_This article is from: _Dragonfly Managing Partner Haseeb Qureshi

_Translation|Odaily Planet Daily ( _@OdailyChina_); Translator|Azuma ( _@azumaeth )_

Editor’s Note: The industry is currently in a moment of confidence crisis regarding the future. Is the bubble too big? Are valuations too high? Are the things I hold in my hand valuable? Questions like these are constantly testing the market's confidence.

On November 28, Haseeb Qureshi, a well-known partner at Dragonfly, wrote a heartfelt long article. In the article, Haseeb summarizes the mainstream sentiment currently permeating the community as "financial cynicism" (a fundamentally skeptical or even distrustful attitude towards the financial system, market participants, asset prices, policy motives, etc.); he also points out that the industry's focus is shifting from Silicon Valley to Wall Street, which reflects an overemphasis on linear thinking and a neglect of exponential thinking; Haseeb believes that ETH or SOL should not be mechanically valued using price-to-earnings ratios and asserts that exponential growth will ultimately lead cryptocurrencies to "devour everything."

Below is the original content from Haseeb, translated by Odaily Planet Daily.

I used to tell entrepreneurs that when you launch a new product, the market's reaction will not be hatred, but indifference. Generally, no one cares about your new chain.

But now I can’t say that anymore. Monad just launched this week, and I have never seen a newly released blockchain face so much hatred. I have been a professional investor in the cryptocurrency field for over 7 years, and before 2023, almost all newly launched chains received either enthusiastic support or complete indifference.

But now, new chains are greeted with huge boos right from their inception. Projects like Monad, Tempo, and MegaETH — even before their mainnet launch — are frequently attacked, which is indeed a brand new phenomenon.

I have been trying to analyze: Why is this happening now? What kind of market psychology does this reflect?

“Medicine” is more deadly than “disease”

A preemptive warning, this may be the most “vague” blockchain valuation article you have ever read. I have no fancy metrics or charts to show you. Instead, I will refute the current mainstream sentiment in cryptocurrency, which I have almost always opposed over the past few years.

In 2024, I feel that what I am opposing is financial nihilism. Financial nihilism believes that all assets are meaningless, ultimately just memes, and that everything we build is essentially worthless. Fortunately, this atmosphere is no longer dominating the market. We have moved beyond this delusion.

But the current mainstream sentiment, I would call “financial cynicism.” Many people think that perhaps these tokens do have some value, not entirely just memes, but they are severely overvalued, with actual value possibly only one-fifth to one-tenth of the current trading price… and Wall Street will eventually discover this, so you better pray that Wall Street doesn’t expose our bluff, or once they take action, everything will be ruined.

Now you will see many bullish analysts trying to construct optimistic Layer1 valuation models, raising price-to-earnings ratios, gross margins, and DCF to counter this market sentiment.

