Money always flows to where there is more money, and liquidity is always in pursuit of deeper liquidity.

The market capitalization of Bitcoin is $1.7 trillion, while the total market capitalization of the U.S. stock market exceeds $50 trillion. Tech giants like Apple, Microsoft, and Nvidia each have a market capitalization that can crush half of the entire cryptocurrency market.

An increasing number of savvy crypto enthusiasts seem to have reached a subtle consensus: trading cryptocurrencies is really not as good as trading U.S. stocks.

The U.S. stock market is deeply tied to the global economy, geopolitical factors, and technological innovation. Its volatility and topicality are far richer than any single cryptocurrency. This level of global attention is something that meme coins and altcoins can never reach.

Major perpetual DEXs in the crypto industry, such as Hyperliquid, Trade.xyz, Ostium, and Lighter, have already launched perpetual contract trading for U.S. stocks.

Combining on-chain perpetual contracts, a financial tool that has long been commonplace in the cryptocurrency market, with the U.S. stock market has made it even more exciting and attractive.

After all, in the traditional financial world, ordinary people face numerous obstacles to trade U.S. stocks: opening overseas brokerage accounts, waiting for lengthy approvals, enduring limited trading hours, and accepting leverage limits of 2x or at most 4x.

But now, the rules of the game are being rewritten. Perpetual contracts are combining with the U.S. stock market in an unstoppable manner. U.S. stock perpetual contracts may also be the next key investment direction for smart money.

This article will delve into the core mechanisms of the three platforms: Trade.xyz, Ostium, and Lighter, comparing their differences in trading experience, risk control, and data performance.

Which DEX has more stocks and stronger leverage?

Let's first look at the most basic questions that traders care about: the types of stocks supported, the available leverage multiples, and the fee structures.

trade.xyz

Trade.xyz is the first perpetual DEX deployed based on the Hyperliquid HIP-3 protocol and is the largest perpetual DEX on HIP-3, launched in October 2025. Its biggest innovation is enabling 24/7/365 trading of U.S. stocks, focusing on U.S. stock indices (XYZ100) and individual stock perpetual contracts. It is currently in a growth phase, with trading fees reduced by ≥90%, and the actual taker fee is only about 0.009%.

