Regardless of whether they are locals or foreigners, everyone cannot escape the traditional mindset of "having a good reunion during the festival." The fourth Thursday of November each year is the traditional major holiday of Thanksgiving in the United States. This year, what people in the cryptocurrency circle may be most grateful for is that Bitcoin has returned to $90,000.

In addition to the influence of "holiday market" factors, a report known as the "Beige Book," which unexpectedly became a key decision-making reference due to the government shutdown, has also helped rewrite the direction of this year's final monetary policy. The probability of the Federal Reserve cutting interest rates in December has soared from about 20% a week ago to 86%.

As the Federal Reserve's attitude reverses, as major global economies simultaneously enter "money printing mode," and as the cracks in the traditional financial system widen, crypto assets are standing at their most critical seasonal window. Once the floodgates of global liquidity open, how will it affect the direction of the cryptocurrency industry? More importantly, will the upcoming holiday be Christmas or a Christmas crisis?

Probability of December Rate Cut Soars to 86%

According to Polymarket data, the probability of the Federal Reserve cutting rates by 25 basis points at the December meeting has surged from about 20% a week ago to 86%. This should be one of the main reasons for Bitcoin's recent price increase, with the reversal in probability attributed to the economic report known as the "Beige Book."

Key Report for Rate Cut Decision

On Wednesday, the "Beige Book," compiled by the Dallas Fed and gathering the latest conditions from 12 regions across the U.S., was officially released. As usual, it was routine material, but due to the government shutdown causing a significant delay in updating key economic data, this report has instead become a rare comprehensive information source that the FOMC can rely on before making decisions.

In other words, this is one of the few windows through which the Federal Reserve can genuinely reflect the operational status of the grassroots economy in the context of data absence.

The overall judgment provided by the report is straightforward: economic activity has changed little, labor demand continues to weaken, cost pressures on businesses have increased, and consumer spending willingness is becoming cautious. Beneath the surface stability of the U.S. economy, some structural loosening is beginning to emerge.

The most concerning part of the entire report is the description of changes in the labor market. Over the past six weeks, there have not been many positive signs in the U.S. labor market. About half of the regional Federal Reserves reported that local businesses' hiring intentions are declining, with a tendency to "not hire if possible." Recruitment difficulties have significantly decreased in several industries, contrasting sharply with the severe labor shortages of the past two years. For example, in the Atlanta district covering several states in the southeastern U.S., many businesses are either laying off employees or only minimally replacing departing staff; in the Cleveland district, which includes Ohio and Pennsylvania, some retailers are proactively reducing their workforce due to declining sales. These changes indicate that the loosening of the labor market is no longer an isolated phenomenon but is gradually spreading to broader industries and regions.

At the same time, although inflationary pressures are described as "moderate," the real situation faced by businesses is more complex than the numbers suggest. Some manufacturing and retail companies are still under pressure from rising input costs, with tariffs being one reason— for instance, a brewery in the Minneapolis district reported that rising aluminum can prices have significantly increased production costs. However, the more challenging issue is healthcare costs, which have been mentioned by almost all districts. Providing healthcare for employees is becoming increasingly expensive, and this cost is not cyclical like tariffs but represents a more difficult-to-reverse long-term trend. As a result, businesses are forced to make tough choices between "raising prices" and "shrinking profits." Some companies pass costs onto consumers, further pushing up prices; while others choose to absorb the costs themselves, further compressing profit margins. Either way, the impact will ultimately be reflected in the CPI and corporate earnings performance in the coming months.

In contrast to the pressures on the business side, changes on the consumer side are equally noteworthy. High-income groups continue to support impressive results in high-end retail, but a broader range of American households are tightening their spending. Multiple regions have noted that consumers are increasingly struggling to accept price increases, especially middle- and low-income families who are more inclined to postpone or forgo non-essential spending when budgets are tight. Feedback from car dealers is particularly typical: as federal tax credits expire, electric vehicle sales have rapidly slowed, indicating that consumers are becoming more cautious when facing large expenditures, even in previously strong growth sectors.

Amid various economic disturbances, the impact of the government shutdown has been clearly amplified in this report. The length of the shutdown has set a historical record, directly affecting the income of federal employees, whose reduced spending has also dragged down local consumption—car sales in the Philadelphia district have noticeably declined as a result. But what is truly surprising is that the shutdown has also affected broader economic activities through other channels. Airports in some Midwestern regions have become chaotic due to a decrease in passengers, leading to a slowdown in commercial activities. Some businesses have also experienced delays in orders. This chain reaction indicates that the impact of the government shutdown on the economy is far more profound than merely "pausing government functions."