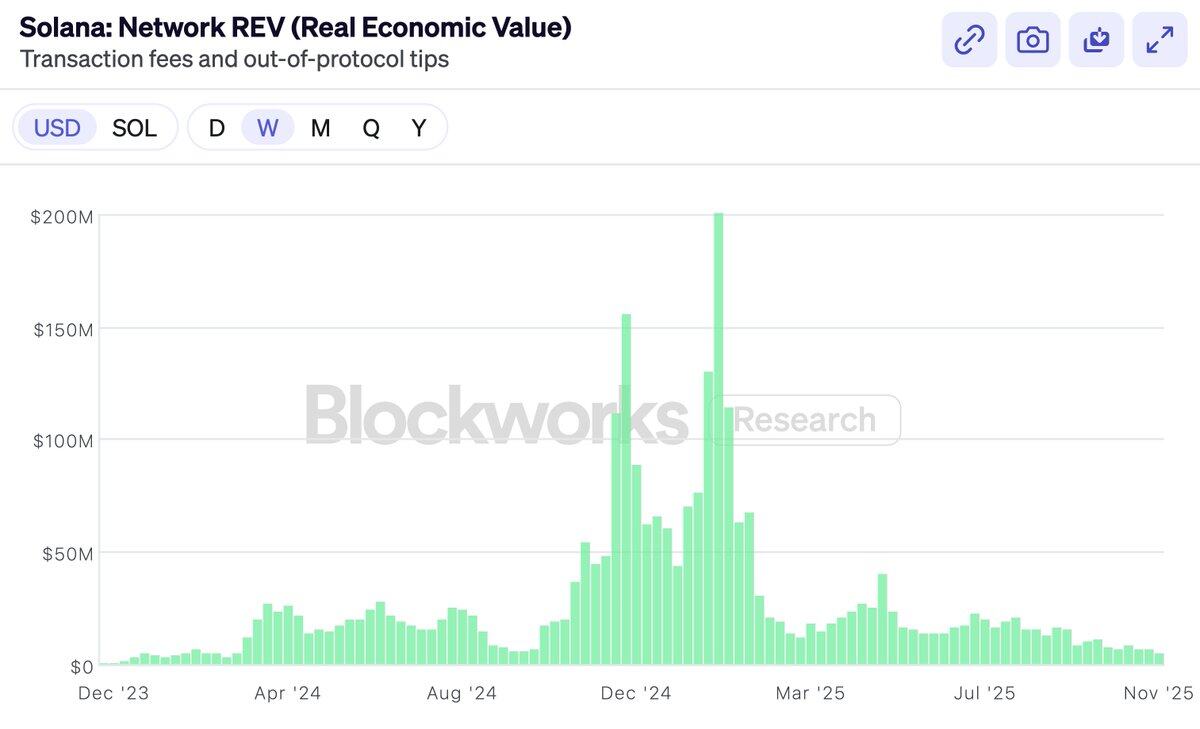

At the end of last year, Solana proudly adopted REV (Real Economic Value) as a metric that could ultimately prove its valuation reasonable. They proudly announced: We, and only we, no longer need to bluff to Wall Street!

Of course, almost immediately after REV was officially adopted, its value plummeted — but interestingly, SOL performed better than REV itself.

I am not saying there is anything wrong with REV. REV is a very clever metric. But the focus of this article is not on metric selection.

Then Hyperliquid officially launched, a decentralized exchange with real revenue, a buyback mechanism, and a price-to-earnings ratio. The community began to shout: “See, I told you! Finally, there is a token with real profits that can be measured by price-to-earnings ratio. Hyperliquid will devour everything because obviously Ethereum and Solana can’t make real money, we can stop pretending they have value.”

Hyperliquid, Pump, Sky, these tokens that emphasize buybacks are indeed great, but the market has always been able to invest in exchange stocks or tokens; you could buy assets like COIN or BNB at any time. We also hold HYPE, and I think it is an excellent product.

But the reason people initially invested in ETH and SOL was not this. Layer1 does not have the same profit margins as exchanges; that is not why people hold them — if people wanted that kind of profit model, they could have directly bought COIN.

So if I am not criticizing the financial metrics of blockchain, you might think this article is condemning the various sins of the “token industrial complex.”

Clearly, everyone has lost money on tokens over the past year — including VCs. This year, altcoins have performed poorly. So another half of the current mainstream sentiment in the community is debating who we should blame? Who has become greedy? Are VCs greedy? Is Wintermute greedy? Is Binance greedy? Are miners greedy? Are founders greedy?

Of course, the answer is the same as before. Everyone is greedy — VCs, Wintermute, miners, Binance, KOLs, they are all greedy, and so are you. But that doesn’t matter. Because any normally functioning market never requires participants to act against their own interests. If our judgment about cryptocurrency is correct, then despite everyone being greedy, investments can still yield returns. Trying to interpret the market downturn by analyzing “who is greedier” is about as effective as organizing witch hunts — I can guarantee that people did not just start becoming greedy.

So this is not the topic of this article.

Many people want me to write an article analyzing how much MON should be worth, how much MEGA should be worth. I have no interest in such articles and do not intend to urge you to buy any specific assets. In fact, if you are not optimistic about these projects, perhaps you shouldn’t buy any tokens at all.

Will new challenger blockchains emerge victorious? Who knows. But if there is indeed a significant chance, the market will price based on that probability. If Ethereum is worth $300 billion and Solana is worth $80 billion, then a project with a 1% - 5% chance of becoming the next Ethereum or Solana will be valued according to that probability.

The community reacts with astonishment, but this is no different from the valuation logic of biotech companies. A drug with less than a 10% chance of curing Alzheimer’s will still be given a valuation of billions of dollars — even if it has a 90% chance of failing in phase three clinical trials and going to zero. This is the logic of probability calculation — it turns out that the market is very good at making such calculations; assets with binary outcomes are priced by probability, not by business revenue, and certainly not by moral standards. This is the valuation philosophy of the “shut up and calculate” faction.

