + packaging an actual yield scenario is just token overdraw; after all, users love to farm, so they just repeat the old path of btcfi with TVL, package it, and list it on exchanges without caring about the future mess.

Users may indeed experience short-term FOMO, but in the medium term, they will be disappointed with the entire stablecoin sector due to these "pseudo" stablecoin projects. However, in the long term, the true giants will rise, and the secondary value of stablecoins has indeed been severely underestimated.

The core value of stablecoins boils down to two things: stability and utility. If you can't even achieve "real reserves + consensus usage scenarios," then no amount of white papers will matter. I can already hear someone saying that USDT's reserves are not 1:1. Sorry, but the consensus usage scenario of USDT is something that even the Trump family cannot surpass at this moment. To put it bluntly, the essence of currency is that if everyone believes it is stable, then it is stable. The core of USDT is the first-mover advantage that brought about the earliest market consensus and years of operational experience in "maintaining stability." I stubbornly believe that this inherent advantage cannot be easily surpassed by a project that casually defines an unstable asset through so-called stories.

- The explosion of stablecoins will be larger, more stable, and longer-lasting than anyone imagines; the stablecoin sector will develop in a structural manner.

Policy recognition and strategic layouts by various governments

Entry of financial institutions

Various payment scenarios represented by AI agents, growth in cross-border payments, daily payments on L2, etc.

New users entering crypto at the lowest cost; CEX reserves; demand for OTC fiat

Large-scale liquidation of RWA

A medium for the complete integration of crypto and traditional finance

I tentatively define stablecoins as the "underlying fuel" for all future sectors.

There are many sectors that will perform well in 2025, as long as they focus on more efficient or diverse forms of financial investment. Risk-taking is human nature; the sector is eternal. It's all about the experience. I won't elaborate further.

Five, When we talk about prices, we are actually talking about the future

How can we use the "next 5 years" to reverse-engineer current opportunities? By this point, you might already sense one thing:

If you agree with me that the most important mainline for the next 5 years is "the complete integration of crypto and traditional finance," then during a bear market, we should shift our focus from secondary price adjustments to thinking about industrial value opportunities and pricing them. Just like how MATIC (later renamed Polygon) initially broke its price in the early L2 sector, or how SOL fell to 9 yuan. In a bear market, anxiety over prices contrasts with the joy of future value opportunities.

From a market perspective, what is price determining? It determines emotions; it determines the fluctuations of expectations; it determines the heat of narratives.

But I believe the real value gap is determined by: who is laying the foundation for the framework of the next 5 years; who is building financial infrastructure that serves both Web2 and Web3; who is embedding themselves into "the financial system of the world under future liquidity integration," rather than just self-indulging on-chain.

So, if you agree with the logic I presented earlier, then there is a very direct question:

How should we view current prices?

- First, clarify a fundamental logic:

In the next 5 years, the vast majority of unicorns will not be "purely crypto-native giants."

"Purely crypto-native innovation" occurs in a market context where there is no traditional financial market integration; it is also a product of the economic push where the foundational infrastructure of blockchain or Web3 has not yet been built. Over the past decade of blockchain history, we have experienced countless peaks:

Native public chains

Native DeFi Lego

Native NFT & Game narratives

Native DEX, derivatives, lending protocols

The last round of giants (exchanges, public chains, leading DeFi protocols) have basically occupied the high ground of "on-chain native infrastructure."

Most "purely on-chain" projects are either minor innovations, rebranded, or regulatory evasion.

"The number of new projects is increasing, but truly meaningful things are becoming fewer."

Because the next layer of true innovation must meet three conditions:

It must connect with Web2 and serve Web3

It must be usable by real-world users, institutions, and funds

It must be embedded in the real financial landscape, rather than just circulating internally within the crypto space

In other words:

Whoever can truly connect crypto to "the flow of real-world money" and "the real financial system" will be qualified to achieve the highest valuation premium in the next round.