On a more macro technical level, artificial intelligence is quietly changing the economic structure. Respondents in the "Beige Book" exhibit a subtle "dual-track phenomenon": AI is driving investment growth on one hand— for example, a manufacturer in the Boston district has received more orders due to strong demand for AI infrastructure construction; but on the other hand, it is causing some companies to begin reducing entry-level positions, as basic tasks are partially replaced by AI tools. Similar concerns have also emerged in the education sector—colleges in the Boston area report that many students are worried that traditional jobs will be affected by AI in the future, leading them to prefer more "risk-resistant" fields like data science. This indicates that the rewriting of the economic structure by AI has already permeated from the industrial level to the talent supply side.

It is worth noting that the changes presented in the "Beige Book" also corroborate the latest data. Signs of employment weakness have appeared simultaneously across multiple districts, while on the price front, the Producer Price Index (PPI) year-on-year is only 2.7%, having fallen to its lowest level since July, and core prices are also showing a sustained downward trend, with no signs of reigniting acceleration. Both employment and inflation, which are directly related to monetary policy, have led the market to begin reassessing the Federal Reserve's next moves.

Economic "Weakness" Spreading Among Regional Federal Reserves

National trends can be seen in macro data, but the reports from regional Federal Reserves provide a closer look at businesses and households, making it clear that the cooling of the U.S. economy is not uniform but presents a "distributed weakness."

In the Northeast, businesses in the Boston district generally report slight expansion in economic activity, with home sales regaining some momentum after a long stagnation. However, consumer spending remains flat, employment has slightly decreased, and wage growth has also moderated. Rising food costs have pushed grocery prices up, but overall price pressures remain manageable, and the overall outlook remains cautiously optimistic.

In contrast, the situation in the New York area is noticeably colder. There, economic activity is gently declining, with many large employers beginning to lay off workers, resulting in a slight contraction in employment. Although the rate of price increases has slowed, it remains high; manufacturing has seen slight recovery, but consumer spending continues to weaken, with only high-end retail maintaining resilience. Businesses generally have low expectations for the future, with many believing that the economy is unlikely to improve significantly in the short term.

Further south, the Philadelphia Fed describes a reality where "weakness had appeared before the shutdown." Most industries are experiencing moderate declines, with employment decreasing in tandem, and price pressures are squeezing the living space of middle- and low-income families, while recent government policy changes have left many small and medium-sized enterprises feeling cornered.

Moving down to the Richmond district, the economy appears slightly more resilient. Overall economic activity is maintaining moderate growth, consumers are still hesitant about large purchases, but everyday spending is showing slow growth. Manufacturing activity has slightly contracted, while other industries remain roughly flat. Employment has not shown significant changes, with employers more inclined to maintain existing team sizes, and both wages and prices are in a moderate rising range.

The southern region covered by the Atlanta Fed is more like a "staying in place" state: economic activity is generally flat, employment is stable, and prices and wages are both rising moderately. Retail growth has slowed, tourism activity has slightly declined, and real estate remains under pressure, but there are signs of stabilization in commercial real estate. Energy demand has increased slightly, while manufacturing and transportation are maintaining low-speed operations.

In the central St. Louis district, overall economic activity and employment show "no significant changes," but demand is further slowing due to the government shutdown. Prices are rising moderately, but businesses are generally worried that the rate of increase will expand in the next six months. Under the dual pressure of economic slowdown and rising costs, local business confidence has become slightly pessimistic.

These regional reports together reveal the outline of the U.S. economy: there is no comprehensive recession, nor is there a clear recovery, but rather a distributed presentation of varying degrees of weakness. It is precisely this set of "differently tempered" local samples that forces the Federal Reserve to confront a more realistic question before the next meeting— the cost of high interest rates is fermenting in every corner.

Federal Reserve Officials' Attitude Shifts

If the "Beige Book" presents the "expression" of the real economy clearly enough, then the statements of Federal Reserve officials over the past two weeks further reveal that policy is quietly shifting. Subtle changes in tone may seem like mere wording adjustments to the outside world, but at this stage, any change in tone often signifies a shift in internal risk assessment.