Honestly, I don’t think this is an interesting topic worth discussing — arguing whether the odds are 5% or 10% is meaningless; for the valuation of any token, the market itself is the best judge, not article analysis.

So what I want to write next is: The crypto community seems to no longer believe that public chains have value.

I don’t think this is because they don’t believe new chains can win market share. After all, we just saw Solana rise from the “ruins” less than two years ago and quickly capture market share. This is not easy, but it is certainly possible.

The problem is more that people are starting to think: even if a new chain wins, there is no “prize” worth winning. If ETH is just a meme, if it will never generate real income, then even if you win, you won’t be worth $300 billion. The competition itself is not worth participating in because these valuations are fake, and they will collapse before you can “claim your prize.”

Being optimistic about the valuation of public chains is outdated; it’s not that no one is optimistic — clearly, there are optimists in the market. Where there are sellers, there are buyers; despite many people liking to sing the blues for Layer1, there are still many who are very willing to buy SOL at $140 and ETH at $3000.

But now there seems to be a general “perception” — the smartest people have stopped buying tokens of smart contract blockchains. Smart people know the game is about to end; if not now, then soon. The only ones left buying these things are the “retail investors” — Uber drivers, Tom Lee, and KOLs shouting about trillion-dollar market caps, maybe even the U.S. Treasury, but definitely not “smart money.”

This is all nonsense. I don’t believe it, and you shouldn’t believe it either.

So I feel I must write a “Declaration of Smart People” to explain why general-purpose public chains are valuable. This article is not about Monad or MegaETH; it is actually defending ETH and SOL because if you believe ETH and SOL are valuable, then everything else follows logically.

As a VC, defending the valuation of ETH and SOL is usually not my job, but QTMD, if no one is willing to do it, then I will write.

Feel the growth of the exponential

My partner Feng Bo has personally experienced the explosion of the Chinese internet as a VC. I have heard too many statements that “cryptocurrency is like the internet,” so many that I am almost no longer moved by them. But when I hear him tell that story, it always reminds me of how expensive the cost of misjudgment can be in such matters.

One story he often tells is that in the early 2000s, all the early e-commerce VCs (at that time a very small circle) gathered together for coffee, and they debated a question: How big can the e-commerce market really be?

Will it mainly be used for electronics (maybe only tech enthusiasts will use computers)? Can it be applicable to women (maybe they rely too much on touch)? Can it work for the food industry (can perishable goods be managed)? These were all very important questions for early VCs when deciding what to invest in and how much.

And the answer, of course, is that each of them was wildly wrong. E-commerce ultimately sells everything, and the target users are the entire world. But at that time, no one truly believed this. Even if someone did, they would never dare to say it out loud.

You just need to wait long enough for exponential growth to tell you the answer. Even among believers, very few thought e-commerce would become this huge. And those few who truly believed almost all became billionaires by “not selling.” Other VCs (including Feng Bo himself) sold too early.

In the crypto space, believing in exponential growth has become out of fashion. But I believe in the exponential growth of crypto. Because I have experienced it firsthand.

