One of the most steadfast bulls in the crypto world is adjusting his expectations, returning from an ideal $250,000 to the reality of $100,000.

“I still think it’s very likely that BTC will break $100,000 before the end of the year, and it may even set a new high.” On November 27, Tom Lee, chairman of BitMine, expressed his cautiously optimistic view on Bitcoin during an interview with CNBC.

This cryptocurrency bull, known for his bold predictions, has publicly softened his previously well-known $250,000 Bitcoin price forecast for the end of the year for the first time.

As the head of research at Fundstrat Global Advisors, Tom Lee has been one of Wall Street's most outspoken supporters of Bitcoin for years. His adjustment in predictions reflects the challenges and opportunities currently facing the cryptocurrency market.

1. Prediction Shift: From Firm $250K to Conservative $100K

Tom Lee's recent statement contrasts sharply with his previous predictions.

● Since the beginning of 2024, he has repeatedly stated that Bitcoin is expected to reach $250,000 by the end of 2025. Until early October this year, he was still reiterating this view. In June 2025, he remained bullish on Bitcoin reaching $250,000 through Fundstrat.

● Now, his stance has subtly changed from a firm specific price target to a more flexible “possibility” statement. Lee now believes that Bitcoin is “very likely” to break $100,000 before the end of the year and may even return to the historical high of $125,100 set in October. He has not completely abandoned his bullish stance but has adjusted the magnitude and certainty of his expectations.

2. Market Reality: Downward Trend and External Pressure

As Tom Lee adjusts his predictions, Bitcoin is experiencing a tough period.

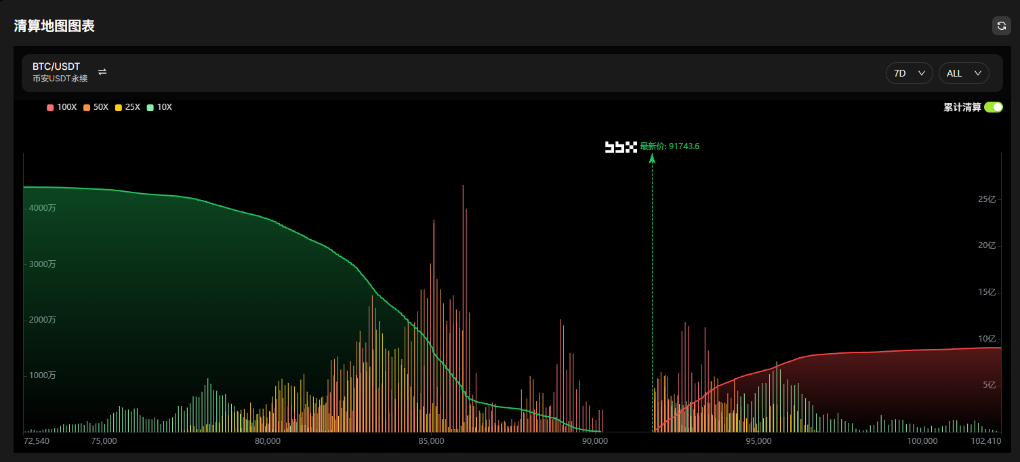

● Since October 10, Bitcoin has been in a downward trend. This decline has been primarily influenced by the $19 billion liquidation in the cryptocurrency market, which occurred after Trump announced a 100% tariff on Chinese goods.

● As of November 26, Bitcoin barely managed to regain the psychological threshold of $90,000 after being below it for six consecutive days. Market performance has been disappointing, especially considering that November has historically been the strongest month for Bitcoin since 2013.

3. Holding Logic: A Few Key Trading Days Determine Returns

● Despite the weak short-term market performance, Tom Lee offers a key insight into Bitcoin's long-term potential. He points out that Bitcoin tends to achieve most of its gains in a few key trading days each year. Lee emphasizes that this asset typically only “takes action” in 10 days each year.

● This view has gained wide acceptance among industry executives. Bitwise CEO Hunter Horsley stated in a post on X in February 2024 that while investors cannot predict when these days will occur.

● Historically, missing the best 10 days of BTC performance means missing almost all returns. Data supports this view— in 2024, the cumulative return for the 10 best-performing days of BTC was 52%, while the average return for the remaining 355 days was -15%.

4. Prediction Record: A History of Right and Wrong

● Tom Lee's Bitcoin price predictions have not always been accurate, and if his latest prediction fails to materialize, it would not be the first time. Looking back to January 2018, Lee predicted that Bitcoin could reach $125,000 by 2022. However, the historical high in 2018 ultimately only reached $17,172.

● However, Lee has also made some accurate predictions. In July 2017, he predicted that under a base scenario, Bitcoin could reach $20,000 by 2022.

● A more bullish outlook could see a potential price of $55,000 during the same period. In fact, BTC eventually reached $20,000 in December 2020 and $55,000 in March 2021.

5. Expert Disagreement: The Battle of Bulls and Bears

Among the cryptocurrency analyst community, Tom Lee's $250,000 prediction has been one of the most bullish views.

● Other cryptocurrency executives, including Galaxy Digital CEO Mike Novogratz, have warned that for Bitcoin to reach that level, “crazy things” need to happen. Even after Lee adjusted his predictions, his view remains more optimistic than some traditional financial institutions.

● For example, investment firm VanEck predicts Bitcoin will reach $180,000, while Standard Chartered predicts $200,000.

● Meanwhile, economist Timothy Peterson recently stated that Bitcoin's bottom may have already occurred or may occur this week.

6. Future Outlook: Long-Term Still Promising

Despite lowering his near-term expectations, Tom Lee remains optimistic about Bitcoin's long-term potential.

He clearly stated, “I still believe some of the best moments will occur before the end of the year.”

With 35 days remaining until the end of 2025, Bitcoin investors are closely watching whether the market can validate Lee's predictions.

Interestingly, although Lee has lowered his year-end forecast, reports indicate he still maintains a bullish view, expecting Bitcoin to rebound to between $150,000 and $200,000 by the end of January next year.

He has even predicted that Bitcoin will reach $3 million by 2030.

As Tom Lee mentioned, the Bitcoin market achieves most of its gains in just a few key trading days each year. In 2024, if one misses the best 10 days of performance, the return rate will drop from a positive 52% to a negative 15%. This characteristic makes accurate predictions difficult, even industry experts have to adjust their views with market changes.

Lee's adjustment in predictions is not a surrender but a rational response to market realities. His newly set $100,000 target provides investors with a more reliable benchmark amid uncertainty.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。