Several heavyweight officials have coincidentally begun to emphasize the same fact: the U.S. economy is cooling, the pace of price declines is faster than expected, and the slowdown in the labor market "deserves attention." This is in stark contrast to their nearly unified stance over the past year of "maintaining a sufficiently tight policy environment," with a noticeably softer tone. Especially in terms of employment, the language has become particularly cautious, with some officials frequently using terms like "stable," "slowing," and "moving towards a more balanced direction," rather than emphasizing that it is "still overheating."

This way of describing the situation rarely appears in the later stages of a hawkish cycle; it feels more like a polite expression of "we are seeing some preliminary signs, and current policies may already be sufficiently tight."

Some officials have even begun to explicitly mention that excessive tightening of policy could bring unnecessary economic risks. The emergence of this statement itself is a signal: when they start to guard against the side effects of "over-tightening," it indicates that the policy direction is no longer one-sided but has entered a stage that requires fine-tuning and balancing.

These changes have not escaped the market's notice. Interest rate traders were the first to react, with futures market pricing showing significant fluctuations within days. Rate cut expectations, which were originally thought to "not happen until at least mid-next year," have gradually been moved up to spring. The "rate cut before mid-year," which no one dared to openly discuss in recent weeks, has now appeared in the baseline forecasts of many investment banks. The market logic is not complicated:

If employment continues to weaken, inflation continues to decline, and economic growth hovers around zero for an extended period, then maintaining excessively high interest rates will only exacerbate the problems. The Federal Reserve will ultimately need to choose between "sticking to tightening" and "preventing an economic hard landing," and current signs suggest that this balance is beginning to tilt slightly.

Therefore, as the "Beige Book" depicts the economy's temperature dropping to "cool," the Federal Reserve's attitude change and the market's repricing behavior also begin to corroborate each other. A consistent narrative logic is taking shape: the U.S. economy is not rapidly declining, but its momentum is slowly depleting; inflation has not completely disappeared, but it is moving towards a "controllable" direction; policy has not clearly shifted, but it is no longer in the unhesitating tightening posture of last year.

A New Cycle of Global Liquidity

Japan's 115 trillion yen in new debt brings anxiety

As expectations loosen within the United States, major economies overseas are quietly pushing the curtain on "global re-inflation," such as Japan.

The scale of Japan's current stimulus plan is much larger than the outside world imagines. On November 26, multiple media outlets cited sources familiar with the matter stating that Prime Minister Fumio Kishida's government will issue at least 11.5 trillion yen (approximately $73.5 billion) in new bonds for the latest economic stimulus plan. This scale is almost double the stimulus budget during Shigeru Ishiba's tenure last year. In other words, Japan's fiscal direction has shifted from "cautious" to "must support the economy."

Although authorities expect tax revenue to reach a record 80.7 trillion yen this fiscal year, the market is not reassured. Investors are more concerned about Japan's long-term fiscal sustainability. This also explains why the yen has been continuously sold off recently, Japanese government bond yields have soared to a 20-year high, and the dollar-yen exchange rate has remained high.

At the same time, this stimulus plan is expected to bring a 24 trillion yen boost to real GDP, with the overall economic impact approaching $265 billion.

Domestically, Japan is also trying to suppress short-term inflation through subsidies, such as a utility subsidy of 7,000 yen per household that will be distributed for three consecutive months to stabilize consumer confidence. However, the deeper impact is the flow of capital— the continuous depreciation of the yen has led more and more Asian funds to consider new allocation directions, with crypto assets positioned at the forefront of the risk curve they are willing to explore.

Crypto analyst Ash Crypto has already discussed Japan's current "money printing" actions alongside the Federal Reserve's policy shift, believing it will push the risk appetite cycle all the way to 2026. Long-time Bitcoin supporter Dr. Jack Kruse interprets it more directly: the high yields on Japanese government bonds are a signal of pressure on the fiat currency system, and Bitcoin is one of the few assets that can continuously prove itself in such a cycle.

UK's Debt Crisis Resembles 2008

Now let's take a look at the recent turmoil in the UK.