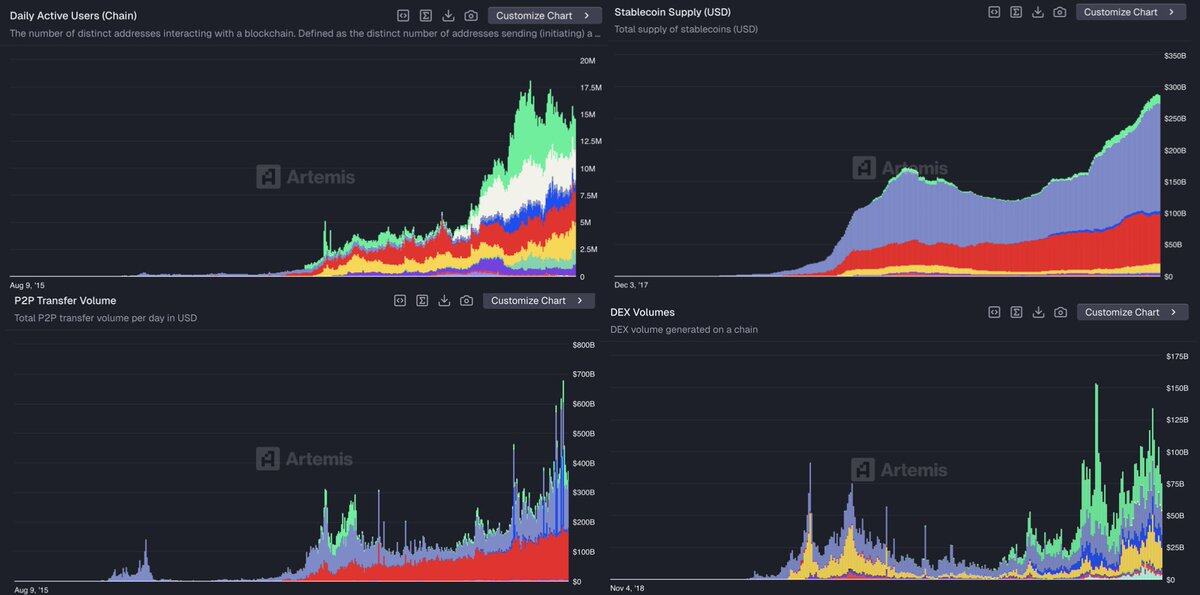

When I entered the crypto industry, no one was using these things. It was small, broken, and terrible. The on-chain TVL was only a few million. We invested in the first generation of DeFi — MakerDAO, Compound, 1inch — when they were still research projects. I remember playing on EtherDelta back in the day, where a DEX trading a few million dollars a day was considered a huge success, but the experience was terrible. And now, we can see daily trading volumes in the tens of billions on-chain.

I remember thinking that Tether issuing $1 billion was already “too crazy,” and The New York Times even wrote that it was a Ponzi scheme on the verge of collapse, but now the issuance scale of stablecoins has exceeded $300 billion and is even regulated by the Federal Reserve.

I believe in exponential growth because I have witnessed it. I have seen it time and again.

But you might counter — well, maybe stablecoins are experiencing exponential growth, maybe DeFi is experiencing exponential growth, but that value won’t be captured by ETH or SOL. Value doesn’t flow to the chain itself.

To this, my answer is: you still don’t believe in exponential growth enough.

Because the answer to exponential growth never changes: these things don’t matter. The future scale will far exceed today. When this field grows to an enormous size, you will reap the rewards of scale effects.

Please look at the chart below.

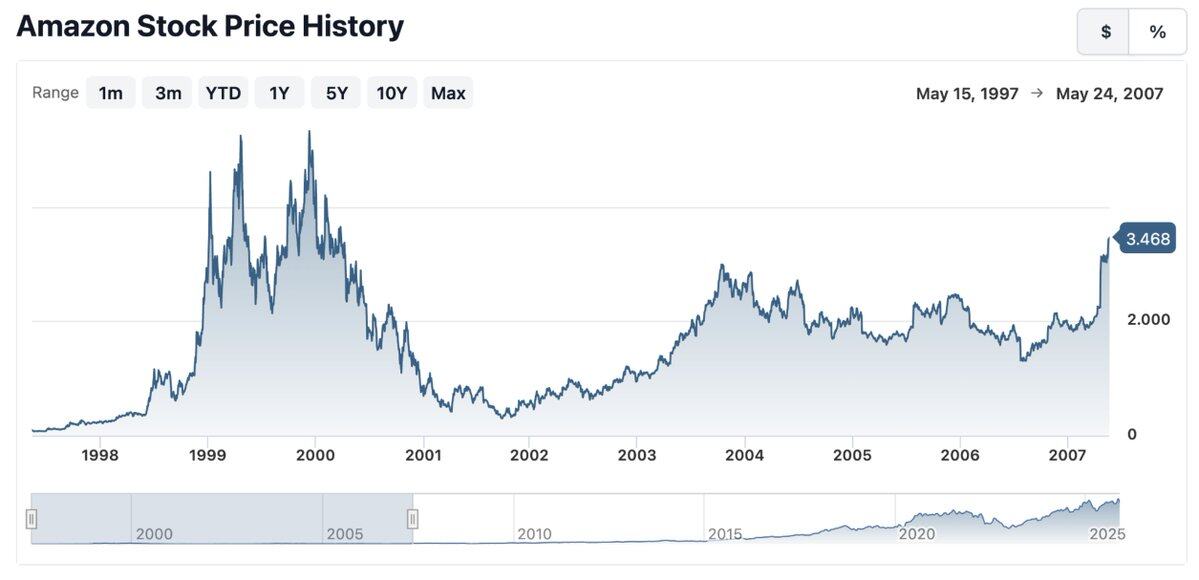

This is Amazon's profit and loss statement from 1995 to 2019, a total of 24 years. The red line is revenue, and the gray line is profit. Do you see that little gray line at the end curving upwards? That was the moment Amazon truly began to turn a profit, 22 years after its founding.