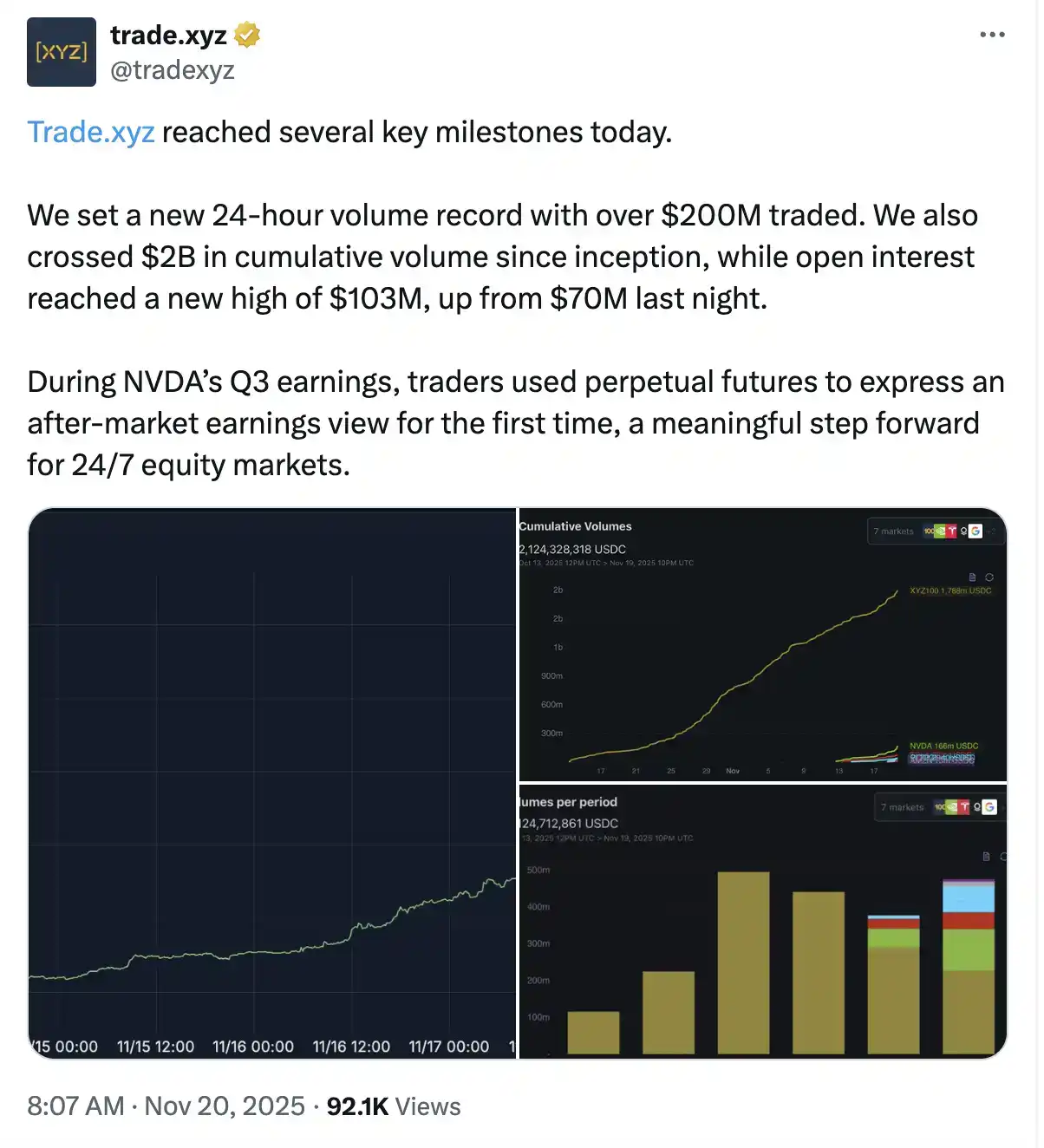

The team is relatively mysterious, mainly consisting of members from the Hyperunit team (@hyperunit), operating in an anonymous or low-profile manner, and has not disclosed detailed founder information. There are community rumors that the Hyperunit team comes from Hyperliquid. Currently, it has not undergone external financing and is a Pre-TGE project. Related reading: "$2 billion in trading volume in 10 days, another hit from Hyperliquid".

As shown in the image, trade.xyz currently supports 11 types of U.S. stock assets, with most stocks offering 10x leverage, while the index product XYZ100 (tracking the Nasdaq) can go up to 20x. The trading model adopts a CLOB model.

The overall fee structure is also quite friendly: in the current growth phase, the fee discount is ≥90%, with actual fees: taker ≤0.009% (about 9 cents per $1,000), maker: ≤0.003%.

Lighter

Lighter is a custom ZK-rollup perpetual trading platform based on Ethereum, officially launched in early 2025, known for zero trading fees and provable fairness. The platform uses zero-knowledge proof technology to verify all order matching and settlement processes. It just launched U.S. stock trading features on November 26.

Founder Vladimir Novakovski has a strong background, being a Russian immigrant, a gold medalist in U.S. math and physics competitions, and after graduating from Harvard at 18, he joined Citadel as a trader, with 15 years of fintech experience. He co-founded the AI social platform Lunchclub (which raised $30 million). Lighter recently completed a $68 million Series B funding round in November 2025, with a valuation of $1.5 billion, led by Founders Fund (Peter Thiel) and Ribbit Capital, with other investors including a16z crypto, Lightspeed, Coatue, and other top institutions.

As shown in the image, Lighter supports 5 types of U.S. stock assets, all with a uniform leverage of 10x. The trading model also adopts a CLOB model.