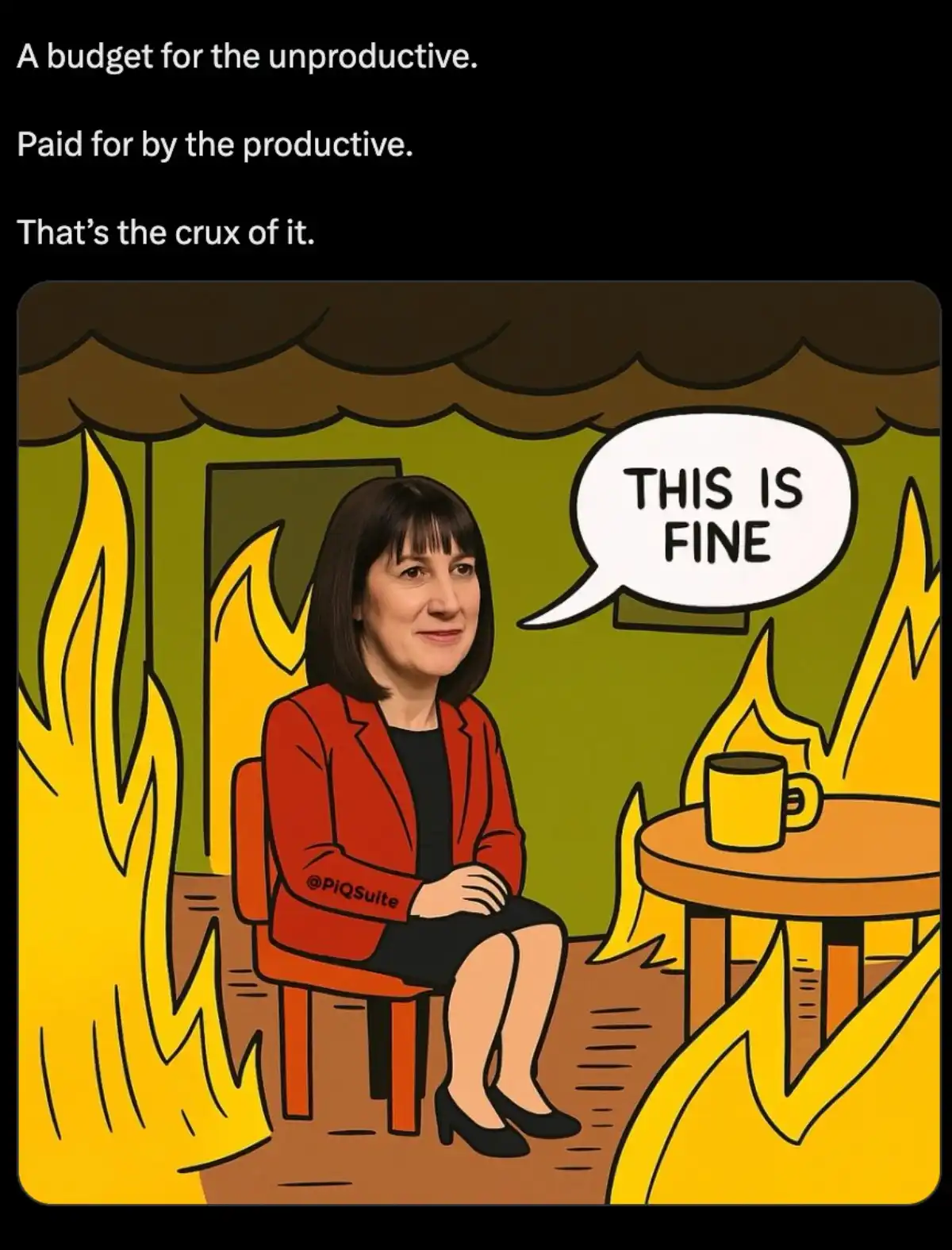

If Japan is flooding the market with liquidity and China is stabilizing it, then the UK's current fiscal operations seem more like adding weight to a cabin that is already leaking. The latest budget proposal has almost caused a collective frown in London's financial circles.

The Institute for Fiscal Studies, regarded as one of the most authoritative analytical institutions, has made its evaluation clear: "Spend first, pay later." In other words, expenditures will be rolled out immediately, while tax increases will not take effect until several years later, representing a standard fiscal structure of "leaving problems for future governments."

The most eye-catching aspect of the budget proposal is the extension of the freeze on the personal income tax threshold. This seemingly insignificant technical maneuver will contribute £12.7 billion to the Treasury in the 2030-31 fiscal year. According to the Office for Budget Responsibility's forecast, by the end of the budget cycle, one-quarter of workers in the UK will be pushed into the 40% higher tax bracket. This means that even if Labour Party members applaud the increase in landlord taxes and dividend taxes, it is still the ordinary working class that will bear the brunt of the pressure.