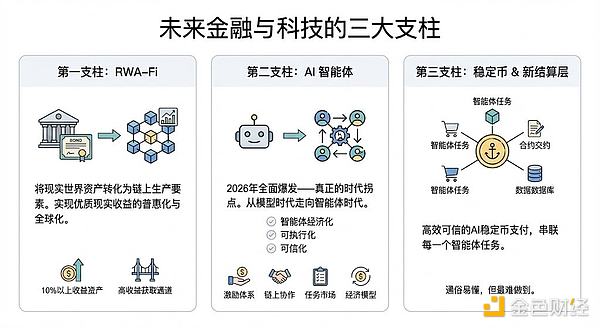

2. From the three main lines of the next 5 years, reverse-engineer what are the "worth watching" sectors now

Main line one: RWA-Fi → Transforming real-world assets into on-chain composable production materials → Making excellent real yield assets accessible and global

A large number of excellent assets with annualized returns of over 10% have not flowed into crypto, currently creating a vacuum. Most of these assets have high user thresholds, and many people who want to participate are limited to institutions, large holders, and those with connections.

IPOs in US and Hong Kong stocks

Real linkage between crypto and stocks, rather than being limited to pure DAT-based financing investment logic

Main line two: AI agents will fully bloom in 2026 — a true epochal turning point

Traditional AI companies have already pushed the "large language model competition" to its limits from 2023 to 2025. The era of models is over; the era of agents has begun. For crypto, the future breakthrough lies in — making agents economic, executable, and trustworthy.

The "large-scale landing period" of AI agents, especially the formal surge in financial scenarios

Web3 will play the most critical role in the landing of agents: the economic system will become a red ocean - agent incentive systems - on-chain collaboration systems - agent task markets - on-chain economic models (yield, payment, custody)

Efficient and trustworthy AI stablecoin payments will connect every agent task

Main line three: Stablecoins & new settlement layers (the most difficult to make understandable)

Summary: Finally, let's revisit the core arguments of this article:

When we talk about prices, we are actually talking about the future. If you only focus on prices, the future will surely slip away from you.

Bull markets are noisy; bear markets are magnifying glasses, microscopes, and truth-telling mirrors.

The bubble of 2025 is not a bad thing; it is the "fracture period" before the industry truly grows. The cleaner the bubble bursts, the clearer the future will be.

Purely crypto-native innovation is nearing its ceiling. The new narrative direction for the industry in the next 5 years: "The complete integration of crypto and traditional finance."

RWA-Fi, AI payments, and stablecoins are the three super main lines for the next 5 years. They are not just hot topics; they are the foundation. RWA, AI, and stablecoins are all accelerating the integration of crypto and traditional finance. RWA bridges the framework and assets, AI addresses practical efficiency and execution, and stablecoins are the underlying fuel for all innovations.

Crypto is transitioning from a "single-player game" to a "plugin for the real-world financial system." Those who can connect to real finance will be the long-term winners.

What truly matters in the AI era is not the models, but the execution: payments, settlements, custody, identity, and automated strategies. Whoever provides execution power to agents will have the most compelling AI agents that captivate users and seize the future.

All short-term surges are expectations; all long-term increases are structures; prices are lagging indicators, while structures are leading indicators.

If you cannot understand 2025, you will miss the entire narrative of 2026.

Finally, Jiayi's reflections

Thank you for 2025, a period that is confusing, perplexing, and filled with self-doubt. It is this "discomfort" that forces me to pull my gaze away from emotions and re-understand the structural changes happening behind the industry, to discern what is true value and what is just noise.

Thanks to the warriors who still choose to BUILD during this cycle. Your explorations and layouts during the industry's most ambiguous times will be the true starting point for the future's "negation of negation" — I believe you will be the ones everyone looks back on in the next five years.

I also thank myself and my team, who have been alongside me and endured my daily pressures. Thank you for maintaining our curiosity about the industry, our respect for trends, and our uncompromising approach to understanding.

We only do what we believe in; we only support those we recognize. We do not cater to the market's short-term emotions, nor do we betray long-term structural logic.

The future will still experience repeated fluctuations, but understanding will never decline.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。