Lighter maintains its biggest selling point and feature for U.S. stock trading: 0 fees, with both retail takers and makers at 0%. For high-frequency trading and market maker users, the fees are Maker 0.002%, Taker 0.02%. Additionally, Lighter calculates funding rates, capped at ±0.5% per hour, based on premium TWAP.

Ostium

Ostium is an open-source decentralized perpetual futures exchange built on Arbitrum, focusing on trading real-world assets (RWA), including U.S. stocks, indices, commodities, and foreign exchange. Its core feature includes leverage of up to 200x.

Ostium Labs was founded in 2022 by former Bridgewater Associates employees, with both founders being Harvard classmates. On October 6, 2023, it completed a $3.5 million seed round, led by General Catalyst and LocalGlobe, with participation from notable institutions including Balaji Srinivasan, Susquehanna International Group (SIG), and GSR. It is currently in the Pre-TGE stage, operating a points system to reward active users.

As shown in the image, Ostium has the most comprehensive variety of U.S. stocks, currently supporting 13 types of U.S. stock assets. The leverage multiples are also quite aggressive, varying based on the liquidity and trading volume of different assets. Mainstream tech stocks like Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla support leverage of up to 100x. Crypto-related stocks like Coinbase, Robinhood, MicroStrategy, SBET, and Circle support leverage of 30-50x.

Unlike the CLOB model of the first two, Ostium adopts a pool-to-pool model using Arbitrum AMM for its trading mode.

In terms of fee structure, the opening fee is fixed at 0.05%, with no closing fee; the oracle fee is charged at $0.10 each time, which may be refunded after closing depending on different trading forms, see fee rules for details; there is also a rollover fee similar to a funding rate, calculated based on block compounding and holding costs, with asymmetric long and short rates.

How does Wall Street trade U.S. stocks while sleeping?

After comparing the targets, leverage, and fees of the three platforms, another very critical factor that determines the "difference in trading experience" is that U.S. stocks do not trade 24 hours, while on-chain perpetual contracts do.

So when external prices are stagnant, how the oracle continues to operate and how to handle trading during market closures varies completely across platforms.