By the time Amazon reached its 22nd year, this net income gray line finally broke away from 0 for the first time. In every year prior, there were columns written, criticisms made, and short-sellers claiming that Amazon was a Ponzi scheme that would never make money.

Ethereum has just turned 10, and below is the performance of Amazon's stock in its first 10 years.

Ten years of stagnation. Along the way, Amazon was surrounded by skeptics and non-believers — “Is e-commerce just a charity subsidized by VCs?”; “They are just selling cheap, low-quality trinkets to people who only love bargains; what future does that have?”; “How can they possibly make real money like Walmart or GE?”

If you were fixated on debating Amazon's price-to-earnings ratio at that time, you completely missed the point. That was just a linear growth mindset, but e-commerce was never a linear trend — thus, all those who debated price-to-earnings ratios over the 22 years were thoroughly disproven by reality. No matter what price you bought in at, no matter when you entered, your level of optimism was far from sufficient.

This is the nature of exponential growth. For truly exponential technologies, no matter how large you think they can grow, they will always surpass your imagination.

This is the core understanding that Silicon Valley has always had over Wall Street. Silicon Valley grows in the soil of exponential growth, while Wall Street is steeped in linear thinking. And in recent years, the focus of the crypto industry has shifted from Silicon Valley to Wall Street. You can feel this shift clearly.

Admittedly, the growth of cryptocurrencies is not as smooth as that of e-commerce. It is more erratic, sometimes stopping and sometimes moving. This is because cryptocurrencies are related to “money,” closely tied to macro forces, and are subject to more intense regulatory pull than e-commerce. Cryptocurrencies strike at the core of the nation — currency — thus the pressure on governments is far greater than that on e-commerce.

But exponential growth is still inevitable. This is a rough argument. But if crypto is exponential, then this rough argument is correct.

Zooming Out

Financial assets crave freedom, openness, and interconnectivity. Crypto technology transforms financial assets into a file format, making sending dollars or stocks as simple as sending a PDF. It makes interconnectivity of everything possible — creating a financial network that operates around the clock, is globally connected, and is completely open.

This will surely succeed. Openness always wins.

If the internet has taught me one thing, it is this. There will be giants resisting, governments will intimidate and pressure, but in the end, they will all retreat in the face of the adoption speed, creativity, and efficiency brought by this technology. This is what the internet has done to all traditional industries. Blockchain will let the same trend consume the entire financial and monetary system.

That’s right — given enough time — everything will be consumed.

An old saying goes: people always overestimate what will happen in two years and underestimate what will happen in ten years.

If you believe in exponential growth, if you zoom out far enough, then all valuations are still low. It is worth pondering: every day, holders persist longer than sellers and skeptics. The time horizon of large capital is far longer than what crypto market short-term traders want you to believe. Historical experience teaches large capital not to fight against major technological trends. Do you remember the grand narrative that initially made you buy ETH or SOL? Large capital still believes that story and has never wavered.

So, what exactly am I arguing?

I am arguing that applying price-to-earnings ratios to smart contract chains (the so-called “revenue valuation paradigm” today) is a betrayal of exponential growth. This means you are categorizing this industry into the realm of linear growth; it means you believe that 30 million DAUs on-chain and less than 1% M2 penetration is its ceiling; it means you think cryptocurrencies are just a corner of the world, that they have not won and are not destined to win.

More importantly, I am calling on everyone to become believers. Not just believers, but long-term believers.

I am asserting that this exponential transformation will surpass all the waves you have experienced in your lifetime. This is your “e-commerce era.”

When you are in your twilight years, you will tell your descendants: “When the great change happened, I was there.” Not everyone believes this could come true — the entire social order will be reshaped, and all monetary and financial systems will be completely overturned by the decentralized computer programs we collectively own.

But it did happen, and it changed the world. And you were part of it.

Disclosure of Interests: The above article is solely personal opinion. Dragonfly is an investment institution for many tokens including MON, MEGA, ETH, SOL, HYPE, SKY, etc. Dragonfly firmly believes in the theory of exponential growth. This article does not constitute investment advice but provides another dimension of thinking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。