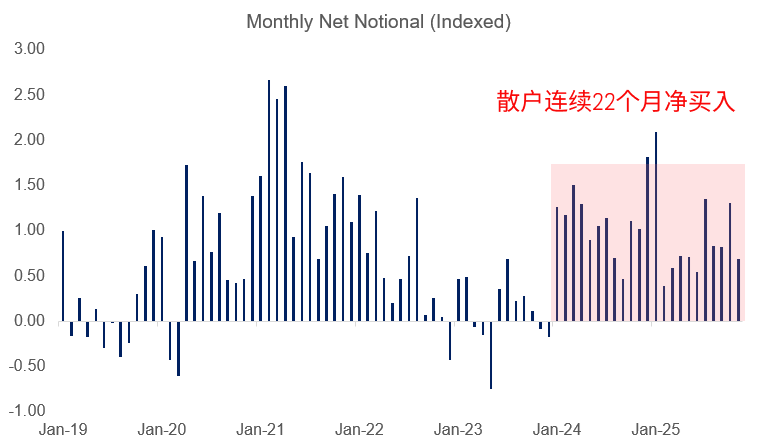

The power of retail investors in this cycle can no longer be ignored. Many friends believe that if institutions do not enter the market, it may be difficult to drive up prices. However, looking at the U.S. stock market, it is actually the complete opposite. I have seen a lot of data, and institutions are just beginning to build their positions, while hedge funds have been selling and shorting for a significant amount of time. Only retail investors have been unrelentingly buying and adding funds for the past 22 months.

Moreover, retail investors are primarily buying ETFs. Therefore, from the actual data, even though there have been two instances this year where the VIX exceeded 25 (indicating panic) and one instance where the VIX exceeded 60 (indicating extreme panic), retail investors have continued to purchase, especially buying more as prices drop. This time, it has almost entirely been retail investors.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。