trade.xyz

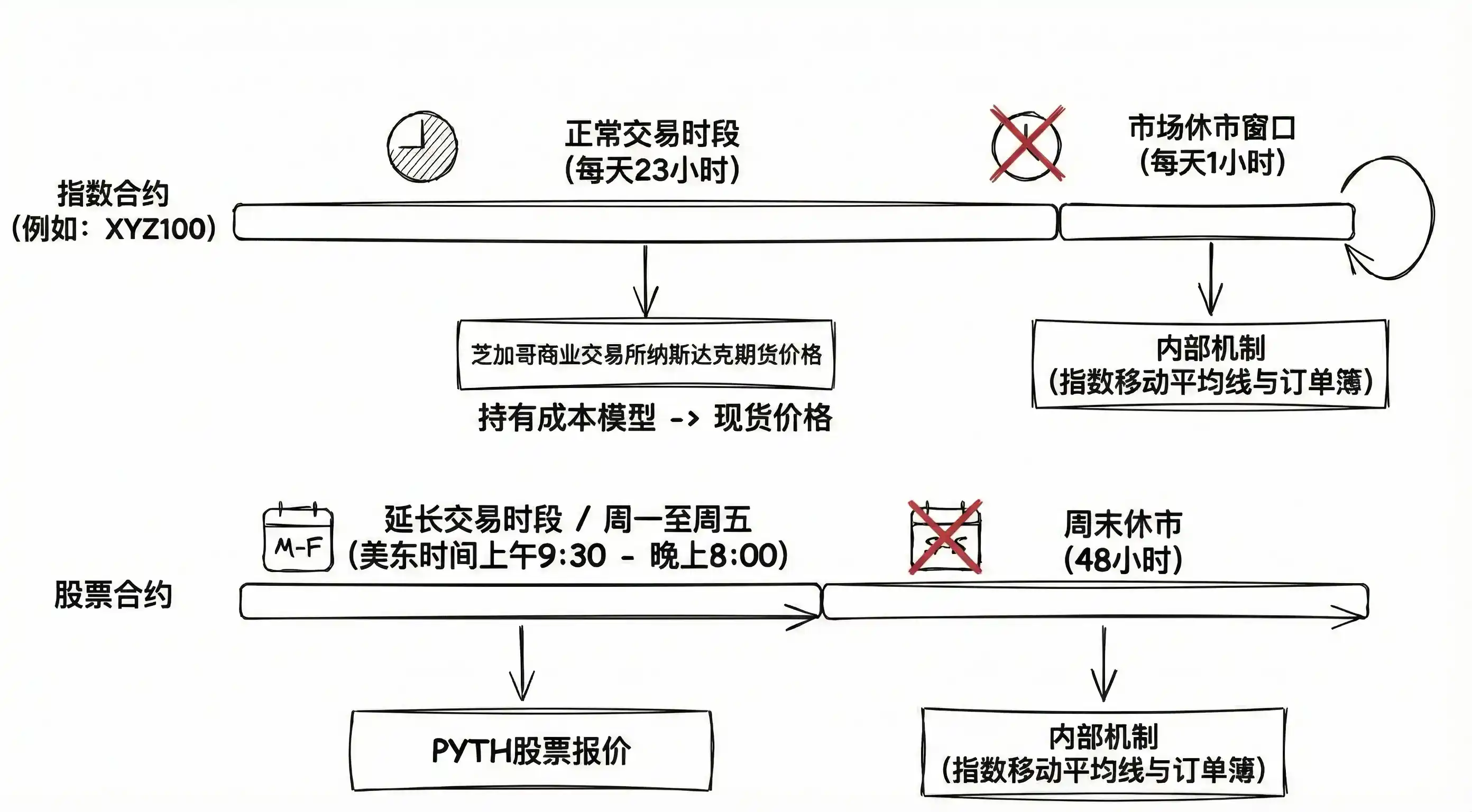

For trade.xyz, its approach can be summarized as "divided by asset, divided by time period."

Index products (like the XYZ100 tracking the Nasdaq) do not directly rely on the U.S. stock spot market but instead use CME's NQ futures—these futures trade for 23 hours a day, providing a more continuous price source. Trade.xyz uses a cost-holding model to backtrack the futures price to the "corresponding spot index price," allowing the index contracts to maintain price updates almost around the clock.

However, for individual stocks, the situation is not so simple. Stocks do not have the nearly all-day liquidity that futures do, so trade.xyz mainly relies on Pyth's price source, covering extended periods such as pre-market, after-hours, and overnight.

Only when there is a complete lack of external data input, such as the one-hour market closure window that futures have daily, or the long 48-hour closure over the weekend for stocks, does the system switch to trade.xyz's internal pricing mechanism: using an exponential moving average (EMA) with an eight-hour time constant to smooth prices based on the on-chain order book, and adjusting the impact price spread according to the depth of buy and sell orders, allowing prices to still reflect on-chain supply and demand in the absence of external data. Once external data is restored, the oracle will immediately switch back to external prices.

This design allows the oracle to self-adjust based on the on-chain order book in the absence of external data, maintaining responsiveness to market supply and demand.

Ostium

Ostium has built its own pull-based RWA oracle system, finely handling different asset trading periods, futures rollovers, and opening gaps. The data sources, exchange period information, and node aggregation logic are all constructed by the development team, then run by a node network like Stork.

The overall cost is relatively high, so trading on Ostium involves an oracle fee of $0.1 each time. If a trade fails due to low slippage or other reasons, this fee will still be charged, but it can be refunded after the trade is successfully completed and fully settled, see fee rules for details.

For ordinary users, this means that prices will not fluctuate wildly during market closures, but you can still place orders in advance—both limit orders and stop-loss orders can be placed, but they will only execute once the market reopens and the price conditions are met, while market orders cannot be submitted during market closures. This mechanism is somewhat like "strictly adhering to the traditional market rhythm," even incorporating special closure times for holidays, making the price feeding behavior closer to the real market.