In addition, tax increase items are falling one after another: tax benefits for pension salary sacrifice plans are being restricted, expected to contribute nearly £5 billion by 2029-30; properties valued over £2 million will be subject to an annual "mansion tax" starting in 2028; and the dividend tax will be raised by two percentage points starting in 2026, with basic and higher rates jumping to 10.75% and 35.75%, respectively. All these policies, which seem to "tax the rich," will ultimately transmit their effects to society in more covert ways.

The tax increases will lead to an immediate expansion of welfare spending. According to OBR's calculations, by 2029-30, annual welfare spending will exceed previous forecasts by £16 billion, including additional costs from overturning the "two-child benefit cap." The outline of fiscal pressure is becoming increasingly clear: short-term political dividends, long-term fiscal black holes.

The backlash triggered by this budget proposal is more intense than in previous years, partly because the UK's fiscal gap is no longer "somewhat expanded," but is approaching crisis levels. Over the past seven months, the UK government has borrowed £117 billion, nearly equivalent to the scale of the bailout of the entire banking system during the 2008 financial crisis. In other words, the debt black hole created by the UK now has no crisis but has reached crisis scale.

Even the usually mild Financial Times has rarely used "brutal" level language, pointing out that the government still does not understand a fundamental issue: in the context of long-term economic stagnation, relying on repeated tax increases to fill the gap is destined to fail.

The market's judgment on the UK has become extremely pessimistic: the UK is "out of money," and the ruling party seems to have no viable growth route, only pointing to higher taxes, weaker productivity, and higher unemployment rates. As the fiscal gap continues to widen, debt is likely to be "de facto monetized"—the ultimate pressure will fall on the pound, becoming the "escape valve" for the market.

This is also why an increasing number of analyses are spreading from traditional finance to the crypto circle, with some directly providing a summary conclusion: when currency begins to depreciate passively, and the wage-earning class and asset-less groups are slowly pushed toward the cliff, the only thing that will not be diluted arbitrarily is hard assets. This includes Bitcoin.

Christmas or Christmas Crisis?

As the year-end approaches, the market habitually asks: is this year a "Christmas" or a "Christmas crisis"?

With Thanksgiving nearly over, its "seasonal benefits" for U.S. stocks have been discussed in the market for decades.

The difference this year is that the correlation between the crypto market and U.S. stocks has approached 0.8, with the rise and fall of both sides almost synchronized. On-chain accumulation signals are strengthening, and the low liquidity during the holiday often magnifies any upward movement into a "vacuum rebound."

The crypto community is also repeatedly emphasizing the same thing: the holiday is the easiest window for short-term trend markets to emerge. Low trading volume means that lighter buying can push prices out of dense trading areas, especially in the context of recent cold sentiment and more stable holdings.

It can be felt that a market consensus is quietly forming: if U.S. stocks initiate a small rebound after Black Friday, crypto will be the asset class that reacts most vigorously; while Ethereum is viewed by many institutions as "equivalent to small-cap stocks with high beta."

Furthermore, shifting the focus from Thanksgiving to Christmas, the core discussion has changed from "Will the market rise?" to "Will this seasonal rebound continue into next year?"

The so-called "Christmas rally" was first proposed in 1972 by Yale Hirsch, the founder of Stock Trader's Almanac, and has gradually become one of the many seasonal effects in U.S. stocks, referring to the period during the last five trading days of December and the first two trading days of the following year, when U.S. stocks typically experience a rise.

The S&P 500 has risen in 58 of the past 73 years around Christmas, with a win rate of nearly 80%.

More importantly, if the Christmas rally occurs, it could be a precursor to good performance in the stock market next year. According to Yale Hirsch's analysis, if the Christmas rally, the first five trading days of the new year, and the January barometer are all positive, then the U.S. stock market is likely to perform well in the new year.

In other words, these last few days of the year are the most indicative micro-window of the entire year.

For Bitcoin, the fourth quarter is inherently the easiest period for it to initiate trends in its history. Whether it is the early miner cycle or the later institutional allocation rhythm, Q4 has become a natural "right-side market season." This year, it is compounded by new variables: expectations of U.S. interest rate cuts, improved liquidity in Asia, increased regulatory clarity, and the return of institutional holdings.

Thus, the question becomes a more realistic judgment: if U.S. stocks enter a Christmas rally, will Bitcoin perform even more vigorously? If U.S. stocks do not rise, will Bitcoin still move on its own?

This will determine whether those in the crypto industry will experience a Christmas or a Christmas crisis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。