Federal Reserve's Beige Book: Economic Stability but Deepening Cracks

The latest Beige Book released by the Federal Reserve cautiously and meaningfully depicts the current state of the U.S. economy. Although economic activity in most regions has been described as "largely unchanged" in recent weeks, the underlying tone is noticeably more fragile. Consumer spending—especially among middle- and low-income households—remains weak, with only the high-end retail sector showing some resilience.

The employment situation, once the strongest pillar of economic recovery, is now showing signs of cooling. Businesses report a slowdown in hiring, easing wage pressures, and a greater reliance on natural attrition rather than layoffs—this is a subtle yet significant shift. Meanwhile, inflation continues to maintain… moderate but persistent price increases, although rising input costs will still be reflected in prices.

The Beige Book also highlights a particular complex situation: due to the government shutdown lasting until November 12, the collection of federal economic data was temporarily interrupted. As a result, decision-makers will lack complete labor market and inflation data sets for October and November at the Federal Open Market Committee (FOMC) meeting in December, underscoring the importance of feedback from real business environments, such as this report.

Despite an overall neutral tone, many businesses suggest that future growth momentum may slow. Manufacturers are slightly more optimistic than retailers, but the overall economic outlook is described as: stable but at risk of softening—this sentiment increasingly aligns with growing expectations for a policy shift.

JPMorgan Changes Rate Cut Timing Strategy

Notably, the Beige Book is not the only signal reshaping market expectations. This week, economists at JPMorgan altered their view on the timing of Federal Reserve policy, now predicting… a rate cut in December—this is a stark contrast to a week ago when they expected the first action to occur in January.

This shift stems from a series of dovish comments from several key Federal Reserve officials, particularly New York Fed President John Williams. Williams' remarks suggest that a rate cut "in the near term" would not conflict with the Fed's inflation targets. This change in tone was enough to prompt Chief Economist Michael Feroli and his team to adjust their forecasts.

The bank stated that the most likely path is a 25 basis point rate cut in December, followed by another cut in early January, although they emphasized that uncertainty remains high before the next FOMC decision.

This shift highlights how quickly the sentiment among policymakers and their interpreting institutions can change. Just days ago, stronger-than-expected labor market data for September had driven market expectations that policy responses would be delayed. However, as economic weakness intensifies and inflation pressures continue to cool, the current trend has shifted towards implementing easing policies sooner.

Bitcoin's Reaction: A Test of Sentiment and Liquidity

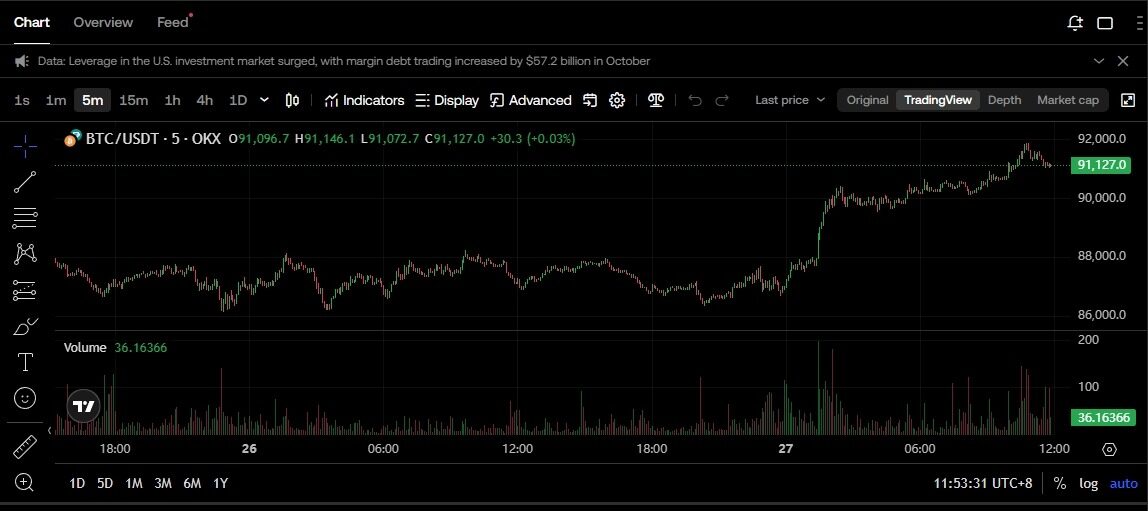

In this policy context, Bitcoin has once again become a barometer of real-time market sentiment. Over the past few days, Bitcoin's volatility has increased, initially retreating in sync with overall risk assets, and then gradually rebounding as market expectations for a December rate cut warmed up.

Historically, Bitcoin tends to respond positively to declining interest rate expectations, as lower borrowing costs and a weaker dollar often drive capital into high-beta assets. However, this time, Bitcoin's response has been more cautious. Price movements indicate that traders are closely monitoring changes in the macroeconomic landscape, but they are also waiting for concrete news rather than reacting merely out of speculation.

Some hesitation may reflect the incomplete economic data caused by the government shutdown. With the Federal Reserve itself lacking some information on inflation and the labor market, the market seems to be taking a cautious stance on a policy shift until the situation becomes clearer.

However, this trend is noteworthy: whenever the likelihood of a December rate cut increases, Bitcoin tends to find support—further solidifying its role as a barometer of liquidity expectations.

What to Watch Next

As the market digests the contents of the Beige Book and JPMorgan's revised forecasts, attention now fully turns to… the Federal Reserve's rate decision in mid-December. Due to the lack of complete inflation or employment data sets available beforehand, the Fed's communications in the coming days will play a crucial role in guiding market expectations.

If policymakers continue to signal easing, and financial conditions tighten further, the likelihood of a December rate cut will increase. However, if new data or statements indicate that concerns about persistent inflation remain, the Fed may still wait until January to cut rates.

Looking Ahead

If the expectation of a December rate cut is confirmed, the next phase for the cryptocurrency market is unlikely to be a sudden vertical reversal, but rather a structural transition. Since early October, trading in digital assets has been defensive, with Bitcoin's price falling from cycle highs to just above $80,000, and then rebounding to around $90,000 as market sentiment shifted. This rebound reflects an important message: the market is not reacting to the current economic situation but rather to the potential impact of cheaper capital months down the line.

Historically, the first rate cut often signals… a shift in the policy regime, but this does not necessarily mean an immediate surge in prices. Traders typically shift from caution to selective positioning, only resuming full risk appetite once liquidity is restored. In such an environment, Bitcoin often leads the way, becoming one of the first beneficiaries after financial conditions ease, followed by a gradual shift of funds into Ethereum, mainstream secondary exchanges, AI, or RWA-related industry hotspots, ultimately flowing into high-beta speculative tokens. The recent hesitation of altcoins also confirms this pattern—investors need confirmation, not just speculation.

Several macro signals will determine the strength and speed of the next round of movements: the direction of the dollar index, the inflow of funds into cryptocurrency ETFs and institutional products, and whether the supply of stablecoins begins to expand again after months of stagnation. If these indicators align with a confirmed rate cut, the market may transition from a stabilization phase to a new upward phase, and this phase's rise would not be based on speculation but on capital flows.

Currently, Bitcoin's recent price rebound indicates that investors are cautiously preparing for a more accommodative policy environment, but are still waiting for a clearer policy landscape. The next key milestone will arrive in mid-December when the Federal Reserve will officially announce its policy decision. Until then, the market is trading not just numbers, but expectations. And for the first time in months, these expectations are leaning towards easing rather than tightening.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。