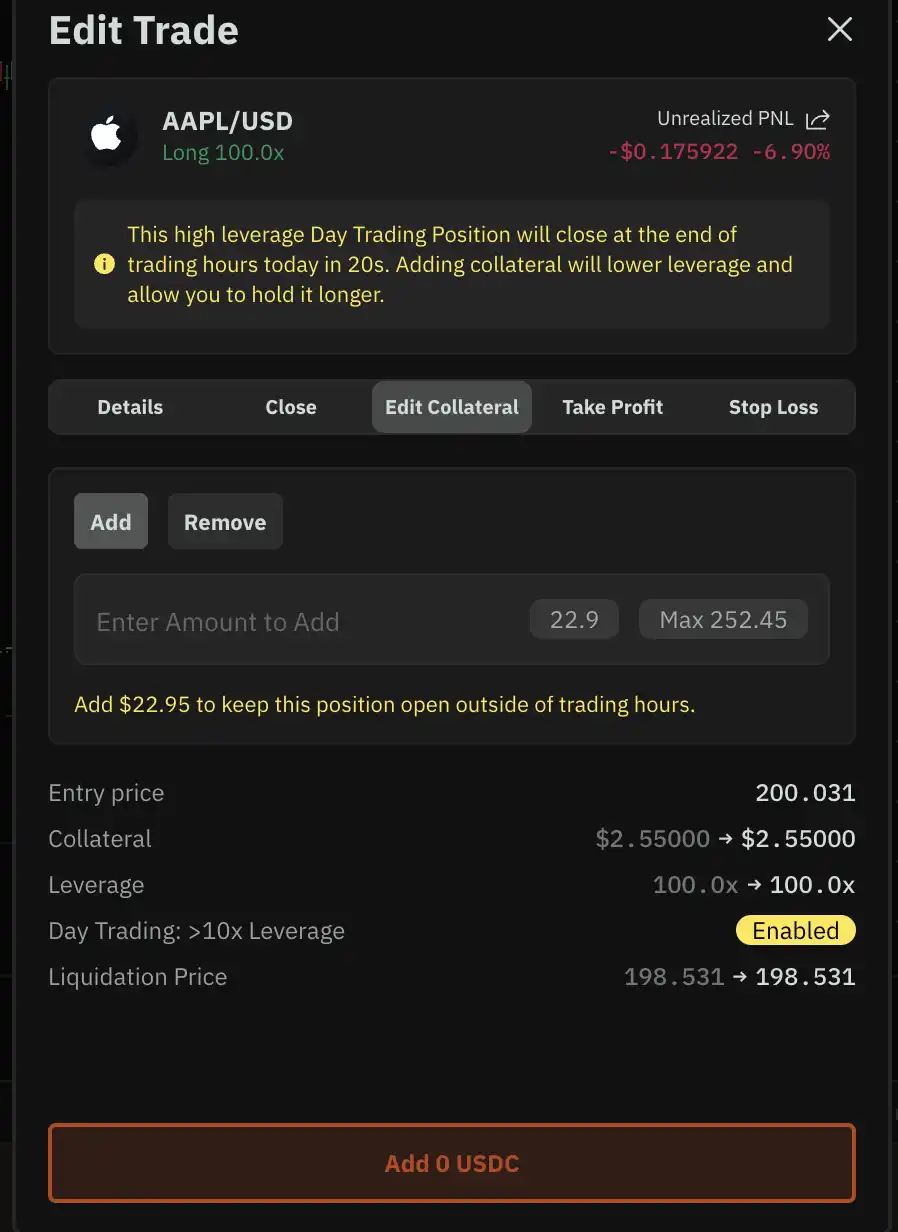

Additionally, while Ostium's leverage can be quite aggressive, allowing for up to 100x leverage, this is only limited to intraday trading. Once the daily window is exceeded or it enters overnight trading, the leverage requirements will be strictly tightened.

Example of an intraday trading position

Specifically, the leverage can be opened or adjusted at any time during normal market hours (Eastern Time 9:30 AM to 4:00 PM). However, once it exceeds the daily window (Eastern Time 9:31 AM to 3:45 PM) or enters overnight trading, the leverage requirements will be tightened, and the specific tightening will vary by asset category. All intraday trades with leverage exceeding the limit will be forcibly liquidated 15 minutes before market close, which is at 3:45 PM Eastern Time, to reduce overnight risk.

Lighter

Lighter's strategy is more straightforward.

During market closures, Lighter chooses to freeze the market in a relatively safe state: entering a reduce-only mode, meaning that positions can only be reduced, not increased or adjusted for leverage, to avoid expanding risk.

During trading hours, its RWA assets and regular crypto assets are treated the same, with prices updating normally and orders matching as usual; but once it enters the market closure period, the index price will no longer update, and the marked price can only fluctuate up or down by 0.5% around the current point to avoid severe deviations.

Funding fees continue to be charged normally, but new active trades cannot be executed.

How to Benefit from Dividends?

When it comes to U.S. stock perpetual contracts, there is an unavoidable question: stocks pay dividends, but what about the contracts?

Cryptocurrencies like Bitcoin never pay dividends; the price is just the price. However, companies like Apple and Microsoft distribute money to shareholders every quarter. In the traditional stock market, the stock price automatically drops on the ex-dividend date—if a stock is $100 and the dividend is $2, it becomes $98 after the ex-dividend date.

This creates a problem in perpetual contracts: if no adjustments are made, wouldn't short sellers just pocket the $2 price difference? As long as they open a short position before the dividend is paid, they can profit when the stock price drops. Isn't this a risk-free arbitrage?

So how do these three platforms handle this issue?

trade.xyz

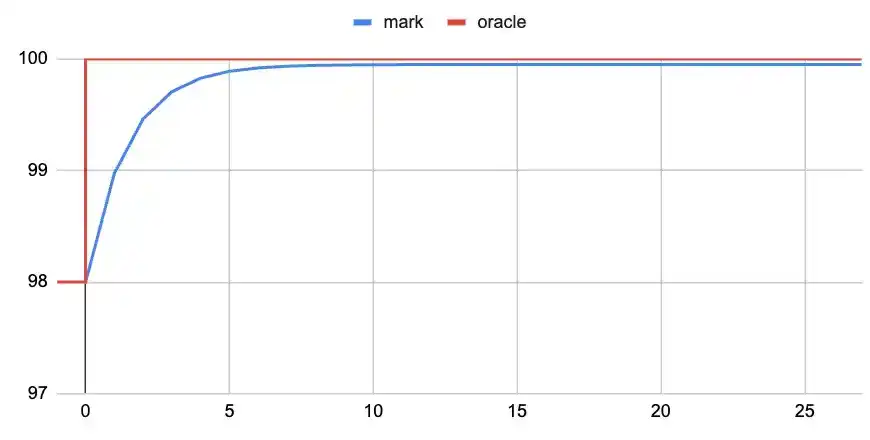

Trade.xyz's solution is to incorporate dividends into the funding rate calculation. Suppose the oracle price is $100, and at a future time T, it jumps to $98 due to a $2 dividend payout. In every hour leading up to T, the marked price must present a smooth discount curve.

At time T-1, to prevent arbitrage, the funding fee paid by short sellers must precisely equal the profit they gain from the price dropping from the marked price to $98. According to the funding rate formula: funding rate = (marked price - oracle price) / oracle price + truncation function (…)

Since the marked price is lower than the oracle price, the funding rate becomes negative. A negative funding rate means that short sellers have to pay long holders. Going back to T-2 and T-3, the marked price will gradually slide from 99.95, 99.90… all the way down to 98.975. Each hour, short sellers must pay a funding fee to long holders.

Image source: https://oldcoinbad.com/p/non-arbitrage-conditions-for-perpetual

The end result is that short sellers appear to have made a $2 price difference (100→98), but they have paid it all through the funding rate; long holders nominally lost $2 (the price dropped from 100 to 98), but by receiving the funding fee, they effectively received the dividend.

Ostium

Ostium, on the other hand, believes that perpetual contracts track price movements, not the stocks themselves. Since you don't actually hold shares of Apple, why should you enjoy dividend payouts? A contract is a contract, and price fluctuations are the only concern.

Therefore, on Ostium: the price should drop on the ex-dividend date, following the oracle; it will not compensate long holders through the funding rate; nor will it charge short sellers any additional fees.

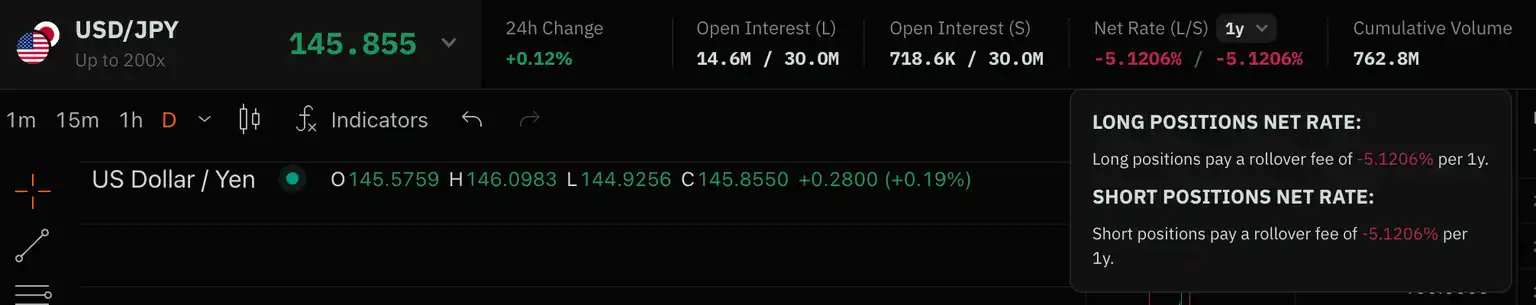

Doesn't that mean long holders are at a disadvantage? Here, Ostium uses another mechanism to balance this: the rollover fee.

What is the rollover fee? Simply put, it is the time cost of holding a position, similar to the financing cost or yield of holding real stocks. Its characteristics are: asymmetry between long and short; the rates for longs and shorts may differ; block compounding: every block (approximately every few seconds) is calculated, but you won't feel it; settlement upon closing: it is not deducted in real-time but calculated when you close the position.

The rollover fee will be displayed on the net profit margin (L/S) label. Hovering over it will show a tooltip explaining the long and short rollover fees.

This means that if you go long on a stock, the rollover fee may be positive; if you go short, the rollover fee may be negative.

This rollover fee mechanism indirectly reflects the holding costs, including the impact of dividends. Although Ostium does not directly handle dividends, through the rollover fee and oracle adjustments, the final profits and losses for both longs and shorts remain relatively fair.

Lighter

Lighter's documentation does not explicitly state a special treatment for dividends, but from the mechanism, it should rely on price adjustments from the oracle.

In other words: when the spot price drops on the ex-dividend date, the oracle also drops; if the contract marked price does not follow, a negative premium will occur; the negative premium leads to a negative funding rate, where short sellers pay long holders; ultimately achieving balance.

This method is somewhat similar to Trade.xyz, except that Lighter does not specifically emphasize the handling of dividends but incorporates it into the overall price tracking mechanism.

Additionally, it is worth noting that Lighter has a funding rate cap: ±0.5% per hour. This is to prevent the funding rate from skyrocketing during extreme market conditions, protecting traders from being overwhelmed by excessive fees.

Summary

The PMF of U.S. stock perpetual contracts has been preliminarily validated. Data shows that trade.xyz's cumulative trading volume has surpassed $2 billion, with a record single-day trading volume of $200 million during NVDA's earnings report, and approximately $734 million in trading volume over the past 24 hours.

Lighter's overall trading volume and OI (open interest) data are impressive, with a trading volume of $7.16 billion over the past 24 hours and OI of $1.634 billion. Since Lighter just launched U.S. stock trading a few days ago, there is limited data on U.S. stock trading, and no very reliable specific data source is tracking it yet.

Looking at Ostium, the total trading volume exceeds $27.2 billion, with a trading volume of $138 million over the past 24 hours.

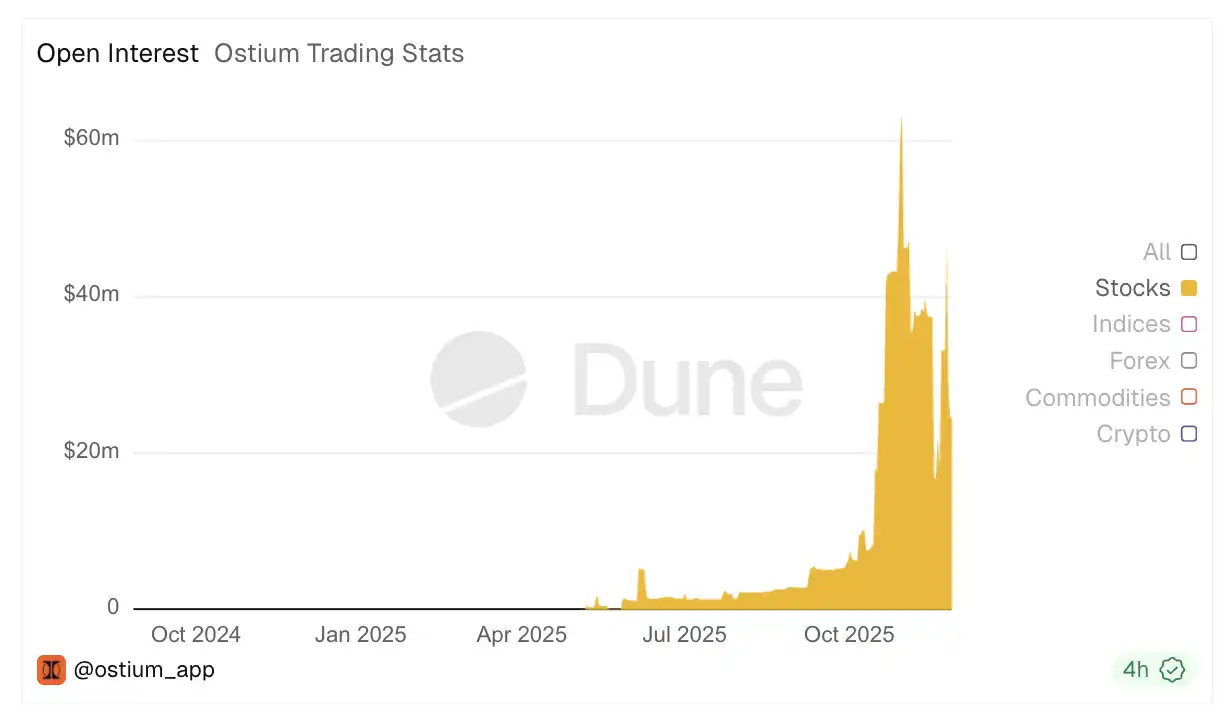

According to Dune's statistics on Ostium's U.S. stock contract trading, the daily trading volume of U.S. stock contracts has already surpassed $50 million. The OI curve for U.S. stock contracts reached a historical peak of about $64 million in October this year, and has now fallen back to around $45 million. The OI also shows that the open interest for Ostium's U.S. stock contracts accounts for 20% of the total open interest.

However, amidst the excitement, it is also necessary to remind all U.S. stock perpetual contract traders: the efficiency of financial markets is brutal, and the temptation of 100x leverage comes with 100 times the risk. For those interested in U.S. stock perpetual contracts, it is best to start with small positions and low leverage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。